Sony Pictures has demonstrated how potent its top IP can be, such as when Spider-Man: No Way Home resurrected the pandemic box office at the end of 2021.

But even before the third Tom Holland Spider-Man nearly hit $2 billion globally, an anime film called Demon Slayer: Kimetsu no Yaiba — The Movie: Mugen Train managed to take No. 1 at the box office that April, competing alongside Mortal Kombat.

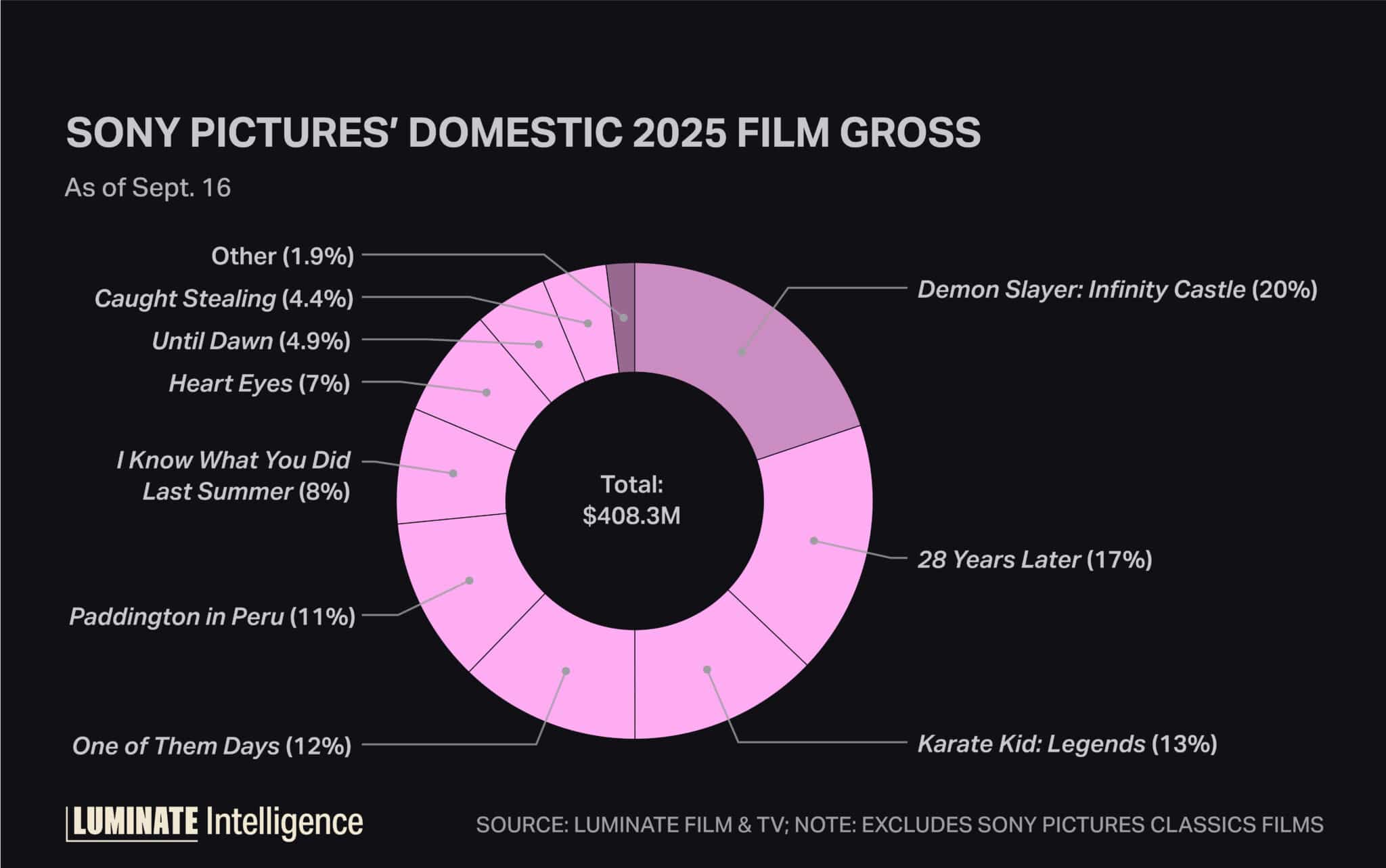

Now, Demon Slayer is back again with its Infinity Castle follow-up — and it’s single-handedly propping up Sony’s box office for the year.

Released through Crunchyroll, Sony’s label and streaming service for anime releases that merged with its Funimation Group when acquired by Sony from AT&T in 2021, Infinity Castle opened to just north of $70 million over the Sept. 12 weekend, surpassing the entirety of horror reboot 28 Years Later’s domestic haul in one fell swoop of the blade.

Infinity Castle also did far better than Karate Kid: Legends, Sony’s closest attempt to a real franchise effort this year in a slate that lacked serious IP.

Demon Slayer is a different beast — and Sony’s chunk of it pales in comparison to how it has performed throughout the rest of the world.

Infinity Castle will end its theatrical run as the highest-grossing anime and Japanese film to date overall, adding another worthy IP to the list of Japanese exports such as Pokémon, Mario and Godzilla. Mugen Train did the same in 2021 — not too shabby for IP that originated from manga before making the jump to TV and now blockbuster films, which first hailed from Japanese distributors Toho and Aniplex.

Therein lies the asterisk on why you don’t see Sony contemporaries in the U.S. following suit with their own cinematic anime releases — none of it is wholly owned IP. Bringing anime overseas to U.S. audiences means splitting the pot.

Disney, for instance, used to distribute Studio Ghibli films, including Spirited Away and Ponyo. Now many years (and acquisitions) later, it is strategically focused on commanding every cent of the IP dominating its slates, even if Marvel is going through growing pains. Specialty distributor GKIDS now largely handles Studio Ghibli movies stateside.

But for Sony and its Crunchyroll label, the goodwill built with U.S. anime fans means the genre will continue to help bridge the gap between major releases, to the point where the studio is more carefully weighing when exactly to release such films.

Case in point: Scarlet. The next effort from Belle director Mamoru Hosoda was set to release Dec. 12, before Sony delayed it to early next year for a better awards run through Sony Pictures Classics, having premiered at the Venice Film Festival this year.

Its initial release would have sandwiched the anime film between the runoff from Wicked: Part 2 and the buildup to Avatar: Fire and Ash the following weekend. Meanwhile, Chainsaw Man — The Movie: Reze Arc is still set for an Oct. 24 limited release.

While Spider-Man: Brand New Day will bring some power back to Sony’s offerings next year, its anime acuity remains a card to play when the going gets tough.