After a year chock-full of massive and record-breaking music rights deals, The Weeknd is closing out 2025 as the first living solo artist to strike a $1 billion deal by leveraging his catalog.

Whereas a typical catalog deal involves artists selling some or all of their music rights, The Weeknd — real name Abel Tesfaye — and his manager, Wassim “Sal” Slaiby, are reportedly keeping their majority stakes while offering a 25% equity stake to Lyric Capital and raising the other 75% of the $1 billion through debt.

In simple terms, The Weeknd leveraged his estimated future earnings on his publishing and master rights to strike a deal with Lyric Capital and get a massive payout up front.

The only other billion-dollar single-artist signings to date were for Queen and Michael Jackson — two iconic acts with decades of time-tested hits. Is The Weeknd as sure enough of a bet as the King of Pop and one of the most beloved rock bands of all time to bring in the desired returns for investors?

As covered in Luminate Intelligence’s Music Rights & Catalog Acquisitions special report, answering that question takes a village of experts and heaps of careful analysis. But one of the most crucial tools for assessing catalog value is via music consumption data, which shows that The Weeknd’s catalog not only performs exceptionally well but still shows continued growth.

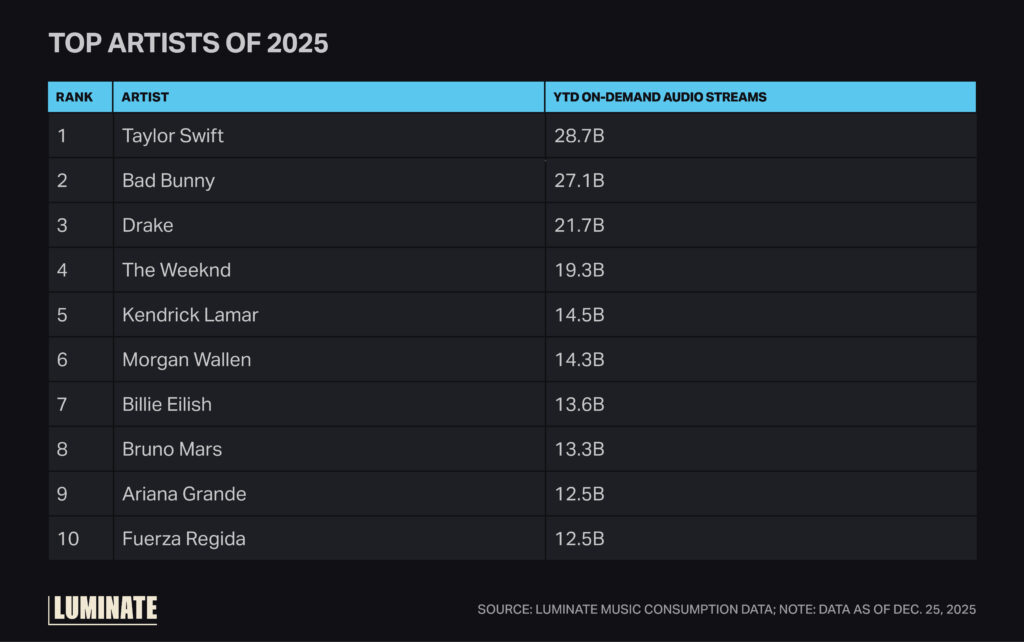

He’s one of the most successful artists of the 21st century, enjoying stream counts that tower well above most artists (with the 2020 single “Blinding Lights” still the most streamed song of all time on Spotify).

In 2025, which saw the release of The Weeknd’s sixth album, Hurry Up Tomorrow, and the continuation of his record-breaking world tour, the artist brought in 19.3 billion global On-Demand Audio streams, with 6.1 billion of those from the U.S. alone.

Although high-value deals are typically reserved for long-established artists, The Weeknd’s massive stream count may have actually helped sway investors despite his relatively younger catalog.

And the most interesting trend is that, even a decade into his career, The Weeknd’s popularity continues to climb: As of Dec. 25, global On-Demand Audio stream count for 2025 is 9% higher than his total for the same period (weeks 1-51) in 2024, while his U.S. streams grew by 19%.

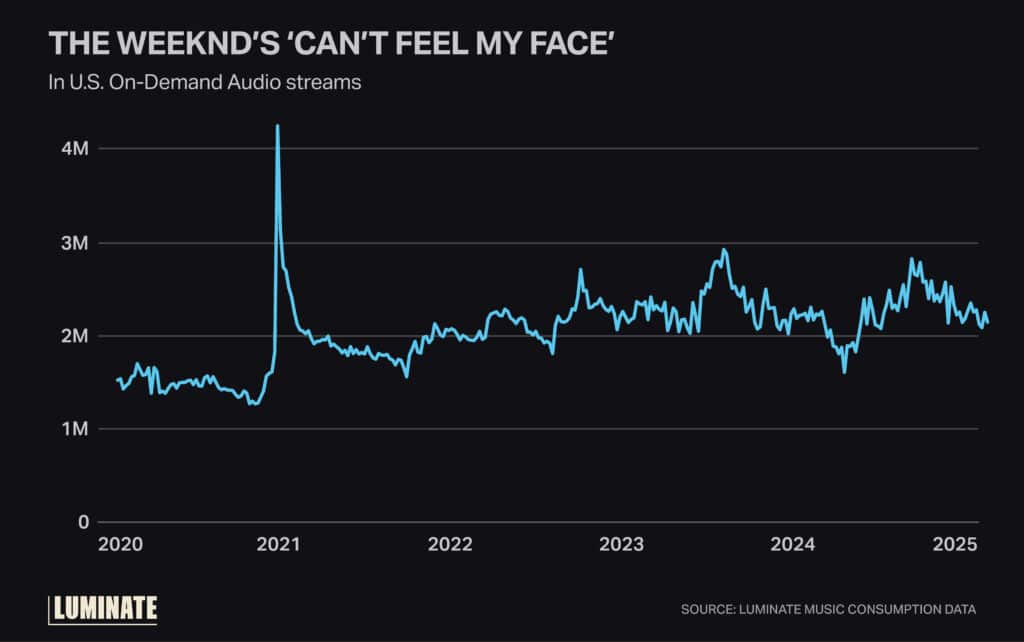

There’s also the question of songs’ “decay curves.” Typically, a hit song will earn the bulk of its lifetime streams within the first year or so of release and eventually settle into a lower but steady average stream count. But The Weeknd’s earliest hits defy that trend.

Take 2015’s “Can’t Feel My Face,” which started trending upward in U.S. ODA streams around The Weeknd’s 2021 Super Bowl halftime show performance after years of flat averages. As of Dec. 25, the song had earned 117.5 million U.S. ODA streams in 2025, up 57% from the same period (weeks 1-51) in 2020.

Whereas investors usually prefer to bank on fully matured hits that will reliably perform well, the fact that the Weeknd’s catalog is at such a rarefied level and shows signs of even more growth may have been too alluring an opportunity to pass up.