How do you measure the value of a theatrical picture on a streamer? Measuring the value of TV series across linear and streaming is intuitive because streaming views and TV ratings are based on the number of people consuming content. Theatrical films are harder to compare apples-to-apples, because theatrical releases are measured first and foremost by box office revenue.

This problem isn’t just academic. Translating streaming views to dollars was a centerpiece of the 2023 strikes because talent felt that they were not being adequately compensated for streaming hits. The result was a metric that rewards content produced for a streamer that garners views representing at least 20% of U.S. subscribers in the first 90 days of release.

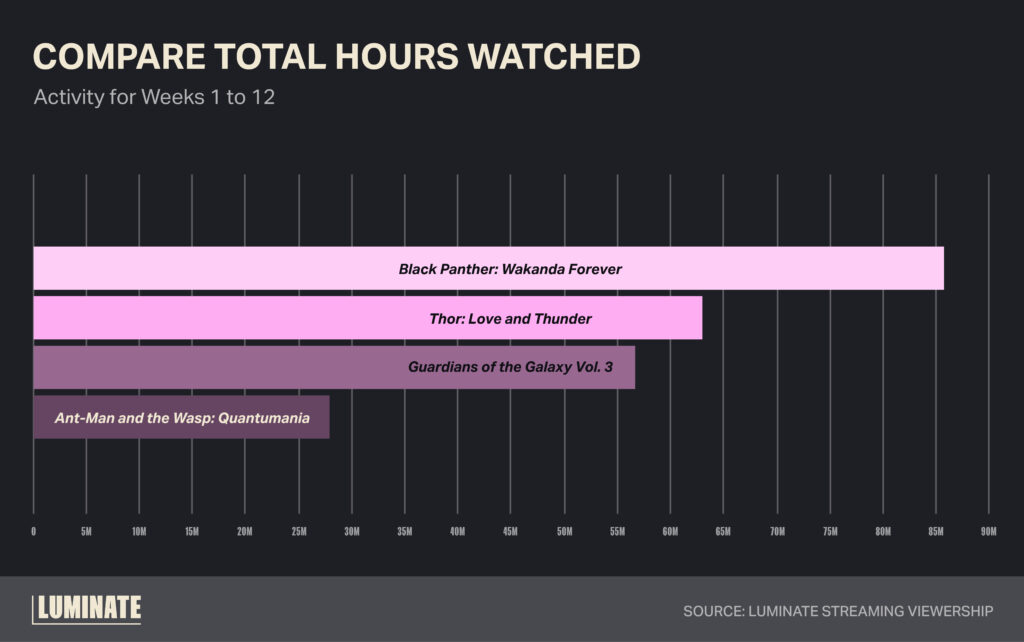

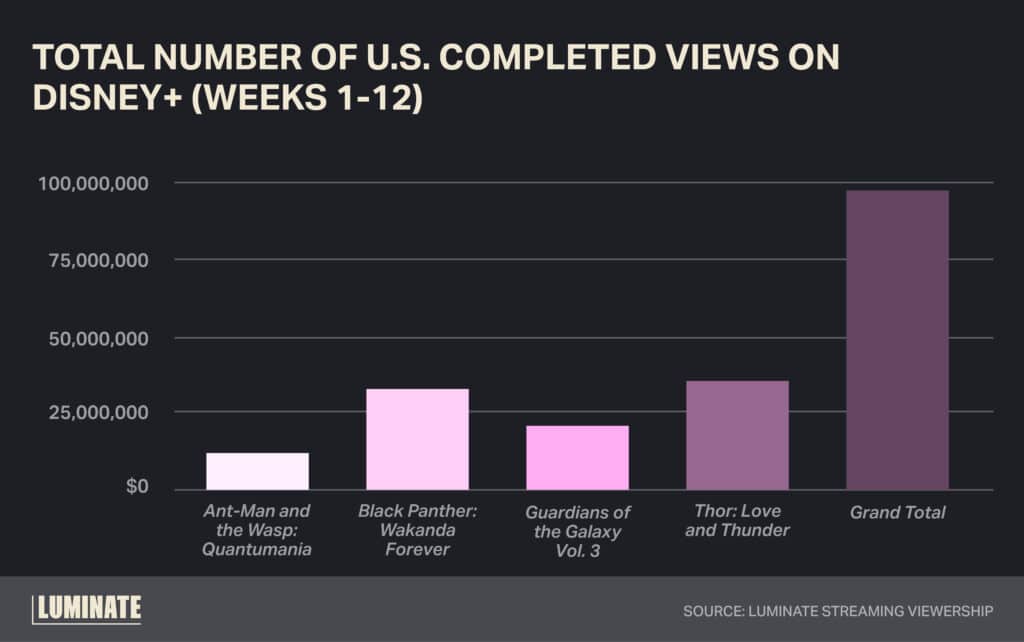

This reveals streaming performance for the same four films for the first 12 weeks on Disney+:

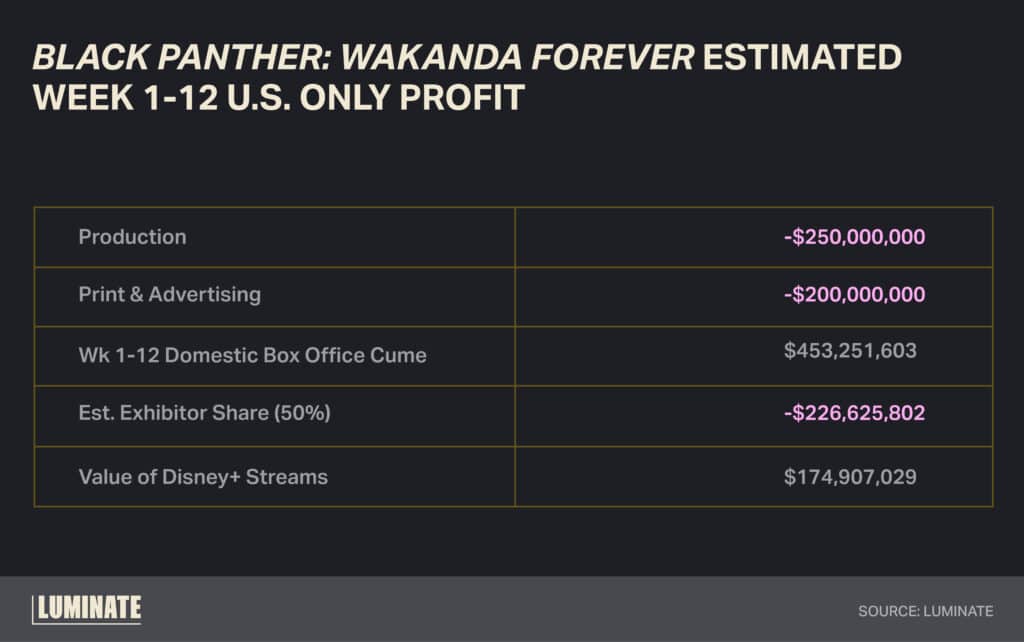

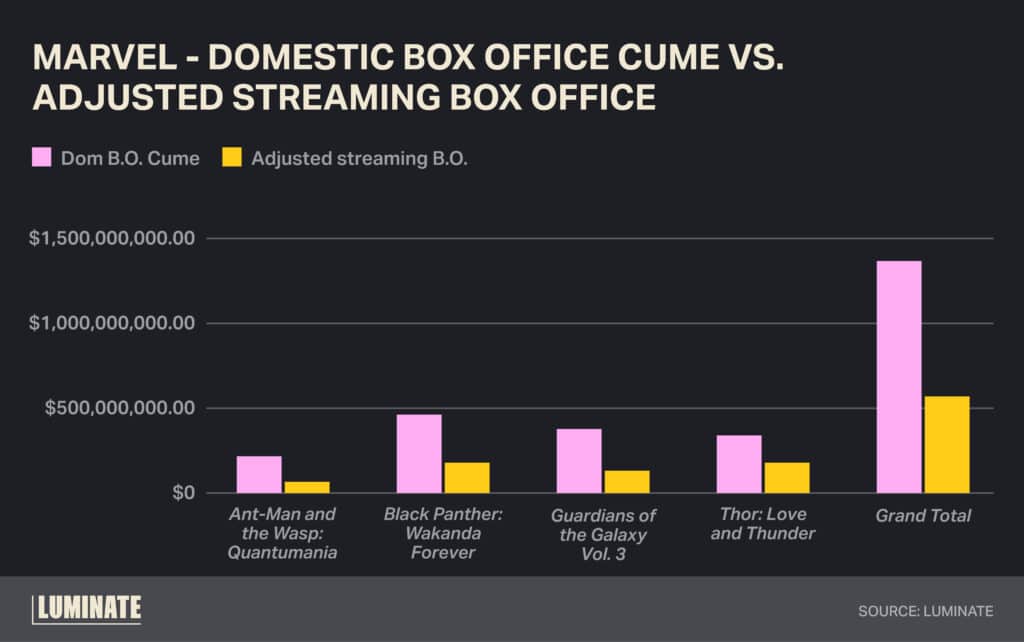

How do you determine the value of these streaming views to The Walt Disney Company? Let’s break it down using Black Panther: Wakanda Forever. The domestic theatrical release generated $453,251,603 in weeks 1-12. Sounds great, but that isn’t the revenue recognized by Disney. In fact, when you break it down by domestic P&L, the film is losing money. This chart breaks it down:

- Production was reported to cost $250,000,000

- The film’s P&A (aka Marketing) cost typically equals the cost of production. We’re conservatively estimating the marketing costs at $200,000,000

- The revenue share between distributors and theater owners fluctuates during a film’s run. Our estimate is a 50% box office split between Disney and exhibitors

- The box office revenue in the U.S. for Weeks 1-12 of release was $453,251,603

- The value of Disney Streams has been estimated by taking the Luminate SV(M) total views, multiplying by an average U.S. ticket price of $11 and assigning the same “revenue split” of 50% that was applied to box office revenue

Of course, Disney’s global release strategy was profitable at the worldwide box office and streaming level. These budgets cannot be supported by U.S. audiences alone. But let us return to the original question – what is a stream “worth”?

From a consumer perspective, there’s a greater opportunity cost to get to the movie theater and buy the ticket(s) and refreshments vs. watching the movie at home on a streaming service.

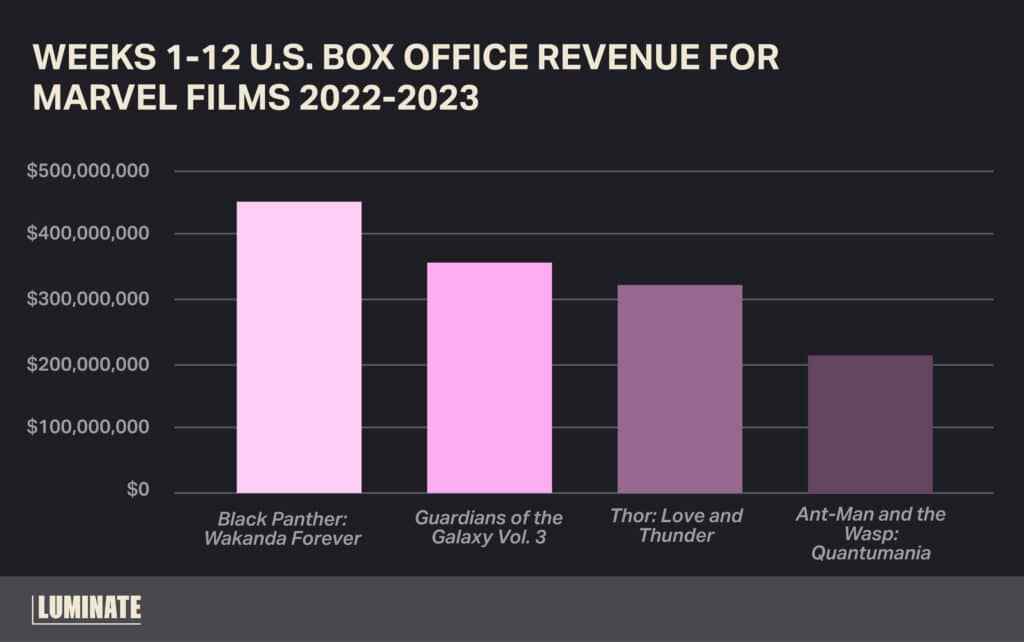

But from the Distributor/Studio perspective, views to completion have a huge value. These are the completed U.S. streaming views of Marvel theatrical releases in weeks 1-12:

This hypothetical model assumes that the benefit to The Walt Disney Company of each completed stream of one of its own films on its streaming services would be 50% of a theatrical ticket price.

This may seem too generous an estimate, but consider this: Marvel represents the highest valuation of a stream, due to its dominant position in the marketplace. Other content and distributors would be estimated on a different heuristic.

Additionally, streams drive subscriptions to owned streaming services and capture an audience that may not have seen the film in theaters. Super fans increase engagement with the universe. The shortened window between theatrical and streaming helps minimize additional marketing costs because there is already awareness. Plus, the revenue is all retained within the corporate ecosystem. What is a convenience to the home viewer is found money for the Distributor.

It’s not a surprise that companies like Disney and Warner Bros. Discovery have used the first-run streaming window of their signature theatrical films to bolster subscribers to their own streamers. It also quite clearly reveals the drivers behind the dual guild strikes of 2023, especially relating to Netflix originals.

Future issues of this newsletter will look at other distributors’ films, such as Warner Bros./DC Entertainment and Netflix Originals. The valuation of streaming films depends on factors like box office distribution (or lack thereof), number of subscribers to streaming platforms and budget.