As the music catalog transaction market continues to evolve, investors are constantly refining their approaches for identifying and uncovering value. Though rising interest rates have started to impact prices that buyers are willing to offer vs. what they would have a year or two ago, music IP is still viewed as an attractive investment based on the stable, reasonably predictable cash flows associated with streaming and radio airplay royalties.

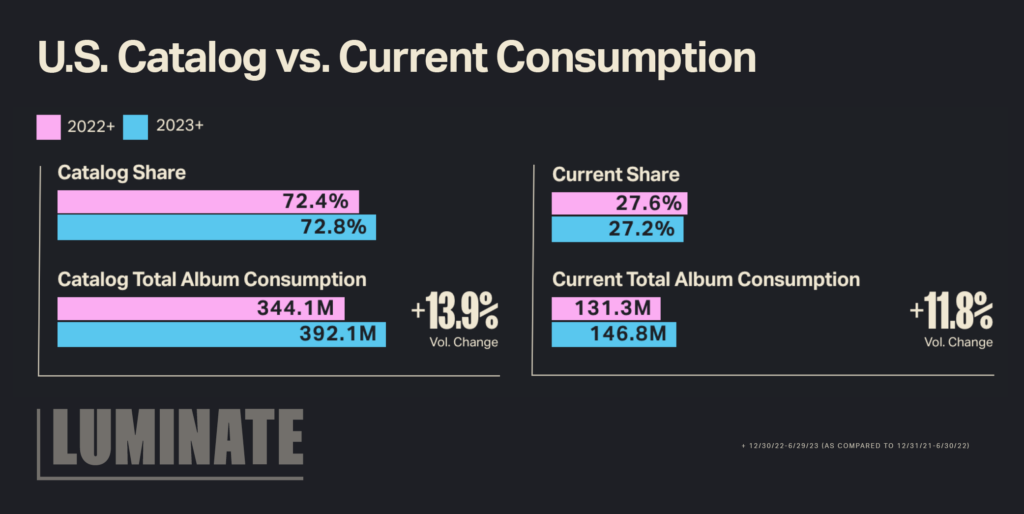

That said, it’s important for buyers and sellers alike to understand the macro landscape of how music is being consumed, both in terms of overall song consumption volume growth as well as how listening breaks down by various musical characteristics. In Luminate’s 2023 Midyear Music Report, we highlighted the fact that Catalog music (songs/albums released more than 18 months ago) continues to gain share of overall consumption. Some of this trend may be attributable to an older consumer base signing up for streaming services, some of it is due to younger audiences discovering older music through means like popular films/TV series or viral videos. Both highlight the value and potential upside of older music catalogs. However, it is also important to note that most Catalog streaming is of more recent titles. For example, at the end of 2022, when analyzing the Top 500k US tracks in On-Demand Audio streaming, 51.3% of streaming was from tracks released 2018-2022 with roughly half of that from those released 2018-2020.

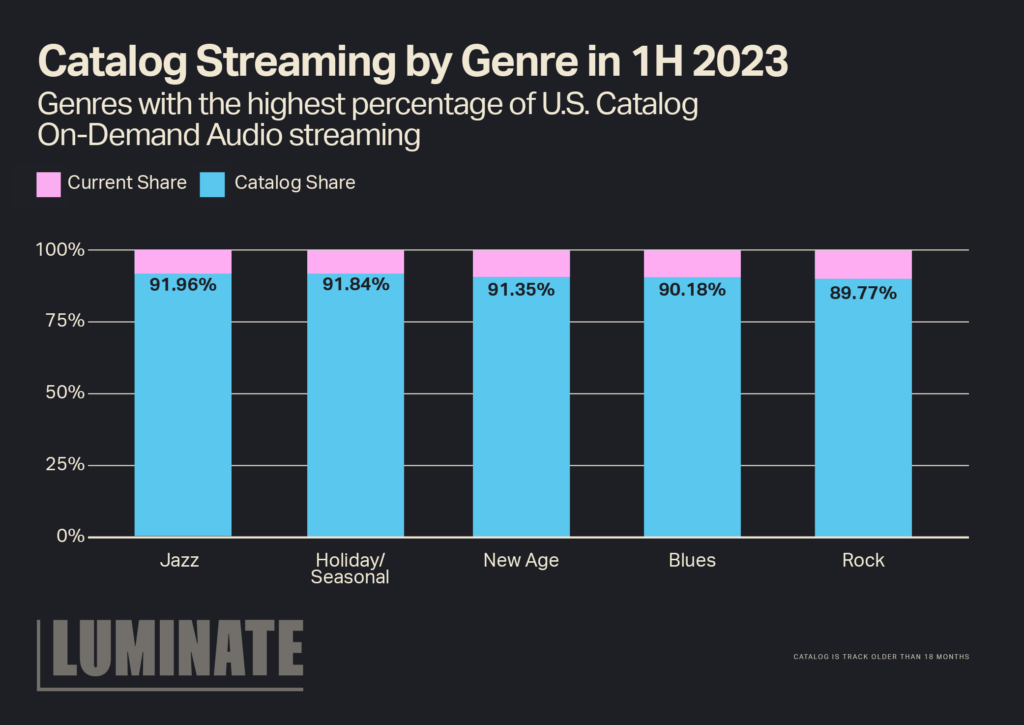

Taking a closer look underneath the hood, we can see the difference in music streaming volume by genre, along with which genres overperform in Catalog music consumption. Below are the genres where Catalog makes up the most share of that particular genre’s On-Demand Audio streaming. While the industry benchmark for US On-Demand Audio Catalog streaming was 73.57% through the first half of 2023, over 90% of the Jazz, Holiday / Seasonal, New Age and Blues genre streaming is catalog while 89.77% of Rock streaming is Catalog. Put another way, tracks older than 18 months receive more of the streaming attention in these genres as fans go back to the older hits.

Keeping your finger on the pulse of these macro listening trends will be key to maximizing your investment in music catalogs and separating the signal from the noise. If you missed the release of Luminate’s 2023 Midyear Music Report, click here and learn more about key music consumption trends, including: “Bands, Brands & Super Fans,” “Locals, Lyrics & Languages,” and “The Impacts of New Tracks.”