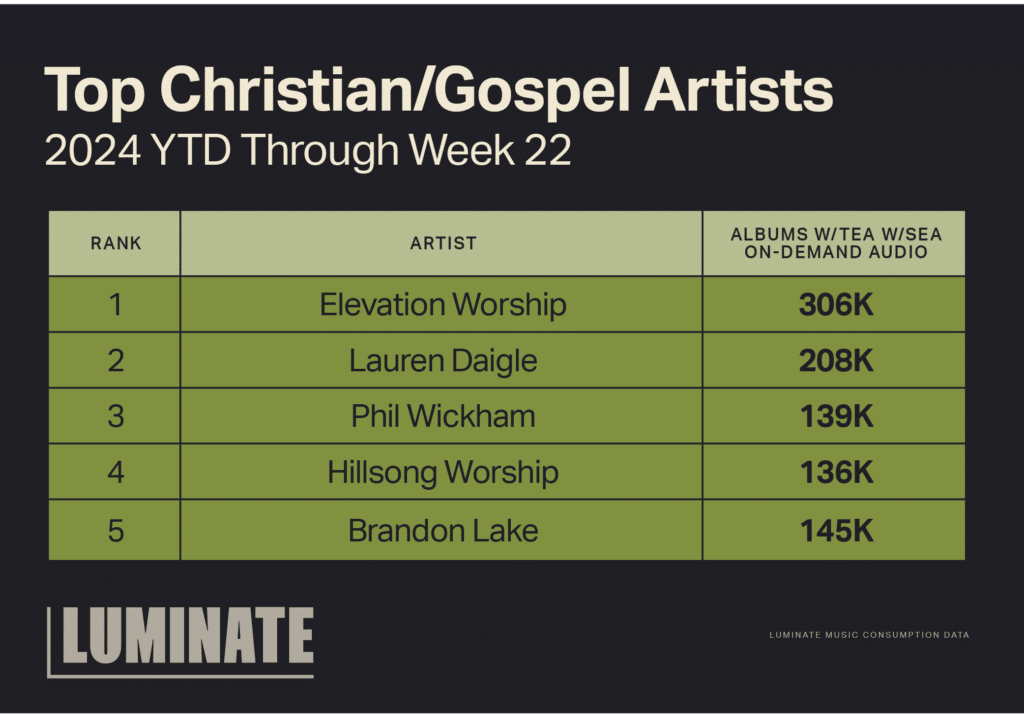

The K-Love Fan Awards were held in May and broadcast earlier this month as the Christian and Gospel music community came together to recognize Christian artists, athletes, authors and entertainers. The night’s big music winners include KING & COUNTRY (Artist of the Year), Anne Wilson (Female Artist of the Year), Elevation Worship (Group of the Year) and TobyMac for Song of the Year (“Faithfully”).

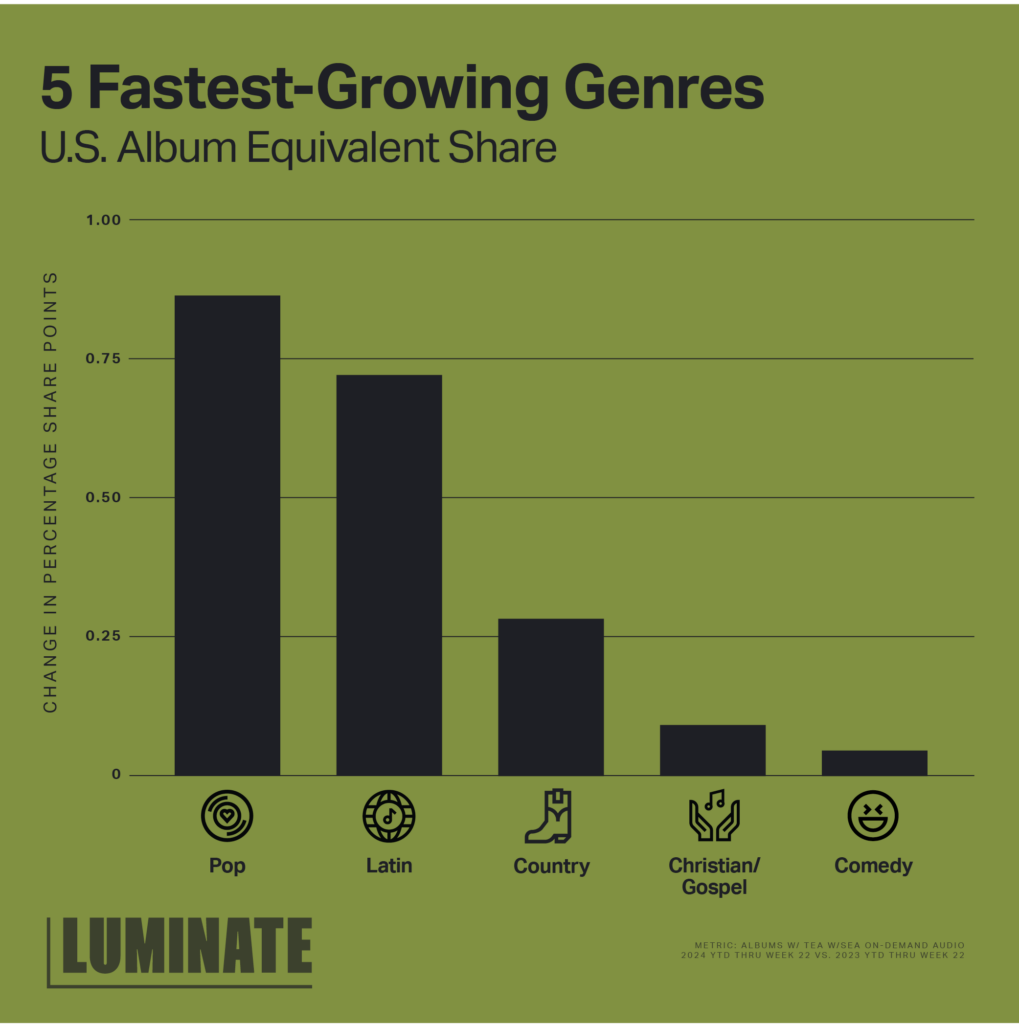

Overall at a genre level in the U.S., the Christian/Gospel genre is the fourth-fastest growing in 2024 through week 22 (week ending 5/30/24) when analyzing overall consumption (Albums w/ TEA w/SEA On-Demand Audio). The genre has grown 8.9% this year in this metric, which is more than twice the industry growth rate of 4% when compared to the same time period last year. (For those new to the Albums w/ TEA w/SEA On-Demand Audio metric, this album equivalent takes into account Album sales with Track Equivalent Activity and Audio Streaming Equivalent Activity to form one album unit equivalent). This growth helped the genre pick up +.09 percentage share points against all other genres so far this year in a zero-sum pool.

So, what is driving this growth? Our Luminate Insights consumer research points to a developing younger audience. The share of listeners that is Millennial and younger has grown from 39% of overall genre listenership in 2022 to 45% in 2024. Additionally, consumer response data shows that the number of hours Christian/Gospel fans spent with music each month increased from 47.9 hours in 2022 to 56.8 hours so far in 2024 (+19% over this time) as these younger listeners spend more time with music.

While Friends/Relatives and AM/FM radio tie as the No.1 source of Music Discovery among Christian and Gospel fans overall, the role played by Friends/Relatives comes into view when looking at younger generations. For Gen Z Christian and Gospel fans, Friends/Relatives is the No. 1 source as they are 20% more likely to cite this than the average Christian and Gospel fan.

These findings point to a developing younger audience that looks to their close network for music recommendations, and could be critical in continuing to grow the genre.

SOURCE:

Luminate Music Consumption Data

Luminate Insights Artist & Genre Tracker (Consumer Research)