In the brutally competitive world of streaming originals, growing the audience of a series in its second season can be difficult.

That makes what the Apple TV+ hit Severance just managed to do all the more remarkable.

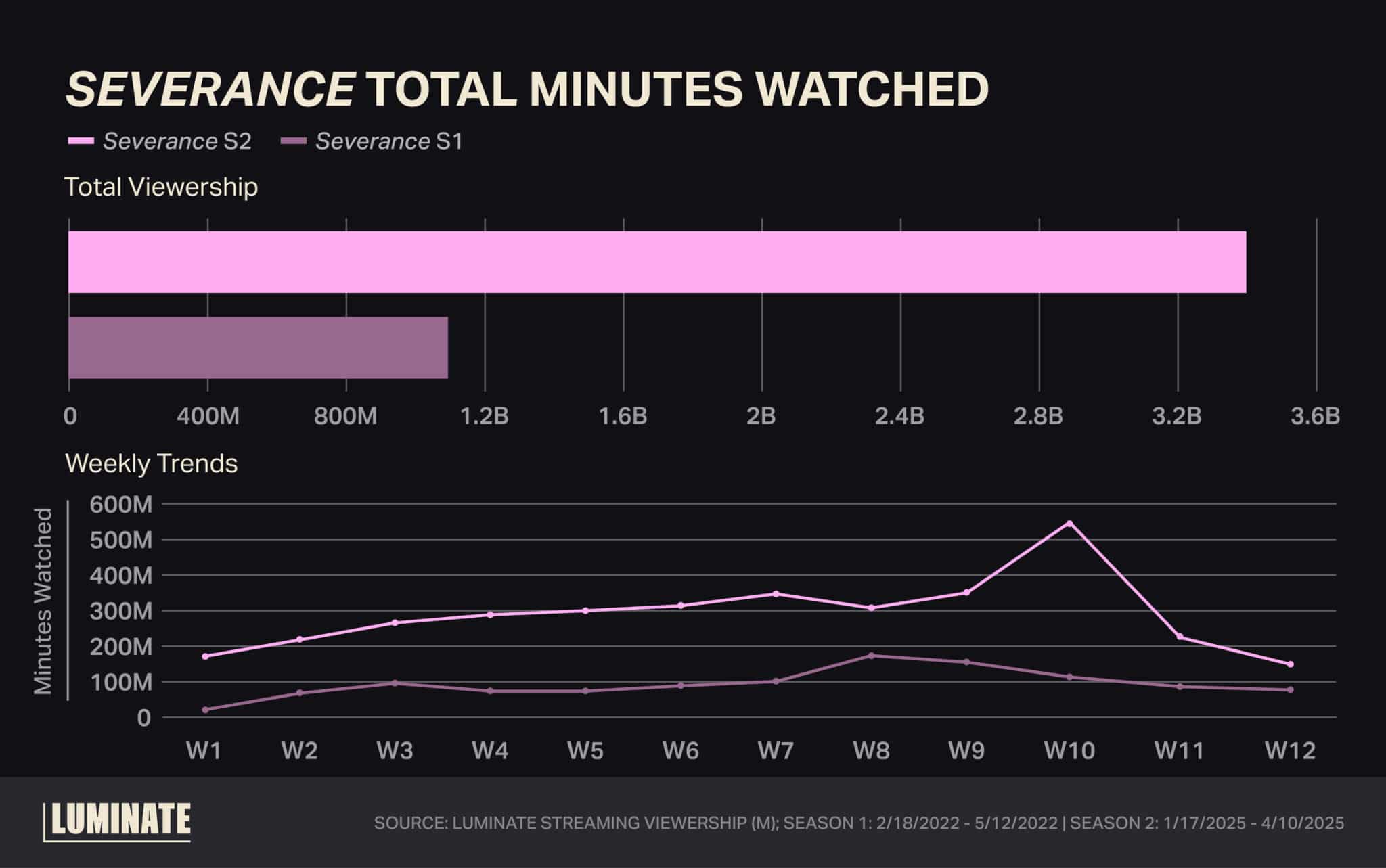

Released this past January, the sophomore season of Severance posted a staggering 218% increase of minutes watched from its first season’s initial 12-week run, according to Luminate’s Streaming Viewership (M) data. Fueling this spike is a massive influx of people who tuned in for the season 2 finale in week 10 on March 27, which netted just over 540 million minutes watched — a 215% increase over the series’ previous high.

And as Streaming Watch noted last week, the halo effect of Severance S2 was strong enough to boost its first season into the Top 20 Scripted Drama originals in the first quarter of 2025.

This strong performance defied a three-year layover Severance experienced between seasons (which was due to a combination of factors including the writers’ strikes). Absence, in this case, apparently made many viewers’ hearts grow fonder.

But what’s even more impressive about the Severance growth spurt is that there was any viewership increase at all, given how few series over the past 12 months grew their audience over their rookie seasons. (Note: This doesn’t include sophomore series that get either partial- or full-season releases on linear TV in addition to their streaming window, including Paramount+/Paramount Network series 1923 and Tulsa King, nor the recently launched second season of The Last of Us on HBO and Max).

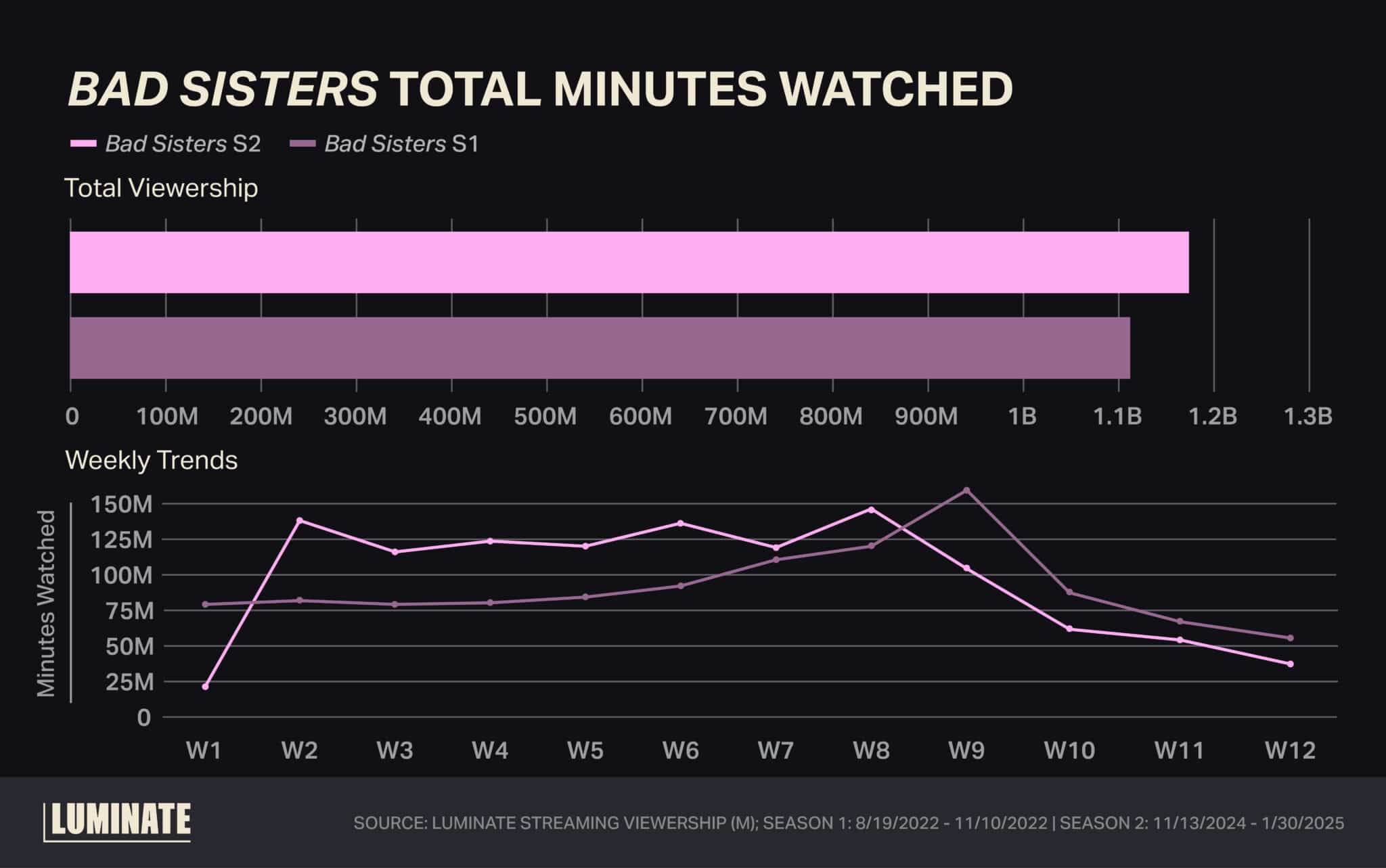

One of the only other few streaming-only examples is another Apple TV+ series, Bad Sisters, an original comedy from the producers of New Girl, which saw a sizable bump in viewership last November when its second season dropped. Two years after its summer 2022 premiere, total season viewership rose slightly by 9%, totaling out to just below 1.2 billion minutes watched. This is particularly impressive given the second season has fewer episodes than the first, yet netted more minutes watched.

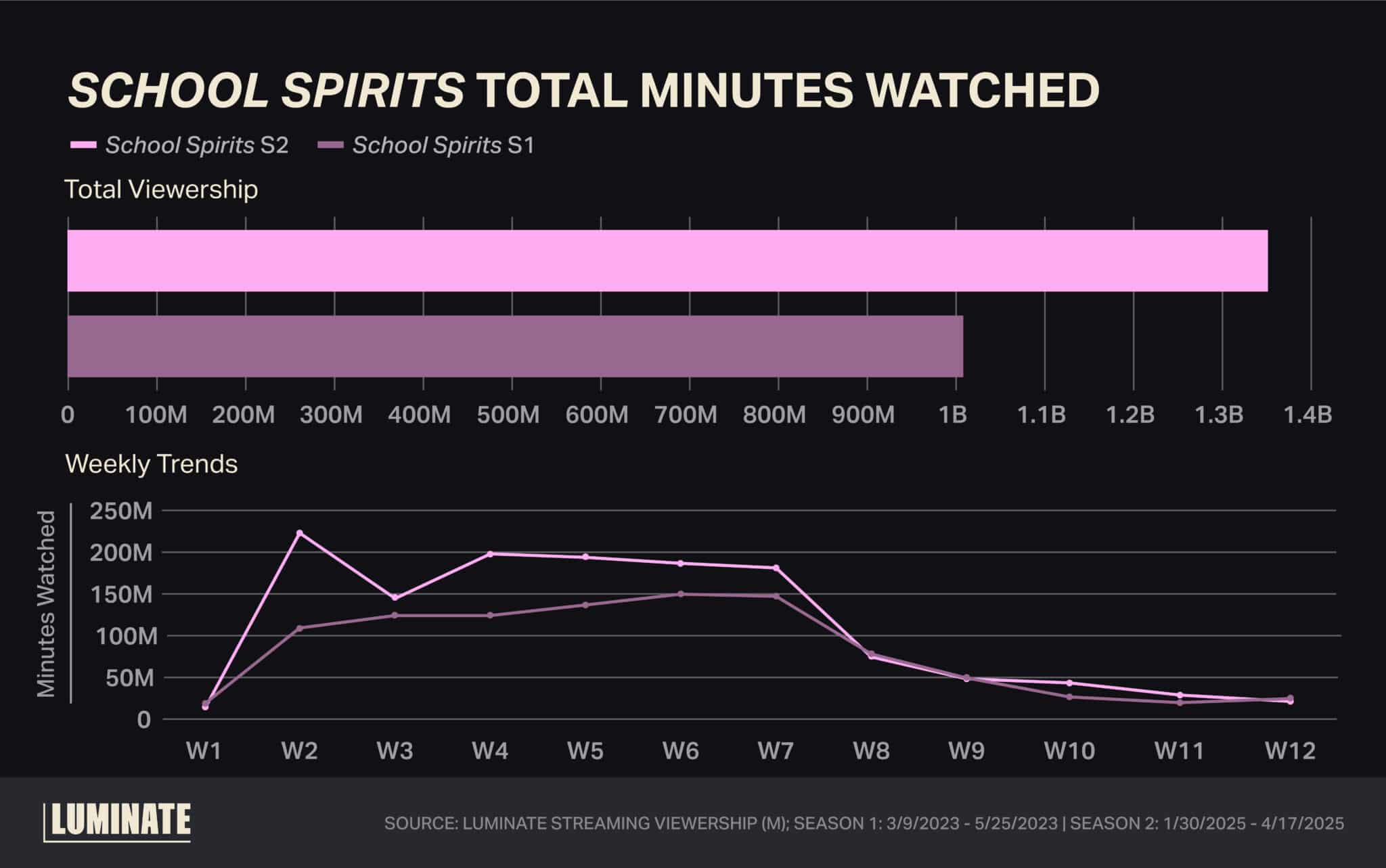

But Apple TV+ isn’t the only streaming service that managed to muster second-season growth. A more recent success — but with a twist — can be seen with the Paramount+ original series School Spirits. Upon its March 2023 series premiere, the teen supernatural series saw moderate success on the platform, netting just over 1 billion minutes watched.

The twist is that after Spirits viewership stagnated, Paramount made the decisive move to bring the series to Netflix. Once season 1 dropped on the streaming giant in November 2023, a correlated viewership spike was recorded by Luminate: Total season 2 viewership increased by 27%, amassing just over 1.4 billion minutes watched during its first 12 weeks.

The gambit validated an oft-used (but not always successful) strategy to get more visibility for a series by licensing it to a bigger streaming rival in hopes additional exposure will translate to more season 2 viewers on the original platform.

The performance of a series’ second season can often be the deciding factor of a title’s longevity. In Luminate’s 2024 Film & TV Year-End Report, we observed that a series was far more likely to be cancelled in its second season than any other.

Severance, Sisters and Spirits are not the only series with surging second seasons, but there aren’t many more like them. Subscribe to Luminate SV(M) to get the data on more of these uncommon growth stories in streaming.