When Paramount rebranded its “CBS All Access” service to “Paramount+” in 2021, its intentions were clear: Like other media conglomerates, it was chasing the runaway streaming success of Netflix. In Paramount’s case, the company was on the road to unifying Viacom and CBS into a single brand, and the name change to Paramount+ allowed the company to expand its streaming content offering and subscriber base.

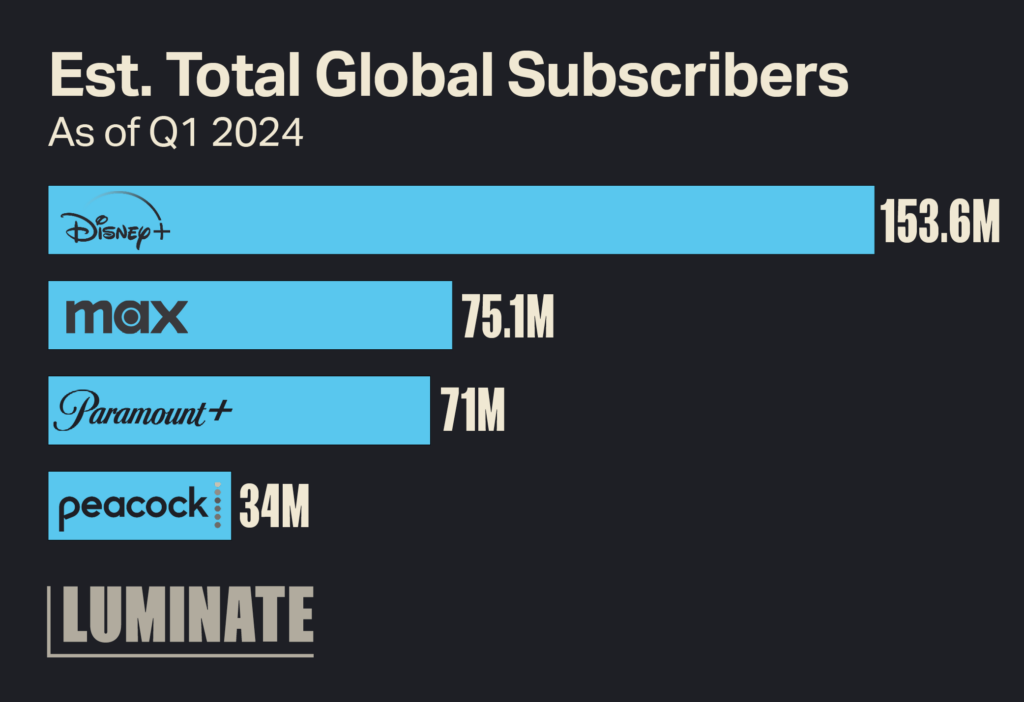

Initial rollout of the rebrand saw new, original programming flood the platform. Scripted titles like 1883 received warm reviews from critics and audiences alike. Additionally, all-star variants of Paramount’s hit reality shows like The Challenge were made platform-exclusive, successfully wrangling those fandoms to subscribe. Beyond its content, Paramount+ amassed a sizable subscriber count, performing similarly to its competitor, Max, which also went through its own rebrand at the end of 2023.

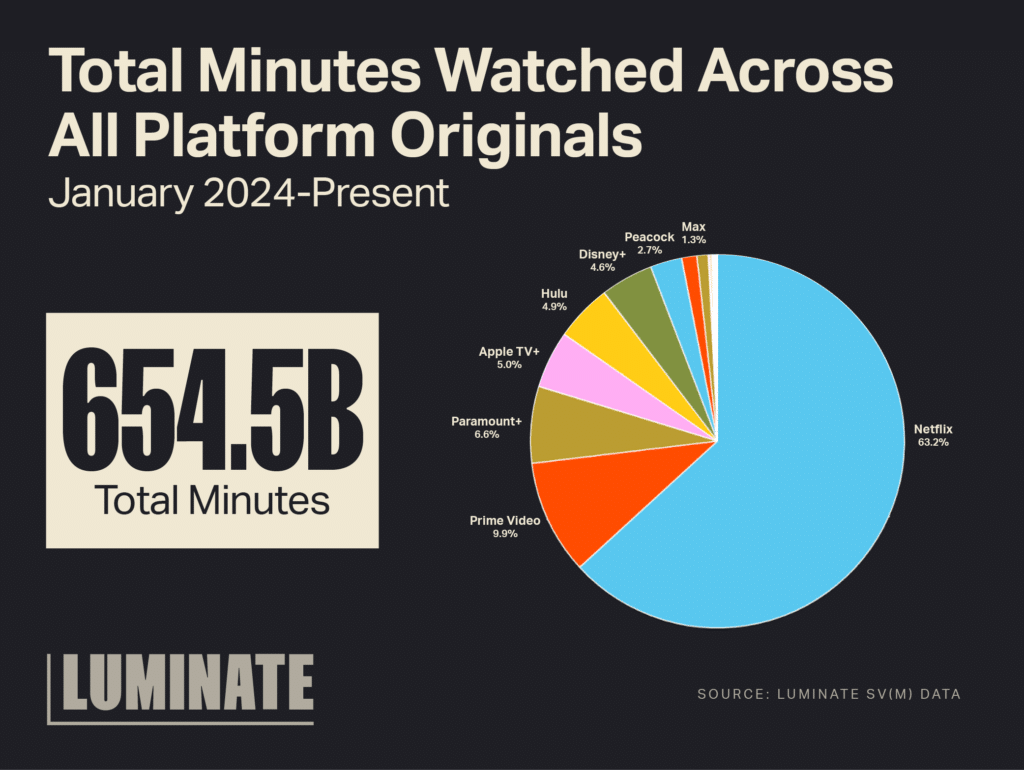

Despite its successes, Paramount Global has still struggled to find profitability. The decline in broadcast television consumption, production and disruptions from COVID-19 and two devastating guild strikes created a snowball effect. As a result, the company has been considered an acquisition target by the financial community for some time. After protracted negotiations and multiple suitors, Skydance Media, led by David Elllison, struck a deal to buy a majority share of National Amusements, which owns Paramount. While many were quick to identify this as a death sentence for the young streamer, the viewership data tells a different story. When looking at originals across every streamer since January 2024, Paramount+ holds the bronze medal for total minutes watched, trailing only Netflix and Prime Video.

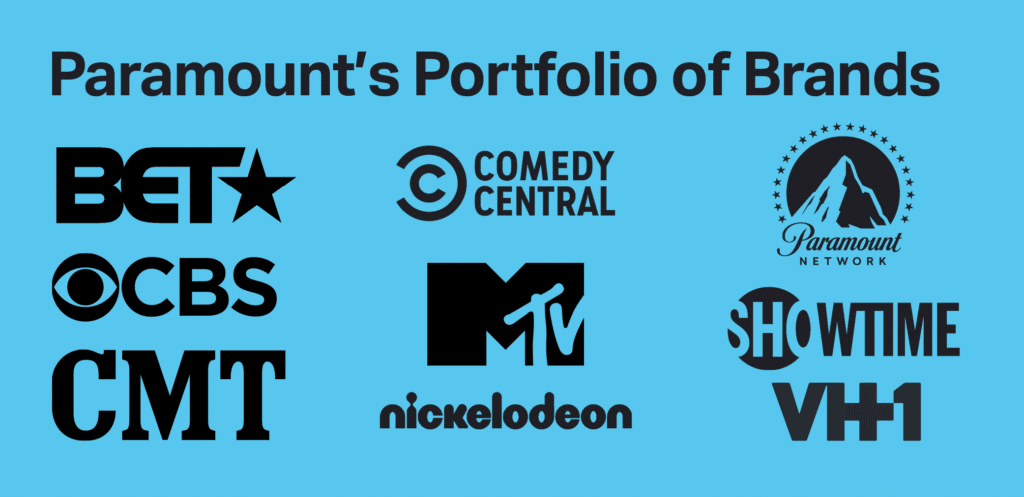

This high viewership performance can be attributed to its catalog of iconic brands, formed via multiple acquisitions and mergers, notably with CBS and BET Media Group. Paramount’s eclectic network portfolio allowed it to cast a wide net across linear television over the past few decades, building it into the media giant it is today.

Paramount is far from the only entertainment company to possess a massive catalog of properties. Other streamers go out of their way to highlight their distinguished brands and capitalize on their strengths. Over at Disney+, the homepages for Marvel, Pixar and National Geographic have their own individual identities. At Max, brands like A24 and Studio Ghibli get special spotlights on the platform. Paramount+ has taken a different approach with its labels, opting to pool its original content under one “Paramount+ Original” moniker, effectively watering down each brand in the process. This homogenization is especially visible in the Paramount+ Superbowl ad, where Captain Picard is seen throwing Arnold’s football-shaped head over a mountain while Jeff Probst and Peppa Pig observe in the background.

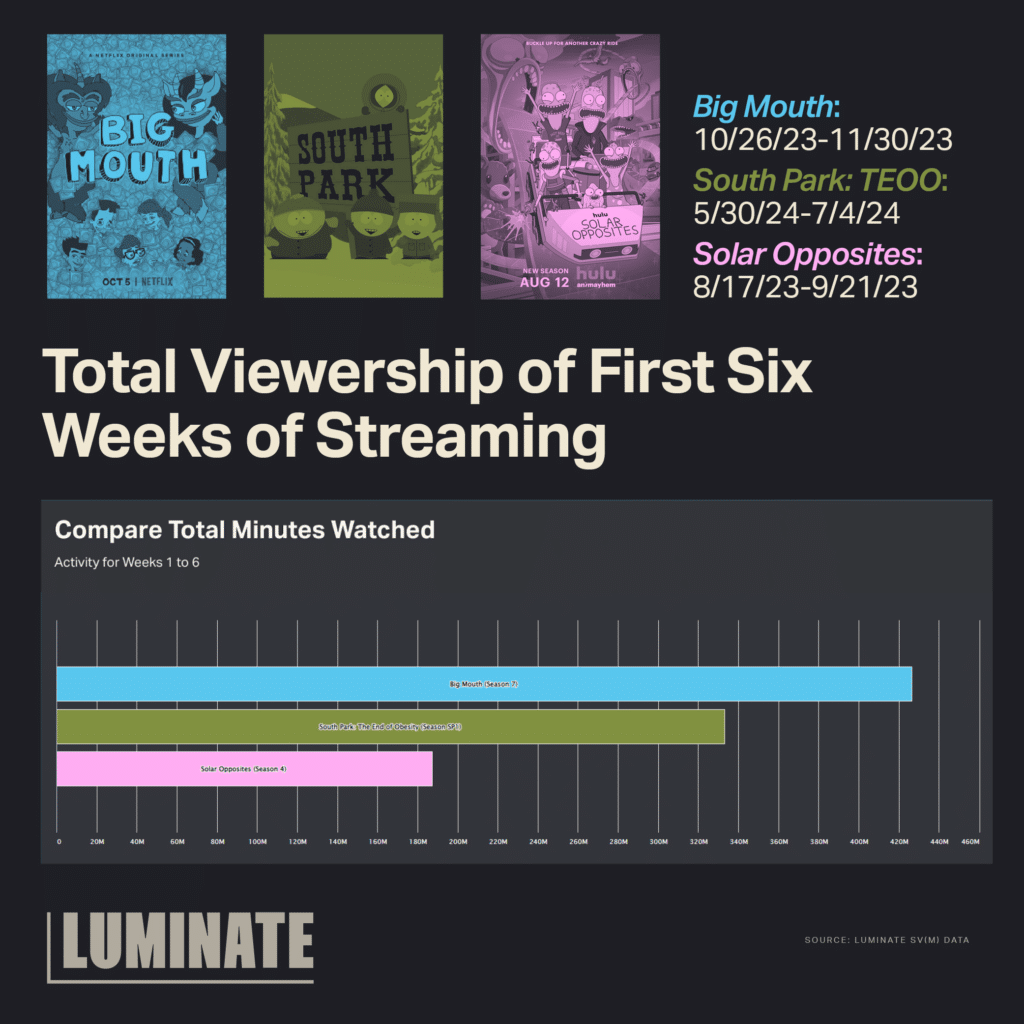

It is unclear why Paramount has not highlighted its brands in the same way other streamers have. Perhaps some executives feel the individual labels don’t hold enough weight to stand on their own. However, the viewership data doesn’t appear to back this notion up. Take for example the South Park: The End of Obesity special. This one-episode short, spun off of the long-running Comedy Central series, performed comparatively to the entire seventh season of Netflix’s Big Mouth. It also completely outperformed the entire fourth season of Hulu’s Solar Opposites. In its first six weeks, The End of Obesity netted 333 million minutes watched, while Big Mouth amassed 426 million minutes cumulatively across 10 episodes and Solar Opposites earned 127 million minutes across 11 episodes. This means that viewers engaged with The End of Obesity 8x more than a single episode of Big Mouth and 20x more than a single episode of Solar Opposites.

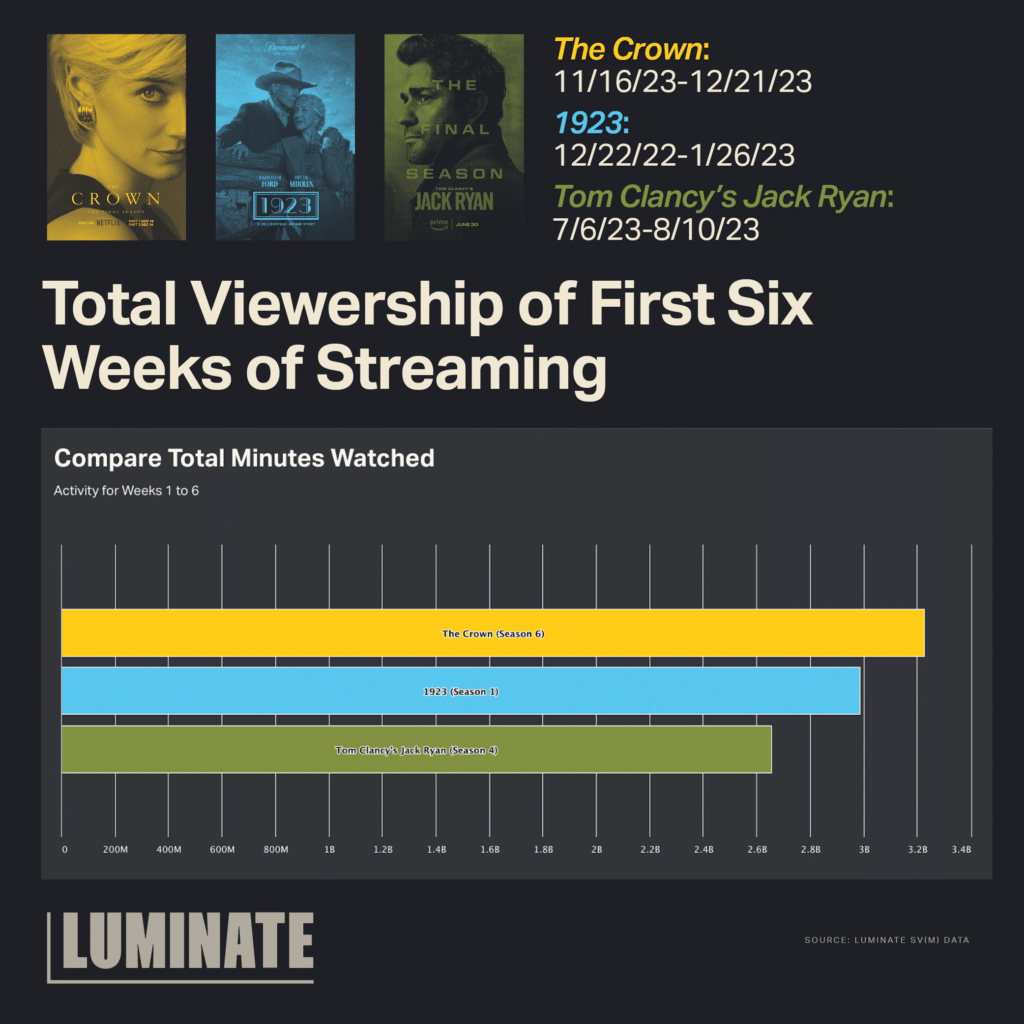

Meanwhile, 1923, a spinoff of the hit Paramount Network series Yellowstone, performed comparatively with the final seasons of The Crown and Tom Clancy’s Jack Ryan. This is particularly impressive as both of the latter series are on streamers with more subscribers and have been in production for years, amassing dedicated fanbases. Both The End of Obesity and 1923 are indicative of a unique and effective strategy Paramount+ has leveraged: The company finds creative ways to bring back valuable IP properties they have previously licensed out. For example, Max has exclusive streaming rights to the mainstay episodes of South Park, and Paramount shares streaming rights for Yellowstone with Peacock. This strategy allows them to cast their content on a wide net while reaping the benefits of associated IPs exclusive to their platform.

While there is speculation that Paramount+ would fare better being bundled or acquired by another streamer, Ellison is acquiring an arsenal of high-performing content. Skydance already has a pre-established reputation for producing high-quality series including Prime Video’s Reacher, Netflix’s Grace & Frankie and Apple’s Foundation. Perhaps all that is needed is a reassessment of how Paramount+ labels and markets its content. Skydance can do this by leveraging its historic catalog while identifying unique cohorts that each Paramount brand can cater to, creating a platform that effortlessly beckons to subscribers. The resulting model would surely keep Paramount a top media group for the foreseeable future.