Skydance and Paramount became a dynamic duo long before their M&A tango made trade headlines this year. In 2009, before Skydance had even launched a television division, a co-financing and film distribution deal was made between the two companies. In 2018, this deal was renewed with an expansion into TV co-productions. During this period, Skydance and Paramount would work together on smash hits…and in the process create a new template for exciting programming to garner high viewership.

When Skydance expressed serious interest in buying a majority stake of Paramount’s corporate parent, National Amusement, in early 2024, all eyes turned to the digital platform seemingly at the center of the negotiations: Paramount+. Initially launched in 2021, the streamer enjoyed both subscriber success and critical acclaim. Despite this, Paramount+ struggled to find profitability. Many saw this M&A deal as an indication of a floundering platform. However, a merging of the companies’ content strategies holds the potential to create an entertainment powerhouse.

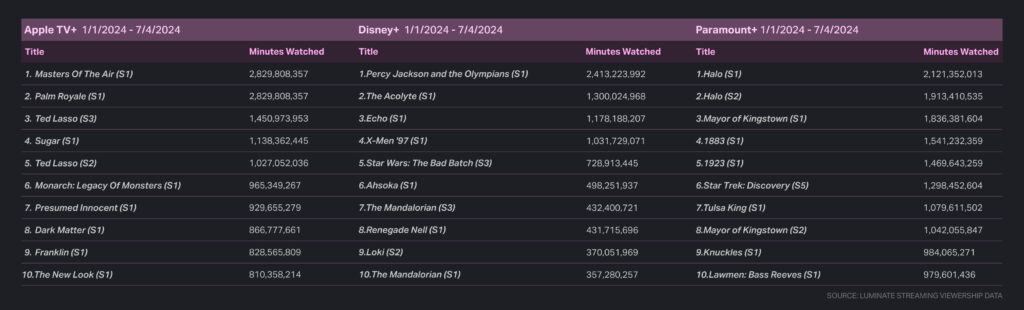

On a grand scale, originals on Paramount+ perform better cumulatively than on Peacock and Apple TV+. This high viewership is largely fueled by franchise content from Star Trek and Taylor Sheridan’s Yellowstone universe. However, the success of non-franchise originals like Knuckles and A Gentleman in Moscow cannot go unnoticed. Additionally, The Challenge: All Stars is one of the highest-performing streaming reality series outside of Netflix, which benefits from longevity boosting its subscriber numbers.

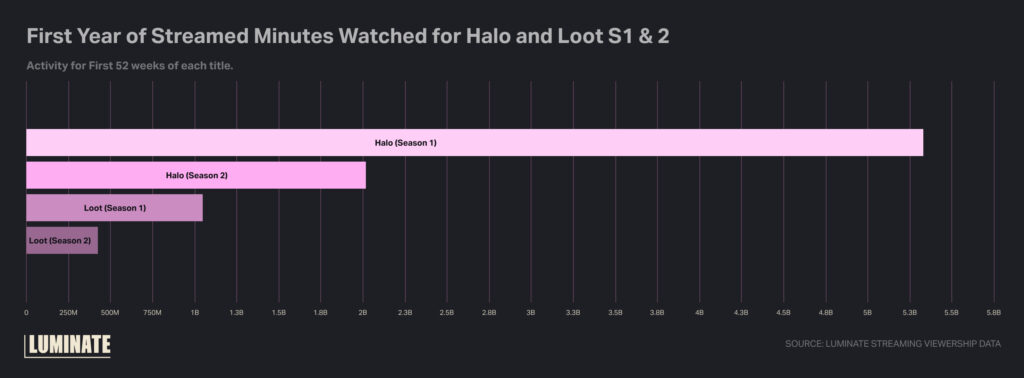

Many were quick to cite Halo’s recent cancellation as a sign that new content cannot amass a fanbase on Paramount+. Yet, Halo raked in over 4 billion minutes watched this year alone. Compare this with a title like Loot on Apple TV+, a show that was just renewed for a third season and whose total YTD minutes watched barely reached 2 billion. This indicates that measurements of success can differ between platforms, and that the performance of Paramount’s high-budget content can have profound impacts on the streamer.

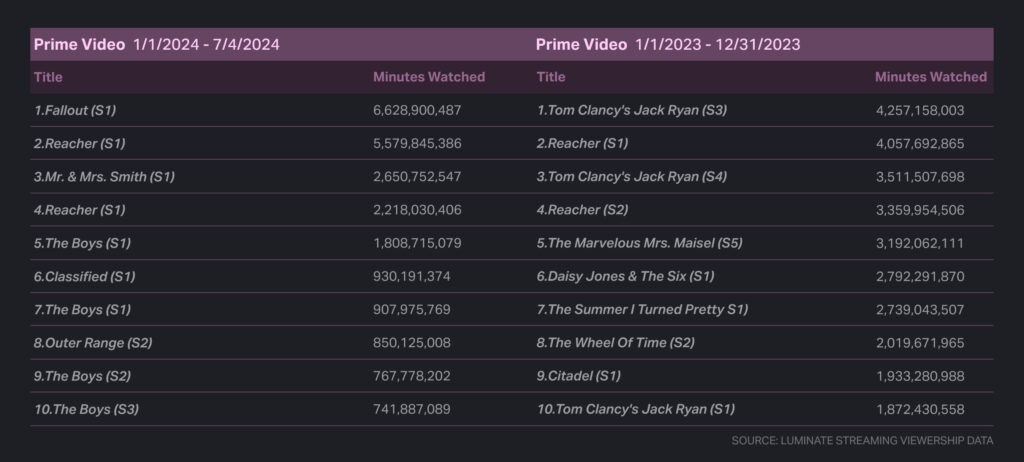

Skydance brings a different backing to the table. Its television arm has reached into many different streamers over the past decade and has a history of delivering high-performing content for each platform. Its series Reacher is the second-highest-viewed series on Prime Video this year; its second season netted over 5.5 billion minutes watched. Additionally, its series Tom Clancy’s Jack Ryan was the top-viewed series for Prime in 2023, netting 4.2 billion minutes watched for its third season alone. Now the minds at Skydance that have been fueling success for Apple and Amazon will be able to focus their efforts on building Paramount’s brands.

What surfaces from this data is a clear, symbiotic relationship that both Skydance and Paramount can leverage as their M&A deal is expected to close next year. Skydance gains unfettered access to Paramount’s powerful IPs and brands, and Taylor Sheridan’s overall deal with Paramount Global is set to run through 2026. This will prove vital for Skydance, as the young TV company doesn’t have its own established IP to leverage. Additionally, access to the Nickelodeon brand can only serve to help the newly incorporated Skydance Animation, led by Pixar-legend John Lasseter, who has so far only produced one feature, Luck, and one series, WondLa, on Apple TV+. The label’s access to juggernauts like Spongebob Squarepants and Rugrats is invaluable, and Skydance Animation holds the potential to bring the Nickelodeon brand to new heights.

Paramount benefits from the large net that Skydance has successfully cast across nearly all streaming platforms. Paramount has already engaged in the practice of licensing its successful content to other platforms, only for those platforms to then produce exclusive content of their own outside of the agreement. This was controversially leveraged with South Park, whose creators formed a licensing agreement with Max only to then produce “specials” that became exclusive to Paramount+. A partnership with Skydance would further legitimize this strategy, potentially opening the door for Paramount to co-produce high-performing programming for other platforms while housing its own supplemental, exclusive content.

Consolidation has gripped Hollywood for half a decade now, from the mergings of Disney and 21st Century Fox to Warner Bros and Discovery. This current merger is far from an outlier. The future of Paramount may be cloudy, but its acquisition by Skydance would inject capital it desperately needs while lifting Skydance Media to a whole new level.