In 2011, Spotify was released in the United States, and the way that American audiences listened to music was turned upside-down. “On-demand audio streaming” wouldn’t be adopted widely for at least a few more years, but some time around 2015 or 2016, the format began to take off. Today, we tend to think of streaming as existing in a steady state or a saturated market but, in reality, it continues to grow. For the past three years, on-demand audio streams in the U.S. have increased by over 100B from each previous year to the next.

It’s an impressive number, but where is this growth coming from? What metros are listening to streaming more now than they did in the past? Where is the next frontier? Streaming has grown – but has it moved?

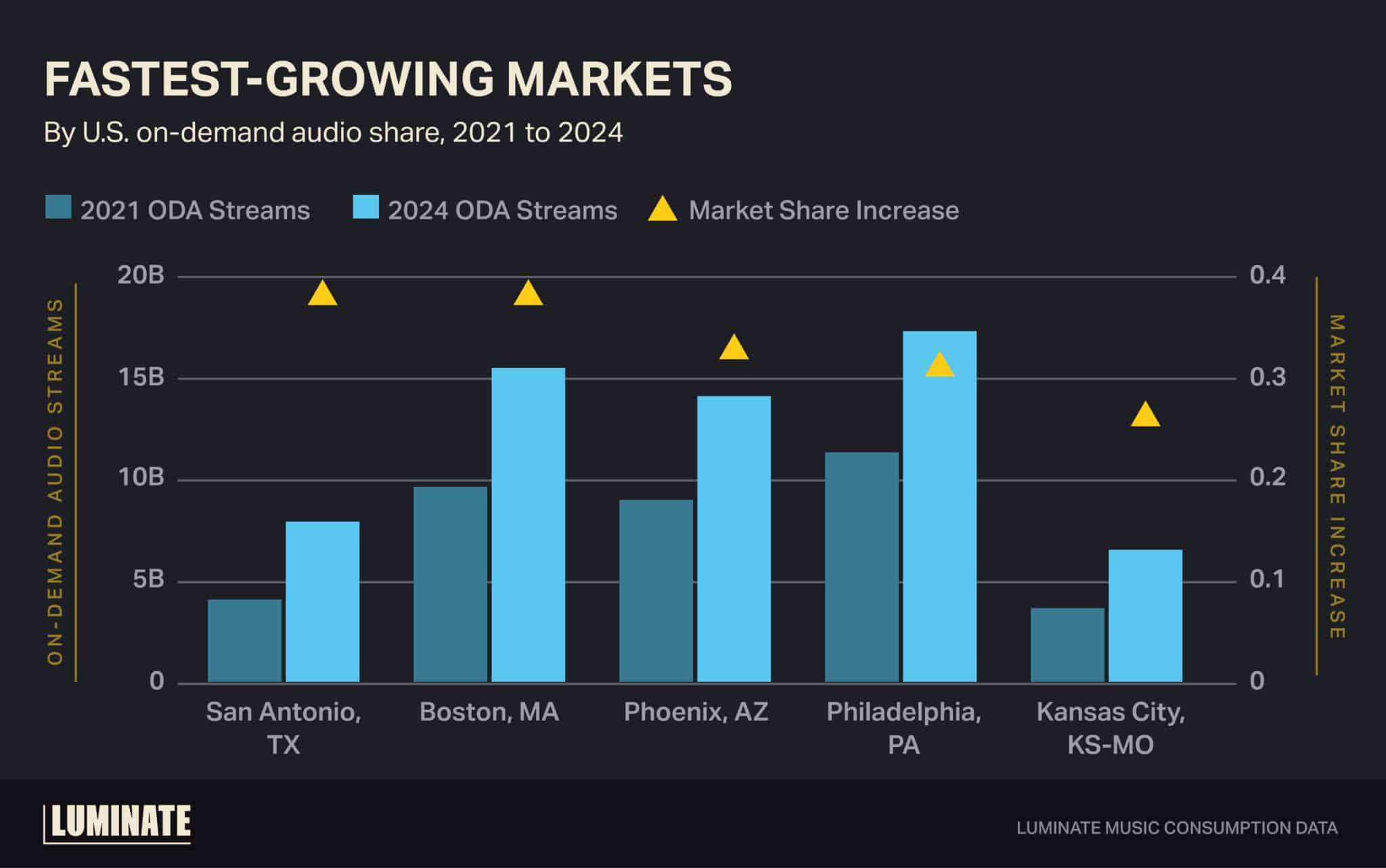

Almost every U.S. metro has seen growth in its nominal volume of streams, so parsing the differences between them all requires a double-click. One way to do this is to look at the change of a metro area’s market share. Los Angeles, for example, used to make up 8% of all U.S. streams. Since 2021, Los Angeles has seen an increase of 9.6B streams, which at first glance looks like strong growth but, in the same time frame, the U.S. market outpaced it and Los Angeles actually lost a half-percent of market share¹. On the other hand, San Antonio, Texas, saw an increase of 3.8B streams, the largest increase of any U.S. metro in terms of streaming share. In 2021, San Antonio made up 0.9% of the market – today, it makes up 1.4x that much.

Have the metros changed what they’re listening to? Conventional wisdom says that regions are static in genre preferences: the South listens to Country, New England listens to Rock and so on. In reality, though, these patterns are far more layered and are prone to change. Here, again, San Antonio has experienced a dramatic shift. In 2021, 10.2% of its on-demand audio streams went to Latin music. Only three years later, that share of Latin music jumped to 16.2%.

![Fastest growing genres by metro area read as 'in [metro area], the highest share increase in on-demand audio streaming from 2021 to 2024 was from [genre].'](https://luminatedata.com/wp-content/uploads/2024/12/12-3-TuesdayTakeaway_Blog-1-scaled.jpg)

It’s a pattern occurring across the board – most U.S. metros have shifted toward Latin music (and a good amount of them have shifted to Country music as well).

How many Latin artists are making sure to plan a tour stop in Charlotte, North Carolina? Are Country artists marketing their new albums in Boston? Understanding the differences between the metros while paying close attention to these shifts in market share and genre is crucial in determining where an artist should tour, how they should market their albums and where they can better reach their fans.

Source:

Luminate Music Consumption Data

¹This and subsequent analyses are based on the change of on-demand audio streams by metro area from 2021 (Q1-Q3) to 2024 (Q1-Q3).