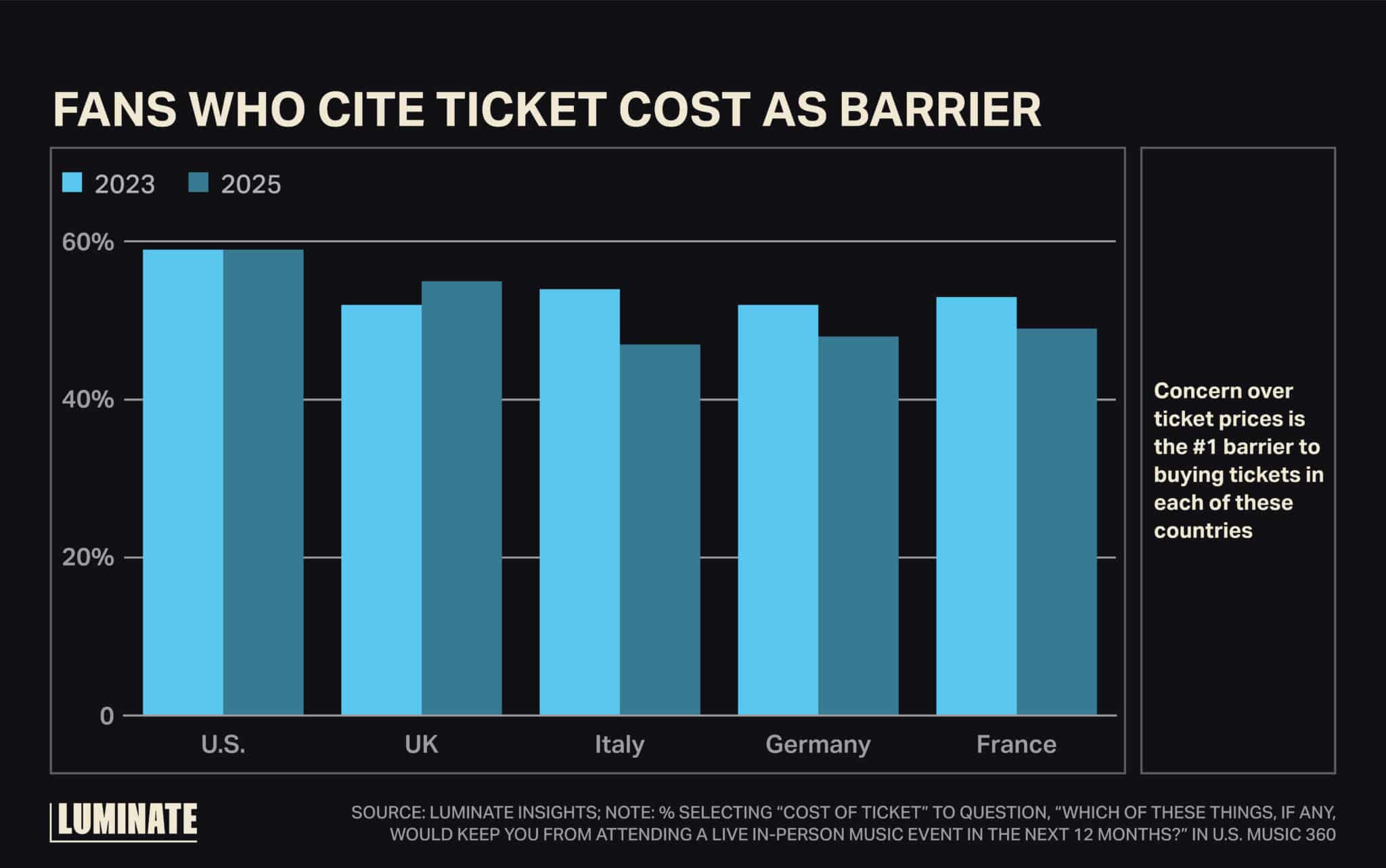

Ticket prices continue to be the biggest barrier to consumers attending music festivals, and yet in several key markets around the globe, cost concerns aren’t as high as they used to be, according to new research from Luminate Insights.

Survey respondents in France, Germany and Italy were less hung up on affordability in the first quarter of 2025 than they were in the same period two years prior. And while the U.S. reported slightly fewer cost concerns despite a surge in cancellations among festivals stateside this year, the UK actually saw a small increase.

This softening in several European markets suggests fans are slightly recalibrating their expectations as higher festival prices become the norm. These trends offer a potential window for promoters and artists to reengage hesitant audiences with just the right offerings.

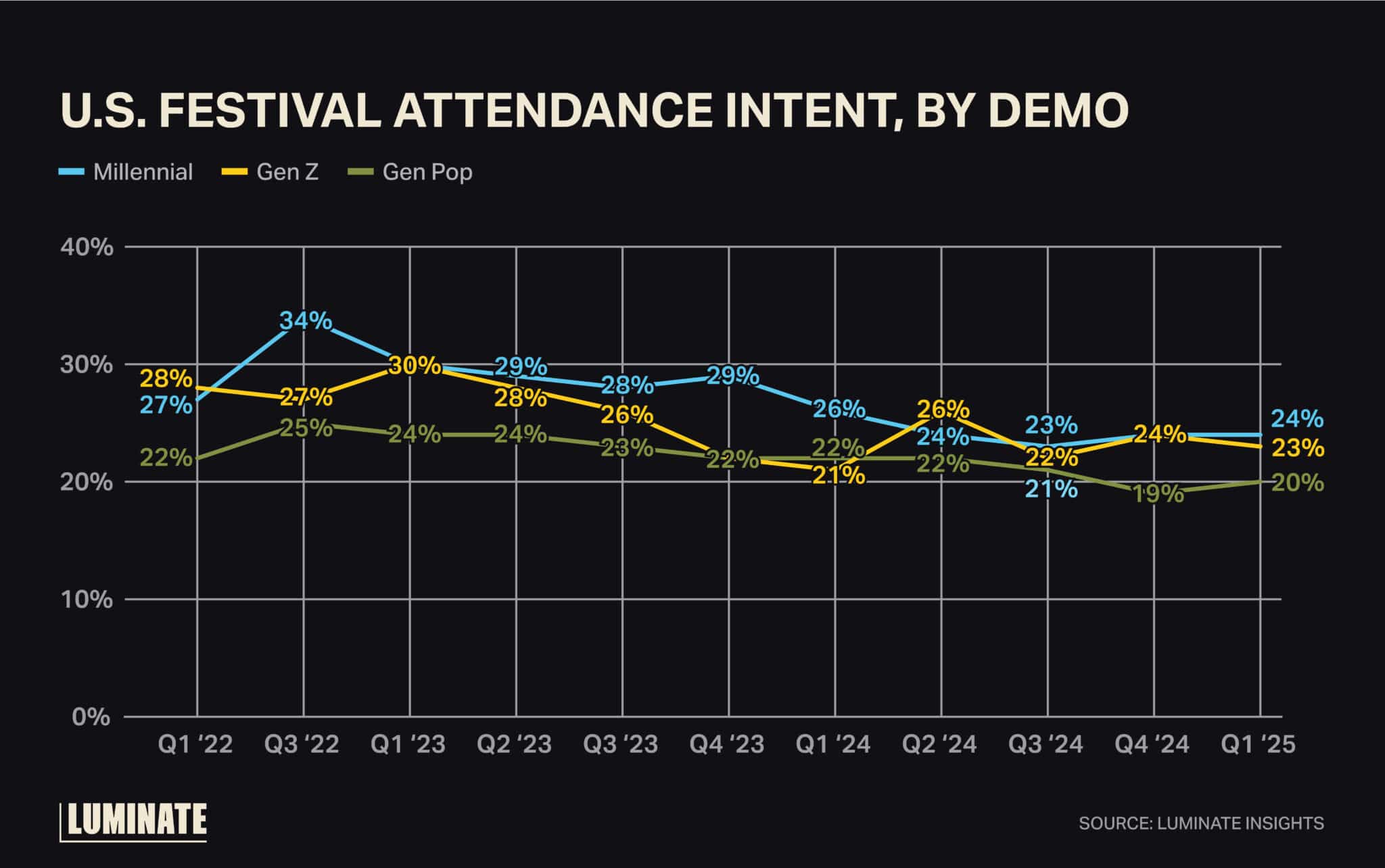

Lingering concerns over affordability in the U.S. may also be impacting festival demand more than other attendance barriers, which range from artist lineup to location. Another question from Luminate Insights’ Music 360 survey gauging intent to attend festivals registered a decline for U.S. fans overall.

Surprisingly, the biggest drop in the States was among Millennials. The percentage of that demo planning to attend at least one festival decreased from 30% in Q1 2023 to 23% in Q1 2025 despite Millennials being the primary live music attendees for years.

Part of that drop is due to Millennials aging and passing the torch to Gen Z as the dominant festivalgoers, though Gen Z’s future intent in the U.S. also declined an almost identical amount in the same time span.

And while Zoomers have shown a particular willingness to spend big and even accumulate debt to attend concerts, the current level of festival prices may already be hitting the limit for prospective attendees.

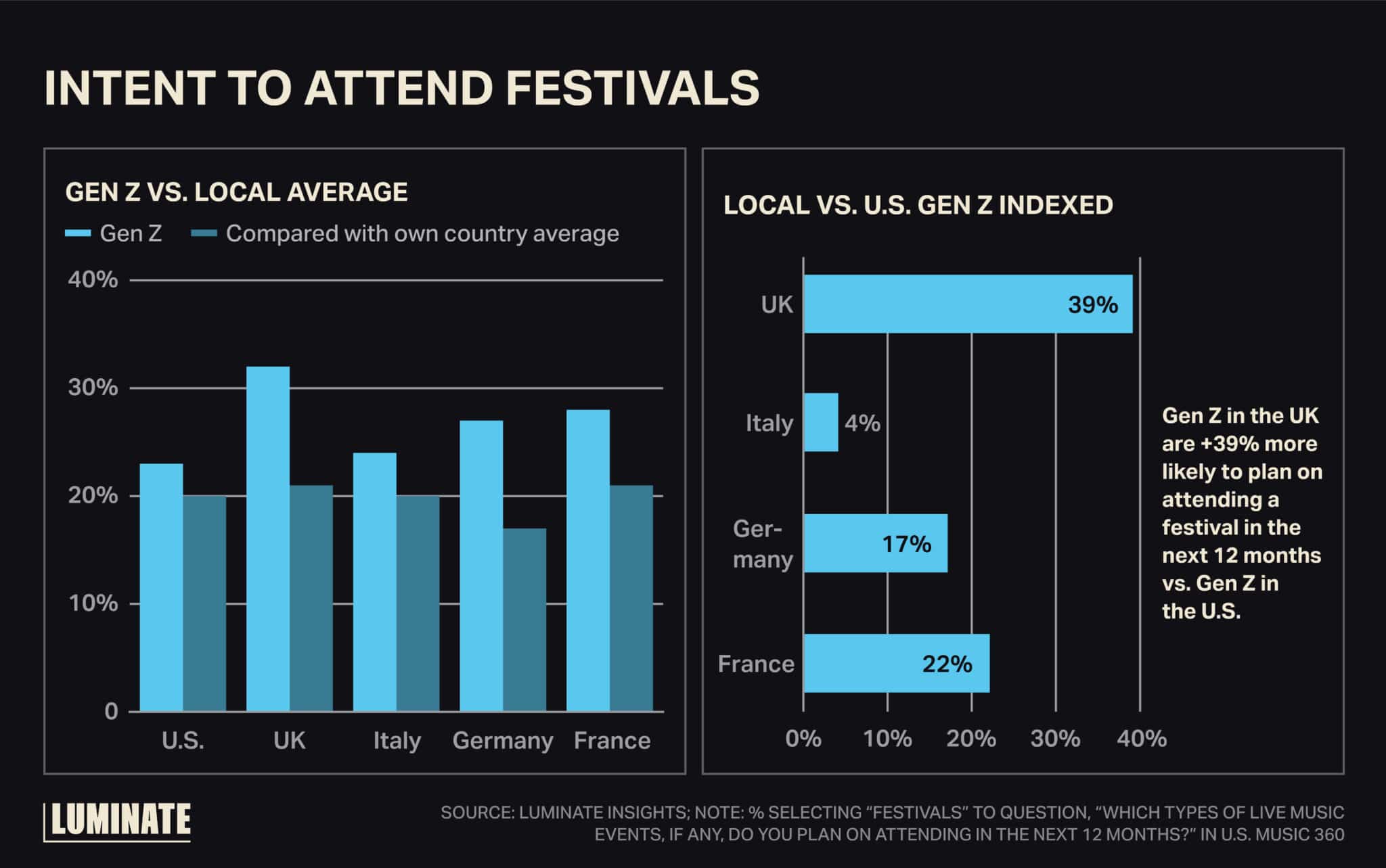

By contrast, European festival demand — especially among Gen Z audiences — is showing more resilience. Across the UK, Italy, Germany and France, Gen Z consumers report significantly higher intent to attend festivals in the next 12 months compared with both their own country and their U.S. counterparts.

For instance, Gen Z-ers in the UK are 39% more likely to plan a festival experience than Gen Z in the U.S. — a striking indicator of regional differences. There may be a few key factors at play that explain the variance between Europe and the U.S., where many already expensive festivals raised prices in recent years.

Chief among them is that, compared with U.S. festivals, European music events tend to be bigger, longer and packed with more artists, which may make the higher cost more palatable in those markets. For example, 3-day GA tickets for this year’s Coachella cost $549, while 5-day GA tickets for Primavera Sound in Barcelona went for around $395 (in U.S. dollars).

For more on consumer perceptions of live music around the world, see Luminate Insights’ Music 360. Luminate’s Jaime Marconette, VP of music insights & industry relations, shared the expansive survey’s findings last month at Music Biz 2025 in Atlanta.