The streaming wars aren’t over, but they might already have a winner. While some companies are quickly re-tooling their streaming strategies to contend (Disney+ now hosts Hulu titles, Skydance is set to transform Paramount+, Apple wants to spend less money on projects), Netflix is busy dominating in viewership.

Looking at the first half of the year (December 29, 2023 – July 4, 2024), each of Netflix’s entire Top 10 has more minutes watched than any other streaming titles besides Apple’s Masters of the Air (2.8B minutes watched) and three shows from Prime Video: Fallout (6.6B), Reacher Season 2 (5.58B) and Mr. and Mrs. Smith (2.65B).

Only two of the titles in Netflix’s Top 10 for the first half of the year, Bridgerton Season 3 and Love is Blind Season 6, are returning series, while American Nightmare consists of only three 45-minute episodes and The Roast of Tom Brady is a one-off, three-hour special. Amazingly, Netflix is able to tally a sky-high number of minutes watched for three hours of content that most streamers could only dream of for an eight-episode series.

Higher viewership should be somewhat expected considering Netflix’s larger subscriber base. It’s no surprise that Prime Video is the only rival streamer with multiple challenges to Netflix’s viewership because they also boast a large subscriber base. That said, most of Prime Video’s subscribers stem from Amazon’s Prime membership service, while Netflix’s audience subscribes exclusively for content.

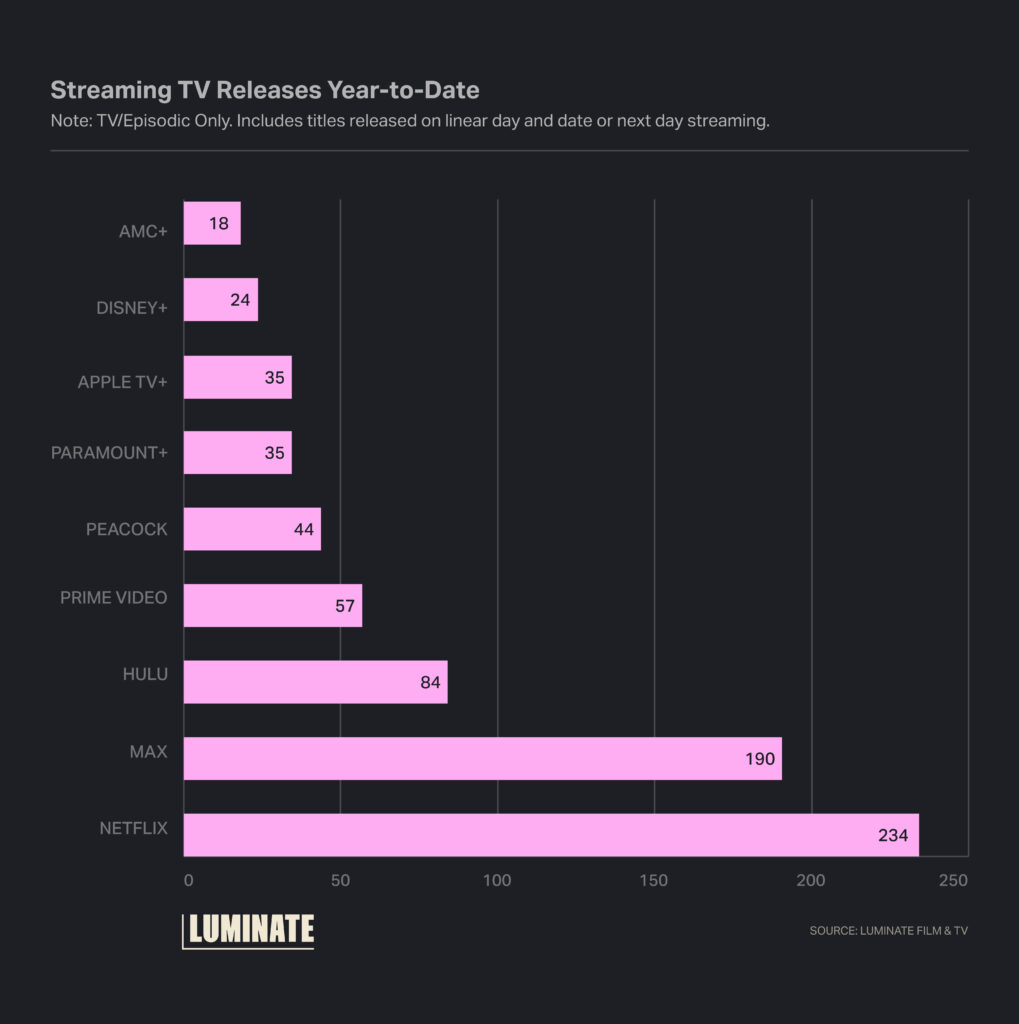

Netflix, it must be said, delivers. Year-to-date, Netflix has released 234 titles on the platform, 44 more than Max. With most of the streamers pivoting toward on-platform advertising, the amount of programming and time spent on the platform becomes even more important for monetizing users.

With more companies opening up their walled gardens to license library titles, Netflix can continue to supplement its lowest-performing originals with reliable titles from places like HBO or, as of this August, AMC, whose collaboration with Netflix is bringing many of its titles to the platform. This approach saves Netflix on development and production costs, allowing it to focus expenses on the biggest shows in order to attract new subscribers.

Since Netflix outperforms everyone else, the question of viewership shifts more to how Netflix’s current numbers compare to previous years. Within its Top 10 original titles, viewership has been lower than the first half of 2023.

This also aligns with the overall trend for Netflix originals, which saw a decline in viewership of 13.2% from the first half of 2023 to the first half of 2024. That being said, Netflix’s number of original TV titles also dipped 9.4% from the first half of 2023, so this isn’t a particularly alarming trend. With the gains Netflix has made in licensing acquired titles, this might actually be a strategy by design.

Netflix can look forward to returning franchises like Wednesday and Stranger Things to further supercharge its already strong viewership numbers. Regardless, Netflix finds its biggest success in breaking out less-recognizable adaptations like The Night Agent or Fool Me Once.

The other streamers need more hit shows. Some shows just need Netflix.