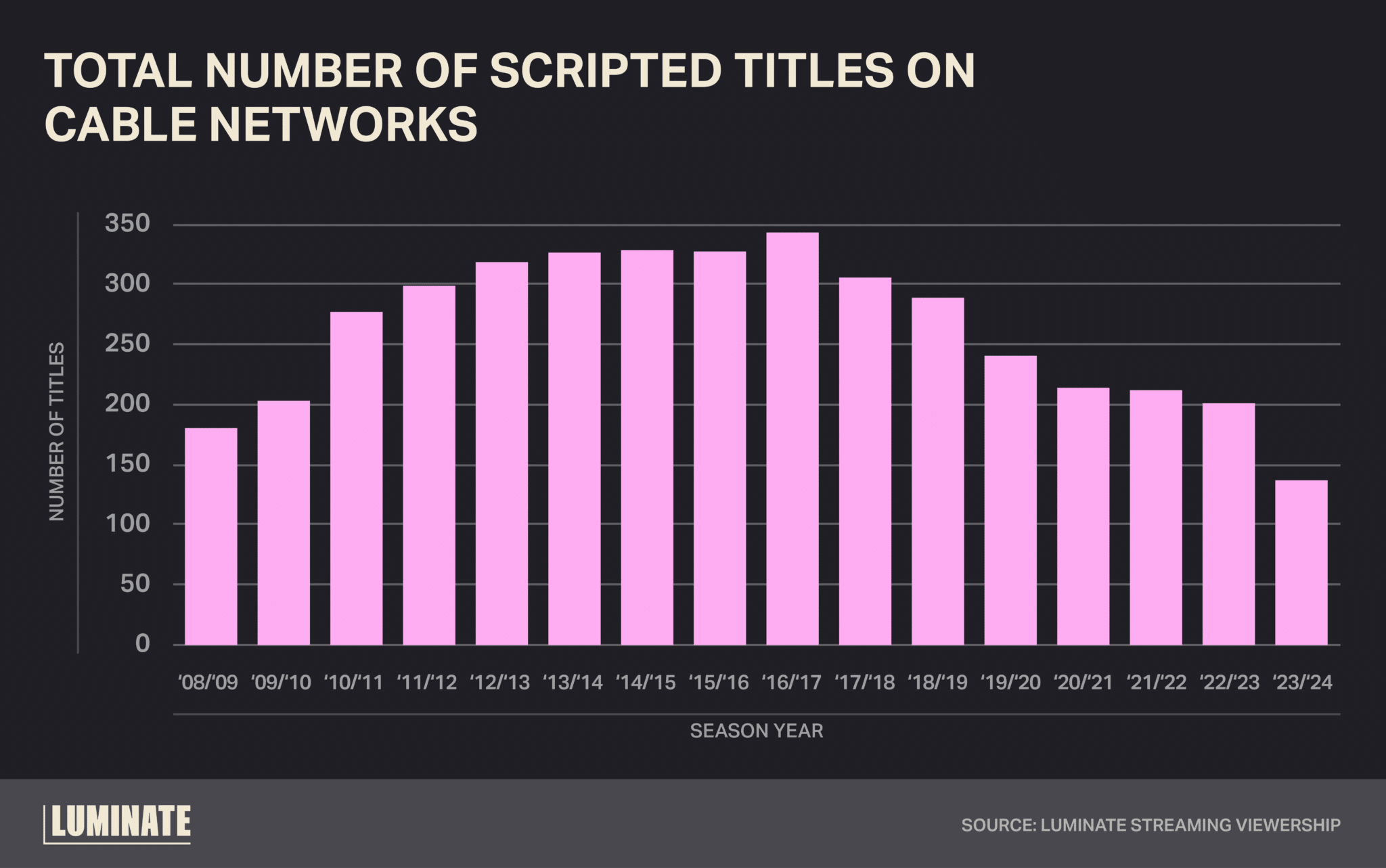

The true beginnings of the decline in viewership for broadcast and cable television began in 2013 as Netflix started rolling out streaming originals series like House of Cards and Orange Is the New Black. During the same year, U.S. cable networks were releasing a combined 330 scripted shows per season-year. In less than a decade, this number would nosedive to 139 in the 2023/2024 season year.

Netflix’s influence on this disruption is obvious. The ability to binge an entire season in one day, supported by the option to pause, rewind and pick up where you left off, rapidly changed consumer behavior. Most important was the platform’s immense content reach. Beyond its domestic, in-house scripted originals, Netflix was also able to bolster its library with acquired content.

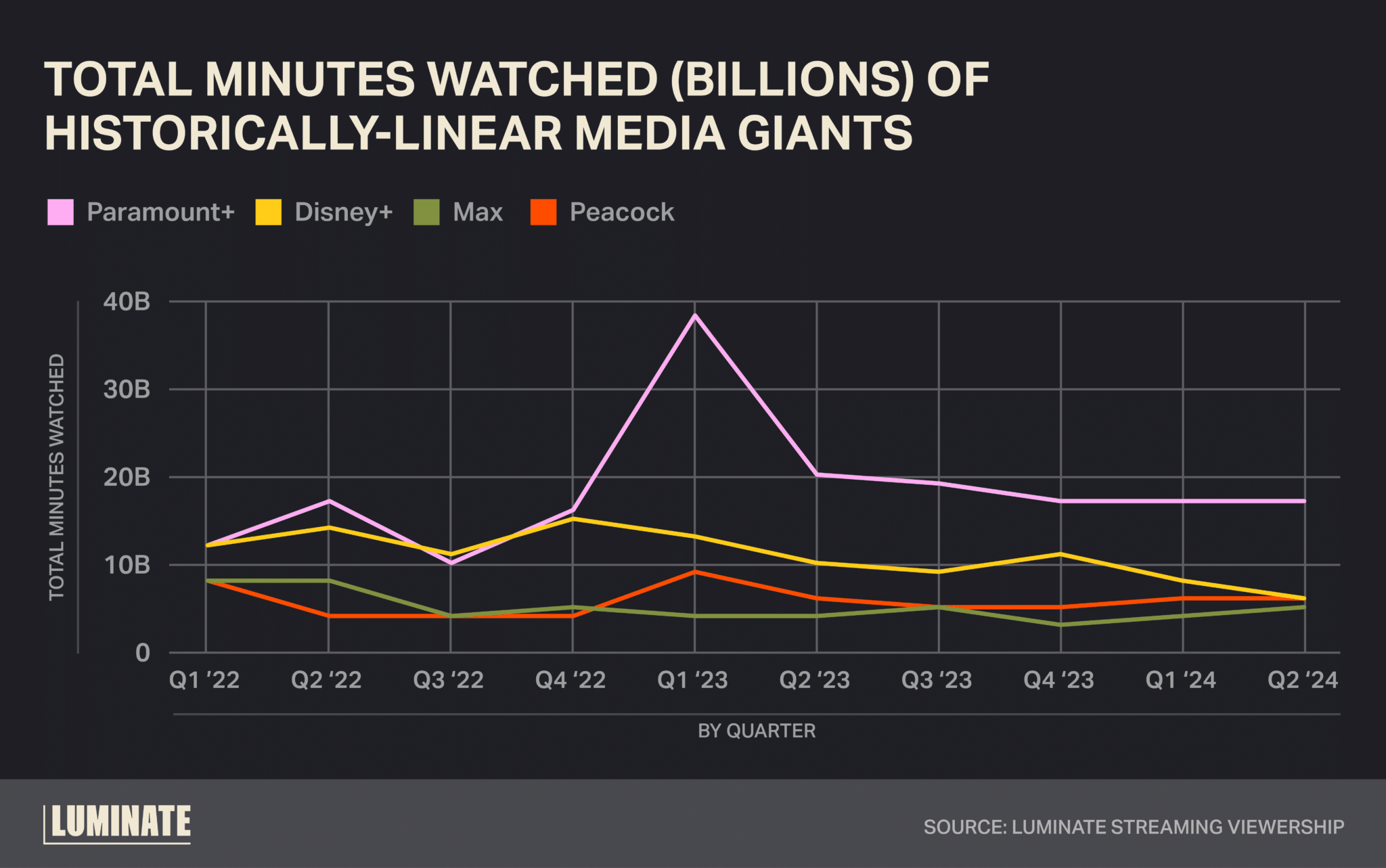

The move by legacy media companies to put their best new content on their nascent streaming platforms only hastened the decline in broadcast and cable. It has been a bumpy and risky transition, but has it paid off? Luminate’s Streaming Viewership tells us that, despite the linear decline of cable television, historic media giants have not been able to achieve an inverse increase in streaming viewership. Since 2022, none of the streamers launched by previous linear media companies have held a consistent growth pattern.

Surprisingly, Paramount+ has fared the best in this transition, with its originals netting a cumulative 183 billion minutes watched since 2022. This feat can be explained thanks to its popular scripted series and dense reality competition slate. Paramount Global has also been bothered by the attrition of its cable networks, ruthlessly pressuring fans of its IPs to their streaming platform. Showtime currently only has four scripted series slated for the 2024-2025 season, while Paramount Network and Comedy Central are down to one each.

On the flipside, Warner Bros. Discovery’s Max platform hasn’t been able to garner the same attention for its original series, only receiving 50 billion minutes watched since the merger of the two established companies in 2022. Following the formation of this venture, the media conglomerate’s journey into the streaming market was fraught with obstacles and bad press. Last year, to the dismay of multiple consumer cohorts, the company shelved finished projects including Coyote Vs. Acme and Batgirl in a bid for tax write-downs. Recently, this tactic hit a larger scale as the company announced in its Q2 earning report a $9.1 billion write-down of its cable networks. CEO David Zaslav cited the recent loss of broadcast rights for the NBA as a major contributor to this move, but many have doubted the viability of a Warner Bros. Discovery partnership. The future of Max’s original content landscape is foggy, but Zaslav has maintained optimism as the company has held price on its high-performing networks as well as TNT, which intends to slate scripted originals in the future.

Looming over all streamers is the rise of short-form content platforms. The endless stream of flashy, addictive content found on TikTok and Reels has only intensified shifts in consumer behavior. It may be easy to look at these shifting trends with pessimism and fear, but the demand and hunger for visual and performative media has prevailed since antiquity. The true test for legacy media companies is in determining if the safety net of money-making IPs can hold profits eternally, or if it only delays the inevitable crisis of apathetic consumers. Investment in originality and innovation may be high-risk, but its high-reward potential might be the only thing that provides a sustainable path forward.