As 2023 winds down, we’re taking the opportunity to look back at some of the notable milestones we’ve hit in the music industry, as well as look forward to what is to come in 2024. Though things have cooled down somewhat relative to the spree of blockbuster Catalog deals just a few years ago, investment in the music space remains strong and continues to attract more players. From large institutional investors partnering with established Music companies to upstart services to individuals who can now buy shares of Music Catalogs via innovative new platforms, there has been a consistent uptick in both active and passive investors. And despite the uncertain macro economic environment and rising interest rates, the catalog transaction market has maintained solid, stable multiples over the last couple of years.

According to Alaister Moughan, Founder of Moghan Music -“Rising interest rates have reduced the number of catalogue deals closed in 2023 as well as the high end of multiples paid. A few of the more passive financially focused catalogue buyers have cooled down as higher interest rates make the passive investment play less appealing in the short term. However, there is still a very engaged pool of catalogue buyers who are focused on acquiring quality catalogue (especially when the underlying copyright is included) in particular genres and demographics which appeal to them and their ability to create value from the catalogues. The business generally seems to have slowed to a sustainable and engaged jog rather than the hectic sprints of the peak back in 2019 / 2020.”

Consistent growth in streaming along with hard won increases to publishing royalty rates have helped to offset cost of debt to some degree, but perhaps the larger consideration when it comes to investment outlook is music’s central role in people’s everyday lives and the confidence that consumers will continue to engage regularly with music whether through paid subscription or Ad Supported listening. According to Luminate’s Music 360 Consumer Landscape Study, music ranks #1 in terms of activities people spend time with, ahead of movies, TV, and Social Media, and the average music listener in the US listens to 13.4 hours of music per week. Additionally, 18% of music listeners not currently paying for a streaming service report they intend on subscribing to one in the next 6 months. Indeed, investors are counting on the stability of music listening on streaming platforms as well as innovation that will drive new licensing opportunities that will create new revenue streams.

Here at Luminate it’s been a very busy year. In addition to the day-to-day work we’ve done to help our clients position and validate their investments in the music space, we hosted ten music finance focused thought leadership events in multiple cities in the US and Internationally, partnering on content with some of the highest profile firms in the investment space including Citrin Cooperman, Primary Wave, and Virtu Global Advisors, as well as innovative new players such as Duetti, Catchpoint Rights Partners, and RYLTY, just to name a few.

Taking a look back at the topics covered at these events and how the industry has performed, we’re excited to share some topline performance metrics as well as some key themes we believe will continue to shape the music industry moving into 2024 and beyond. We see 3 key themes that will heavily influence the growth of the Music Industry and Investment outlook moving forward.

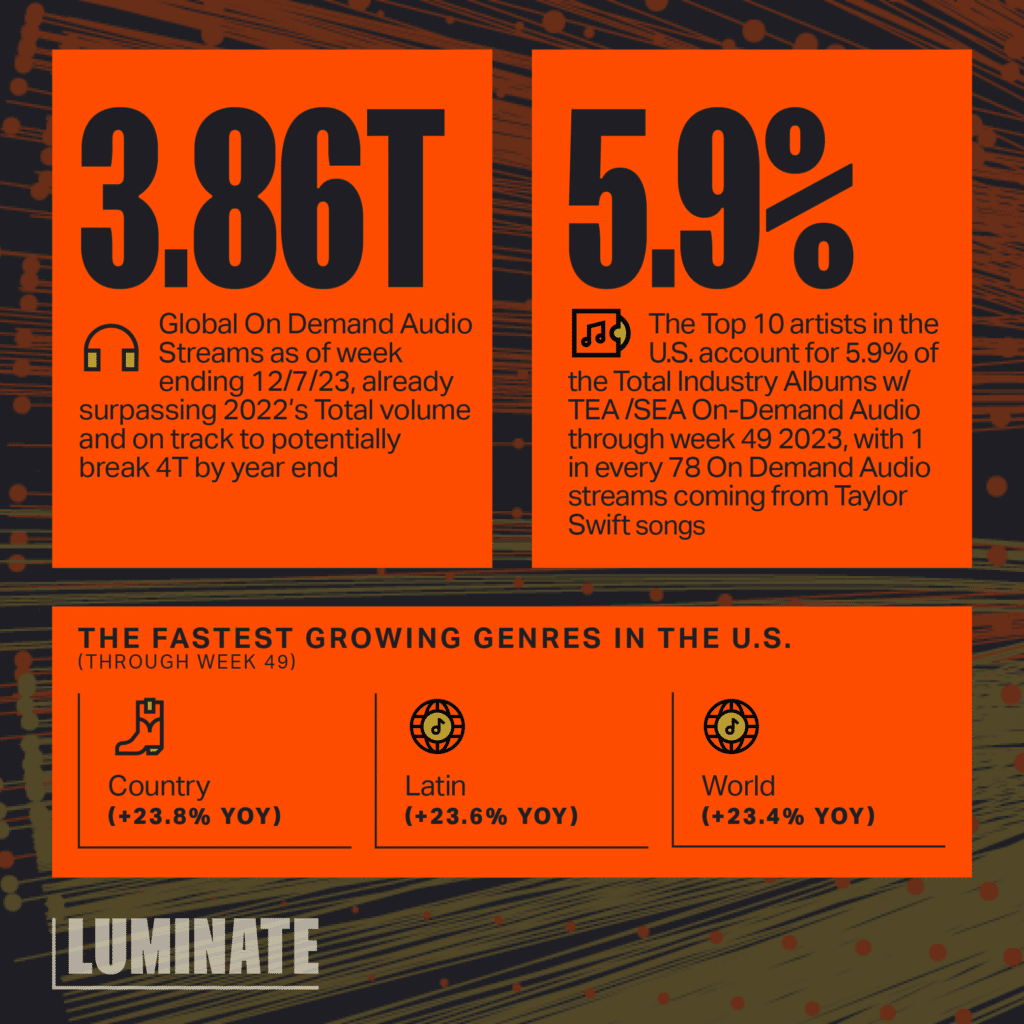

It’s no secret that there is a massive and growing amount of music available on music streaming platforms today. With the growth in demand for deep catalog, music from local/independent artists, and the most niche of niche music genres, streaming services have been “super serving” their customers, to say the least. Coupled with the ability for any artist to distribute music through low cost and DIY distribution platforms, music fans have never had more music at their fingertips. According to Luminate, 112k tracks a day on average were uploaded to music streaming services in the first half of 2023.

However, only a very small portion of those tracks ever achieve any meaningful consumption. In fact, of the nearly 12M Artists Luminate tracks worldwide, less than 1% of those Artists accounted for more than 90% of the Global On Demand Audio Streaming volume in Q3 of 2023. With all the conversation that has evolved around the notion of artist-centric royalty payment models to mitigate fraudulent streaming and shift more of the royalty pool to “legitimate” music, any change to payout models could have major implications, particularly for artists further down the mid to long tail of music. Still, there are those out there betting on the long term value of smaller, independent music creators.

According to Lior Tibon, CEO and Co Founder of Duetti – “We estimate that there are well over 100,000 artists who generate at least $10,000 each per year from their catalog and our research clearly demonstrates the long term resilience and durability of their music with fans.”

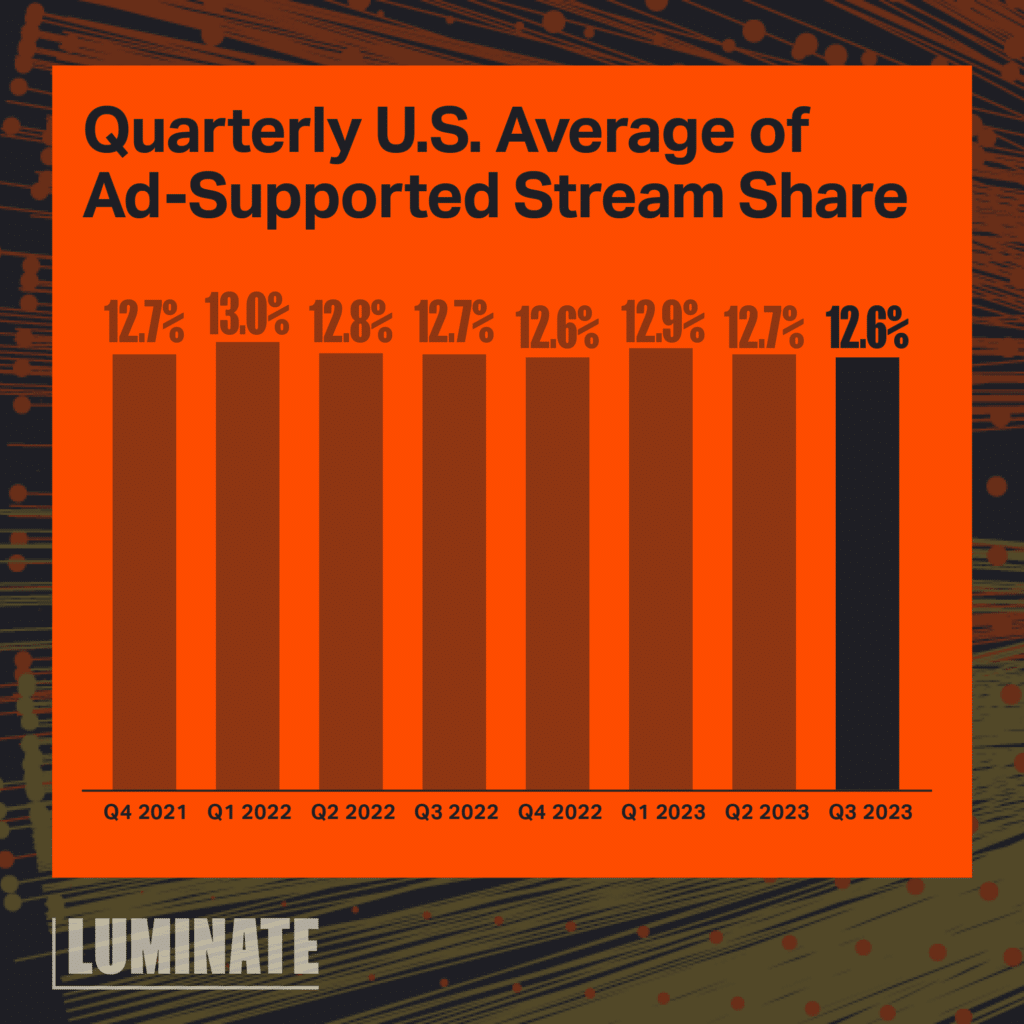

Since Fall 2022, Apple Music, Spotify and Amazon Music have all announced increases to their music streaming subscription prices. This comes after years of discussion and plenty of debate over the concern that a raise in prices will cause a meaningful drop in Premium subscriptions, or at the very least create drag on trade up from Free/Ad Supported plans. We’re now roughly a year in since Apple raised its prices, just over 4 months since Spotify’s price increase and though it may be a little early to understand the full impact to paid subscriber base, our data shows that there is still a slight downward trend in the share of ad-supported streaming in the U.S. over the last eight quarters with more users streaming premium content.

Of note, when looking at only Q3 2023 vs Q3 2022, though the rate of ad-supported streaming may only be .09% lower in the latter quarter, this equals approximately 21.5m more premium On-Demand Audio streams in the industry; so small changes in trend can mean large volumes at the US industry level.

As the North American streaming market matures and continues to level off (still growing, but at a slower rate), growth will inevitably be driven by other markets, particularly in Asia Pacific and Latin America. There are plenty of challenges involved with trading consumers in these markets up from Free/Ad Supported streaming to paid subscriptions, but there is no doubt that there is growing music listenership and avid artist fanship in a variety of markets around the world. Streaming services have enabled more artists to reach a global fan base in a cost effective manner. It has also changed the paradigm of primarily Anglo-American music exporting across the globe as we are seeing a significant uptick in the variety of music from other countries being listened to in North America.

Emerging Market Profile – Brazil

Earlier this year the IFPI reported that in 2022, Brazil broke into the Top 10 rankings of Global recorded music market revenue. As the Brazilian market grows in streaming volume and revenue on the strength of greater streaming adoption it’s helpful to also look at the spending profile of the fans in this country.

- Overall Brazilian music listeners spend the equivalent of $59.20 USD on music activities each month (80% of the average monthly spend in the U.S., which is $74 per month)

- Over ¾ of this spend goes to live music events (52.6%) and music streaming services (23.1%). In the U.S. a higher percentage of total spend goes on live music event (65%) and a smaller proportion on music streaming services (9.5%).