With its whopping $7.7 billion deal for the streaming rights to all UFC events in the U.S., newly christened Paramount Skydance is making a big play to reposition its SVOD for younger subscribers.

Under the seven-year agreement, UFC matches will stream starting next year at no additional cost to U.S. Paramount+ subscribers, with a selection of fights also simulcast on CBS. It’s a bold move (worth nearly as much as the $8 billion Skydance spent to acquire Paramount in the first place) but a smart one, as new Paramount CEO David Ellison looks to jump-start the beleaguered media company.

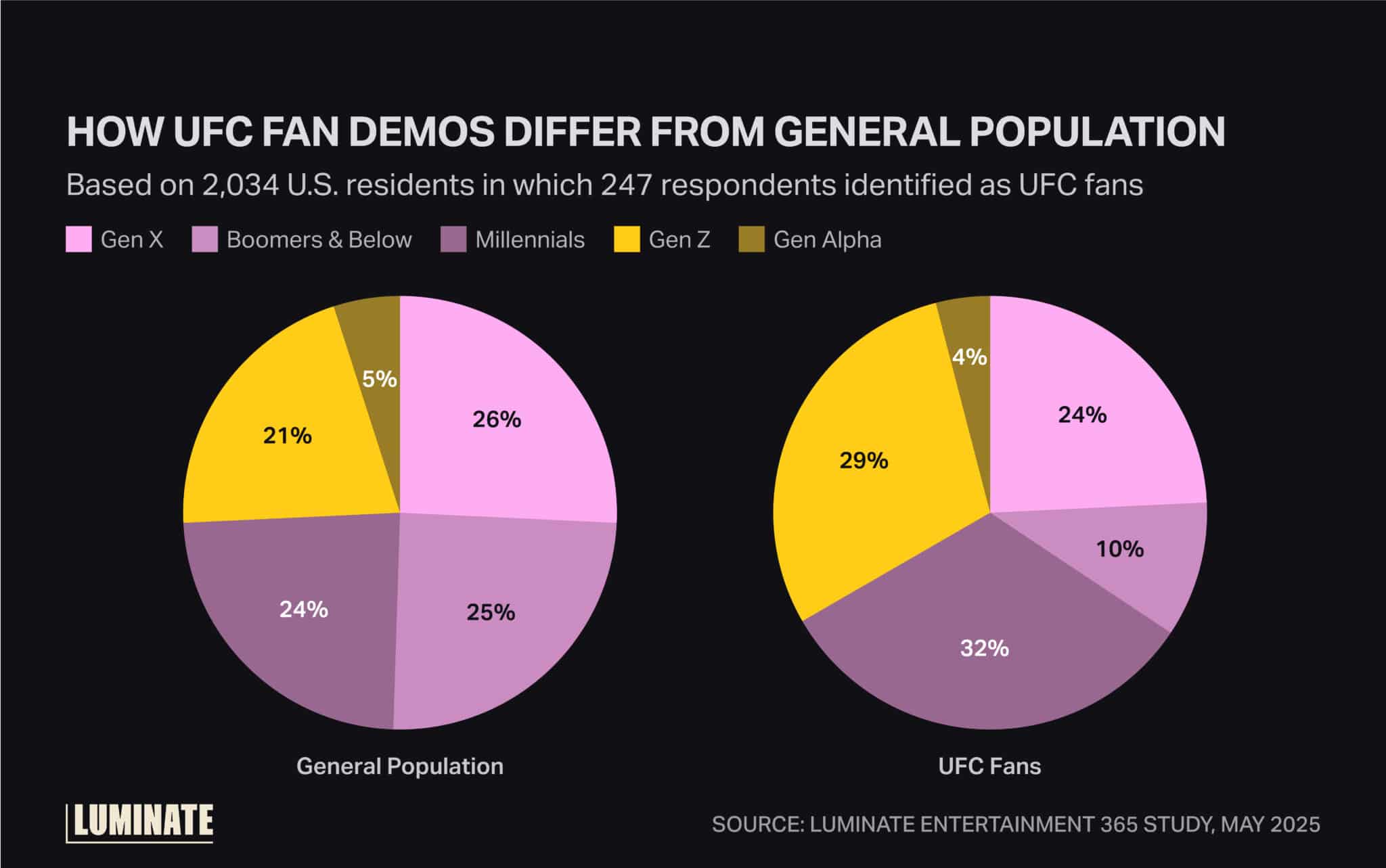

According to Luminate’s Entertainment 365 study, a third of all U.S. sports consumers already watch, attend or follow UFC fights. But when broken down generationally, Gen Z and Millennials are the backbone of the sport’s viewership, making up 61% of its fanbase.

When skewed for male Gen Z and Millennial fans, the study shows this cohort nearly doubles the general population’s interest.

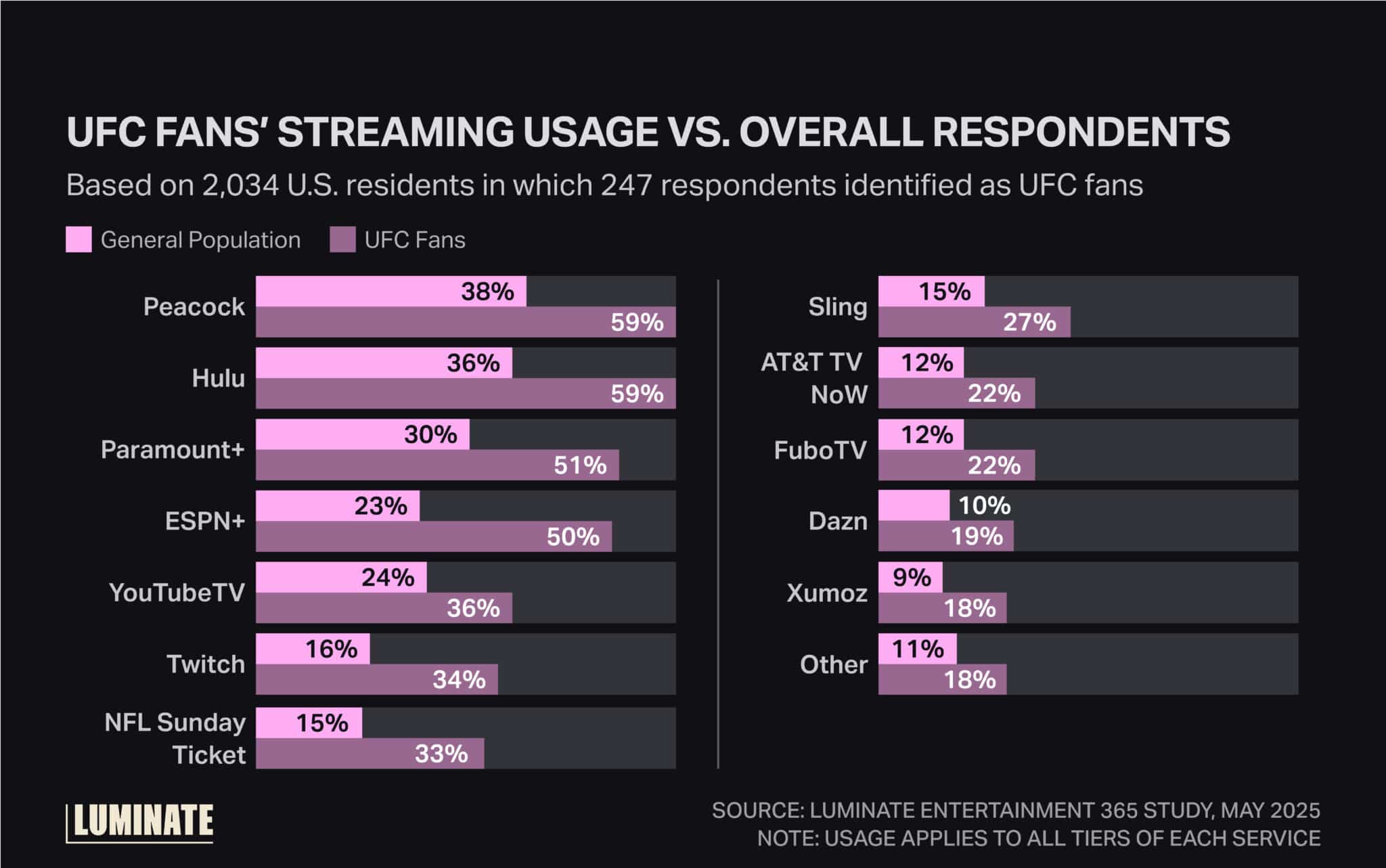

Luckily for Paramount, the same fans are also more likely to be acquainted with its streamer. Compared with 30% of the general population, just over half of UFC fans already use Paramount+, about the same proportion as those paying for ESPN+ to watch fights under the league’s current deal.

However, those UFC fans currently must pay an additional $79.99 per match on top of the base ESPN+ subscription, in keeping with UFC’s historical pay-per-view business model. The new deal with Paramount is a cost win for fans and will likely bring an influx of new viewers to the sport, not to mention a potential boost in young subscribers to Paramount+.

This demographic play is a major component of Ellison’s vision for a revitalized Paramount. The company has long been seen as an old folks’ home in both broadcast TV (where CBS boasts the oldest primetime audience of the Big Four networks) and streaming.

The biggest Paramount+ originals, such as Yellowstone spinoff 1923, heavily over-index with viewers 45 and older, according to demographic data from Luminate Streaming Viewership (M) — in stark contrast to SVOD’s reputation as a format for younger consumers.

Thus, the UFC deal represents the first step toward a Paramount and Paramount+ that court the coveted Gen Z and Millennial audiences and position the company for the next era of media. But it’s not the last: Paramount marked the start of September with a deal to adapt Activision’s Call of Duty video game IP for a feature film, with the potential for TV series as well.

If Ellison & Co. successfully right the Paramount ship, UFC may well be remembered as the beginning of that course correction.