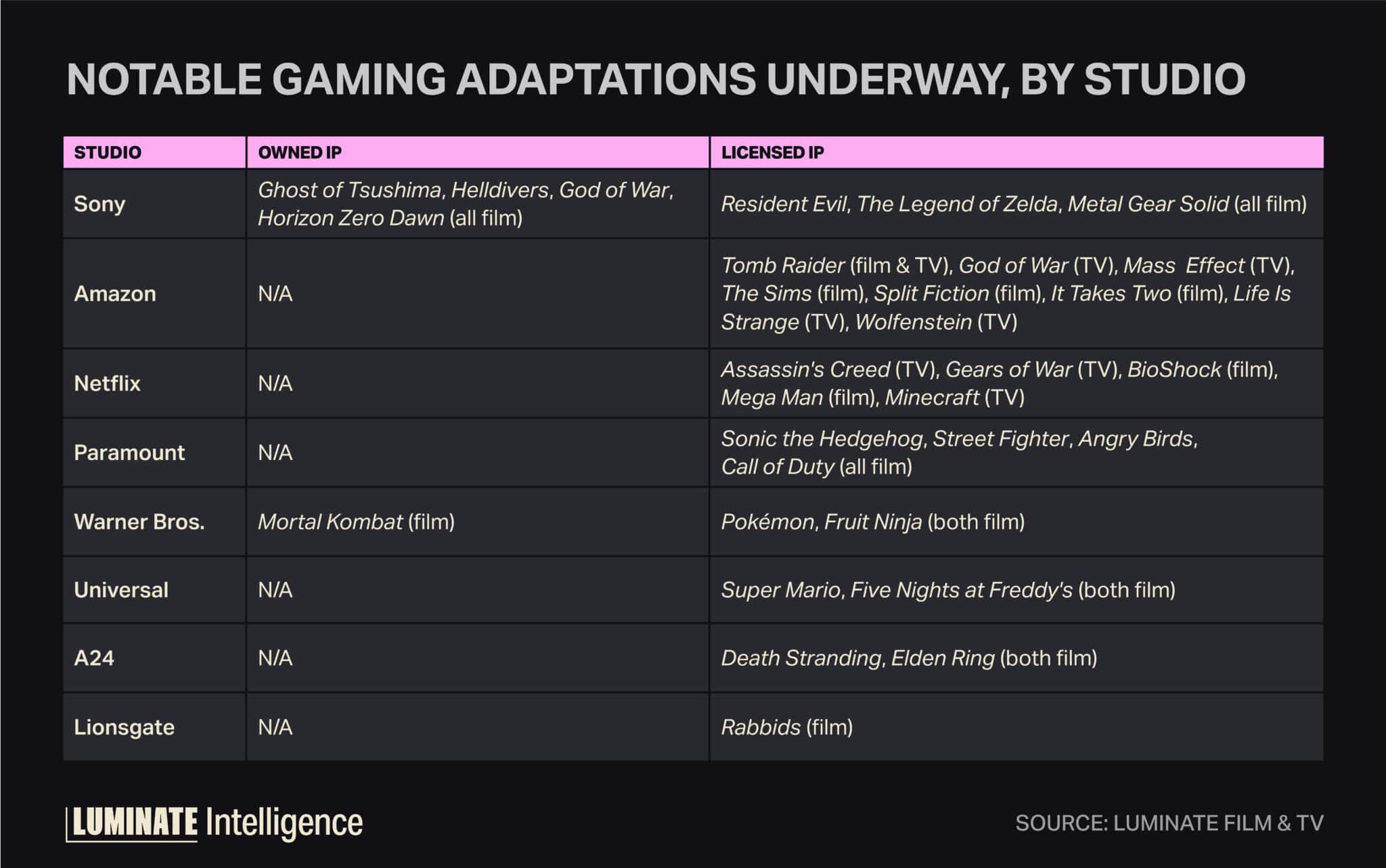

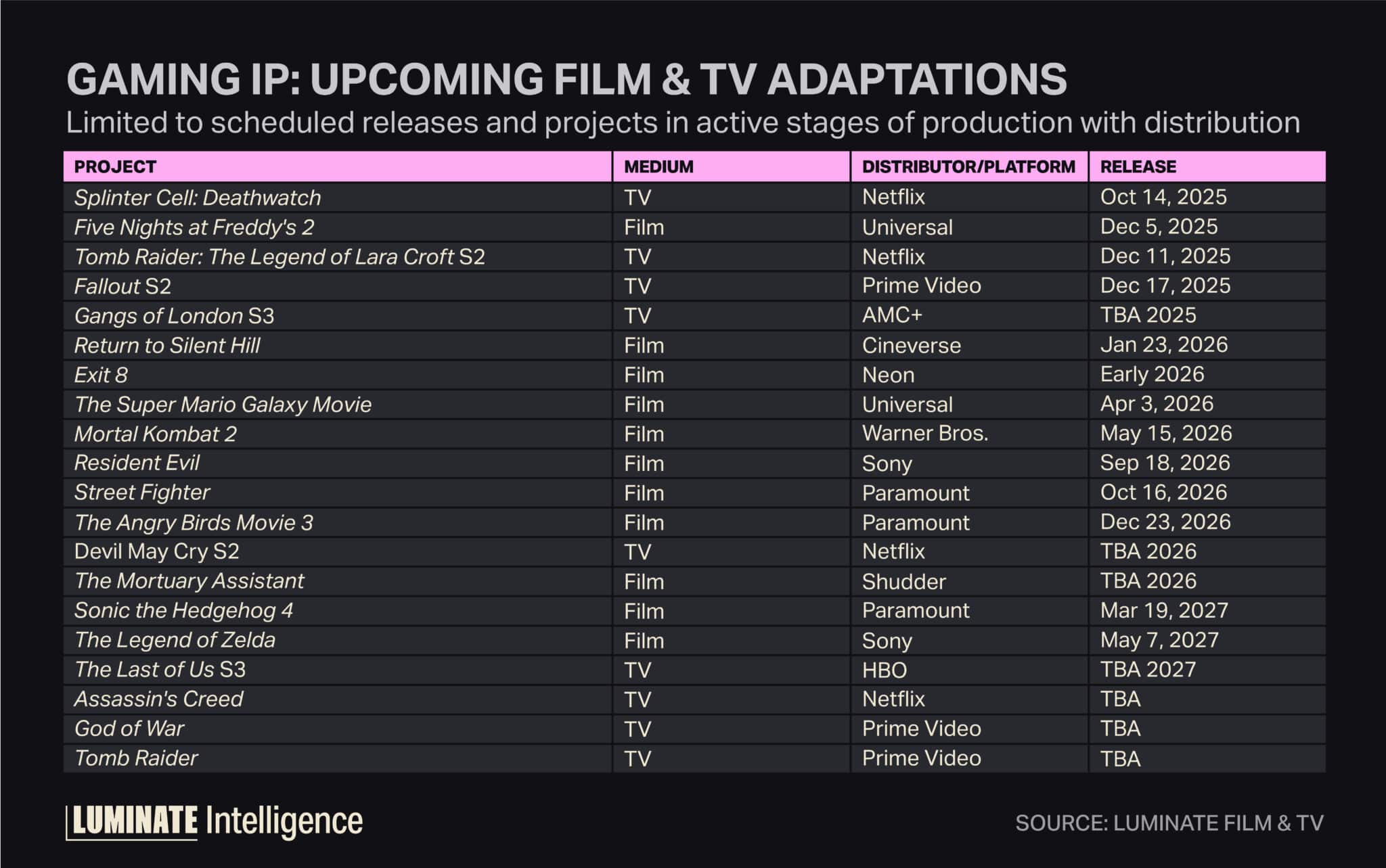

Newly christened Paramount Skydance turned heads in September with a major deal for a Call of Duty film, buoying a strong base of licensed gaming IP like Sonic the Hedgehog.

The move granted Paramount the film and TV license to the Activision IP — by far the biggest in the console ecosystem — giving it a big edge in an increasingly crowded market where major players are grabbing gaming IP wherever they can get it.

However, there is little symmetry to be found in how each company is approaching the IP at their disposal.

PlayStation owner Sony, for instance, is understandably a heavy cross-media player, having kicked off its PlayStation Productions shingle with its Uncharted film in 2022 and HBO’s The Last of Us in 2023, which has at least one more season left. Sony also has several films in development based on wholly owned IP, including God of War.

Still, the projects that are moving fastest in Sony’s pipeline are licensed from other owners. Weapons director Zach Cregger’s Resident Evil reboot next year and a live-action adaptation of Nintendo’s The Legend of Zelda are everything Sony has coming up in the near term.

Hints at an Uncharted sequel have yet to materialize into confirmed plans, while subsequent PlayStation adaptations such as Gran Turismo and Until Dawn were nowhere near as successful as Uncharted.

Similar to The Last of Us, the only adaptation of PlayStation IP approaching the production stage is Amazon’s live-action God of War series from Battlestar Galactica steward Ronald D. Moore, which is in pre-production.

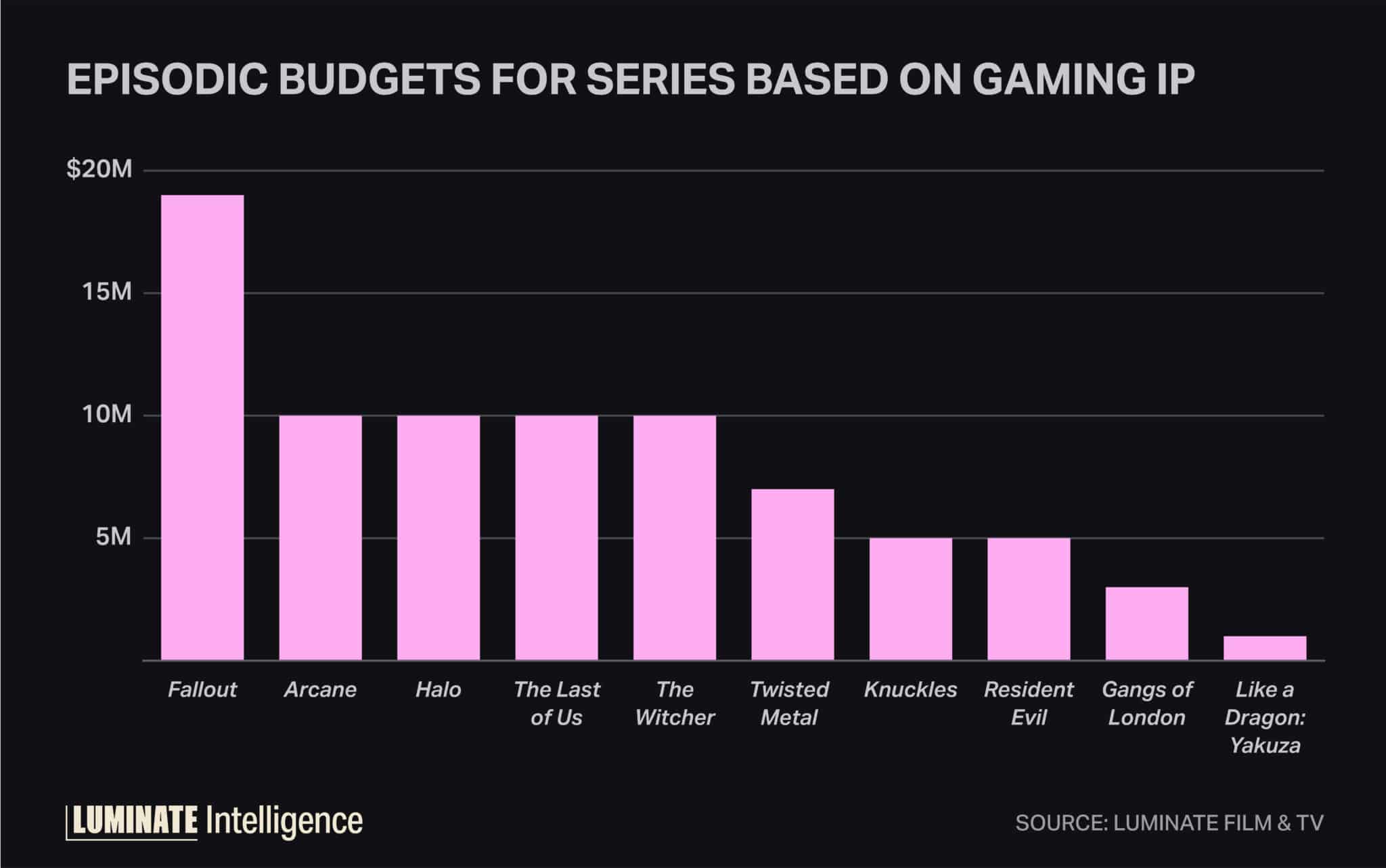

Given Amazon’s big success with Fallout, which has a second season due in December, it makes sense that Amazon is taking advantage of its financial resources to commit to more live-action TV series based on video games, including Tomb Raider, which recently cast Game of Thrones’ Sophie Turner in the lead role. If greenlit, space-set Mass Effect will also be somewhat of a successor to Prime Video’s The Expanse. Despite Amazon MGM’s packed 2026 film slate, there isn’t a single film adaptation that isn’t still in the development stage.

Episodic budgets for live-action series based on gaming IP tend to be among the highest, which is likely why Warner Bros. is avoiding further TV adaptations of games after The Last of Us and only has one Mortal Kombat sequel in the periphery, with little else in development, though a sequel to 2025’s best domestic performer A Minecraft Movie is nearly guaranteed.

Netflix does have a live-action Assassin’s Creed series in pre-production from Roberto Patino, who is also penning A24’s film adaptation of web series The Backrooms. But the streamer is mainly focused on animated adaptations, with a Gears of War anime series coming after critically acclaimed Cyberpunk 2077, Tomb Raider and Devil May Cry anime shows, as well as an animated Minecraft series. Despite delays and setbacks, a BioShock film script is further along, but nothing has materialized beyond basic development work.

As for A24, film adaptations for Death Stranding and Elden Ring remain the closest examples the distributor has to a coherent franchise strategy with directors attached, but both projects remain in development.

Universal also appears to be perfectly content with Five Nights at Freddy’s and Super Mario in its film roster — with sequels due in December and next April, respectively — but no other gaming-based projects otherwise. After its Borderlands flop last year, Lionsgate has no gaming adaptations coming up, aside from a Rabbids project in development since 2019.

Outside of those companies actually engaged with bringing gaming IP to the big and small screens, Disney remains focused solely on its own IP, with no film or TV adaptations based on the space.

And in stark contrast to Amazon, Apple has yet to chase gaming IP, despite audience goodwill for Rob McElhenney’s Mythic Quest series, which revolved around a gaming studio.

As much as gaming IP has been dramatically pursued in recent years, the adoption of such properties and the subsequent execution of adaptations is still highly inconsistent from studio to studio.

Paramount certainly has an advantage with Call of Duty, but as its Hollywood contemporaries have shown, getting these projects to the finish line is easier said than done.