As the global music industry continues to evolve, the shift from Ad-Supported tiers to Premium subscriptions becomes more vital for increasing average revenue per user (ARPU). Understanding these trends not only clarifies the current state of the market but also equips stakeholders with the knowledge needed to anticipate future revenue streams.

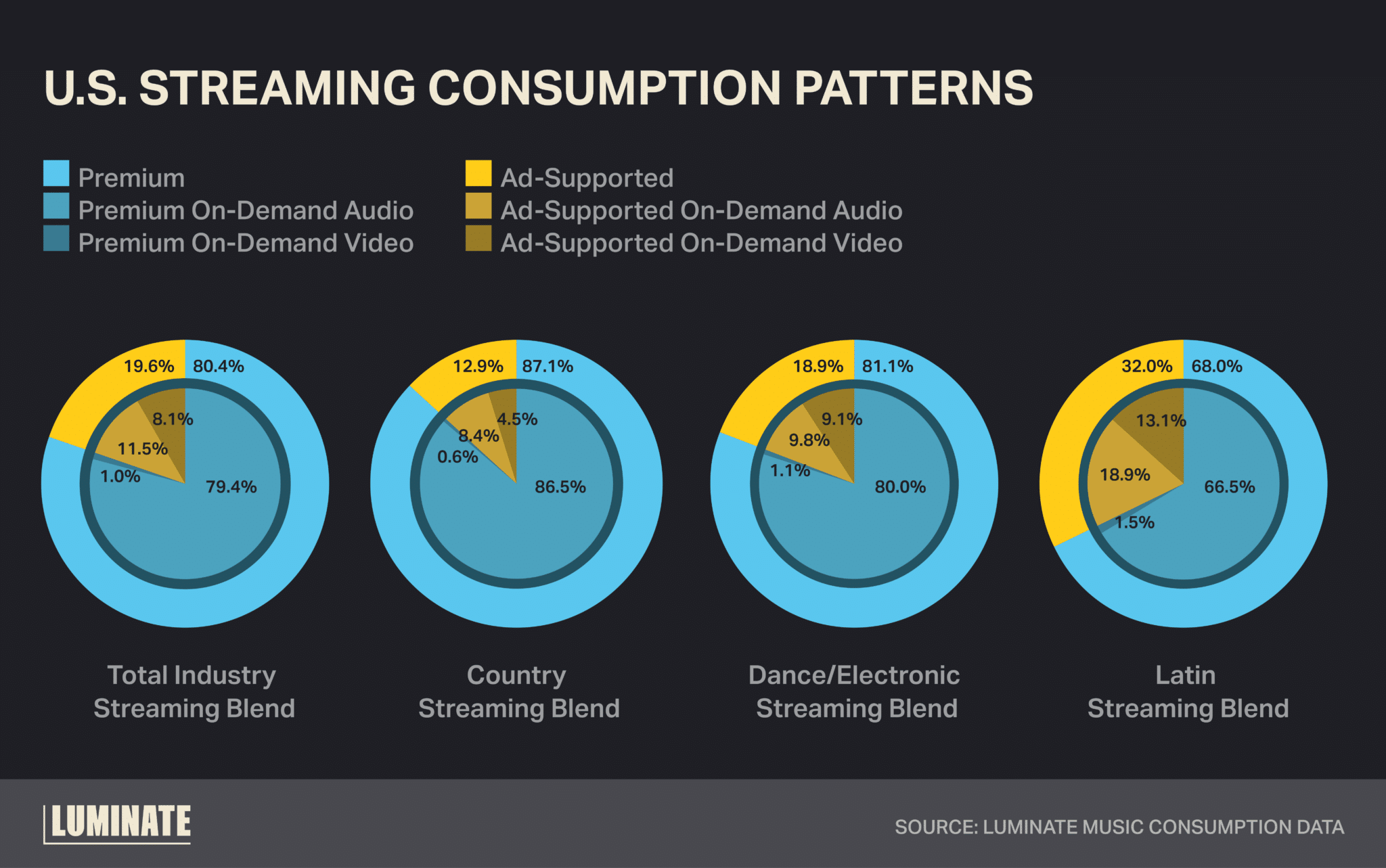

According to Luminate music consumption data, the proportion of U.S.-based streaming from Premium subscriptions has grown over time, contributing to rising value with respect to downstream royalty payouts.

In the context of understanding how this trend impacts the value of catalog assets, it’s important to understand which genres or types of music derive an outsized proportion of streams from Premium plans. At the same time, music that generates a disproportionate amount of activity from Ad-Supported streams should not necessarily be viewed as “less valuable.” It could very well highlight a developing fan base who may eventually trade up to Premium plans and continue to listen to their “old favorites” with reasonable frequency several years down the line. The challenge for rights owners is in striking the correct balance between owning music that is already over-performing in terms of Premium proportionality while “being early” on catalogs that may over index on Ad-Supported stream counts now.

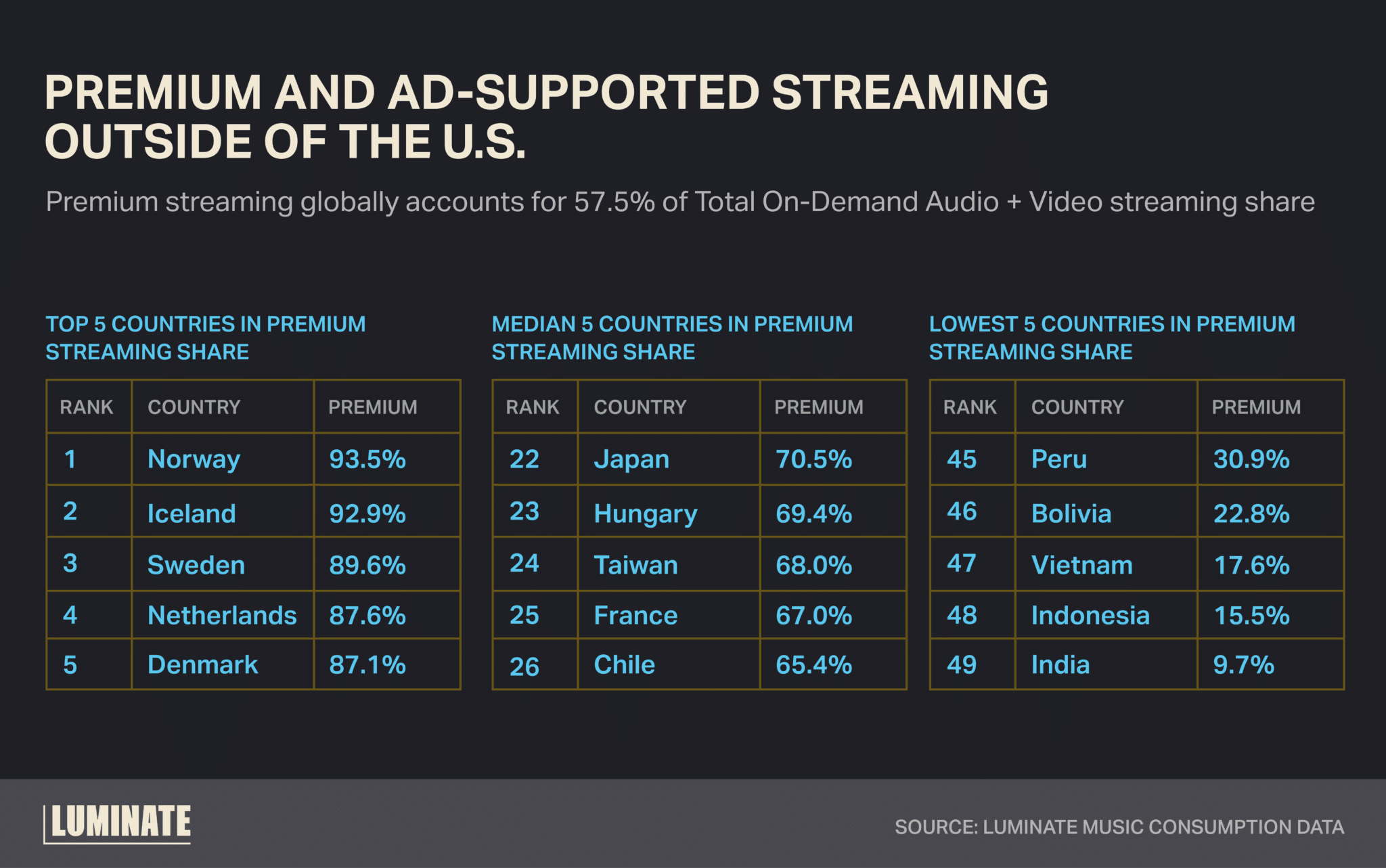

As the U.S. market continues to mature, rights owners must look to other territories to derive outsized growth. Based on the below assessment of countries with the highest proportion of Premium streams (skews Scandinavia) vs. lowest (skews Southeast Asia), where are the appropriate areas to place your bets, based not just on population and demographic dynamics but also music listening behaviors and preferences? There is no magic button to shift massive numbers of people into Premium subscriptions overnight, but certainly having an understanding of what markets are under-developed in paid streaming yet also host consumers who are highly engaged with music can help inform long term global strategies.

SOURCE:

Luminate Music Consumption Data