While the audience size of the average original program on Netflix has long surpassed that of its many rivals in the SVOD category, Luminate Streaming Viewership (M) data enables a closer look at a few cracks in its competitive standing.

Year-over-year viewership trends across original and licensed content from the streaming giant have actually seen net declines in both films and TV series. But the drop in film viewership is less dramatic, only falling 12% from 2022 levels to 87.4 billion minutes watched in 2024.

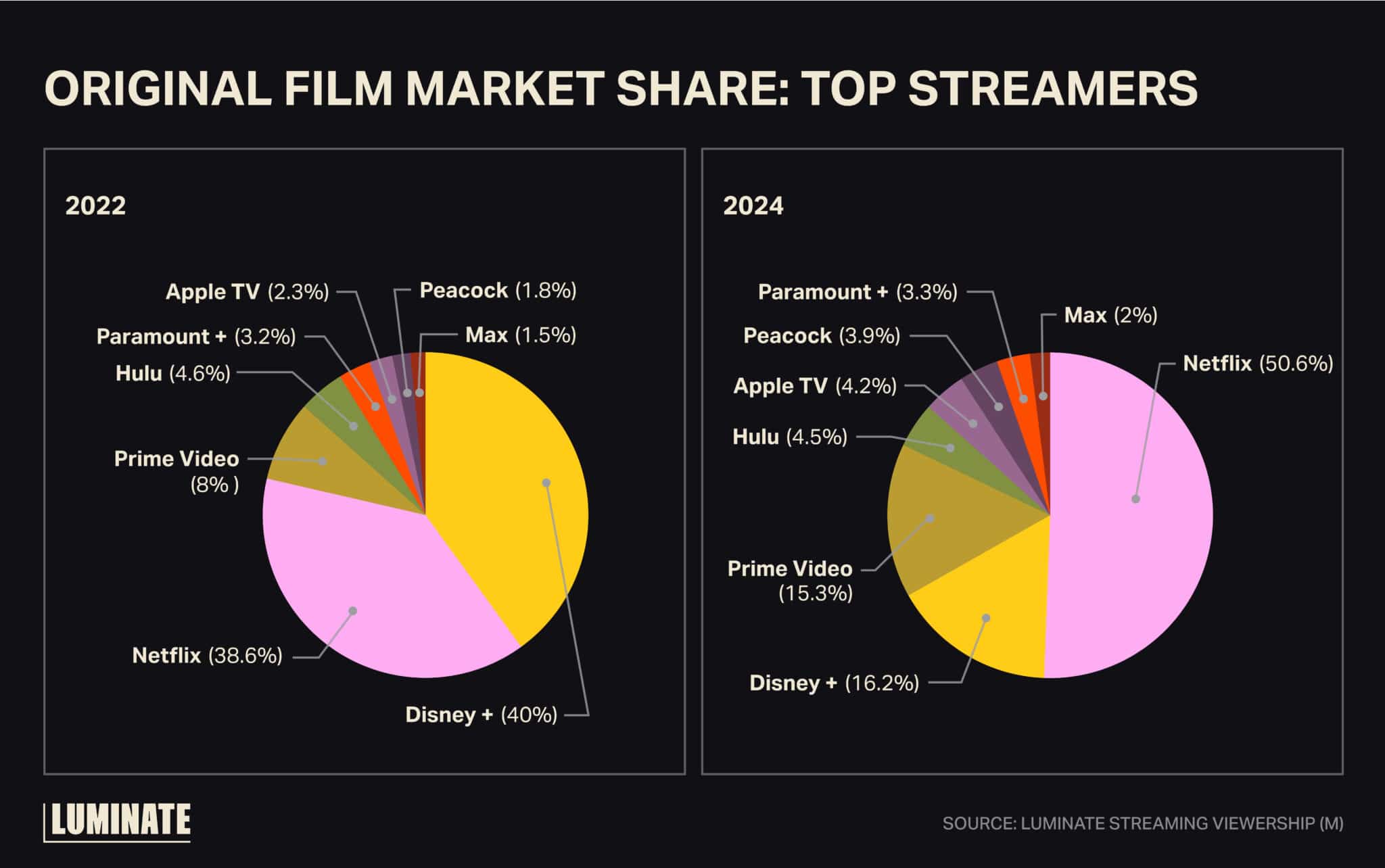

When comparing Netflix’s film performance with other platforms, its viewership share has in fact increased year over year by 12%. This is because Disney+ has seen a sizable net decrease in total original film viewership, thus giving Netflix the boost.

While Netflix has actually decreased the volume in recent years of what remains a wide range of films — from awards-season darlings to holiday comfort flicks — action movies may be the streaming giant’s most powerful draw. Last year’s biggest title among all SVODs was its airport thriller Carry On with 5.4 billion minutes, per SV(M), and the most-watched film to date in 2025 is Netflix’s espionage-themed Back in Action, at 4.1 billion minutes.

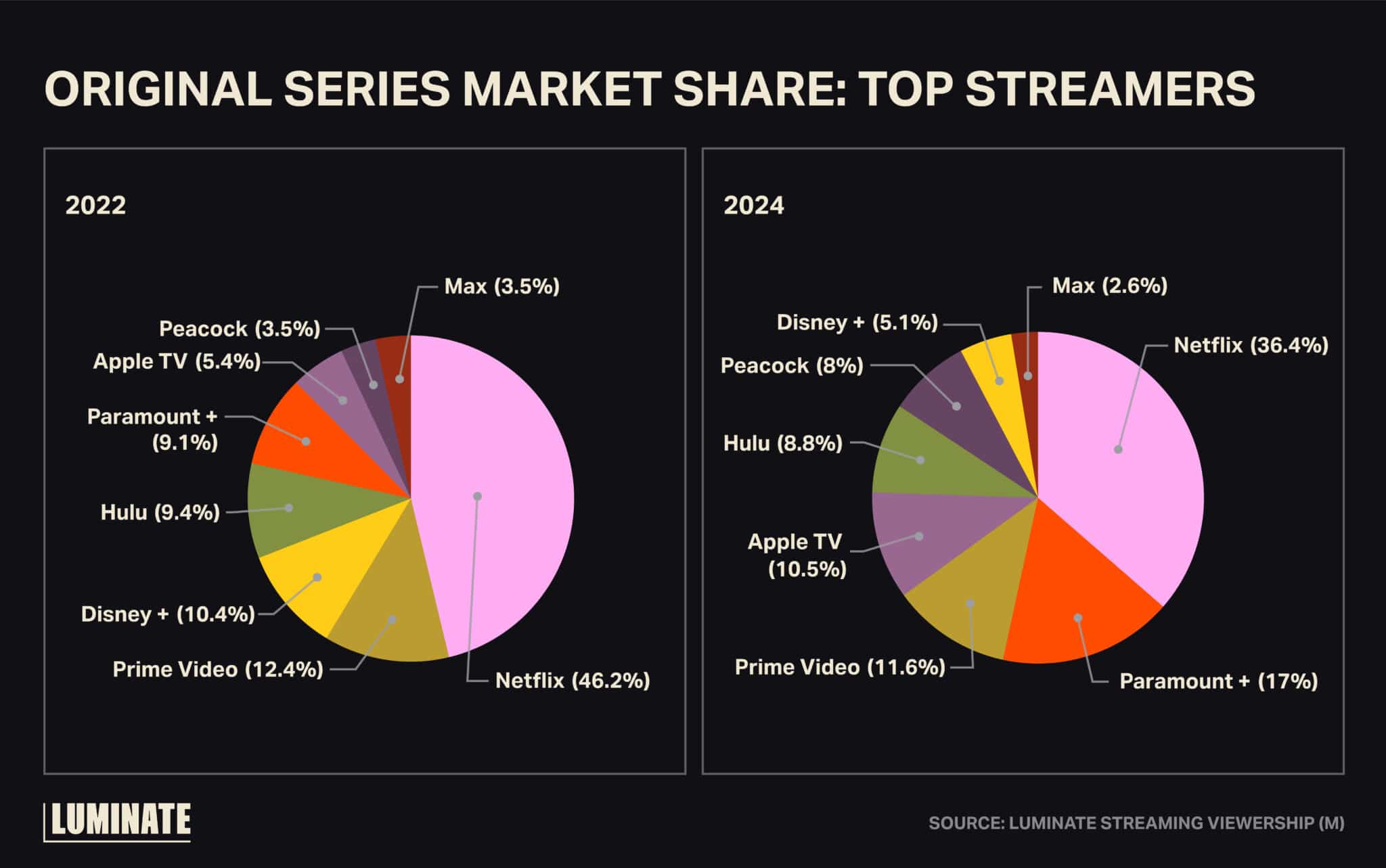

However, Netflix’s decline in series viewership is more pronounced than its film counterpart, and that slide is not ubiquitous across the streaming landscape.

Annual TV viewership for the streamer in 2024 was down 39% from what it was in 2022, when it ballooned to 280.6 billion minutes. Meanwhile, platforms such as Paramount+ and Peacock have actually achieved net increases, rising 43% and 74%, respectively. This phenomenon has had a visible impact on Netflix’s TV market share, which has seen a 10% decline since 2022.

To some degree, Netflix’s slippage on the series front is also a reflection of the fact that while the streamer is still well represented among the top series each year, even its most attention-getting hits are nowhere near as successful as they used to be. The platform’s biggest shows back in 2022 — Stranger Things, Ozark and Inventing Anna among them — amassed far larger audiences than its 2024 No. 1 series, Fool Me Once.

Time will tell if Netflix can improve its standing in series in 2025. Both TV and film year to date are tracking identically in terms of market share to how the streaming service fared last year, but there are big premieres set for the months ahead, including the return of Squid Game for a third (and final) season on June 27 and the second season of Wednesday on Aug. 6.

Check back with Luminate Streaming Viewership (M) data to see how far those launches move the needle for Netflix.