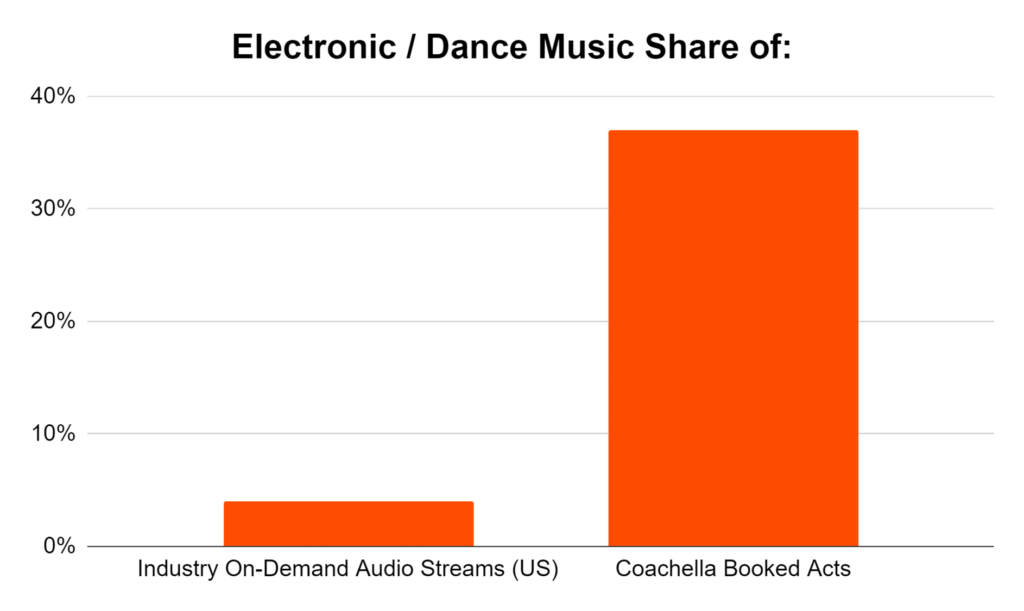

With Coachella formally initiating festival season on Friday, we wanted to explore how and why different genres enjoy outsized presence at live music events relative to what we might expect from consumption. Take these two points about Electronic music – which will be the focus of this analysis – as an illustration:

- Roughly 37% of Coachella’s booked acts in 2023 are Electronic artists – the largest genre presence by roughly two-fold

- Electronic music accounts for 4% of overall consumption in 2023 – approximately one-tenth of the genre’s presence at Coachella – in the United States

To help circle this square, let’s look at a broader profile of Electronic/EDM music listeners:

- Approximately 20% of music listeners tune into EDM on a monthly basis and 11% on a weekly basis

- Nearly half (46%) of EDM listeners are under the age of 35 (making it one of the youngest genre listenerships)

- EDM listeners have an incredibly diverse listening palette, tuning in to roughly 75% more genres on a monthly basis than the average U.S. music listener

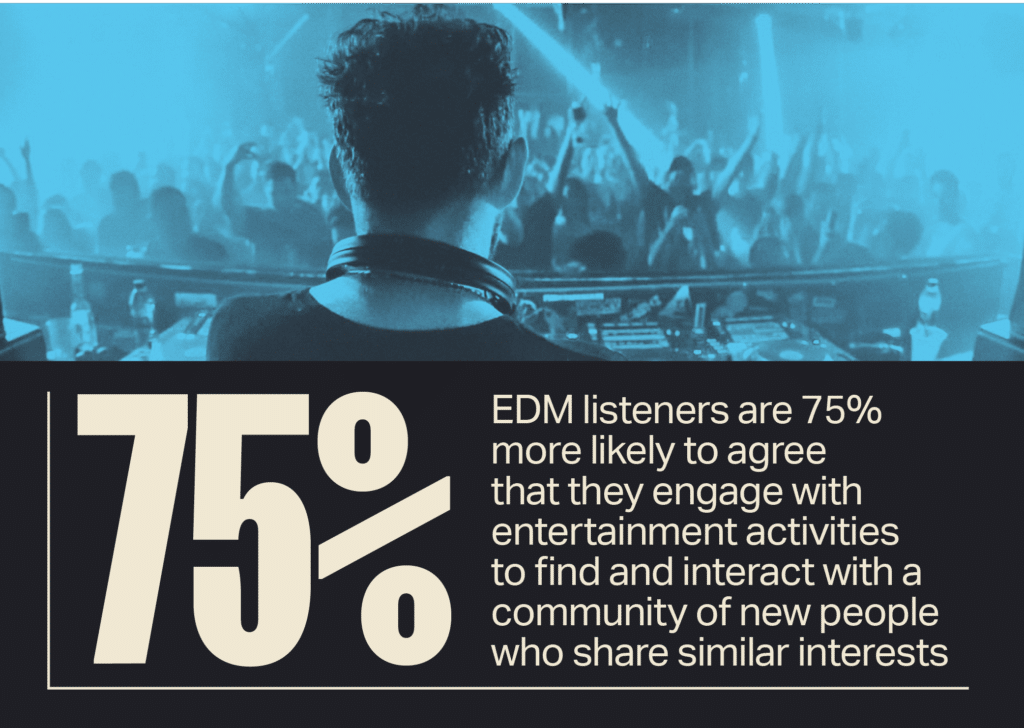

- Importantly, EDM listeners are 74% more likely to agree that they “engage with entertainment activities to find and interact with a community of new people who share similar interests” than U.S. listeners overall

EDM listeners in the U.S. also spend, on average, 58% more on music than the listeners in the U.S., spending an especially large amount on club/DJ events, music festivals, and artist merchandise.

With such a dedicated and engaged fandom, why is there such a large disparity between Electronic music’s presence at festivals vs. its presence on streaming services? Below are a few reasonable explanations:

- The demographic composition of EDM listeners (age especially): Live event attendees tend to be much younger than music listeners overall, even more so than the age distribution of DSP users (either free or ad-supported). Given Electronic music’s age distribution, it is naturally going to attract more live-event goers

- Sky-high demand from Electronic fans/consumers: Even accounting for their age/demographics, EDM listeners are still a uniquely engaged audience who are eager to spend money to see live music – and this is especially true for music festivals (where they are 54% more likely to plan on attending one in the next year relative to music listeners overall)

- Electronic music listeners tune in to a wide array of genres in a wide array of contexts, and it’s possible their streaming preferences are distributed across a breadth of different genres

- Given their interest in finding/engaging with communities of like-minded people, it’s possible that electronic fans are attending live events to meet and interact with other fans just as much as they are to see their favorite artists

While there are endless ways to engage listeners & fandoms across the music industry, it seems clear that Electronic/Dance artists have carved out a special niche by capitalizing on the live events that their fans are eager to attend.

Source:

References to “Electronic listeners” throughout this analysis will specifically refer to monthly EDM listeners

Luminate U.S. Music 360 survey (Feb. 2023)

Luminate Entertainment 365 survey (Feb. 2023)

Luminate custom analysis of Coachella’s lineup by genre

Luminate Music Connect