The U.S. TV industry is flush with franchise fever.

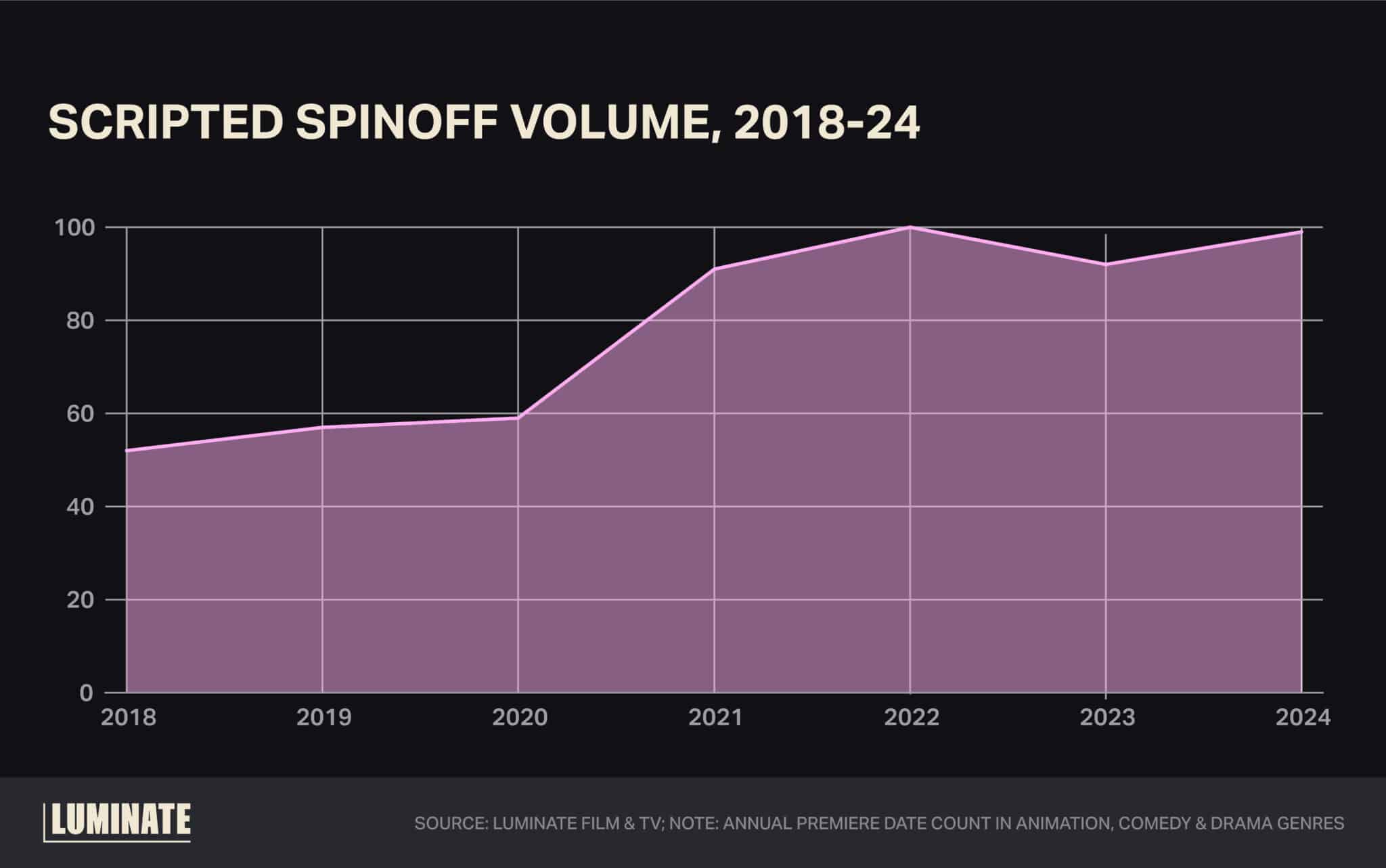

The number of scripted spinoff series currently on linear TV and streaming has increased 75% vs. the same time last year, according to Luminate Film & TV — from 28 to 49. The latest example is HBO Max’s And Just Like That, a reboot of Sex and the City that saw its third-season premiere on May 29.

While the spinoff count dipped during the 2023 Hollywood strikes, it’s set to skyrocket in the coming years, with an additional 56 series extracted from pre-existing TV and film intellectual property currently in development.

This clearly signals Hollywood’s growing interest in maximizing its return on successful IP, in a similar fashion to the franchise-heavy approach that has dominated the theatrical film market for the past decade.

The surge may not come as a surprise to anyone who made the rounds in New York earlier this month for upfront season, when the latest wave of programming plans were announced.

Peacock, for example, is set to unveil a follow-up to classic comedy The Office, while little of CBS’ primetime schedule isn’t a bet on franchise expansion, as Fire Country, FBI and Blue Bloods all launch their attempt to model NCIS, which itself will be three series deep come fall after having rolled out three previously.

It’s probably no coincidence that CBS is owned by Paramount Global, the company behind Yellowstone, considered a gold standard for TV universes everyone wants to emulate. Bloomberg recently valued the franchise at $3 billion.

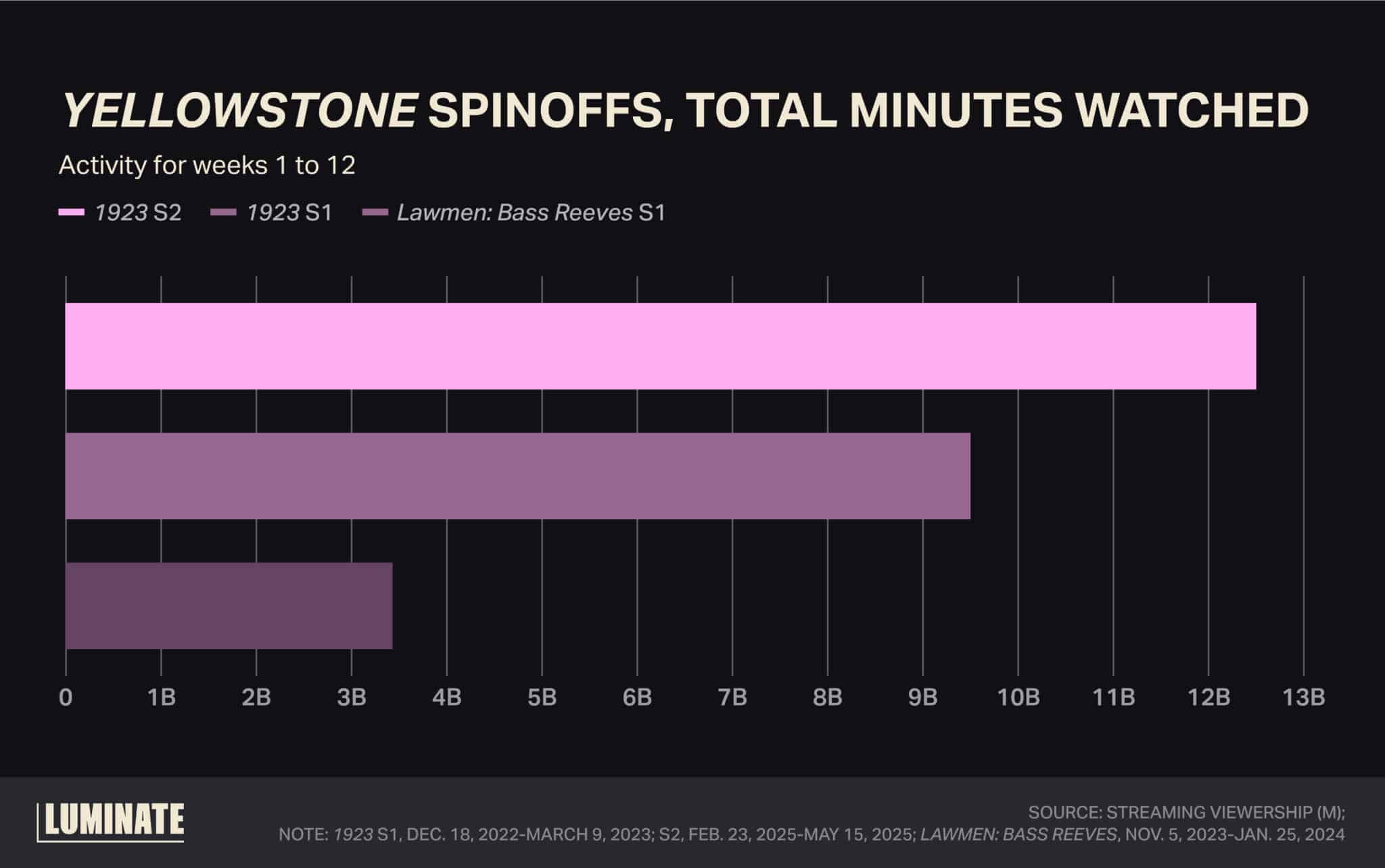

Taylor Sheridan’s Western sagas have commanded a massive share of Paramount+’s drama slate since kicking off in 2018. The best example is 1923, led by Harrison Ford and Helen Mirren, which was a success in its first season at 9.5 million minutes watched over the first 12 weeks, according to Luminate Streaming Viewership (M) data. Now that series has grown by some 30% over its second season, which premiered in February.

However, not every Yellowstone offshoot works as well. Lawmen: Bass Reeves was a moderate success in 2023 by Yellowstone standards given it fell short of 3.5 billion minutes, and Paramount has yet to order a second season.

As the industry goes full throttle into franchise mode, Lawmen is a sobering reminder that for every success story à la 1923, there are plenty of examples of TV universe-building that falter, including a few recent high-profile flameouts that should be noted.

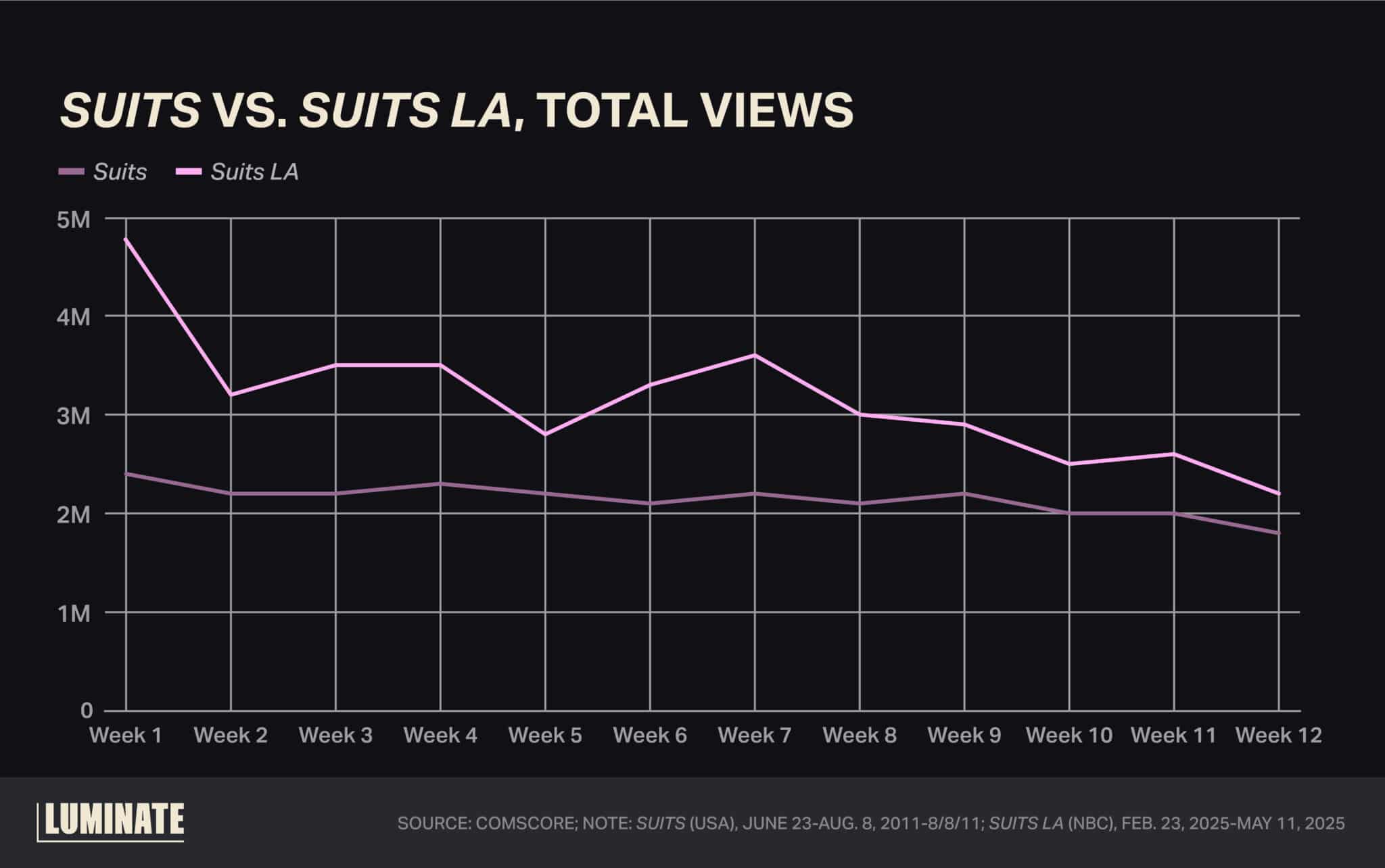

Earlier this month, NBC canceled Suits LA, the network’s attempt to franchise its 2011 USA Network hit Suits. When the flagship series was added to Netflix last year, a huge resurgence in viewership prompted Universal to greenlight the spinoff.

Suits LA came out of the gate strong, with its series premiere netting 4.8 million views, according to Comscore. Yet by the time the season finale aired three months later, viewership had dropped to less than half of where it started. Compare this with the original, whose audience was much more consistent week over week.

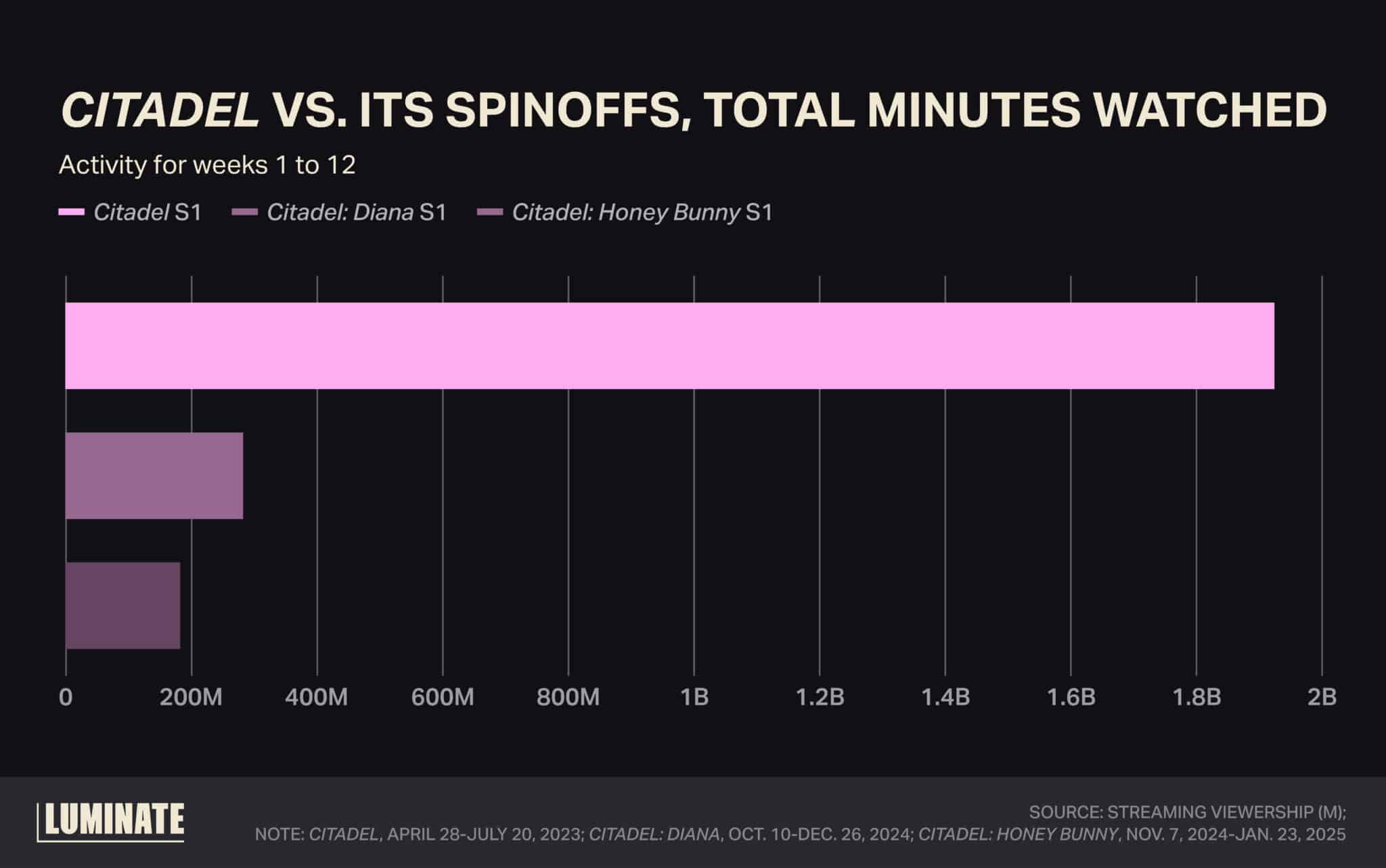

Last month, Prime Video axed two series spun off from its U.S. spy thriller series Citadel. Both offshoots, Diana and Honey Bunny, were actually commissioned ahead of the original’s premiere. And both netted only a combined 500 million minutes watched in the first 12 weeks — less than a quarter of the 1.9 billion netted by the original.

And it remains to be seen how Apple TV+ is feeling about the future of Side Quest, a spinoff of the recently canceled Mythic Quest, which launched in March to audience levels far below its predecessor.

Franchising is a logical strategy for an increasingly fragmented viewing world and cost-conscious industry. Borrowing from the DNA of IP that has already proven its viability is a less risky bet than gambling on wholly unproven content.

But be wary of another risk in the process: pursuing that strategy without studying the SV(M) viewership data that captures just how the many different spinoffs in circulation are performing.