Five years on from COVID, established IP remains an integral component of the challenged film exhibition environment. But what has noticeably changed is which franchises do the heavy lifting.

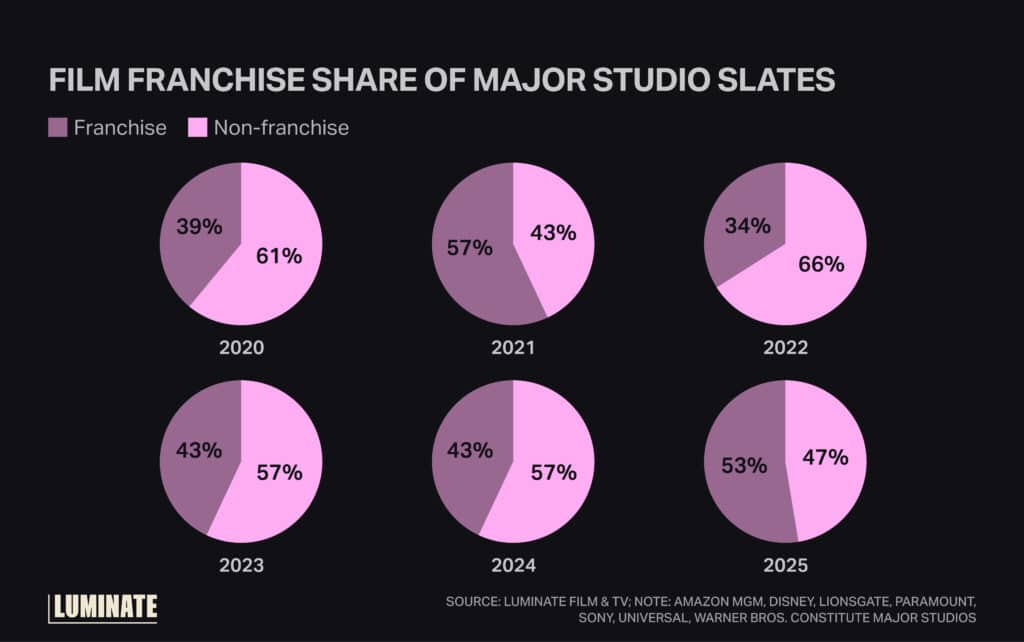

2025 was the first year since 2021 in which franchises account for more than half of the wide-release output across the seven major studio slates, including Lionsgate and Amazon MGM.

However, much of the highest-performing IP from U.S.-based studios took a backseat to first-time film franchises and formerly dormant properties this year. That said, there’s one major overseas exception in this year’s top grosser from China, Ne Zha 2, which made close to $2 billion.

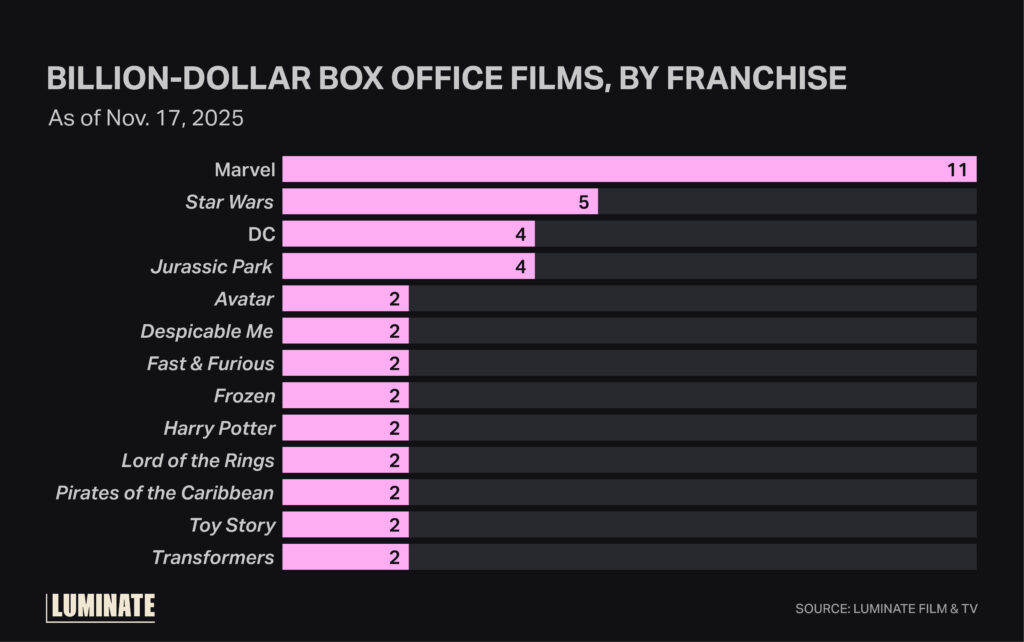

Among the leaders of billion-dollar blockbusters, Marvel, DC and Jurassic World saw new entries hit theaters in 2025, and none earned more than $1 billion — including all three Marvel Cinematic Universe films. Of those three, only Fantastic 4: First Steps managed to break $500 million globally, well under the $1.3 billion haul of Deadpool & Wolverine last year.

James Gunn’s reimagined Superman topped out at just over $600 million over the summer. The last DC film to break a billion was 2019’s Joker, whose 2024 follow-up finished at just over $200 million — a defining bomb of the decade.

Warner Bros.’ only billion-dollar success since 2019 is Barbie, the top-grossing film of 2023, but new franchise A Minecraft Movie came close, topping out at just under $960 million. It’s also the best domestic performer of 2025 so far, with $424 million, demonstrating how crucial it has been for Warners to utilize third-party IP at a time when core film IP such as Harry Potter is on ice.

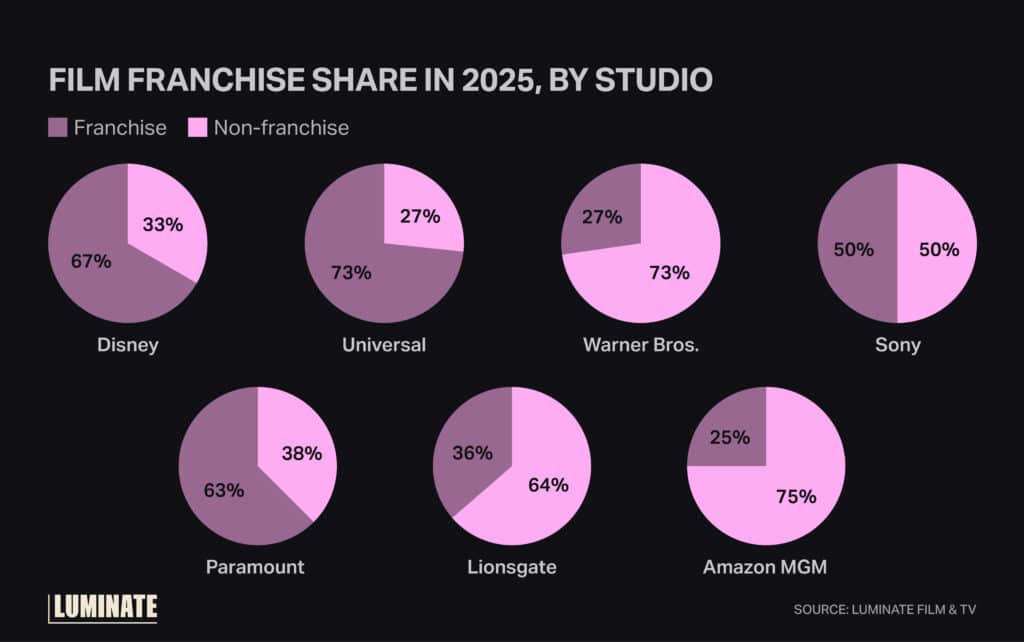

In fact, Warners was the least dependent on established film franchises this year.

The studio’s original horror effort Sinners still rounds out the domestic top five for the year, and new entries in the Final Destination and Conjuring horror series were among the year’s best, despite a 14-year gap between the last Final Destination and its reboot this year.

Meanwhile, Sony’s only film to break $100 million in the U.S. is global anime powerhouse Demon Slayer: Infinity Castle, demonstrating how less dominant strains of film in the past are redefining major-studio slate strategy.

That doesn’t mean Universal was wrong to hastily put together Jurassic World Rebirth in the wake of Chris Pratt stepping down from the newer dinosaur films, which have consistently net $1 billion. Rebirth still made $869 globally in 2025 and is Universal’s best of the year. Its live-action remake of How to Train Your Dragon is the only other film that crossed $200 million domestically.

None of Universal’s other releases even made it past the $100 million domestic mark, making Wicked: For Good this weekend and next month’s Five Nights at Freddy’s 2 key finishes for the year. Those sequels are further examples of how beneficial it is to bring outside IP with built-in audiences to the film landscape for the first time.

Per Luminate Streaming Viewership (M), Wicked is even the most streamed film of 2025 despite releasing a year ago. Likewise, Universal’s The Super Mario Bros. Movie in 2023 remains the studio’s best film of the decade and its next best shot at another billion-dollar outing when The Super Mario Galaxy Movie hits theaters in April 2026.

Disney’s best example of reheated IP is this year’s live-action remake of Lilo & Stitch, which wrapped its run with a little over $1 billion, as opposed to the modest $275 million net from the 2002 animated original.

Disney’s Avatar: Fire & Ash, due Dec. 19, is more than guaranteed to break $1 billion, as the last entry in 2022 earned $2.3 billion altogether.

A sequel to 2016’s Zootopia is out this Thanksgiving. Given how the first hit a billion dollars and Disney’s overdue sequels to Inside Out 2 and Moana 2 delivered billion-dollar hits last year, it serves as another sign that hits from last decade can still matter in the current theatrical climate when done right.

For more box office data, check out the Luminate Film & TV database.