Earlier this month, we highlighted in a Tuesday Takeaway that Latin music grew its share¹ of U.S. On-Demand Audio streaming the most in Q1 2025. This week, we’re refocusing on the core genre with the biggest share, R&B/Hip-Hop, a dominance that had eroded in recent years but is showing a new sign of life in one of its subgenres.²

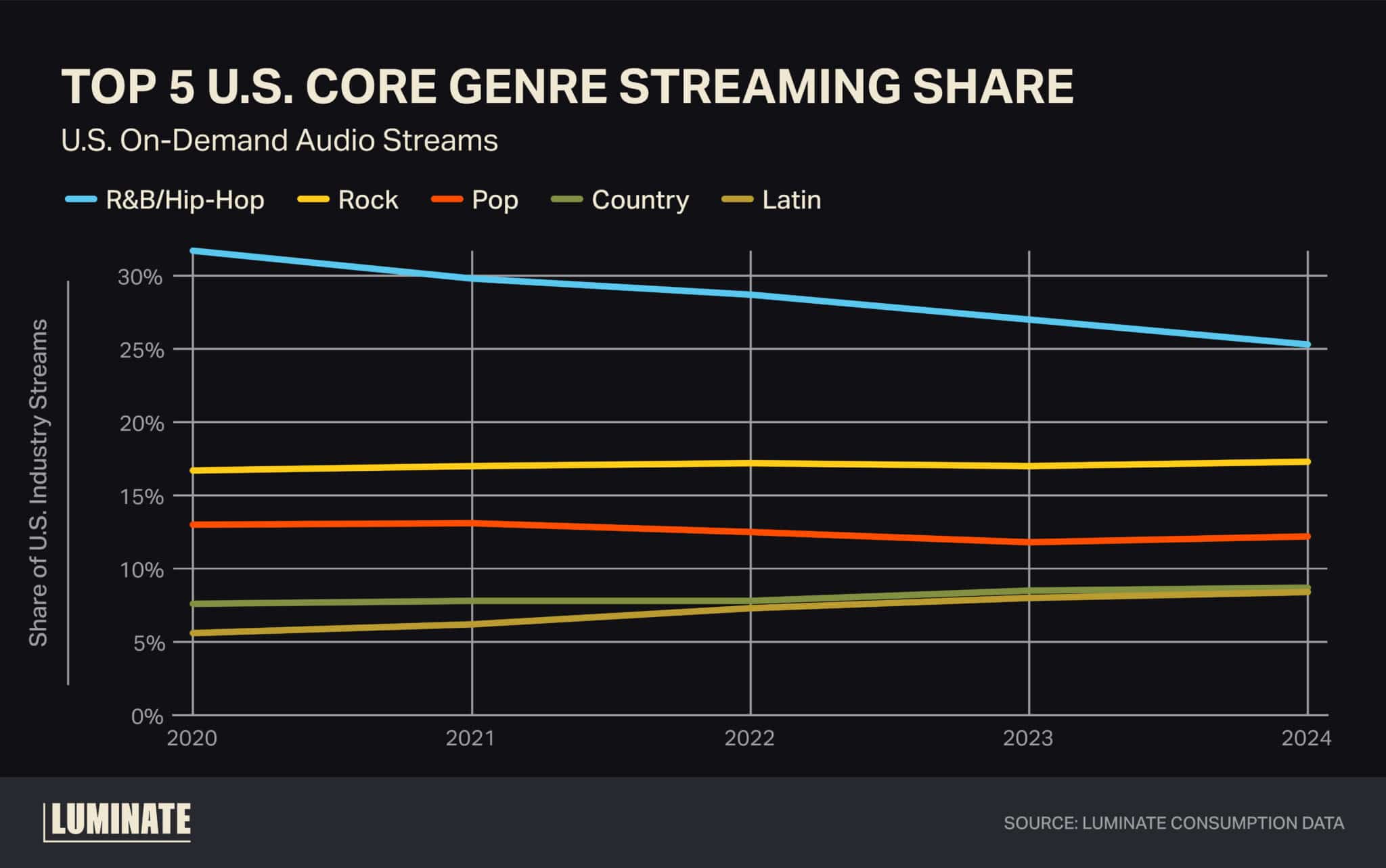

R&B/Hip-Hop has long been the leading core genre, maintaining a commanding 25.3% share in 2024, as Luminate noted in the 2024 Year-End Music Report. But this lead has been steadily shrinking since 2020, if not before, ceding 1.7 share points last year due to increased competition from other genres such as Latin and Country, and dropping 1.0 share point in Q1 2025 compared to Q1 2024.

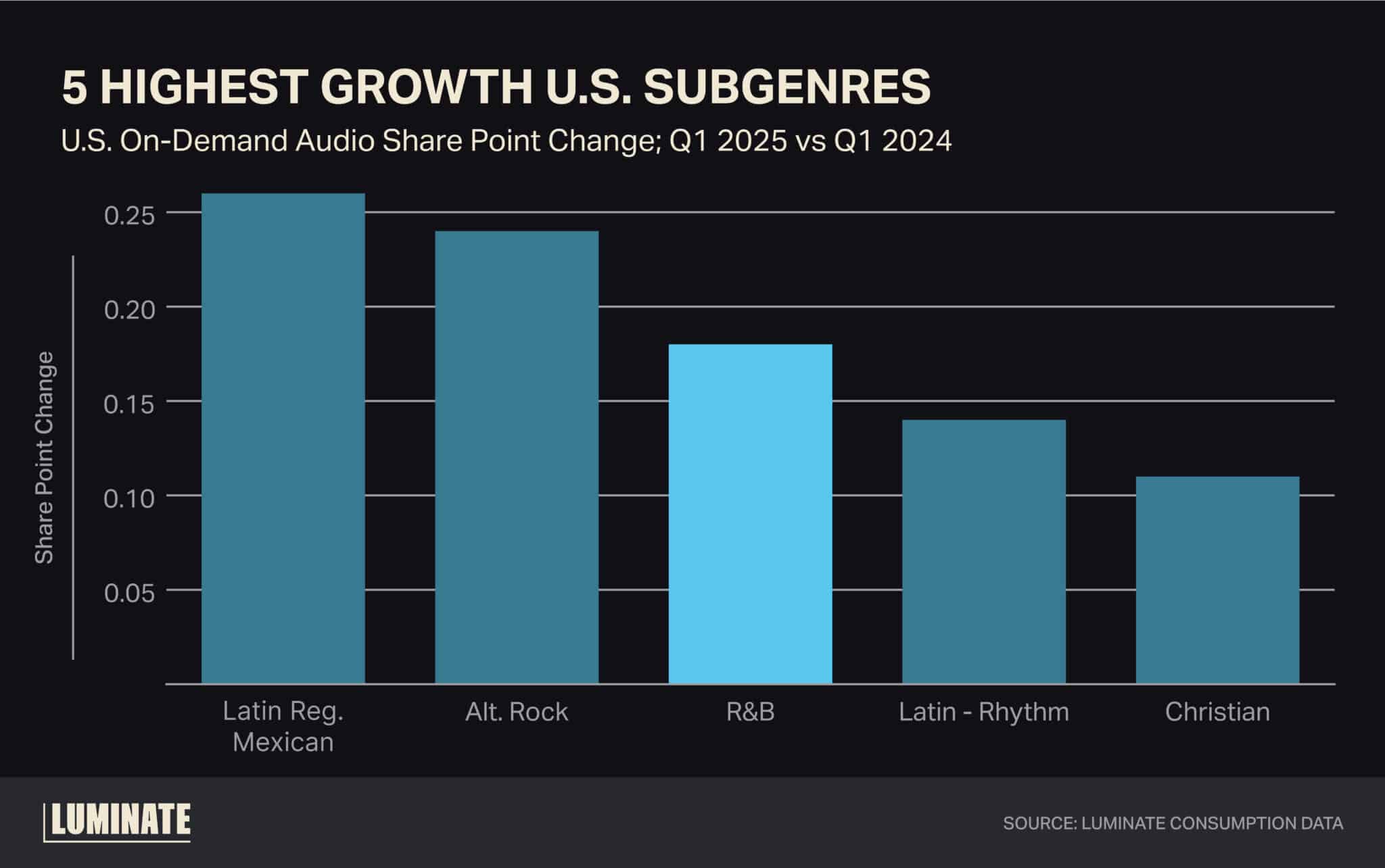

But the growth of the R&B subgenre within R&B/Hip-Hop provides a glimmer of hope for the broader category. For the first time in three years, R&B has finished among the five subgenres that experienced the most share growth in Q1 2025 on the strength of 9.1% volume growth over this time last year.

Typically, there’s a clear correlation between the performance of core genres and their respective subgenres. For instance, it’s natural that because Latin was the core genre exhibiting the most growth, Latin Regional Mexican and Latin Rhythm both ranked among those subgenres growing the most. Similarly, Rock and Christian/Gospel, which ranked in the Top 5 core genres, are mirrored at the subgenre level, with Alt. Rock and Christian showing robust growth.

But the R&B subgenre, which is on a divergent trajectory from the broader R&B/Hip-Hop core genre, is a reminder of the importance of digging further into the data to gain deeper insights into consumer behavior.

So, what’s driving the growth within the R&B subgenre? In a word: hits. The No. 1 R&B song in Q1 2025, “30 For 30” by SZA and Kendrick Lamar, also ranks as the eleventh most streamed song in the U.S. overall, with 173.3M in audio activity. Three more of the Top 5 R&B tracks this quarter are also considered Current (released within the last 18 months), with all debuting within the last eight months.

As we progress through 2025, one key question will be whether R&B can sustain its early momentum. Its performance could offer valuable insights into how shifting preferences might impact core genres and their subgenres in the months ahead.

Sources:

Luminate Music Consumption Data

Notes on Methodology

1. Sharepoint change: Sharepoint change measures how much one share increases or decreases relative to another, taking volume into account and expressed in percentage points rather than raw percentages.

2. Subgenre: For those not familiar with genre tags, each track can have only one core genre. At the subgenre level, each track can have multiple. So, for instance, a track can be tagged both Rap and Electronic/Dance to help better describe a particular track.