If consumers have benefited from the rise of streaming TV, they’ve also suffered from at least one irritating side effect: ever-lengthening breaks between seasons of their favorite shows.

Just look at some of this year’s marquee streaming releases: Severance returned three years after its freshman season; Peacock’s Poker Face took just over two years and Wednesday almost three.

Stranger Things will return to close out its run nearly three and a half years since its last entries dropped, and while Squid Game rolled out two mini seasons just six months apart, December’s S2 drop likewise came more than three years after the Korean series’ blockbuster first season.

The writer and actor strikes that roiled Hollywood in 2023 no doubt played a role in most of these gaps, but it’s clear that the space between seasons for major series is much, much longer than it used to be. (Recall that HBO’s Game of Thrones consistently turned out a new season every year for most of its run.)

Indeed, streaming companies may be eager to leverage the old cliché, “Absence makes the heart grow fonder.” In the best-case scenario for these titles, the long-delayed new episodes not only perform well but elevate the previous season’s viewership as new audiences catch up and fans refresh their memories of what came before.

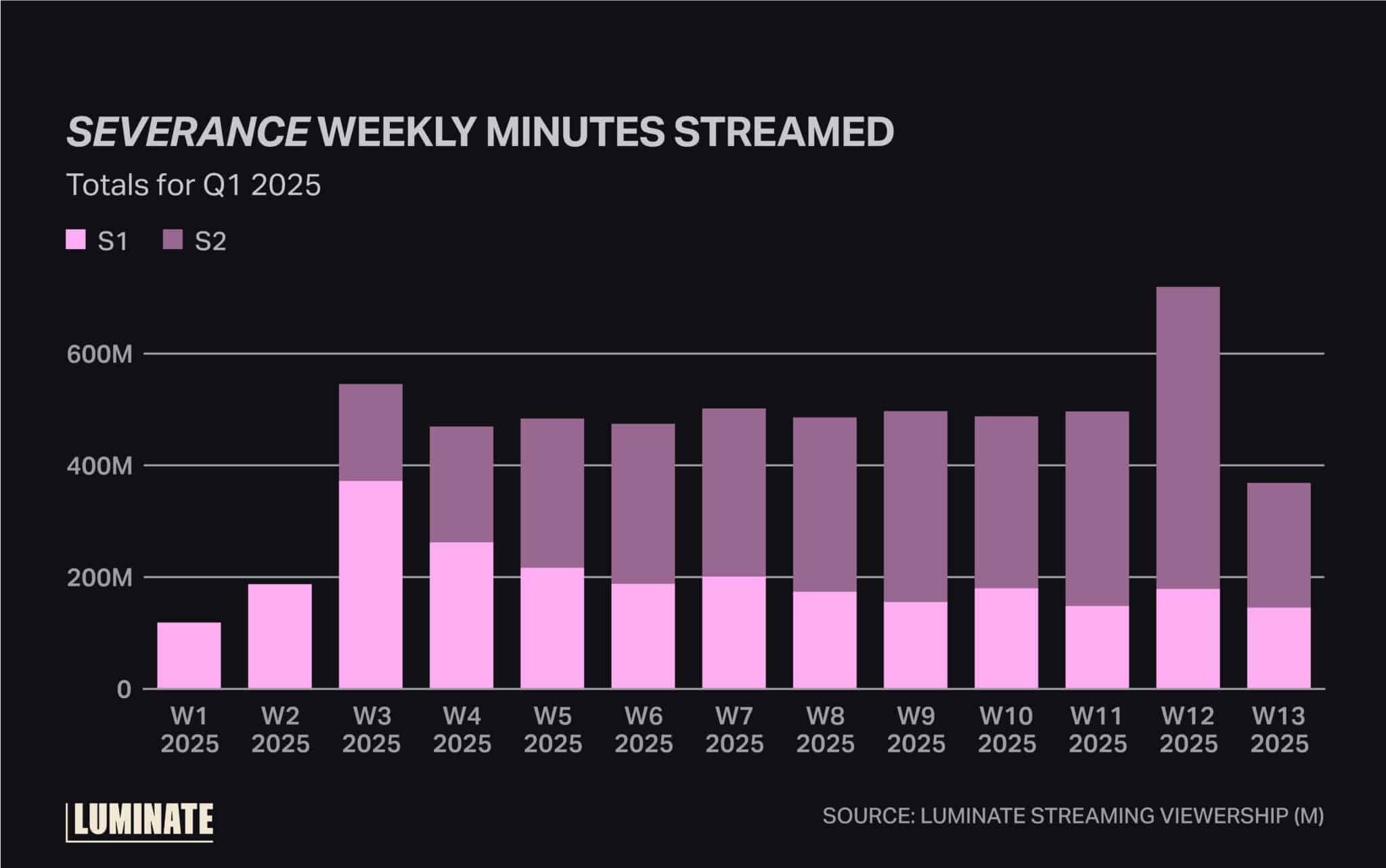

Severance is the prime example of this, with S2’s halo effect keeping S1 among the 25 most streamed original TV seasons throughout the first quarter of the year, according to Luminate Streaming Viewership (M). In fact, the show’s freshman season was streamed more in the first six weeks of 2025 than in its first 12 weeks of release back in 2022.

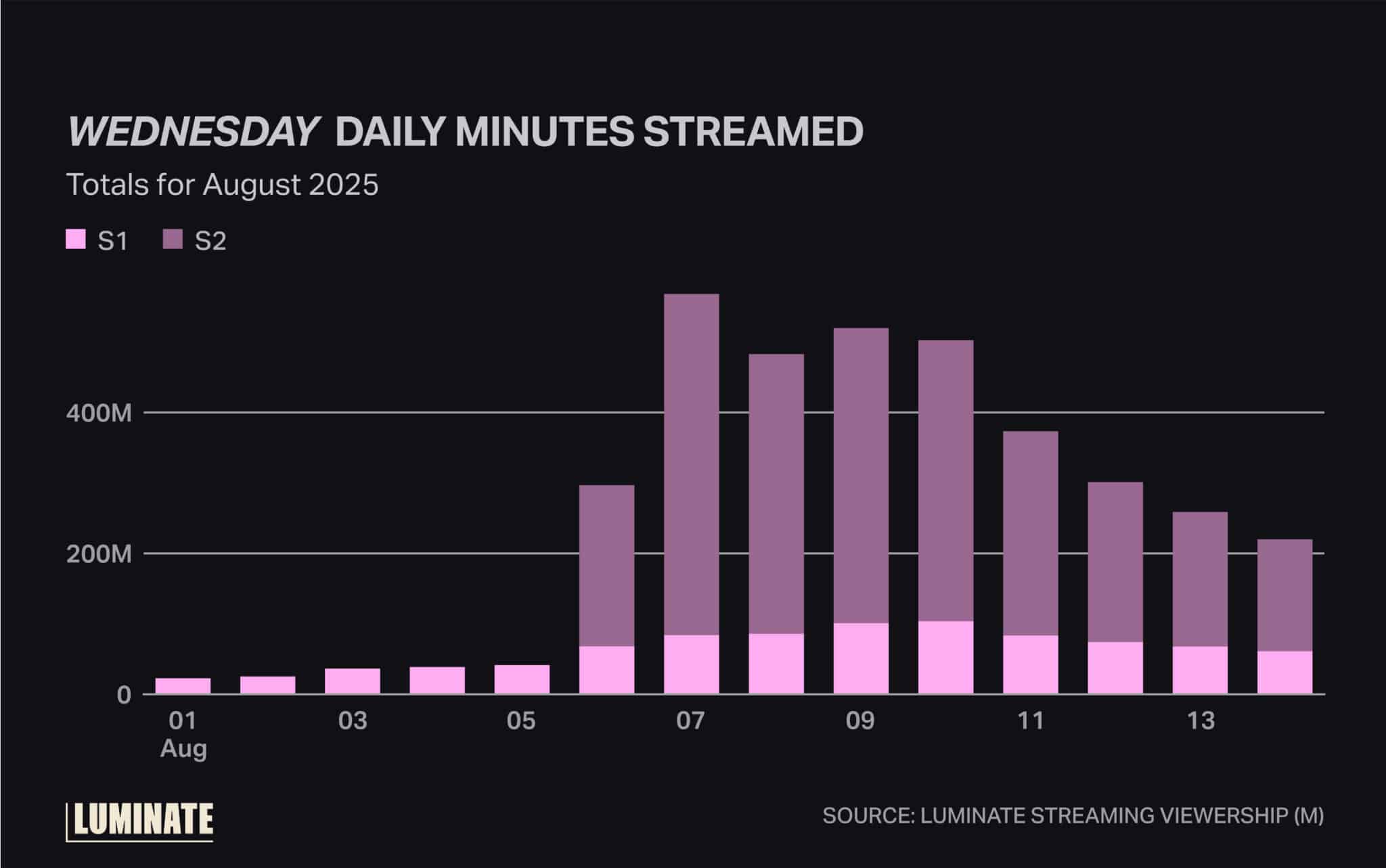

It also seems the long wait for more Wednesday helped elevate the already smash-hit title even further. Just two days of availability (and only four episodes) were enough to propel the Netflix series’ new half-season to No. 4 on the chart for the week of Aug. 1-7; meanwhile, S1 rose again to reach the top 10 for both that week and the next.

Intriguingly, there’s a flip side to this phenomenon: While the long wait appears to benefit some shows, a quick turnaround on seasons can seemingly hurt other titles.

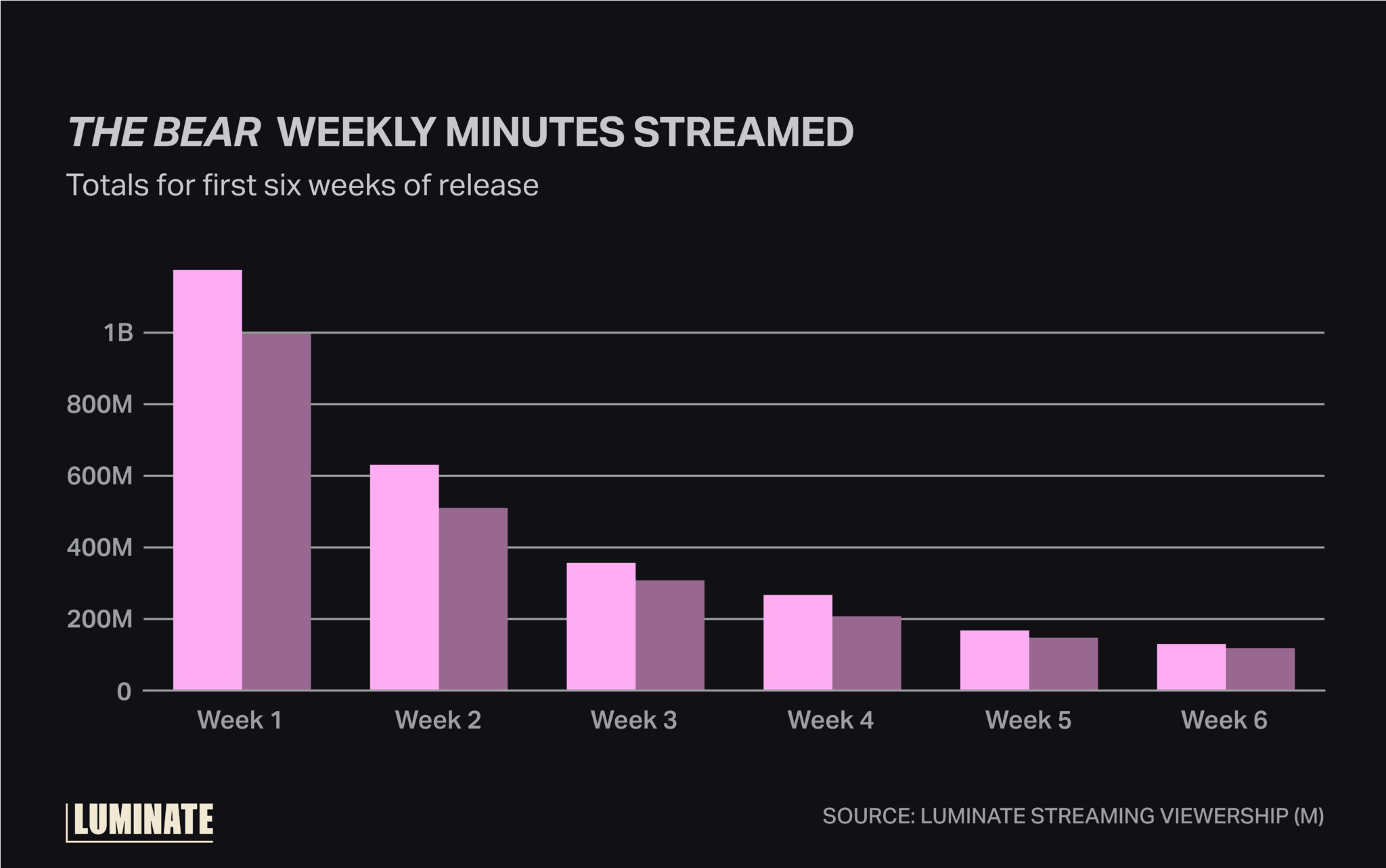

Take Hulu’s The Bear, which has rolled out a new season like clockwork every June since its 2022 premiere. At first, this strategy worked well, with viewership for the first three seasons building each year.

But season 4, which dropped this June, saw an abrupt and significant downturn. After six full weeks of release, the new season had recorded 17% fewer minutes streamed and 20% fewer estimated views than S3 did in its first six weeks.

There are complicating factors here, of course, such as a notably more muted reception for S3, which could have affected S4 viewership. (Though obviously an imperfect metric, it’s worth noting S3 has a 53% positive audience rating on Rotten Tomatoes, a stark contrast to the first two seasons’ 92%.)

But The Bear isn’t the only streaming series to see its fortunes decline amid a relatively swift barrage of new entries. For instance, oversaturation seems to have hurt Netflix phenomenon Love Is Blind over time, while another Big Red N series, Virgin River, has recorded a dropoff in viewership annually since 2022.

Estimated views in Virgin River seasons’ first 12 weeks of release fell from 19.4 million for S4 (released in July 2022) to 15.6M for S5 (September 2023) to 14.3M for S6 (December 2024). Compare this with the success of a similarly female-skewing Netflix series, Ginny & Georgia, which took, yep, a two-and-a-half-year break between seasons.

So, should streaming original series space out their seasons as much as possible to build audiences over time? Well, it’s not so simple.

After all, Squid Game S2 didn’t come close to matching the first season’s mammoth numbers (192.6M global views vs. 265M in their first 90 days, according to Netflix data). And Poker Face recorded a sophomore slump despite its two-year break, with Peacock’s “howcatchem” seeing its 12-week minutes streamed and estimated views both fall 37% from S1 to S2.

As with so much in the complex world of streaming, there is no one-size-fits-all strategy for success. But for the right titles, it seems absence can indeed make fans grow fonder — or at least more eager to binge.