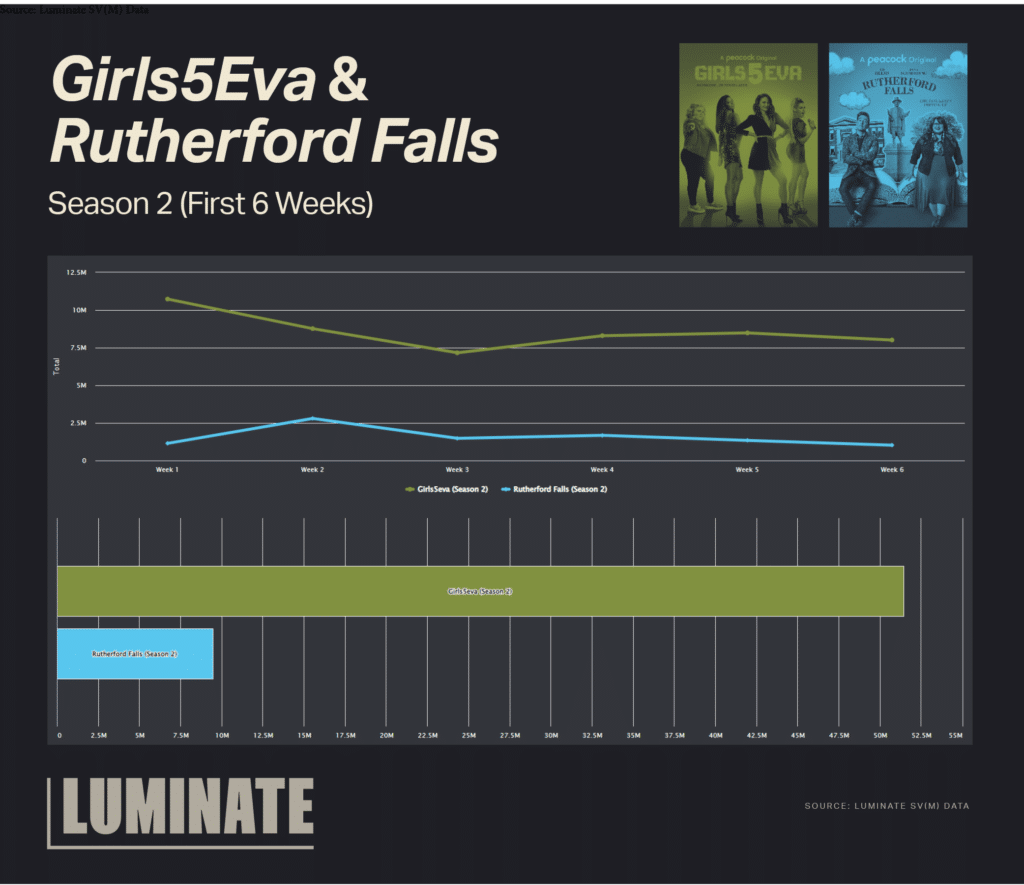

The second season of Meredith Scardino’s music satire, Girls5Eva, dropped on Peacock in May 2022. The series had become a highlight of Peacock’s spring comedy slate, amassing a dedicated following during its inaugural season. Upon its premiere, Girls5Eva performed well on the platform, holding a consistent lead of 7 million minutes watched over Peacock’s other headlining comedy original, Rutherford Falls. It was a positive omen for the future of Girls5Eva, but when NBCU licensed the third season renewal to Netflix, it came as a shock.

There was considerable trade buzz surrounding this platform shift, with The Hollywood Reporter comparing it to Cobra Kai’s move from YouTube to Netflix in 2021. Last month, when the third season of Girls5Eva finally premiered on its new home, it received comparable viewership to its sophomore season premiere on Peacock. Additionally, Girls5Eva’s first two seasons were released concurrently with the third season’s Netflix-exclusive premiere, and it is within these previous seasons that some interesting data surfaces.

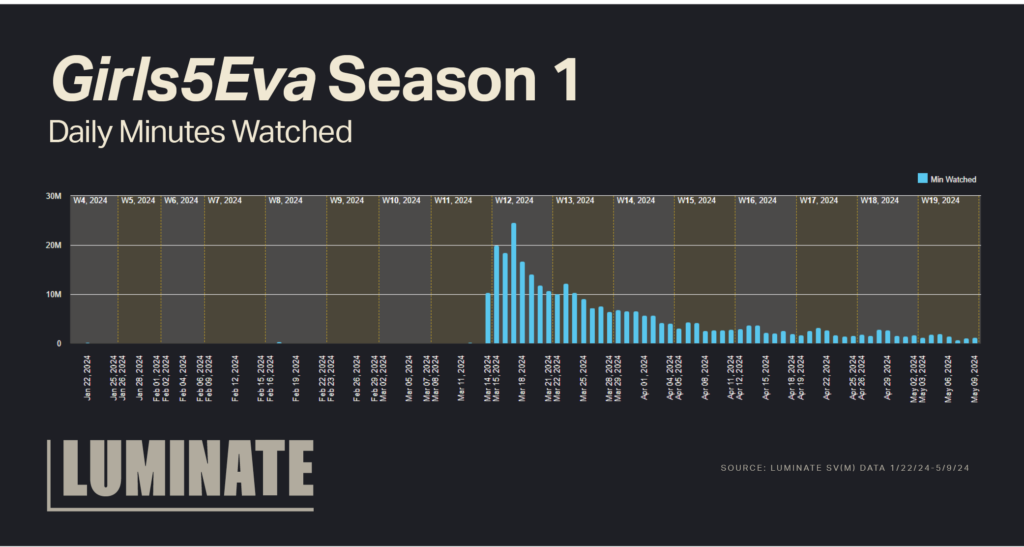

Season 1 of Girls5Eva, originally a 2021 release, became a smash hit when it moved to Netflix in 2024. Viewership peaked at 24.5 million minutes watched, significantly higher than at any point during the series’ run on Peacock. Season 1 jumped to Number 15 on Luminate’s Top 50 TV Shows Chart, the highest-ranking comedy that week. When viewership tapered off after its initial Netflix release, average minutes watched for Girls5Eva Season 1 maintained an impressive daily average of 1 million minutes watched throughout Spring 2024.

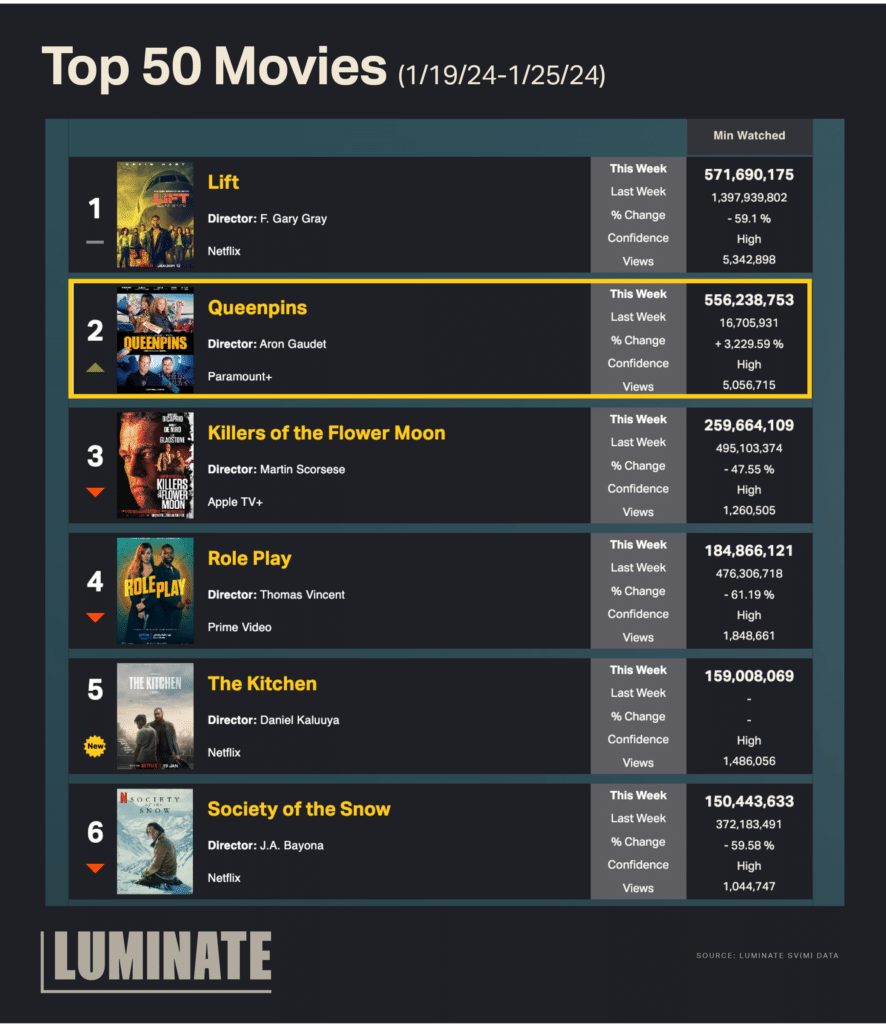

This trend is not uncommon for titles that move to Netflix. A similar phenomenon can be seen with the 2021 crime comedy feature Queenpins. After a limited theatrical release, the Kristen Bell-led film ran as a Paramount+ Original. Its two-year run on the platform was largely underwhelming, netting a few thousand views per day. When Netflix acquired streaming rights for the title and released it on January 18, 2024, its viewership skyrocketed. Queenpins netted close to 5 million total viewers in its first week on the platform. It peaked at Number 2 on Luminate’s Top 50 Movies Chart, staying in the Top 10 for three weeks. After its peak, the series has maintained a consistent daily viewership in the tens of thousands.

Much can be inferred regarding this platform-shifting effect. Netflix has nearly a decade ahead of most of its competitors in amassing subscribers. Digital streamers like Peacock and Paramount+ dwarf in comparison to Netflix’s massive catalog of originals. NBCU clearly thought Girls5Eva was a higher-value property for the studio that could benefit from the larger Netflix audience rather than using the title to drive Peacock subs. Something can also be said for the freedom of versatility Netflix possesses. The platform is not tethered to the pre-existing brand identity and catalog that plagues some of the younger streamers like Disney+. This seemingly allows Netflix to make bold and determined decisions surrounding its original and acquired titles. As we move into a new era of streamers allying and forming “bundles,” it will be interesting to see if this “Netflix Effect” can be replicated on another platform and drive business back to the content owners.