SVOD price hikes have become so commonplace you can practically set your watch to them — and in Disney’s case, that’s pretty much literal.

This will mark the third October in a row the Mouse House has raised prices on its streaming portfolio, with monthly ad-supported Disney+ and Hulu plans both getting a $2 hike (from $9.99 to $11.99). For an ad-free experience on Disney+ — which, lest we forget, cost $7.99 just three years ago — consumers will have to shell out $18.99 per month come Oct. 21.

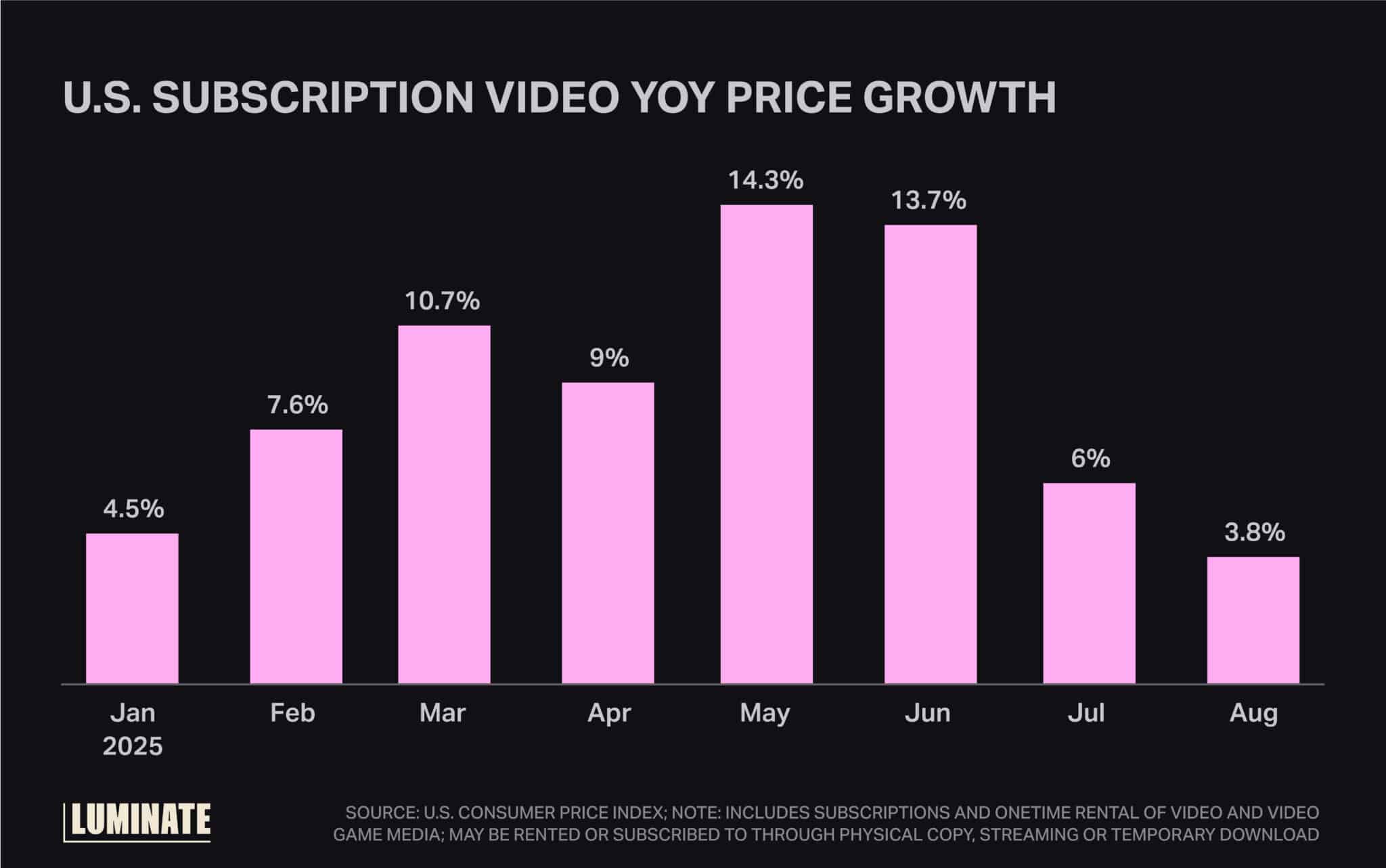

Prices have grown enormously across the entire SVOD field in the last three post-Netflix correction years, of course. The U.S. Consumer Price Index’s subscription video category (which, it should be noted, also includes rentals and video games) recorded a whopping 14% year-over-year increase in both May and June, among the highest of any tracked sector.

But Disney’s price growth has been immense even by these standards. Since introducing its ad-supported plan in 2022, Disney+ has raised its monthly ad-free price by nearly 140% — not 40%, 140%.

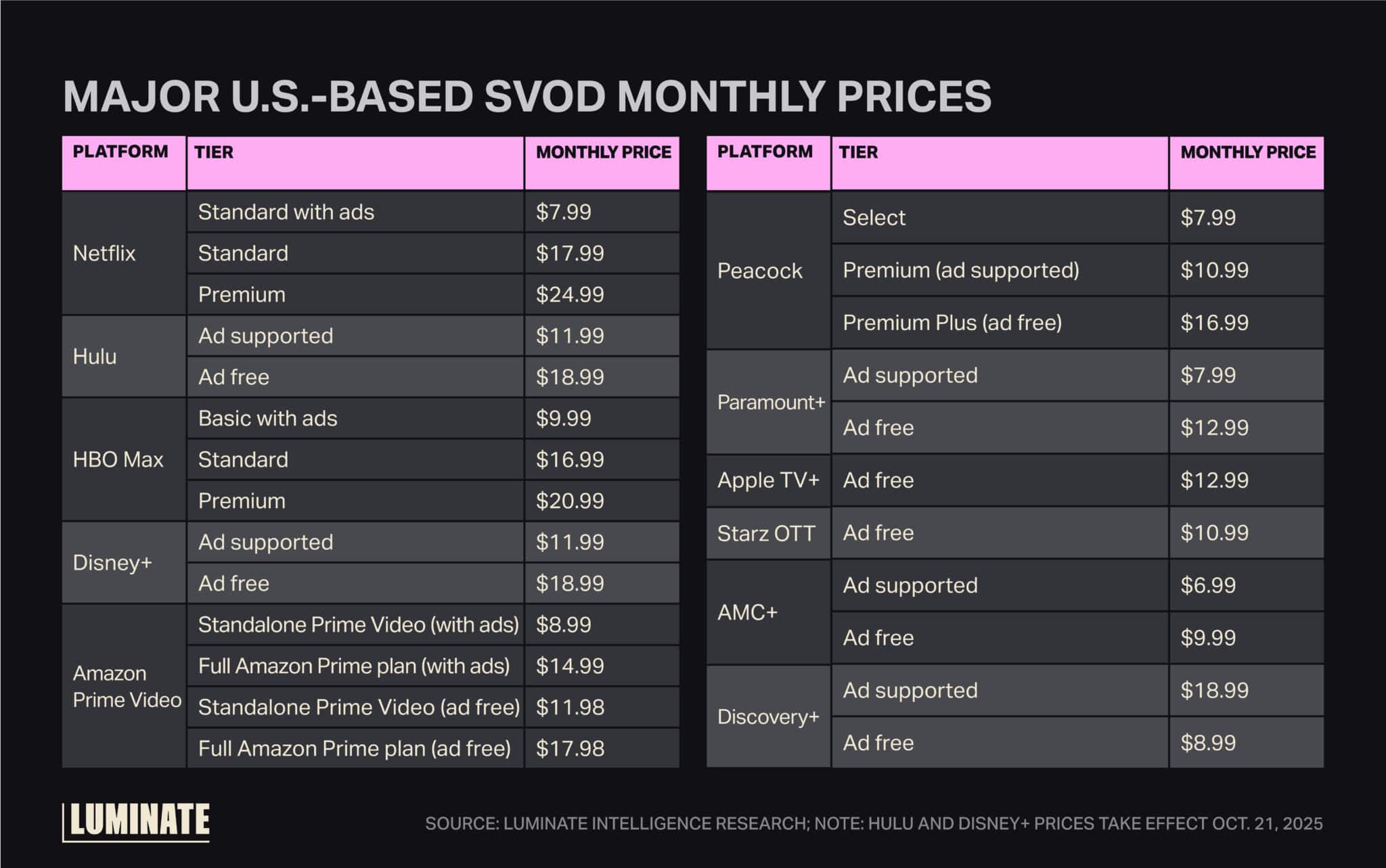

The ad plan, meanwhile, has grown 50% more expensive over its short life and notably will now cost $4 more per month than Netflix’s AVOD tier. “Given the relative engagement of the two platforms, Disney now appears meaningfully overpriced relative to Netflix,” Lightshed Partners wrote in a recent note.

But I would argue Disney may still have room to grow, as its not-so-secret weapon gives it a pricing power above and beyond almost any other SVOD: a unique bundling strategy.

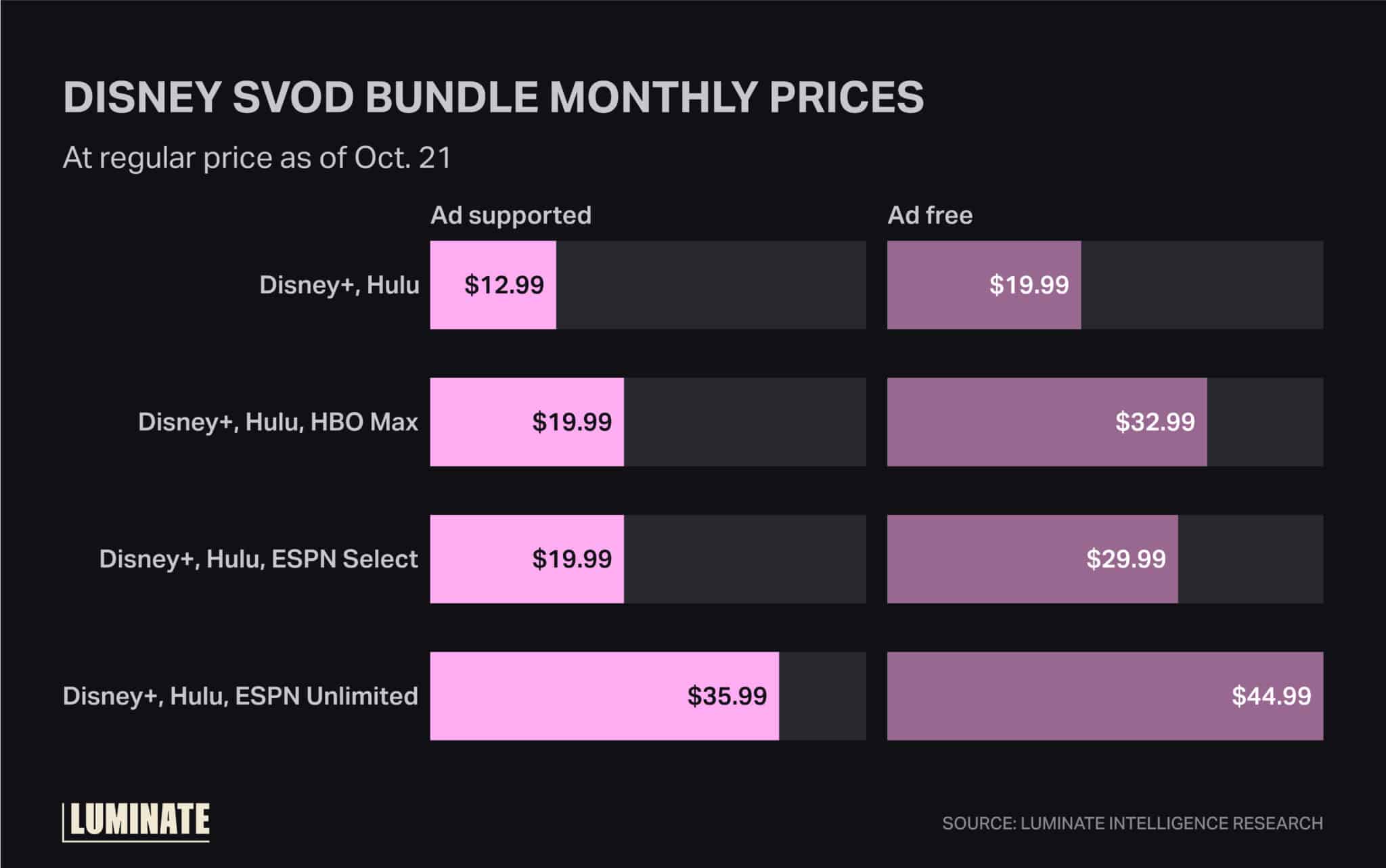

Indeed, pushing consumers to the bundle is one of, if not the, most important factors behind the Mouse House’s repeated price hikes. Disney has long been pricing its SVOD bundle products competitively with the standalone services, to the point where the Disney+ and Hulu package, in both ad-supported and ad-free forms, now costs only $1 more per month than either service on its own.

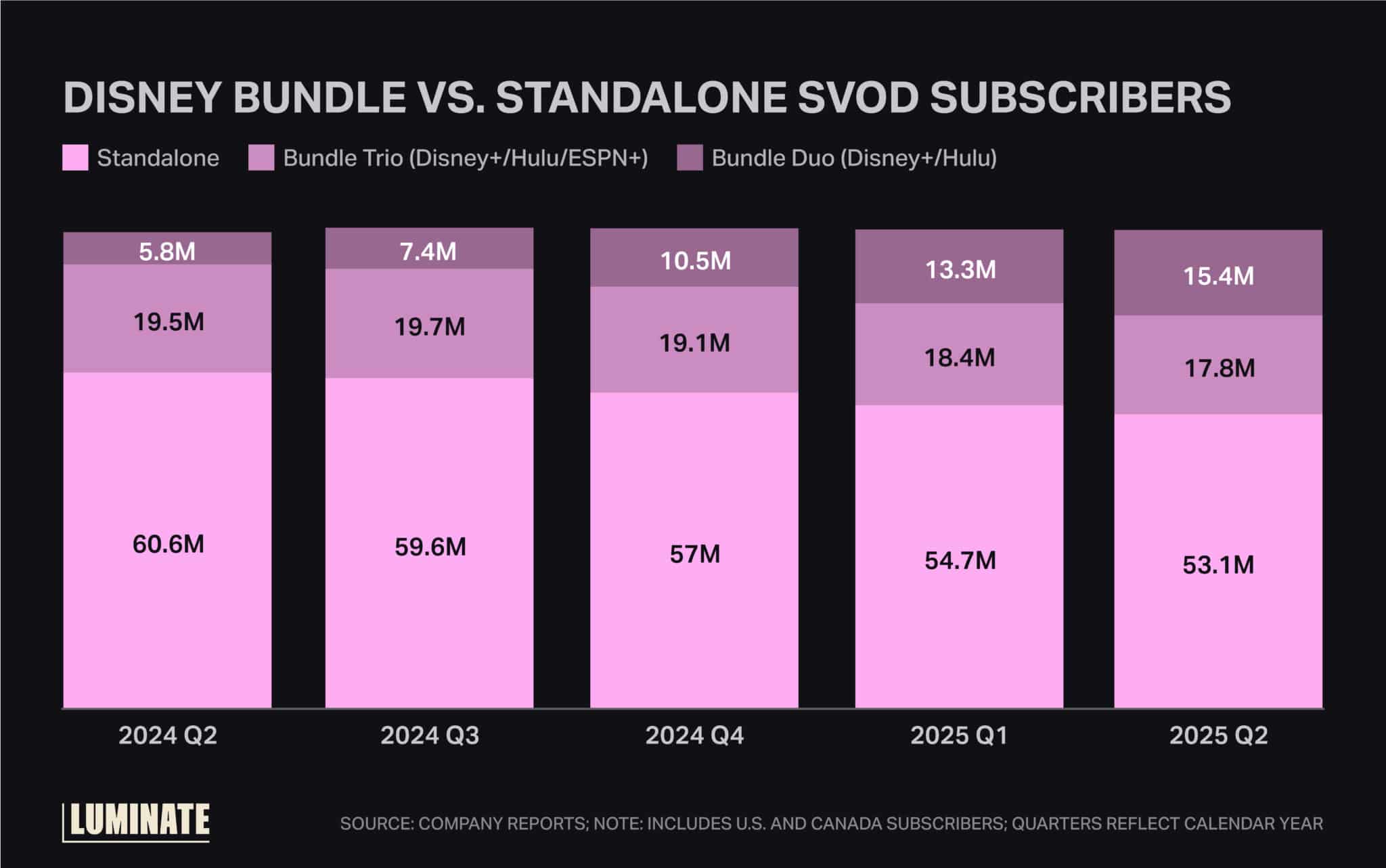

The theory, largely supported by available data, is that bundle subscribers tend to be higher-quality customers, with greater retention and engagement given the perceived value of the package deal.

This is why I’ve argued that Disney will have to keep the Hulu brand alive for the foreseeable future, even as the standalone app is shut down: It’s essential to the Disney Bundle’s value proposition and to Disney+’s future as a would-be super-app.

The proof of that is in the pudding: Since Disney began integrating Hulu content into the Disney+ app for bundle users, subscriptions for the “Bundle Duo” package have soared, growing from 5.8 million to 15.4 million in a one-year span.

Despite this, however, only about 40% of Disney’s UCAN streaming subscribers were bundle customers as of Q2, meaning the packages still have a great deal of room to grow in the domestic market. And the price hikes are key to achieving this: The higher the costs of Disney+ and Hulu on their own, the more appealing getting both for just $1 more will seem.

There’s undoubtedly a price ceiling on the services even as a pair, but pushing the bundle as a premium, high-value product — with access to some or all of ESPN as additional options — is Disney’s best bet for building a platform that can truly rival Netflix. And as long as its rivals continue raising their prices, the Mouse will be justified in positioning its offering as one of the best value deals on the market.