If there’s been a narrative that defines the streaming wars in 2025, it’s the notion that Netflix is seeing its rivals making progress on their bid to close the gap with the market leader on the original-programming front.

But a closer look at the recently concluded summer season using Luminate Streaming Viewership (M) audience data offers a striking counternarrative — even in spots where Netflix might appear to be seeing competitors make inroads.

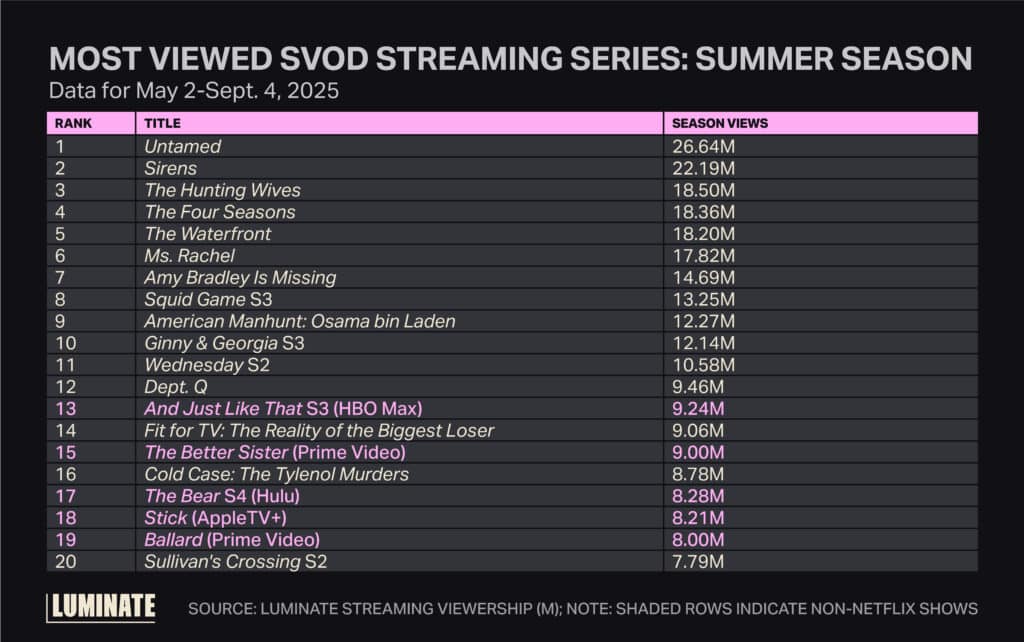

At first blush, Netflix’s original-series dominance in the U.S. would seem more clear cut than ever. When measured by views, the streamer didn’t just have the top show; rather, it landed all of the top 12, and 15 of the top 20.

Netflix won this summer with proven formats and genres. Crime drama Untamed tops the list, with four other twisty dramas following. Its documentary slate also had a strong showing, with three true-crime series and one non-crime docuseries landing in the top 20.

This year actually marked an improvement for Netflix over summer 2024, when three other streamers had hits crack the top 10, including The Boys on Amazon Prime Video and Apple TV+’s Presumed Innocent.

Strong as its 2025 summer performance is, it seems Netflix could learn some valuable lessons by studying what kinds of series from other streaming services represented programming niches it might want to counterprogram more effectively.

For instance, while Prime Video thriller crime drama The Better Sister is in a similar vein to many of the Netflix titles at the top of the chart, Bosch spinoff Ballard and Apple TV+’s Owen Wilson vehicle, Stick, represent genres that aren’t currently topping Netflix’s chart: a police procedural and a star-driven comedy, respectively.

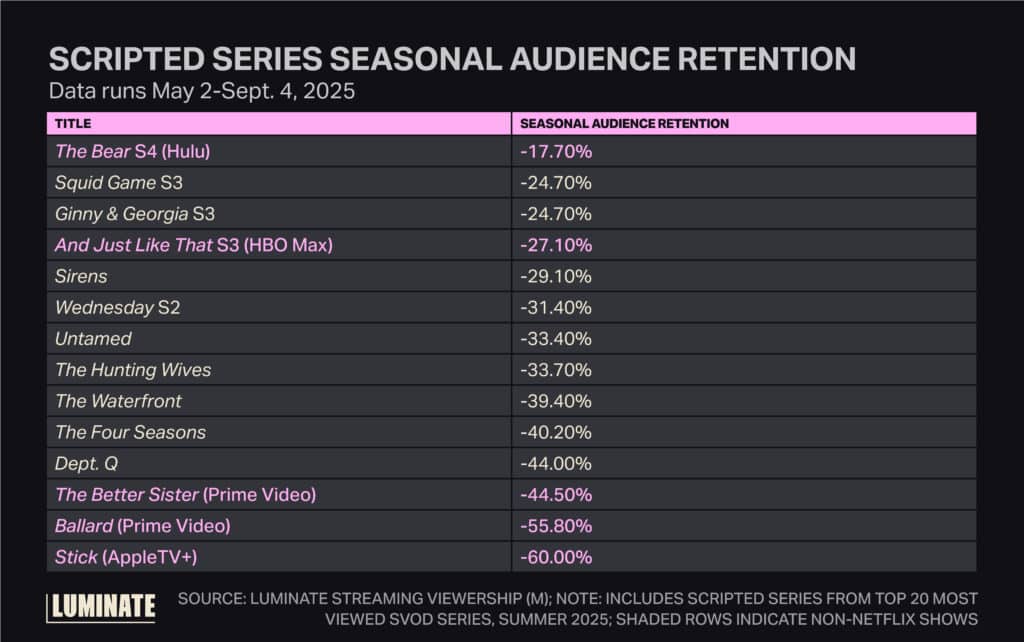

However, a deeper dig into Luminate SV(M) data is also necessary to fully understand just how original series are performing beyond the topline numbers.

Note three of the five non-Netflix scripted titles to make this summer’s top 20 showed the highest audience decay rate from first episode to last. Despite those shows’ strong openings, this viewer retention metric is a critical indicator of a series’ long-term viability.

Stick’s weekly release schedule might explain some of its 60% drop-off, but this much of a decay suggests marketing brought in a huge initial audience that the show itself couldn’t hold. That said, Stick has already been renewed, and a strong second season could help lapsed audiences rediscover the title.

In contrast, Ballard’s binge-release format doesn’t offer the same built-in explanation for its steep audience drop. The series is still waiting for a S2 greenlight, but the strong interest at the beginning of the season — as well as its franchise ties — make renewal still likely.

While a 30%-40% decline for a new Netflix show is a repeatable business model, a 60% drop-off on a competitor’s big bet is a much riskier problem. Rivals may be wise to look for pockets of creative white space where the streaming audience isn’t being super-served, but Netflix’s broad base of crowd-pleasing series is proving itself a very winning formula.