Tuesday Takeaway,

from Luminate

With Tax Day just behind us, we’re turning our attention back to some of the Financial elements of music. Now we’re sure there are plenty of methods and tricks to minimize your tax exposure when it comes to the income your music generates, whether you are receiving recurring royalty revenue or you are selling your catalog, but we’re going to leave any advice on that front to the tax experts. We do, however, want to dig into some of the reasons that artists decide to sell vs. hold onto their music rights, along with some of the factors that should be considered as part of that decision.

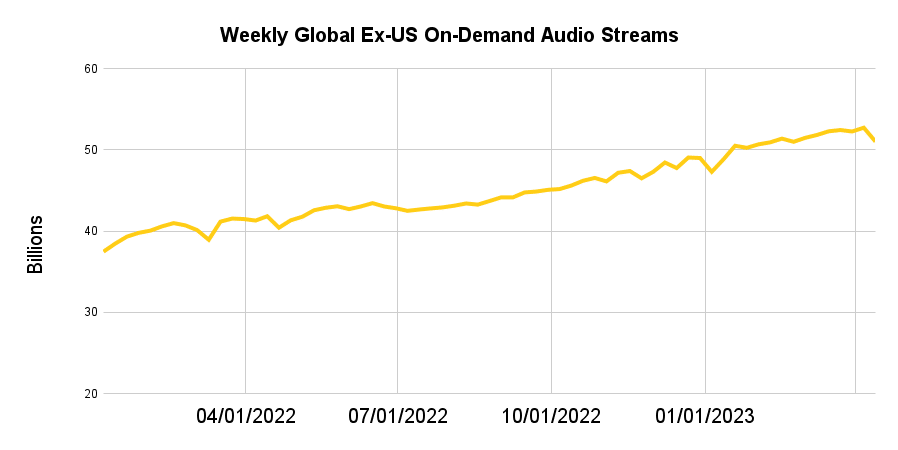

It’s no secret that there has been a veritable frenzy in music catalog transactions in recent years. While catalog values and multiples remain historically high, we’re starting to see a slight slowing in transaction volume. One seemingly obvious reason for this is that a rising interest rate environment and increasingly precarious economic conditions are causing investors to scrutinize deals a little more closely than they may have only a couple of years ago. On the other hand, the continued growth of streaming, particularly outside the US, has driven higher expectations on price from catalog owners who have been avid spectators of the headline grabbing transactions of the last several years. Many, frankly, have been waiting for “the right time” to sell.

Add to that the declining dynamic of having to “sell out of necessity.” When the world shut down during the pandemic, one of the primary income sources for an artist was all of a sudden rendered “temporarily out of service.” Touring has since whipsawed back into full force and with it, the economic spoils that accompany it. Therefore, sellers (both artists and rights holders) can be more patient for the right offer to come along, or the right investor to meet their price.

That being said, there are a number of factors that both buyers and sellers should be aware of in order to be able to make more informed, data driven decisions.

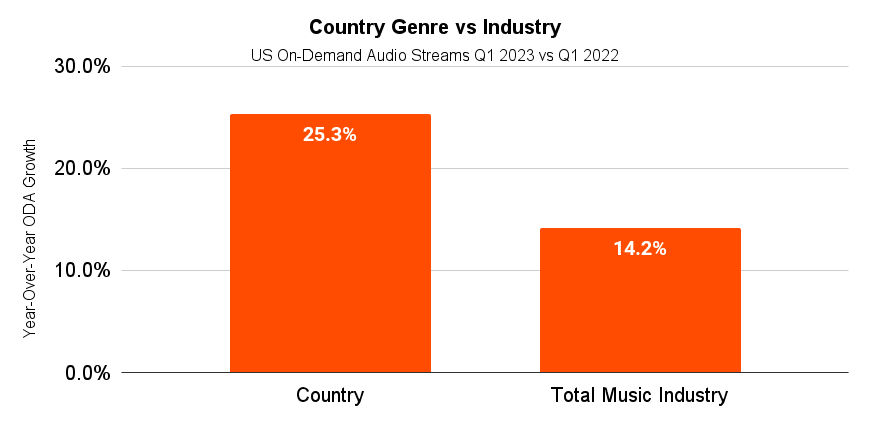

Streaming Growth Rates

How is the overall market trending and how is the genre trending over time? For example, Luminate shows that the Country music genre is outpacing total industry growth in Q1 2023 by a significant margin, which could have the effect of boosting values of Country music catalogs.

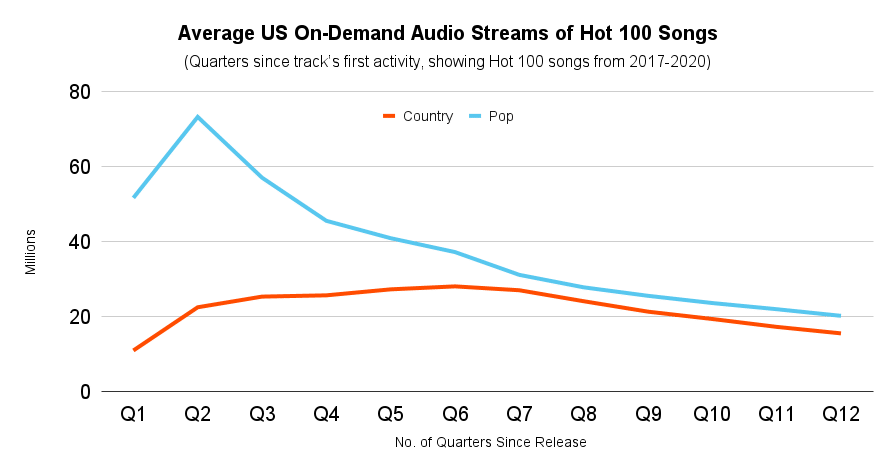

Decay Rates

What is the shelf life of your music? Is your music still on the upswing, or has it hit its peak and started to recede? How long does it take before the music you are selling reaches a “stable state” streaming pattern?

The nuances of streaming trends along with questions like those below help guide rights holders – and those looking to secure music rights – when evaluating a potential transaction.

Additional questions to consider –

-For sellers: how important is it to retain control of your music and receive recurring royalty revenue in relatively small increments vs. taking a lump sum payment and relinquishing ownership rights?

-For buyers: how can you use market data to refine projection models and potentially purchase “further up the curve” with a reasonable degree of confidence?

If your company is currently investing in music rights or considering entering the space, reach out to me at jmurphy@luminatedata.com to learn more about how Luminate is helping clients answer questions surrounding music as an asset class.