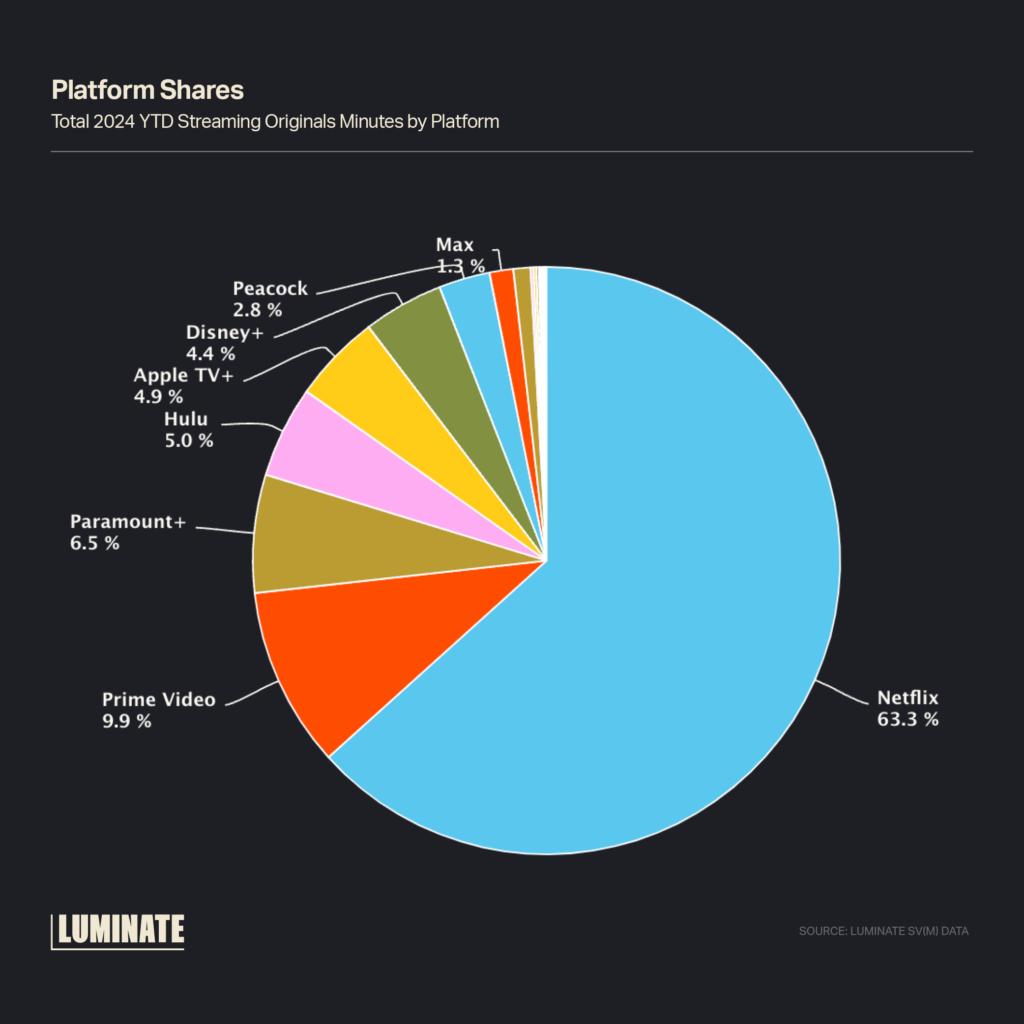

It’s strange to think of a company with a market cap of $3.41 trillion as a startup. But when it comes to original streaming content, Apple TV+ is relatively new to the game. It only started developing original scripted series in 2017 and launched its first hit, The Morning Show, in late 2019. Despite setbacks caused by the pandemic and guild strikes, Apple earned 72 Emmy nominations across 16 of its original shows during the announcement on July 17, its highest total ever. For comparison, the industry’s streaming leader, Netflix, received 107 nominations. When viewed by 2024 year-to-date minutes watched by platform, it’s clear that Apple is punching above its weight.

The Value of an Emmy

What, though, is a nomination really worth? Award nominations are always great for bragging rights and for raising talent profiles. But for networks and streamers, it’s hard to find an ROI metric on expensive “For Your Consideration” ads and press junkets. The value of an Emmy award has historically been measured both by ratings for the season following the awards ceremony as well as the ratings for the awards presentation itself.

Now that streamers dominate the Emmys, there’s an opportunity to use Luminate’s streaming consumption metrics to understand the impact award nominations have in real time.

This analysis looks at two weeks of streaming activity for shows nominated in the following categories: Outstanding Drama Series, Outstanding Comedy Series and Outstanding Limited or Anthology Series. Streaming activity is compared between Week 29 (July 12-18) and Week 30 (July 19-25); Week 29 includes both the time frame prior to the Emmy nominations and directly after, while Week 30 includes the first full week following the announcements.

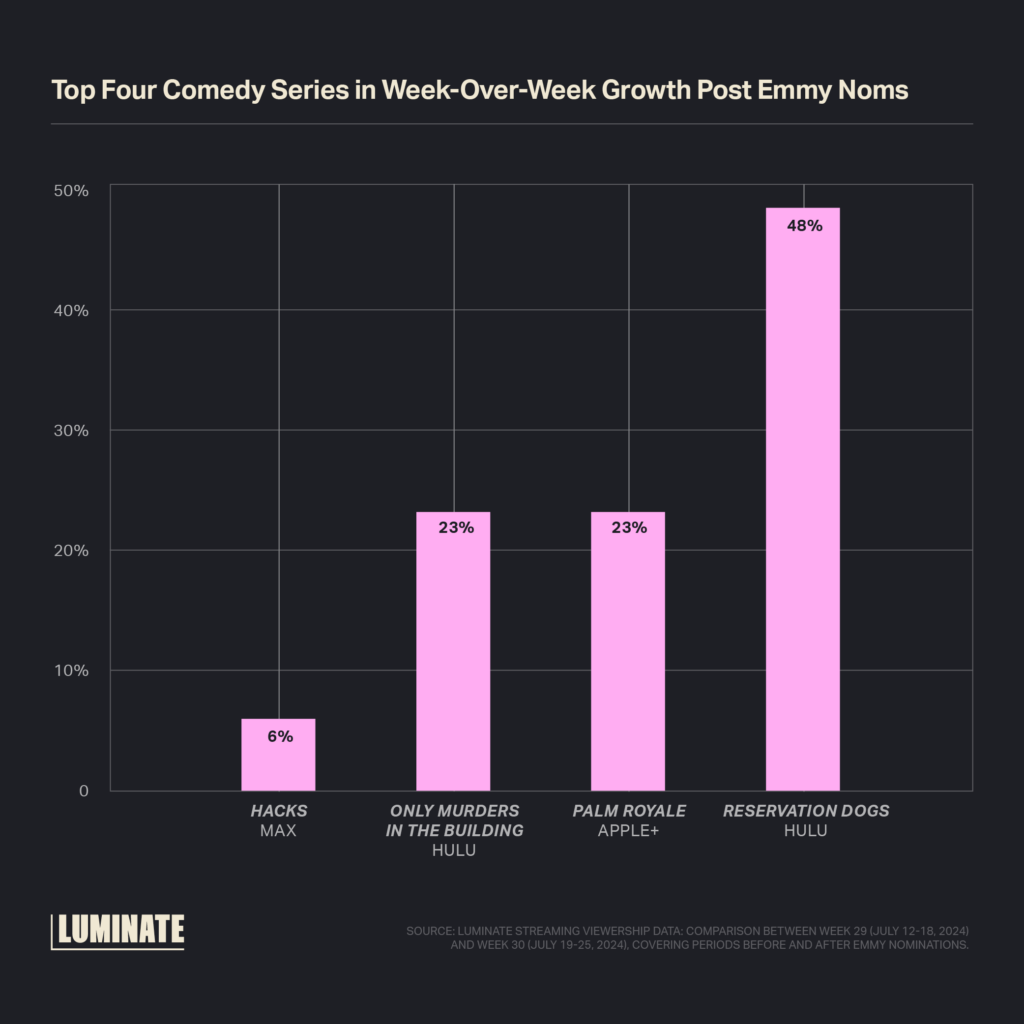

Outstanding Comedy Series

In a time when scripted comedy is struggling as a genre, it was good news to see that each of the eight Emmy-nominated comedy series received a 5% boost on average in Week 30. The streaming growth that week was led by FX on Hulu’s Reservation Dogs, which had an eye-popping 48% increase in consumption. Apple’s Palm Royale and Hulu’s Only Murders in the Building each saw 23% growth. The Palm Royale increase is significant because it’s the only show in its first season among the nominees in its category.

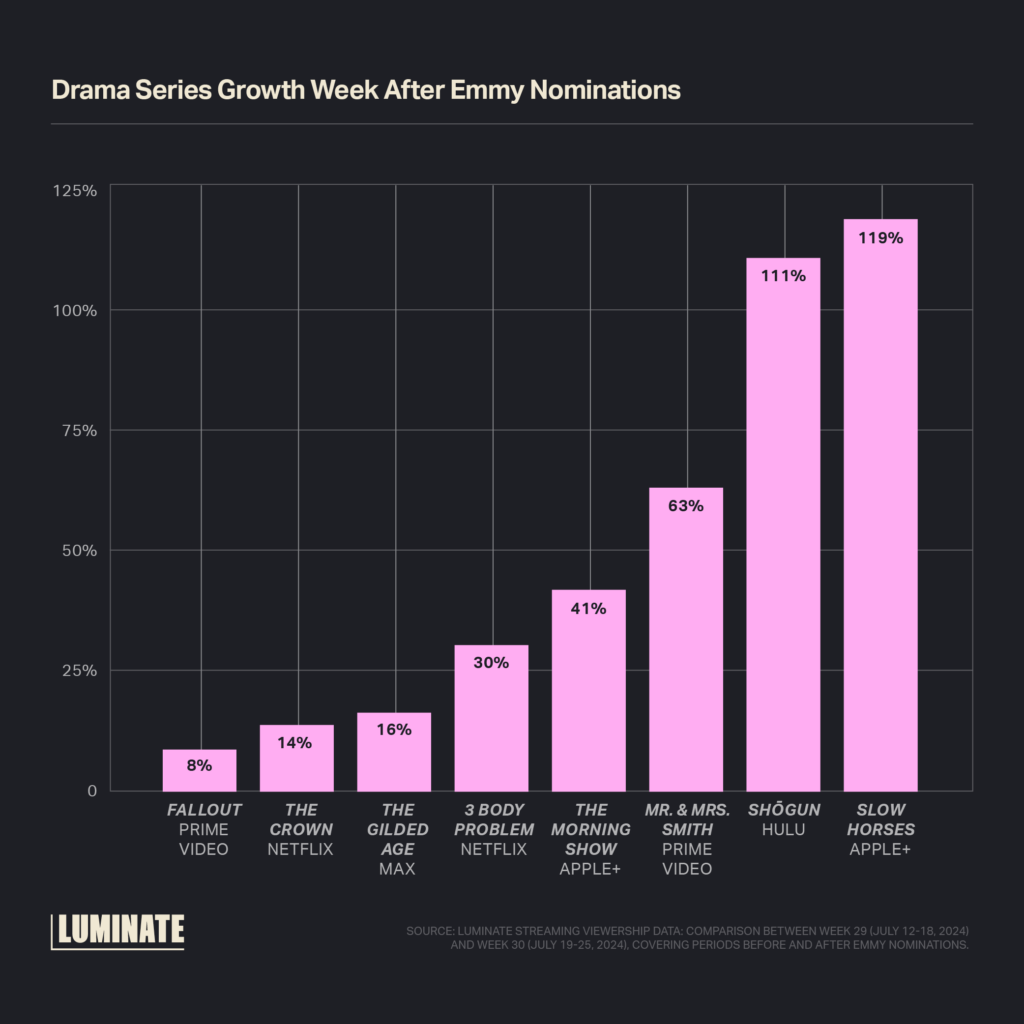

Outstanding Drama Series

The Drama category lived up to its name with a high impact of Emmy nominations. Every nominated series experienced significant growth from Week 29 to 30 with an average of 50% across the shows. Apple led the charge with a 199% increase in streaming minutes viewed for Slow Horses. Shōgun came in second place, possibly with a boost from hybrid streaming/linear distribution.

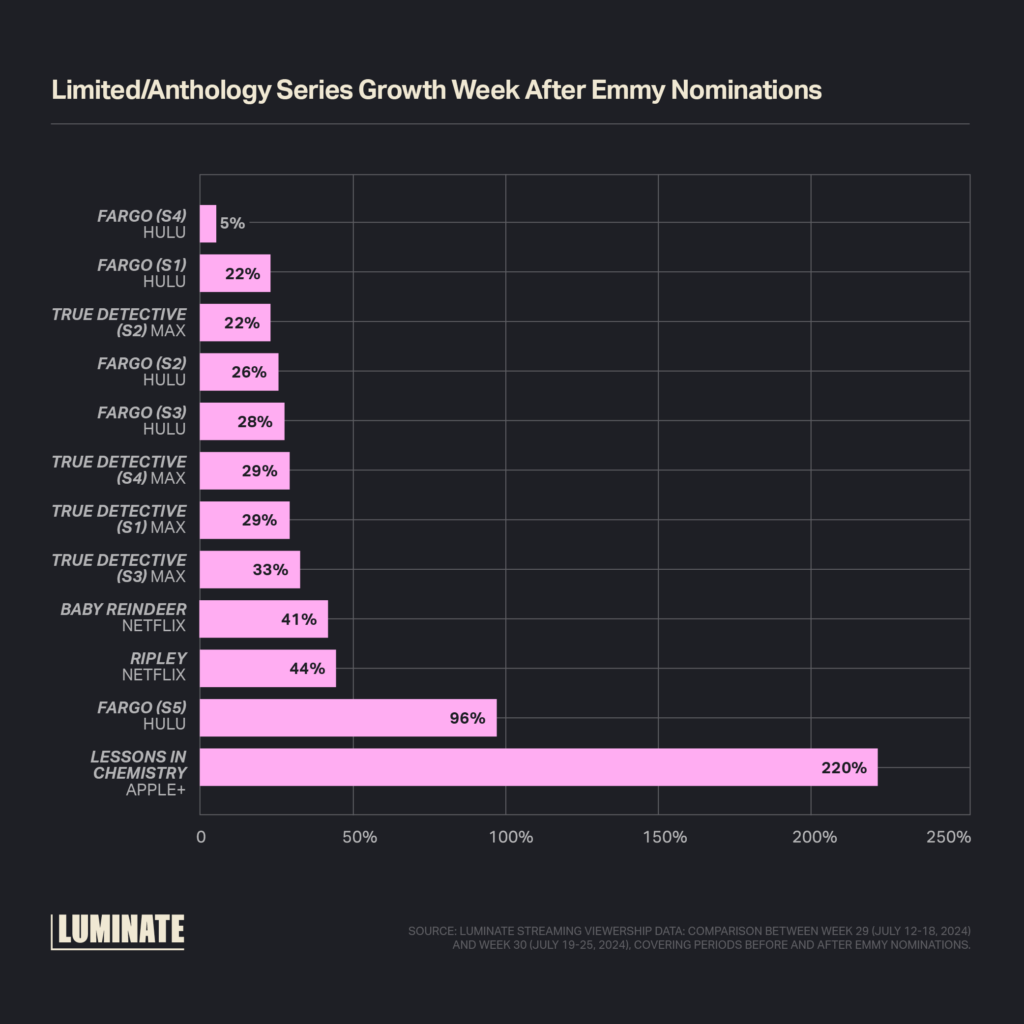

Outstanding Limited or Anthology Series

The limited series category was among the most hotly contested, and many worthy contenders did not make the cut. Lessons in Chemistry, starring Brie Larson, ran away with the post-nomination growth contest with a 220% increase in minutes watched, while the latest season of Fargo also felt an impressive bump with 96%. Anthology series like Fargo and True Detective have a notable advantage in this category from a viewership perspective: Not only did each show’s most recent season of each show benefit from an Emmy nomination, but viewership for prior seasons also increased as well.

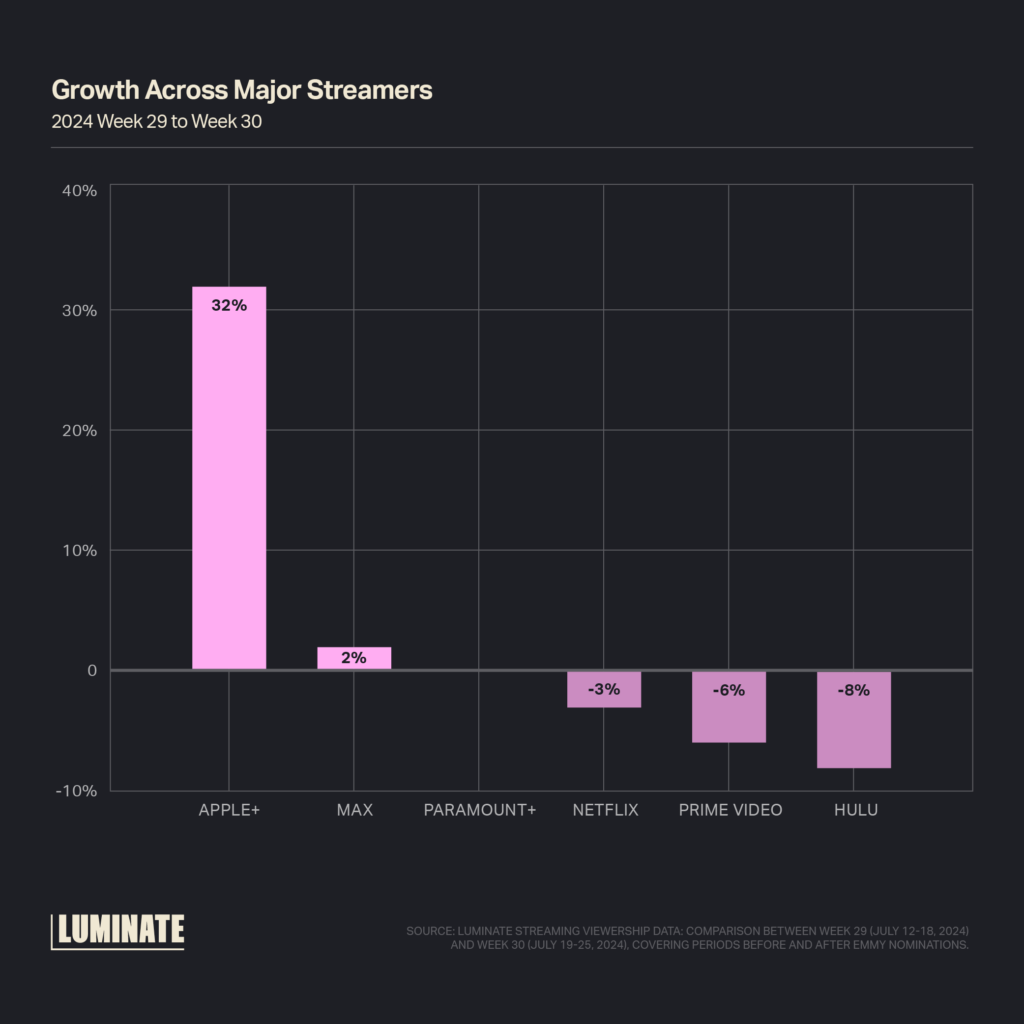

The Halo Effect

There is another interesting story looking beyond award nominated titles at all of the acquired and original content at the streamers. Apple’s award nominations appear to have raised overall awareness and engagement with its platform with 32% growth in minutes watched between Weeks 29 and 30. It couldn’t have been better timing, as the season finale of Presumed Innocent drove Week 30 views as well. The only other streamer to register any positive change in that period was Max with 2%. Across the board, Emmy voters chose to recognize character-driven, low VFX content. It’s clear that audiences are recognizing these shows as well.

The Emmy Award winners will be announced on September 15, 2024. Streaming Watch will follow up on this study to see how winning awards impacts viewership.