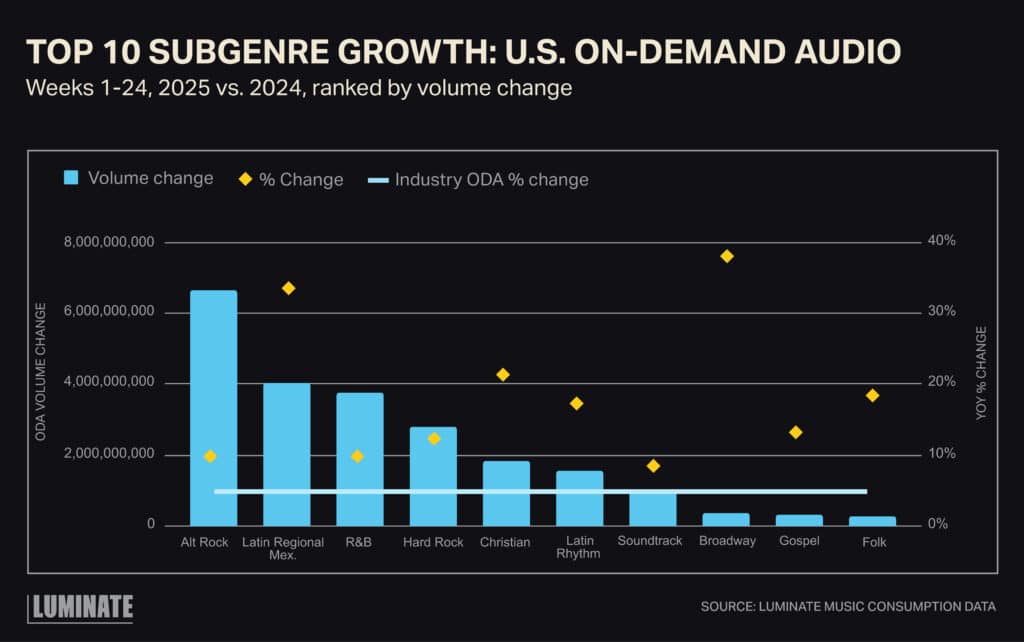

As Luminate finalizes its annual 2025 Midyear Music Report for publication on Wed., July 16 — and gears up to discuss it in a webinar on the day of release — we bring you a sneak peek here. Our audience intelligence shows three subgenres have become standout stories in U.S. music streaming this year: R&B, Hard Rock and Christian.

New data shows each is experiencing notable growth — and each is backed by a uniquely engaged audience. Understanding the differences among the three isn’t just interesting, it’s critical to building long-term fan relationships.

R&B: Genre Fluid and Twitch-Driven

For the first time in over three years, R&B ranks among the top five U.S. subgenres in On-Demand Audio growth, according to Luminate consumption data (as Tuesday Takeaway also explored in April).

Consumer research from Luminate’s Artist + Genre Tracker found the R&B audience is predominantly Gen Z women — and, interestingly, the average R&B streamer in the U.S. is 110% more likely to discover music on Twitch than listeners of other music.

R&B fans also appear to be genre fluid, with two-thirds saying they enjoy when artists venture beyond their typical sound. This suggests strong potential for cross-genre collaborations and livestreaming strategies via platforms such as Twitch that speak directly to R&B’s digital native audience.

Hard Rock: Gaming Discovery Meets Vinyl Loyalty

With new releases from Sleep Token and Ghost landing at No. 1 on the Billboard 200 just two weeks apart this spring, Hard Rock is riding a wave. Listeners are mostly male Millennials, with 138% more likely to discover music through video games and 150% more likely to listen on vinyl. That’s a powerful combination of digital and analog fandom — providing clear opportunities for exclusive physical formats and in-game music placements.

Christian: Playlist Power and Repeat Listening

Christian music is quietly booming, thanks to a younger, streaming-forward fanbase that skews 60% female and 30% Millennial. This audience is 90% more inclined to discover songs via playlists, while 75% report they listen to songs on repeat. That’s a sure sign of high emotional connection — and a strong fit for repeatable content.

Audience Insights Are the Key to Growth

The three subgenres noted here are growing for different reasons, but they all illustrate one truth: Knowing your audience is essential. Whether it’s platform preference, discovery behavior or listening habits, tapping into these signals allows the industry to engage fans better and sustain momentum.

Watch for Luminate’s 2025 Midyear Music Report and accompanying webinar next week, where we dive into these stats as well as industry metrics and the top trends impacting the global music industry.

Source:

Luminate Music Consumption Data

Luminate Insights Consumer Research Data