As Disney prepares to fully knit Hulu into the Disney+ streaming app, the Mouse House’s leadership has made clear that they’re hoping the move will help boost engagement on the company’s flagship streamer.

And to be blunt, Disney+ could use the help.

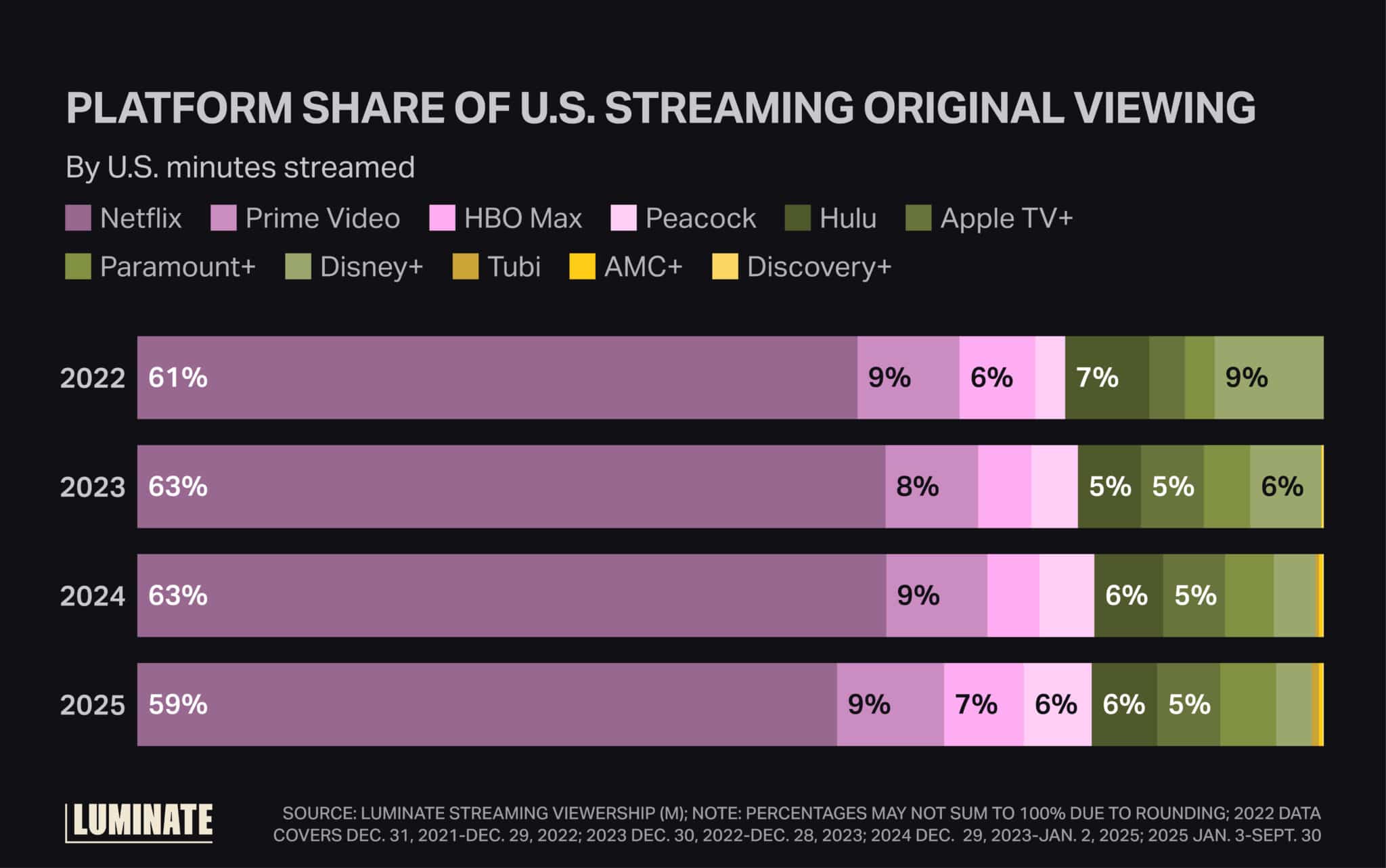

An analysis of Luminate Streaming Viewership (M) data shows the platform had the steepest original content engagement drop-off among the major SVODs over the past three years. Disney+ fell from a 9% share of U.S. viewing time for streaming originals in 2022 to just 3% in 2025 (year-to-date through Q3).

This was not just a loss of market share, either. According to SV(M), Q1-Q3 viewing time for Disney+ original series plummeted from 44.3 billion minutes in 2022 to 20.2 billion in 2025, a decline of nearly 55%.

The falloff is partly explained by Disney’s reduction in streaming original output: Per Luminate Film & TV data, more than 40 Disney+ original series premiered in 2022; in the first three quarters of this year, there were just 16.

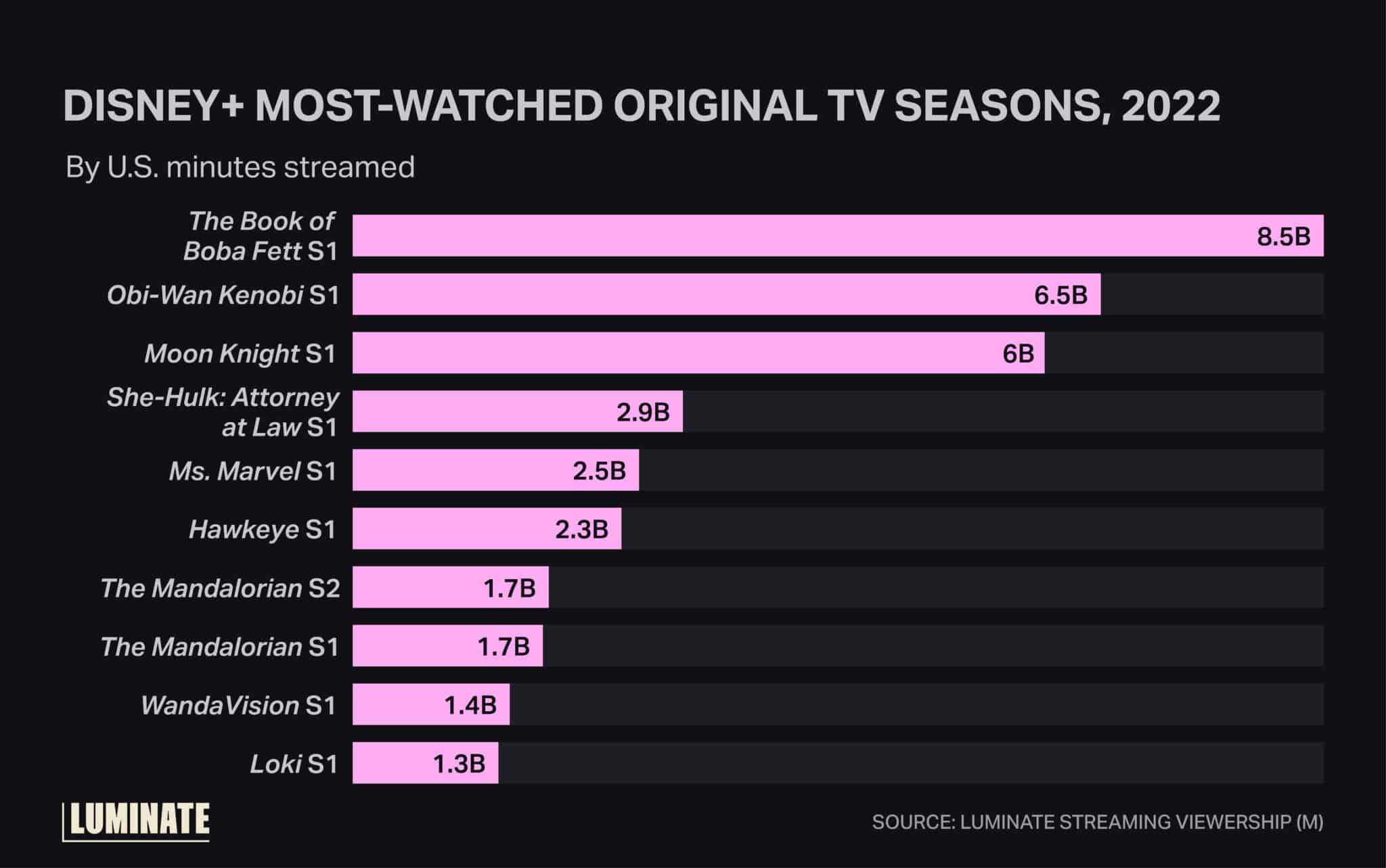

Furthermore, Disney CEO Bob Iger has been open about reducing streaming content for some of the company’s biggest franchises. The top ranks of the most-watched Disney+ series in 2022 included Star Wars series The Book of Boba Fett and Obi-Wan Kenobi, along with Marvel titles Moon Knight, She-Hulk, Ms. Marvel and Hawkeye.

It’s a stark contrast to 2025, in which only one Star Wars series and one Marvel series landed on Disney+: Andor Season 2 and the first season of Daredevil: Born Again. (Unsurprisingly, those are the most-watched titles of the year so far.)

Beneficial as this may be in terms of franchise management, it’s taken a major toll on Disney+ engagement. Which brings us back to the matter of Hulu: The more adult-oriented SVOD, long an integral part of Disney’s bundled streaming offering, has seen remarkably sustained viewership for its original series.

While Hulu’s raw viewing time for originals has dipped slightly — year to date through Q3, it’s at 40.5 billion minutes, versus 46.2 billion at the same point in 2022 — its market share has held steady at around 6% over the last three years.

The streamer has also continued to turn out a, well, stream of buzzy hits including The Bear, Paradise and The Secret Lives of Mormon Wives (not to mention the stealth engagement machine that is The Kardashians, whose new seasons reliably land in the platform’s top 10 each year).

With Hulu content now set to be permanently integrated into Disney+, all of that engagement will now benefit its parent company’s flagship app while bringing more users into the Disney+ environment to potentially be drawn in by other, non-Hulu content.

It’s therefore no surprise that the company is moving so aggressively to combine the two services; in the new streaming landscape, engagement is king.