In our 2024 Year-End Music Report, we introduced the Luminate Export Power Score – a metric designed to evaluate a country’s ability to export recorded music globally. Typically, when we analyze how countries are performing we focus on streaming trends, but this approach doesn’t take into account the full impact of how artists from said country are performing in international markets.

The Luminate Export Power Score is a combination of four data points:

- The rank of artists in each country based on Total On-Demand Streaming and Country of Origin

- The number of countries importing music from a given export country

- The streaming size of importing countries

- The number of artists per export country reaching international audiences

In other words, a country would score highly if they had a significant volume of artists reaching international markets, had artists with strong performance in those countries and had artists reaching countries with a higher share of the global music industry.

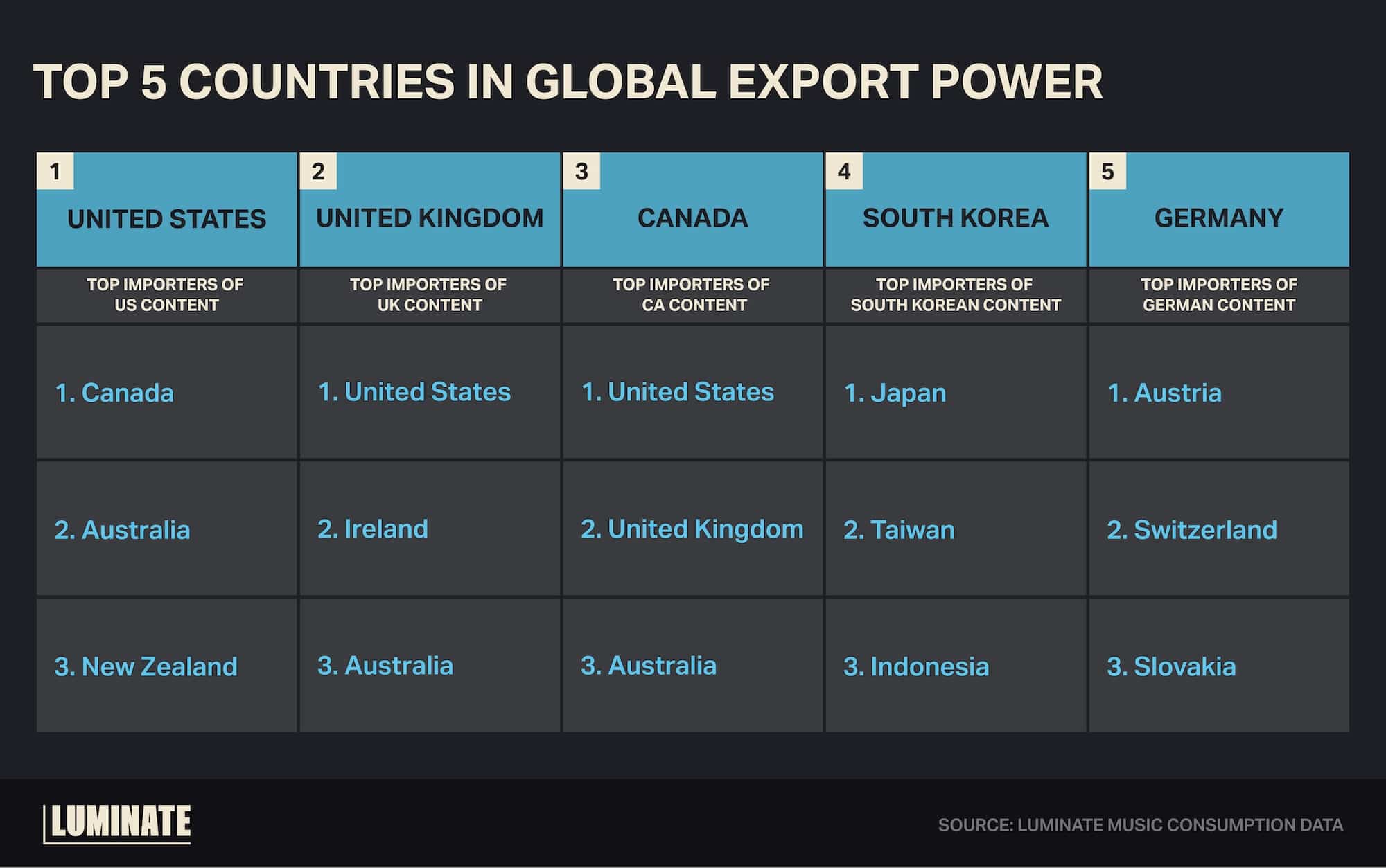

With that being said, here are the countries with the highest export power, and their biggest importers, in 2024:

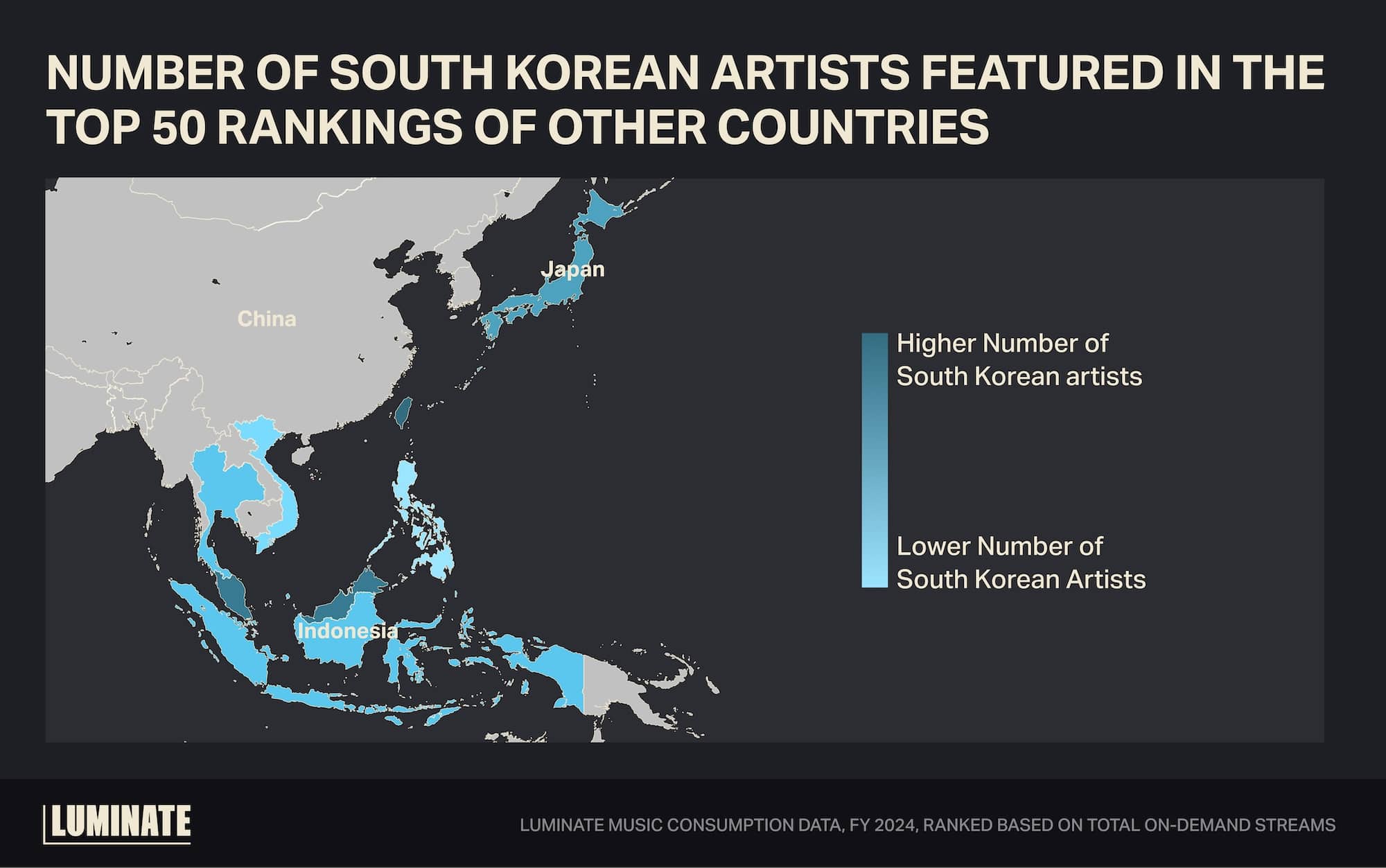

To better illustrate this concept, let’s examine South Korea and its top importers. The map below highlights the countries where South Korean artists ranked in the top 50, with darker shades of blue representing a greater concentration of artists. South Korean artists appeared in the top 50 in 12 markets, with the highest concentration seen in neighboring countries Taiwan, Singapore and Malaysia. Of these 12 markets, Japan featured nine South Korean artists in its top 50 while Indonesia featured three, with both countries representing the largest streaming market share in the APAC region (excluding India). In Taiwan, four of its top 10 artists originate from South Korea. The U.S. did not qualify as a Top-3 importer in 2024 as it did not have any South Korean artists in its top 100 rank.

With Luminate Insights data, we can gain more insight as to why Japan is such a huge importer of South Korean content. According to Luminate’s Japan Music 360:

- 18% of Gen Z & Millennial Music Listeners in Japan are K-Pop fans (+5% higher than the average music listener in Japan)

- Japanese K-Pop music consumers spend on average 37.3 hours in a typical week listening to music (+6.5 hours higher than the average music listener in Japan)

- 43% of Japanese K-Pop music listeners are planning on attending a live concert in the next 12 months (+20% higher than the average higher than average music listener in Japan)

This shows that Japanese K-Pop fans are avid music listeners with a strong dedication to the genre.

The Luminate Export Power Score can help pinpoint where your artist’s audience is now as well as where it could be developing. By combining this with Luminate Insights consumer research data, there’s an opportunity to gain a deeper understanding of fans’ music listening and purchasing habits, allowing you to effectively engage with these audiences.

Don’t forget that you can read more on the Luminate Export Power Score, the songwriter’s presence in the global stage, global premium streaming trends and much more in our 2024 Year-End Music Report linked here.

Source:

Luminate Music Consumption Data

Luminate Insights Consumer Research Data – Japan Music 360 (2023)