September is off to a great start at the movies, thanks to Warner Bros.’ The Conjuring: Last Rites, which achieved a franchise-best opening and continued the studio’s hot streak throughout 2025.

But if the hits don’t keep coming, the rest of the year could struggle to be a major reversal of 2024’s strike-impacted decline that halted film exhibition’s post-pandemic growth.

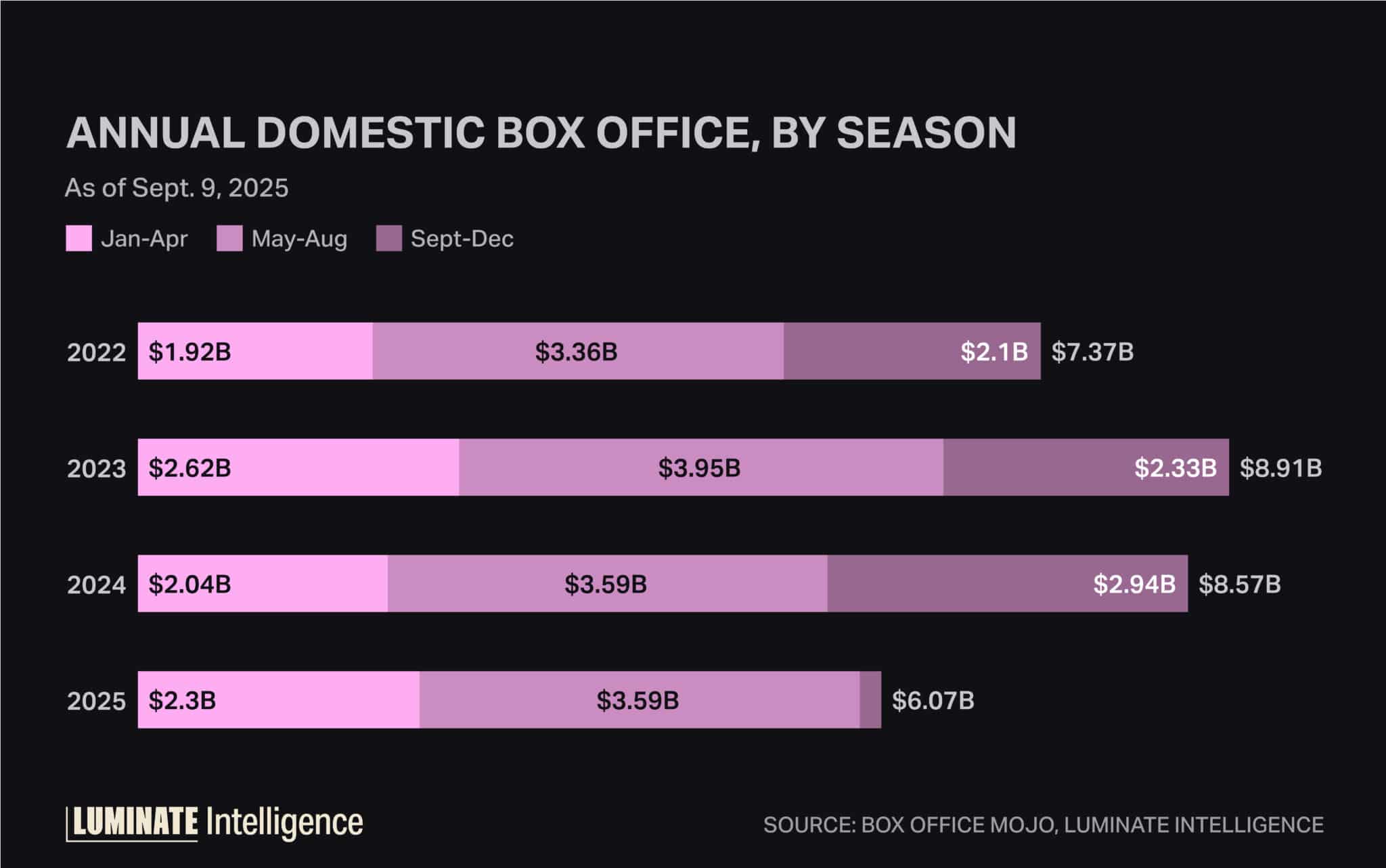

As solid of a rebound as last year’s summer and fall seasons were due to big performers including Inside Out 2, Deadpool & Wolverine, Twisters, Beetlejuice Beetlejuice and Wicked, the year was still weighed down by a weak spring led by Dune 2 — and little else. All in all, 2024’s domestic gross closed 3.8% down year over year.

The good news is 2025 domestic gross was up 4.6% by the end of August. However, that’s due almost entirely to the double whammy of Warner Bros.’ A Minecraft Movie and Sinners in April, which elevated the first four months of the year past last year’s feeble showing, following a soft start to 2025’s calendar.

However, this summer’s lead over the equivalent four months in 2024 ended up being minuscule. While Lilo & Stitch saw the same billion-dollar success as Inside Out 2 last year at the global level, obtaining a nice chunk well over $400 million from the domestic box office, no other summer films reached as high of a threshold.

Jurassic World Rebirth topped out well under $900 million after the billion-dollar achievements of the past three entries, while the best of the year’s three Marvel movies — The Fantastic Four: First Steps — made it just above $500 million globally. Meanwhile, Disney’s live-action Snow White and Pixar’s Elio flopped on big budgets.

This puts all the pressure on fall to match last year’s showing if hopes are for 2025 to grow from last year and get its box office closer to 2023’s total, which almost surpassed $9 billion domestically.

With Last Rites adding to a string of seven consecutive hits for Warner Bros., the studio’s domestic cumulative gross for the year is back above Disney’s. However, Warners has just one film left, Paul Thomas Anderson’s pricey One Battle After Another. The Leonardo DiCaprio flick closes September on a budget that is at least $130 million but potentially as high as $175 million.

Compare that with Disney’s holiday options — Zootopia 2 for Thanksgiving and Avatar: Fire & Ash in December — and it’s clear which studio is set to win the year, on top of contributing greatly to 2025 matching the last third of 2024’s domestic gross. Universal’s concluding chapter to Wicked heading into Thanksgiving and a sequel to Five Nights at Freddy’s right after that are also bound to help.

Still, Paramount and Sony blew their summer blockbuster shots, aside from modest turnout for the former’s conclusion to Mission: Impossible. Other than Paramount’s latest SpongeBob film in December, neither studio has dependable franchise fare scheduled, and Lionsgate already got John Wick spinoff Ballerina out the door to muted turnout over the summer. Only a new Now You See Me remains on that front, set for November.

Meanwhile, Amazon put aside its big films for 2026 and has less than a handful of awards-friendly films, including After the Hunt, to close out the final months.

It’s possible the Wicked, Zootopia and Avatar follow-ups are enough to carry 2025 to year-over-year growth despite the lack of topline franchises outside of the holidays.

If not, the clock resets all over again for the 2026 slate.