Whether you’ve been on TikTok or heard K-Pop songs on the radio, it’s undeniable that the genre is having a big year in music. Some of this year’s achievements include:

- NewJeans became the first K-pop girl group to top Billboard’s World Albums Chart for 7 non-consecutive weeks in a row with Get Up

- FIFTY FIFTY’s song “Cupid” peaked at number one on the Billboard Global Excl. U.S. chart and they became the first all-female group of any genre, to hit #1 with a debut entry on the chart

- Jung Kook & Latto’s “Seven” was this year’s Billboard No. 1 Global Song of the Summer

With the success of K-Pop globally, let’s use Luminate country-level data to see how the genre performs in other territories by answering questions like: Which countries are the first to hear K-Pop new releases? Which countries are streaming the genre more this year and which countries are seeing growth in K-Pop streaming?

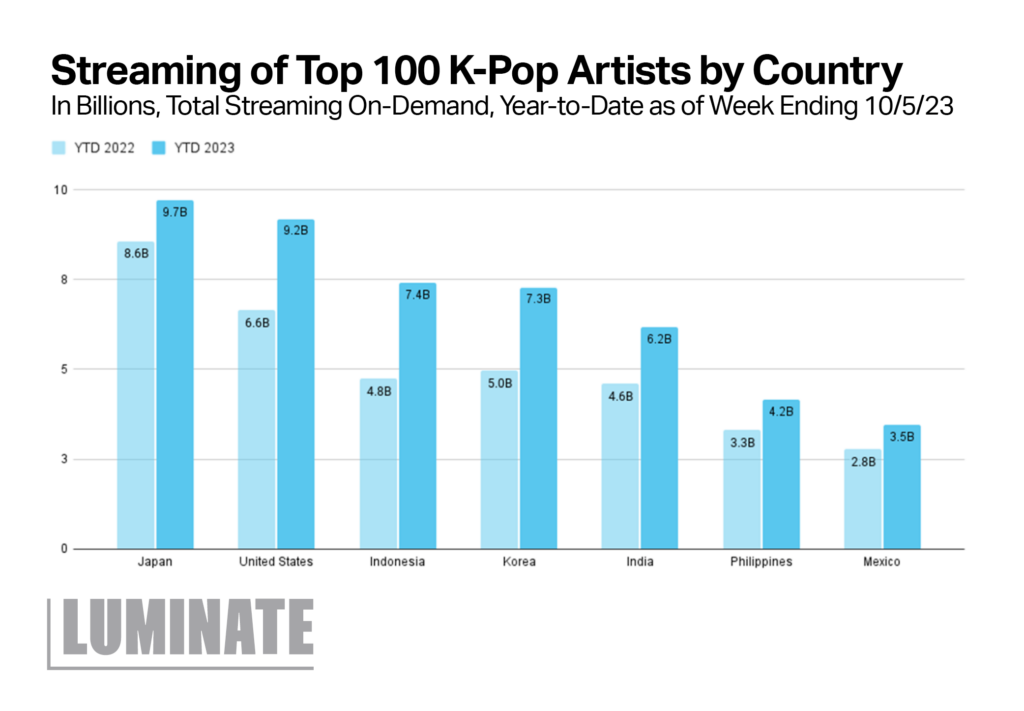

Top Streaming K-Pop Regions

Looking at the Top 100 K-Pop artists YTD globally, these artists have a combined 90.4 billion Total On Demand (audio and video) streams, which is a +42.2% increase over the Top 100 K-Pop artists of 2022 through the same time period. Of these countries, Japan has the highest amount of Total On-Demand streams at 9.7 billion, followed by the United States at 9.2 billion. Vietnam and Hong Kong saw impressive growth since last year in K-Pop Total On Demand streams, with Vietnam seeing a +59% increase and Hong Kong at +60%.

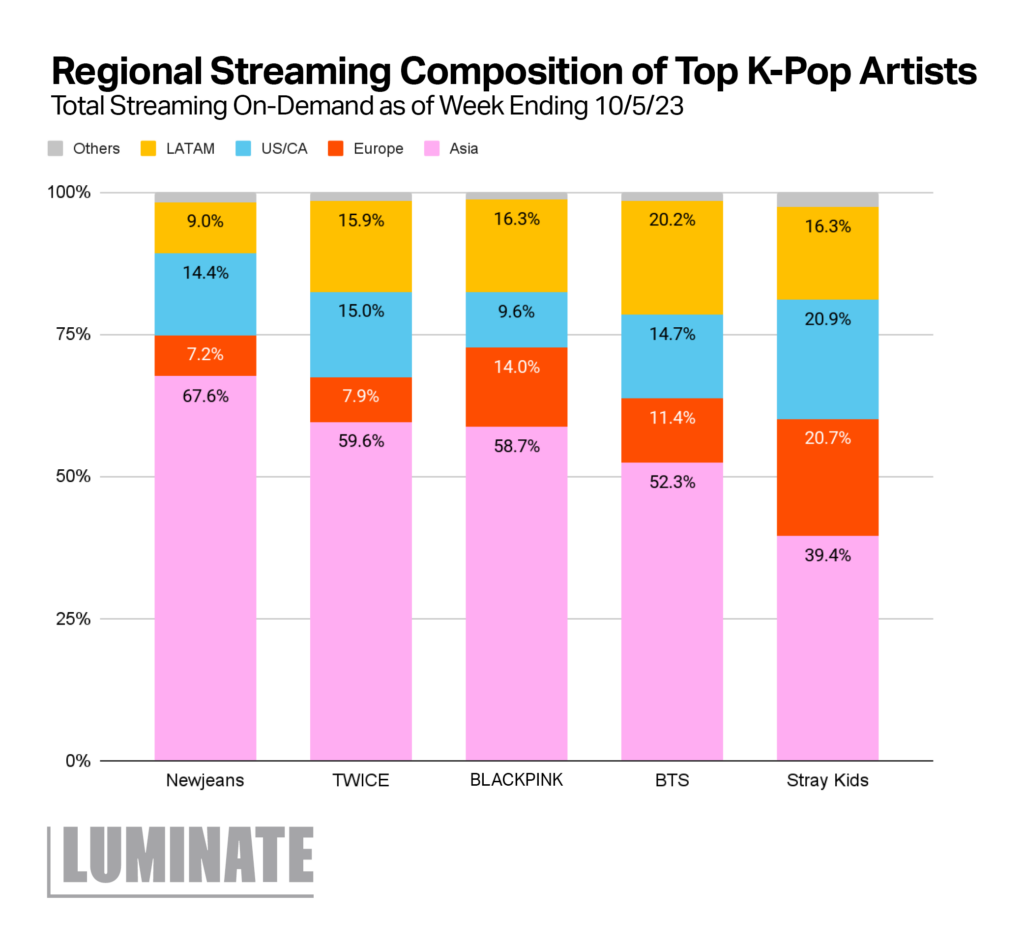

Based on the Top 5 K-Pop artists in the US, we can see some regional similarities when looking at their global streaming patterns. For example, a majority of streams of top K-Pop artists originate from Asia, followed by North America and Europe. However, it is crucial to note that regional composition differs between each artist. For example, over +60% of Stray Kids’ streams come from outside of Asia with 29% of streams coming from the US, Mexico, and Brazil.

K-Pop First Listeners

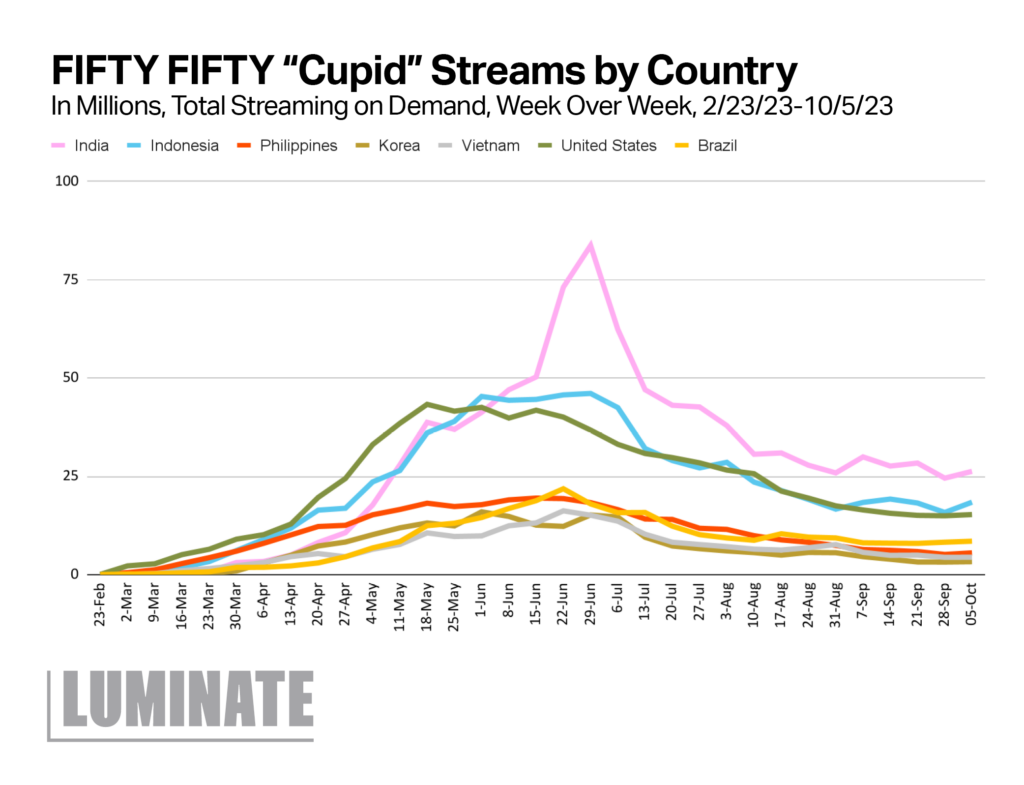

As mentioned earlier, there have been many K-Pop releases this year that have had massive success worldwide. One of them is FIFTY FIFTY’s Cupid, which has 1.2 billion On-Demand Audio streams globally. The sped-up version of this track was released the week of April 13th and went viral on TikTok, resulting in the lift of streams globally. Looking at the chart below, some of the track’s first listeners were South Korea’s neighboring countries (Philippines, Indonesia) as well as the US, then taking off in India due to the virality and reaching other territories such as Brazil and Mexico.

Young Listeners Driving Adoption in Japan

Through analyzing the top streaming K-Pop regions, we can observe how many international countries are engaging with Korean music, especially Japan. Luminate’s Insights Japan Music 360 consumer research study reveals that 39% of Gen Z Japanese females listen to Korean music and are 105% more likely to listen to K-Pop compared to Japan’s general population, demonstrating how the younger generation is driving K-Pop listenership in Japan. In terms of music discovery, 36% of Gen Z Japanese females report discovering new music through short video clips, which is 71% more likely than the average Japanese music listener, and demonstrates how these platforms are helping spread music across borders.