As perhaps the most consistent performer in theatrical film, production company Blumhouse surprised Hollywood last month by delivering a rare misfire with M3GAN 2.0.

While there’s no shortage of speculation over why the horror sequel underperformed — from overconfident summer scheduling to serious narrative tone shifts — there’s a less obvious theory that may have contributed to this flop as well. And it’s one Blumhouse ought to take note of, as the company has other highly anticipated horror sequels due in theaters later this year.

Of all the ways to raise awareness before a follow-up is released, having the preceding movie as widely available as possible on streaming is an effective tactic for bringing in new consumers unfamiliar with the franchise or rekindling a love for the last title that existing fans already had.

But that can be tricky for Blumhouse films distributed by Universal, which travel a circuitous route. Upon release to streaming, they hit Peacock first for around four months, before moving to Amazon Prime Video and then back to Peacock for another stretch that closes out Universal’s pay-1 window. Then they move to Starz for a secondary window.

In the case of the original M3GAN, it is still streaming on Starz and was there before the sequel released on June 17 due to the relatively short amount of time between the films’ theatrical releases.

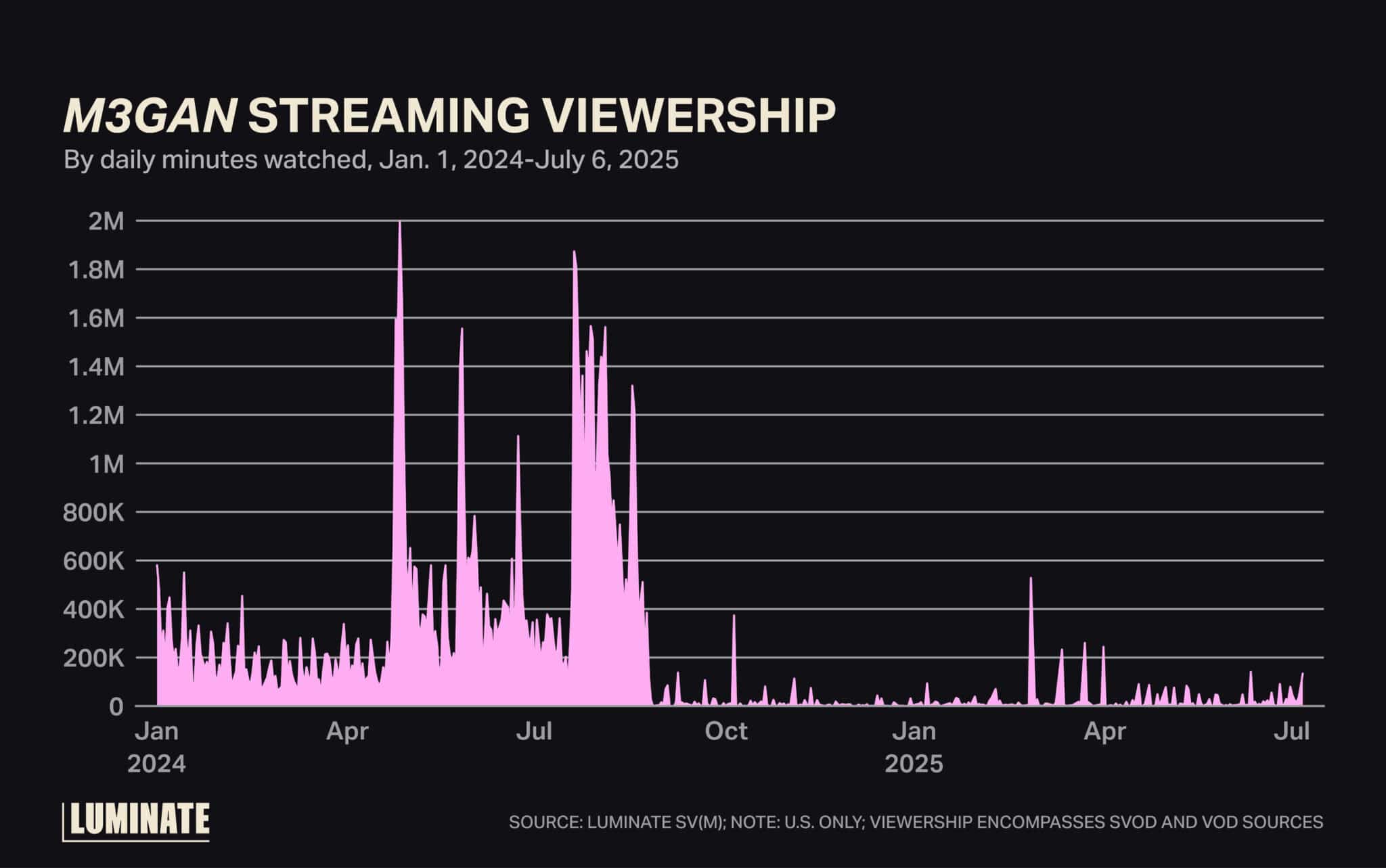

There’s a marked difference between the level of exposure M3GAN had with viewers during its 2024 stretch on Peacock, from late April to late August, as opposed to when it moved to Starz on Aug. 26, according to data from Luminate’s Streaming Viewership (M). M3GAN averaged 621K daily minutes across Peacock and VOD platforms in that second stint, peaking at 2M minutes when it initially returned.

But when M3GAN was on Starz before the release of M3GAN 2.0, it averaged only 19K daily minutes on VOD, topping at just 528K minutes two weeks after a teaser trailer for the sequel was shown during the Super Bowl.

The difference can be chalked up to the size of each streamer’s reach: Peacock has 41M paid subscribers — all in the U.S. — as opposed to the 13M OTT subscribers Starz counts in the U.S. and Canada.

Blumhouse and Universal have two additional first-time horror sequels on the calendar this year in The Black Phone 2 and Five Nights at Freddy’s 2, underscoring the need to avoid repeating the poor turnout for M3GAN 2.0.

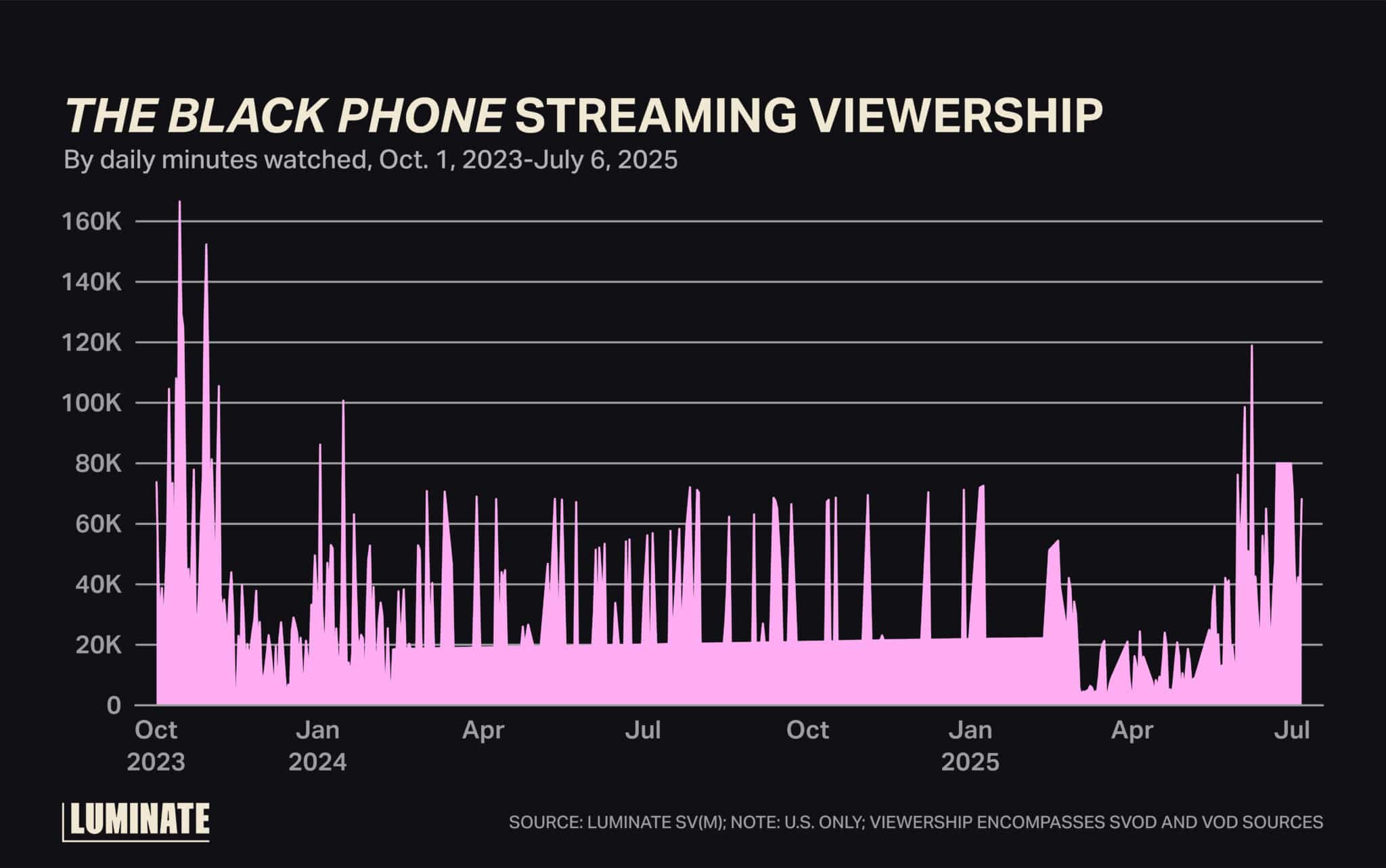

The Black Phone made nearly as much as M3GAN at the 2022 domestic box office, topping out at just over $90 million. But unlike M3GAN, the Ethan Hawke frightfest is already back on Peacock ahead of its sequel’s Oct. 17 release, having returned in February after a year on Starz. The film logged 119K daily minutes watched in June after Universal dropped a full trailer, its highest daily total since its last Peacock run in October 2023.

With three months to go, Black Phone 2’s promotion has a lot of wiggle room left, making its availability to Peacock’s larger subscriber base an advantage.

Having grossed $137 million domestically — despite the simultaneous streaming release — and close to $300 million worldwide, Five Nights represents Blumhouse’s best hope of an enduring film franchise since its Paranormal Activity and The Purge heydays. And with a budget of just over $50 million, the sequel is the prodco’s most expensive effort to date.

But the original Five Nights is still airing on Starz after completing its window on Peacock and Prime Video following its original December 2023 simultaneous release in theaters and on Peacock. The film hit Starz in April and will likely stay there through next April, well past the sequel’s Dec. 5 release.

Making the film available to more streaming subscribers before a full trailer is out would undoubtedly help its marketing, even if Five Nights has the extra benefit of hailing from a heavily merchandised video game franchise.

But as much as distribution on Peacock makes a difference in comparison to Starz, what really moves the needle are streamers with far more subscribers than either.

From Warner Bros. via New Line and Blumhouse-owned Atomic Monster, The Conjuring: The Devil Made Me Do It hit theaters and HBO Max concurrently in 2021 and has since stayed there — with one notable break.

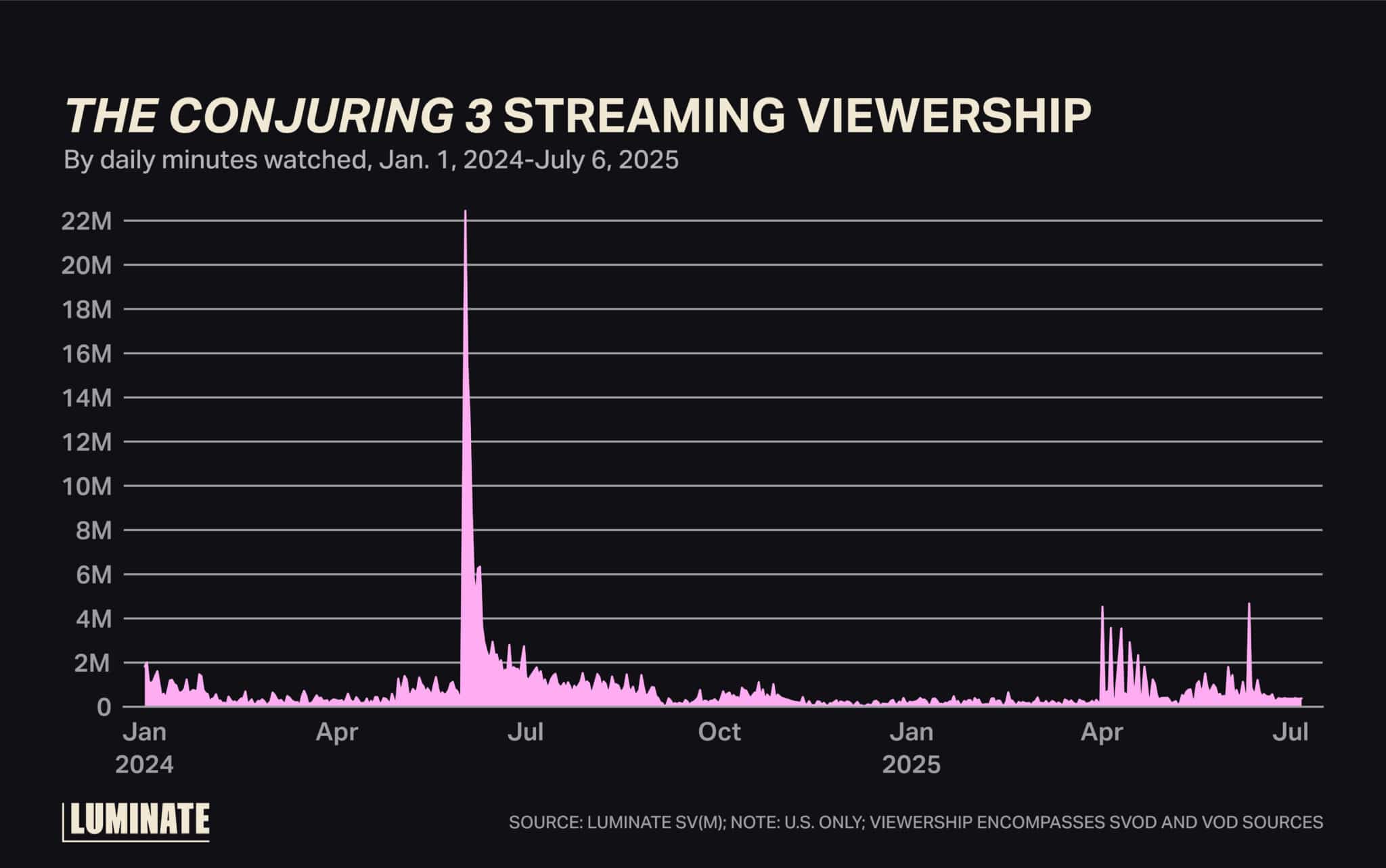

As part of Warner Bros. Discovery’s effort to license out more IP to other streamers, the third main entry in New Line’s horror universe arrived exclusively on Netflix in June 2024, alongside the first two Conjuring films, and saw viewership skyrocket past 22M minutes watched in a single day.

Such is the power of Netflix’s near-90M U.S. and Canada subscribers. But HBO Max’s 58M domestic subscribers matter to the equation as well, with Conjuring 3 logging nearly 5M daily minutes watched earlier this summer, following an initial teaser in May.

Studios and production companies must seriously consider which streamers franchise entries live on before new sequels hit theaters, especially for newer IP.

To track the performance of other movies on the leading streaming services, check out Luminate’s SV(M) platform.