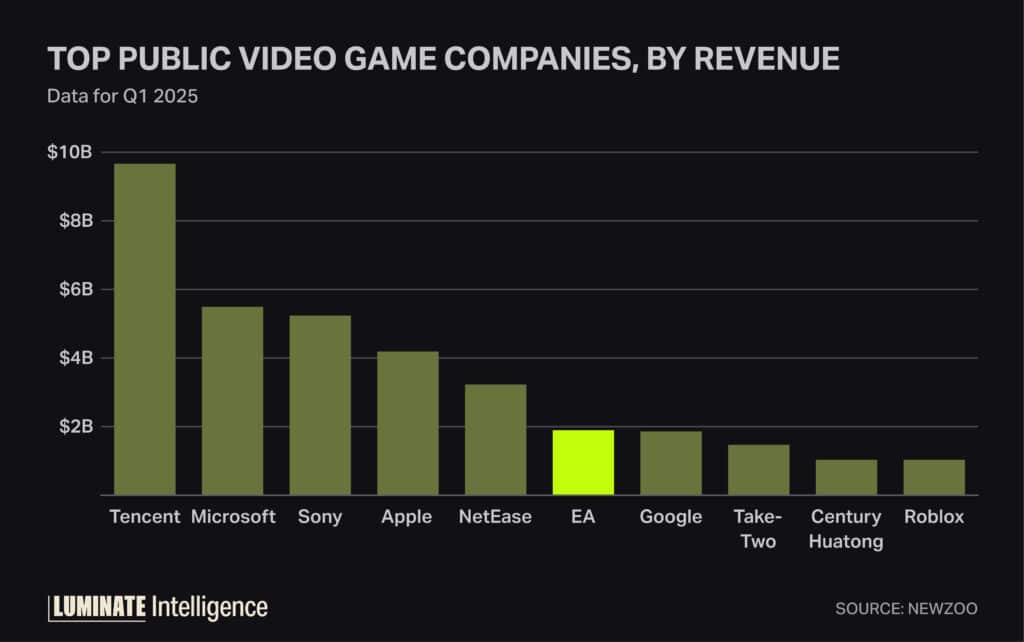

When Microsoft completed its mammoth deal to acquire Call of Duty publisher Activision Blizzard in 2023, Electronic Arts became the largest standalone Western video game publisher.

But at the end of September, Saudi Arabia’s Public Investment Fund turned heads with its deal to acquire EA for $55 billion through a consortium joined by Jared Kushner’s Affinity Partners and Silver Lake, the largest deal in history to take a company private.

The signing is the culmination of PIF’s various gaming acquisitions and investments through its Savvy Games Group, which acquired Monopoly Go! entity Scopely in 2023 for just under $5 billion. Scopely in turn took over Pokémon Go maker Niantic’s gaming assets earlier in 2025.

This year was also marked by CVC Capital Partners’ bid to acquire a majority stake in Dream Games for $5 billion, which was primarily motivated by its popular mobile game Royal Match.

The deal to buy EA and take it private, however, isn’t something a single game is driving. Rather, the longstanding EA Sports brand and its multiple annual releases are the obvious motivator behind the transaction. Saudi Arabia is already a hub for live entertainment such as sports, and Savvy’s previous acquisitions saw PIF take control of esports companies ESL Gaming and FaceIt in 2022.

Furthermore, as much as 82% of EA’s net revenue in its June-ended quarter came from live services, showing the degree to which EA has successfully pivoted its business model to recurrent spending on EA Sports titles and competitive esports titles including Apex Legends and Battlefield, whose latest entry in October just set a three-day record for the IP’s launch sales.

What this all means for EA’s other IP — of which there are many — is the biggest question mark of its impending acquisition. Prior to that announcement, EA this year was marked by restructuring that saw lauded studios such as BioWare reduced to less than 100 employees following the poor performance of games including Dragon Age: The Veilguard.

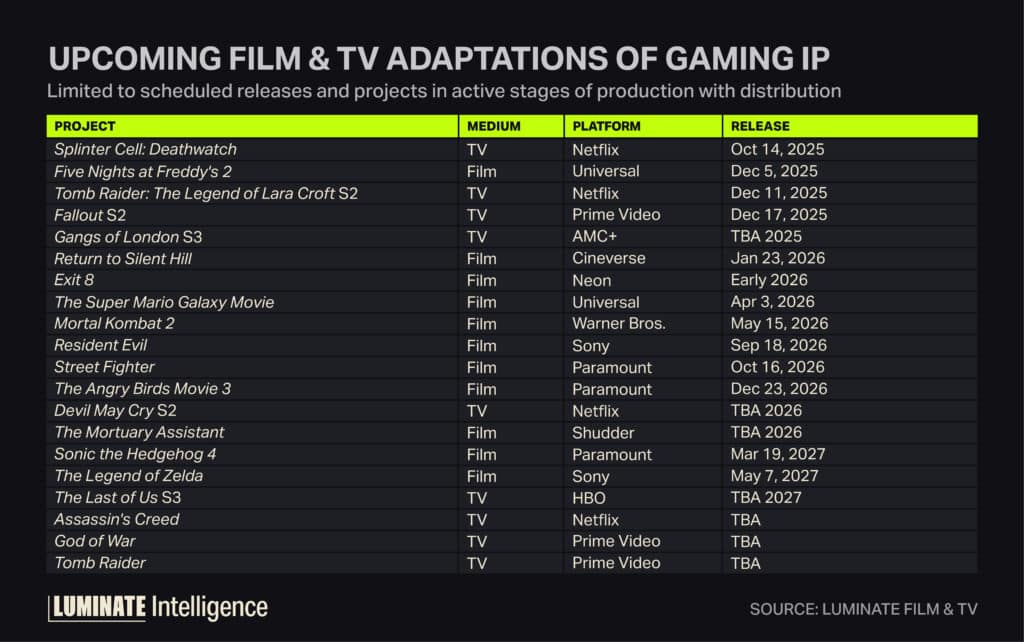

These cutbacks raised questions regarding whether an overdue Mass Effect sequel in development can make it to the finish line. Likewise, there is no EA property among the list of Hollywood adaptations of video games set to release in the near term.

EA has managed to set up and license out multiple IP for adaptations, but Luminate Film & TV shows all of these projects are still in development. Most promising is a Mass Effect series at Amazon, which is investing heavily in TV game adaptations, including its successful Fallout series and live-action takes on God of War and Tomb Raider currently in pre-production.

Amazon is also planning to adapt EA’s The Sims into a feature film, as well as 2025 hit Split Fiction and It Takes Two, which both hail from EA’s Originals label.

Non-EA IP such as Tomb Raider and Borderlands have themselves facilitated M&A deals in the past few years. The former, bought by Embracer Group from Square Enix through the purchase of studios that work on Tomb Raider games, quickly saw its rights licensed in full to Amazon, while Borderlands parent Gearbox, which had also been acquired by Embracer, was sold to the game series’ publisher Take-Two Interactive in 2024.

Therefore, it’s likely PIF’s dealmaking when it comes to EA won’t stop with its acquisition of the publisher. The rest of the industry may well take a similar approach and provide new homes for EA properties if their future at the Saudi-owned entity raises questions over where such IP will best flourish.