When mob thriller The Alto Knights fizzled out this spring after a poor showing for Bong Joon Ho’s expensive Mickey 17, many were quick to write off Warner Bros. for the year.

Now, Weapons has added to a marathon run of five movies — or six, if you include Apple’s F1: The Movie, which Warners distributed — making the studio’s turnaround something the industry must study in the years ahead.

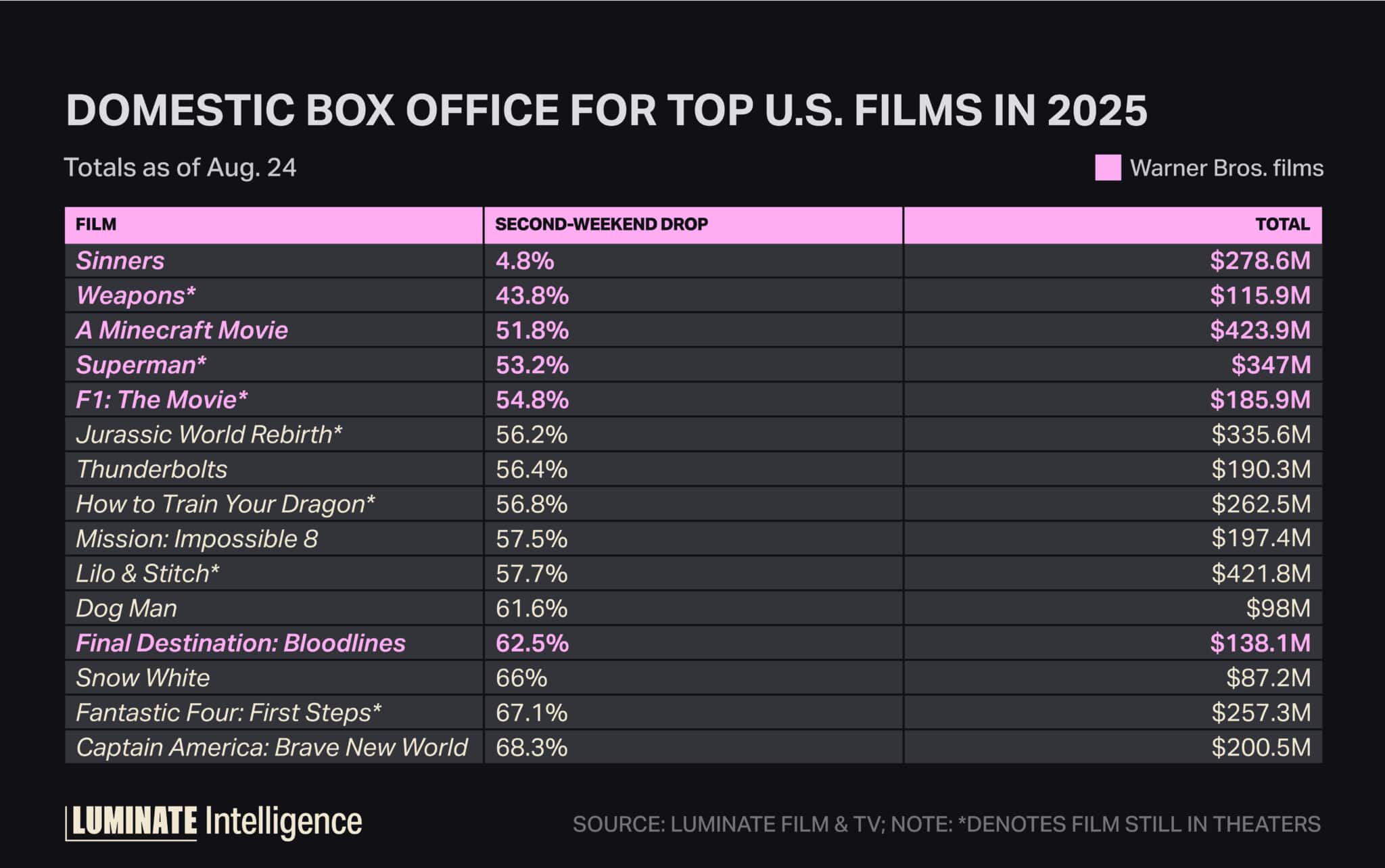

When organizing 2025’s top 15 domestic releases by the drops in theatrical gross on their sophomore weekends, the five that saw the lowest losses in turnout were all distributed by Warners. That includes powerhouse projects A Minecraft Movie, the best domestic film of the year; Superman, the best superhero film of the year; and Sinners, both the best horror film of the year and best original effort, having grossed more domestically than all three of Disney’s Marvel efforts this year.

Sinners saw the lowest attendance drop of all in its second weekend, losing just below 5% of its opening weekend’s audience, while Weapons notched the second-lowest audience decline earlier in August.

The end result paints a picture of what an optimal studio slate looks like, by the numbers.

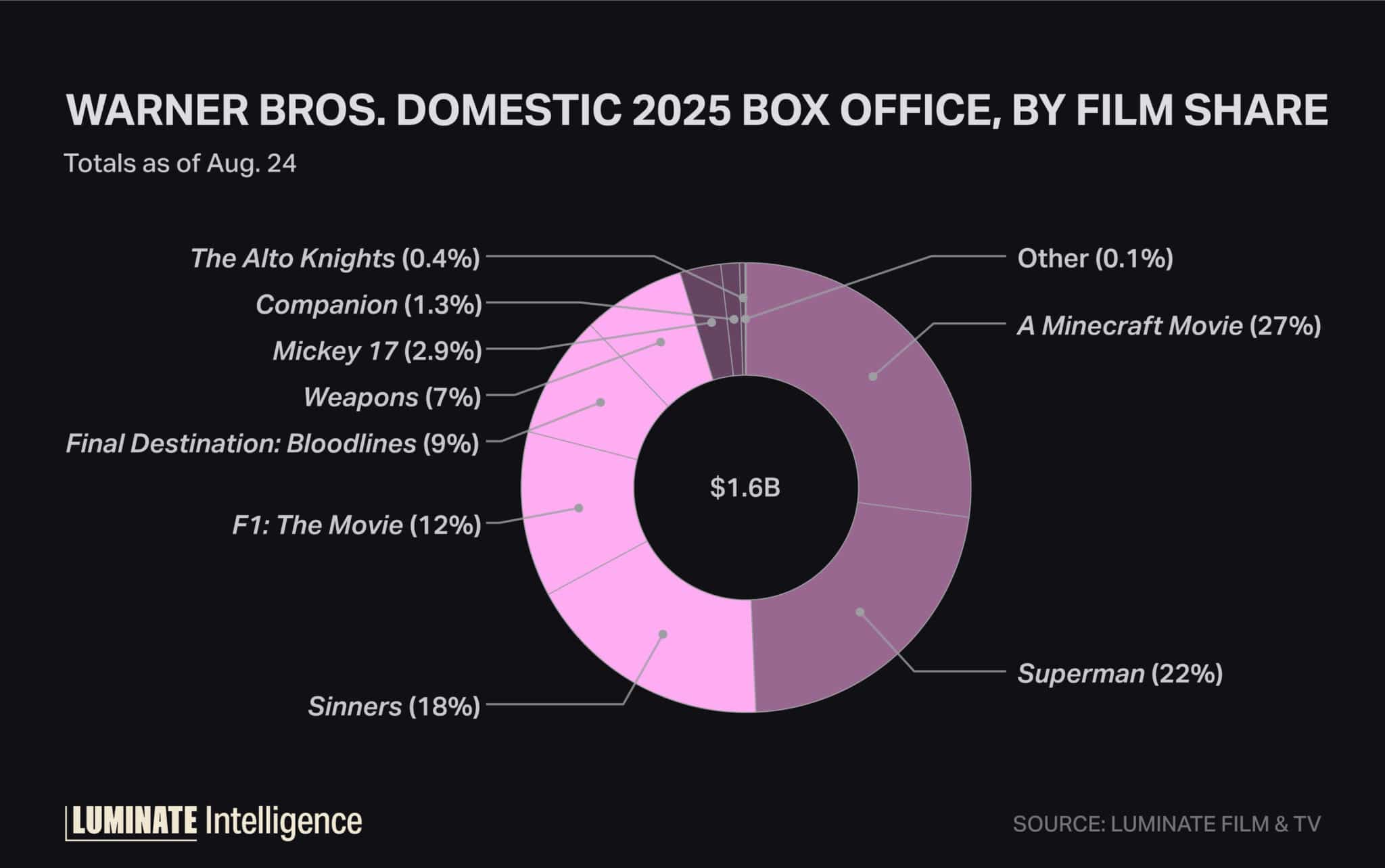

Stacked against everything else, Mickey 17 and Alto Knights no longer look like critical misfires for Warners’ 2025, even if the former lost significant money on its $133 million budget. Superman and A Minecraft Movie account for nearly half of Warners’ domestic gross, standing victorious as the studio’s biggest tentpole bets of the year.

Likewise, Sinners, Final Destination: Bloodlines and Weapons together represent a horror-centric third of its cumulative gross. With Apple’s F1 in the mix, the four represent 46% of Warners’ total.

That means the misses that led to a flurry of trade publications speculating over the firing of Warner Bros. film heads Pam Abdy and Mike De Luca account for a puny 5% of studio performance.

However, the Warners slate isn’t perfectly balanced. There’s nothing in the vein of comedy intended for adults, and the studio’s remaining films this year are The Conjuring: Last Rites (franchise horror), One Battle After Another (Paul Thomas Anderson’s turn at an auteur effort budgeted at well over $100 million) and Mortal Kombat (video game action sequel).

Disney has the strongest-performing theatrical comedy of the year in Freakier Friday, which underperformed Weapons in the same release weekend, cementing Netflix as the year’s comedy champion with Happy Gilmore 2, the streamer’s best domestic opening on its home turf.

Still, the security of Warners’ horror movies doing as well as they have shows the way forward for major studio slates. Instead of throwing a ton of tentpoles at the wall and leaving little money left to invest in smaller efforts, the studio was able to top its 2025 slate with two reliable tentpoles, with Minecraft launching what will undoubtedly be its newest film franchise.

If any approach affords studios the chance to experiment more with its offerings and try new things, it’s that.