This summer, AMC and Netflix inked a deal licensing 13 AMC titles to Netflix. This wasn’t a typical licensing deal, as many of these titles were already flagship series on AMC’s own paid streamer, AMC+. When they arrived on Netflix on August 19, the titles were given prominent AMC branding, a rare sight in Netflix’s UX. AMC hopes this move will ultimately drive viewers from Netflix’s massive subscriber base back to AMC+ for subsequent seasons, while the pact allows Netflix to offer subscribers quality premium titles without having to front production costs. It seems like a win-win, but what does the data show?

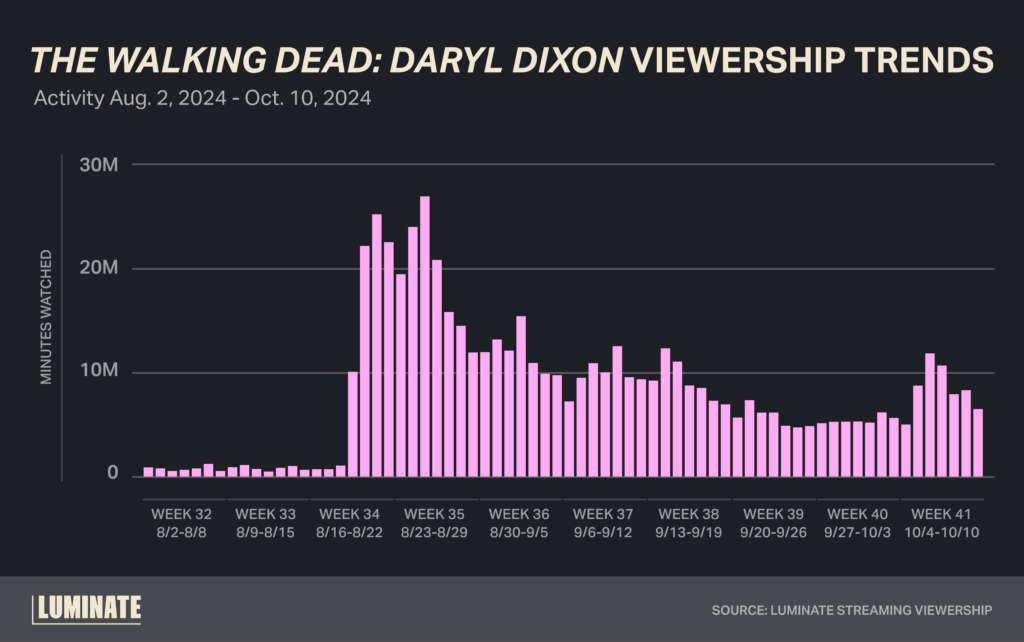

Every show AMC licensed to Netflix saw increased viewership when it was licensed to the service. The Walking Dead: Daryl Dixon is a good example of this lift. In the zombie spinoff’s first week on Netflix, viewership increased by 1470%.

Daryl Dixon Season 2 released on AMC and AMC+ on September 29, 2024, so the Netflix lead-in was perfectly timed to boost viewership for the series on AMC’s own platform. It wasn’t too long ago that the “Netflix Effect” allowed Breaking Bad to be discovered by many viewers on Netflix, who caught up on the show on the ultimate binge streamer then flocked to the last few seasons live on AMC.

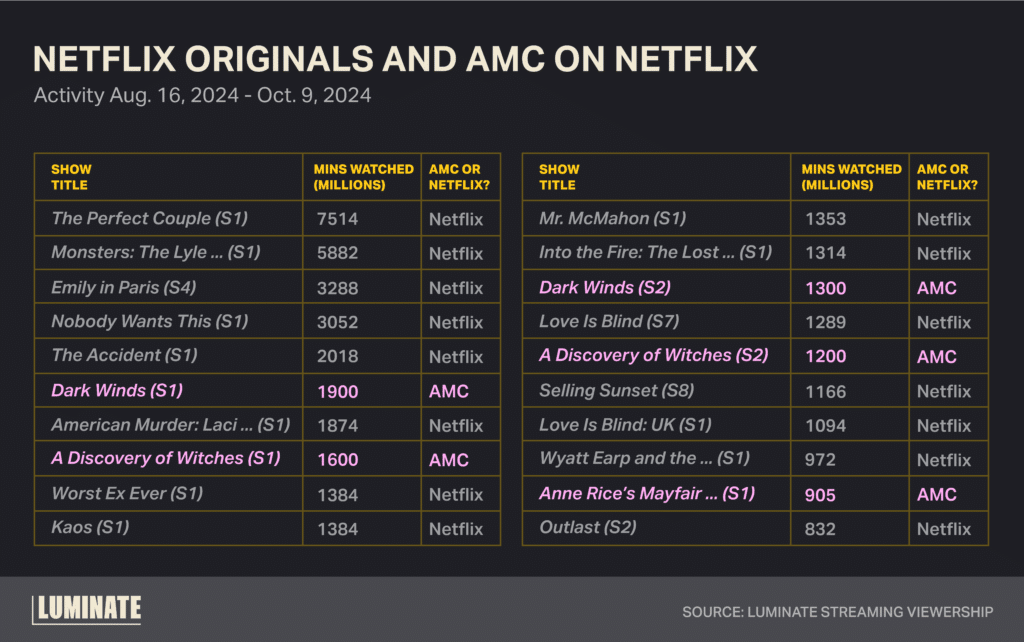

With so much original content on Netflix now, there had been concern that the AMC titles could get lost in the shuffle. That doesn’t seem to be the case so far. Since releasing on Netflix, AMC shows accounted for five of their Top 20 “original” shows, including two in the Top 10. (Note: This ranking does not include other library titles on Netflix, just AMC shows and Netflix originals.)

Dark Winds, an ongoing series at AMC, is the big winner here. The high viewership for its second season indicates audiences largely completed the series. The third season of Dark Winds is expected to premiere in early 2025, and AMC is hopeful that new fans driven from seeing the series on Netflix will tune in. While A Discovery of Witches also had impressive viewership, the series has ended, so it holds more value to Netflix than AMC (depending on the price of the license).

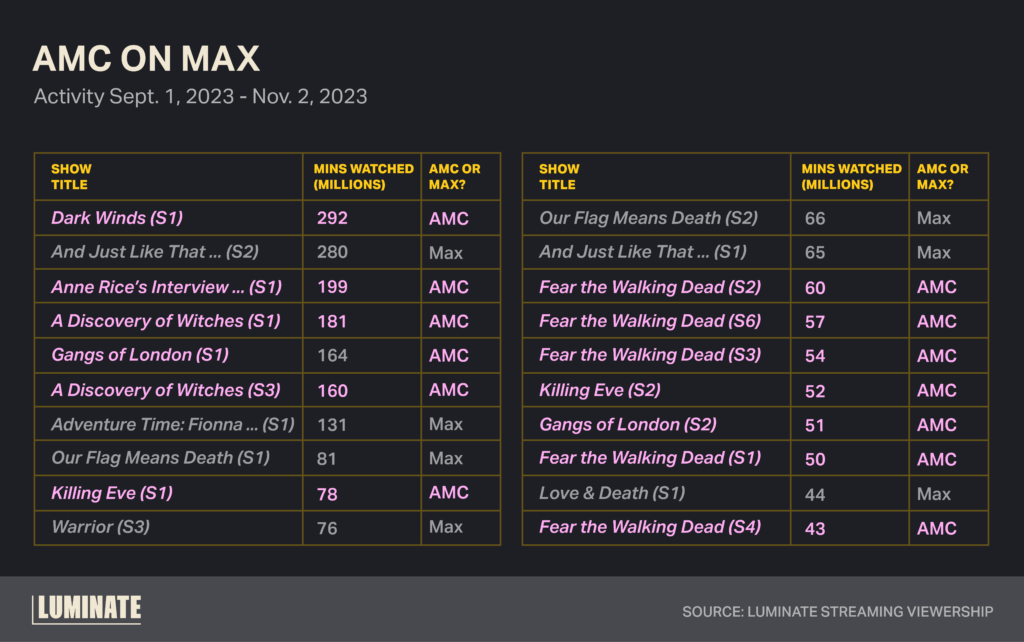

This isn’t the first time AMC has licensed streaming titles to another streamer. Last year, the network licensed titles to Max for a limited two-month period. During that time, AMC titles accounted for 13 of the Top 20 “original” shows on Max. (Note: This ranking is strictly of AMC titles on Max and Max originals and does not include existing library titles on Max or linear HBO titles like House of the Dragon.)

While AMC is still building its own direct-to-consumer audience, the network is finding new ways to leverage the clear value of its existing titles. Interested viewers are being driven to AMC’s ongoing properties on these partner streamers. The Max release was effective in boosting subscribers; from Q2 ’23 to Q3 ’23, AMC went from 11 million to 11.1 million subscribers, a 1% increase. And then in Q4 ’23, when the AMC titles were taken off Max, subscribers increased from 11.1 million to 11.4 million. With the larger scope of Netflix, AMC hopes this can drive even more viewership back to AMC+. Is the “Netflix Effect” still effective? We’ll keep watch…