This past May, Disney and Warner Bros. Discovery announced they would begin offering a Disney+/Hulu/Max bundle, prompting questions: How does a mega-bundle like this impact each participating streamer? And, does this combined force create a true, existential threat to Netflix? Luminate’s Film & TV data gives us some interesting insight.

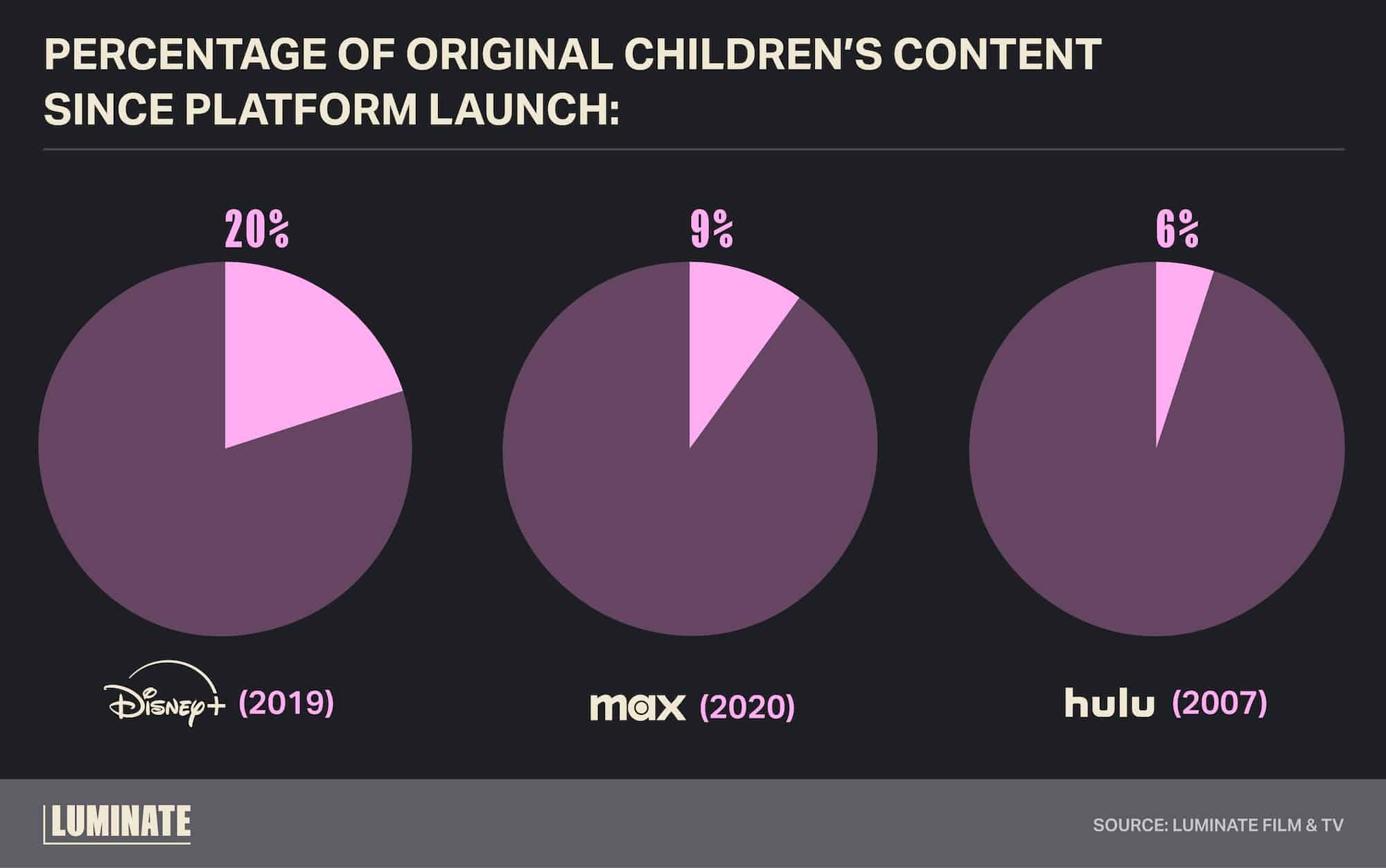

Let’s break down what Max gets from this partnership. Disney+ and Hulu each offer individual benefits to the market sector Max is trying to wrangle. Of the three streamers, Disney+ caters to families the most by dedicating 20% of its Disney+ originals to children. As this is more than double both Max Originals and Hulu, a discounted bundle with Disney+ offers a clear value for families.

The bundling of Hulu and Max forms a symbiotic relationship between the two platforms. Max towers over Hulu with the scale of their unscripted content, boasting Discovery’s massive alternative programming slate and HBO’s award-winning documentaries library. Inversely, Hulu offers exclusive, high-quality content under its own banner, with titles like The Act, and via the “FX on Hulu” label, with titles like The Bear. Max is able to leverage HBO’s prestige content with titles like Succession and The White Lotus but has seen minimal viewership success with its Max Originals slate.

When it comes to pure subscriber count, Disney+ is the best positioned of the streamers to catch up to Netflix, the market leader. But when it comes to viewership, the gap feels more like a canyon. Warner Bros. Discovery faces an uphill battle, having lost NBA broadcasting rights just as Netflix and Prime Video are moving deeper into live sports coverage. A partnership between Disney and WBD benefits both companies by boosting cumulative viewership and mitigating content churn. This is a vital strategy as both companies seek to cut content spending in a post-strike age. Investors seem optimistic about the strategy, especially with The Walt Disney Company reporting record profits for its streamer in Q3 2024. As these two burgeoning streamers face Netflix’s gargantuan, homogenous scope, only time will tell if this new strategy is introducing an offer that can’t be refused.