If traditional media companies can’t save the cable bundle, perhaps they can re-create it in the aggregate.

That seems to be the intention behind the new Fox One service, which launched Aug. 21 and brings Fox Corp.’s portfolio of linear TV channels to subscription streaming for the first time. Despite its $20 monthly price point, Fox One is so far being positioned less as a compelling product in and of itself and more as a compelling addition to the existing streaming landscape.

The Fox service is already slated to bundle with ESPN’s new direct-to-consumer platform in a package launching Oct. 2, with a 20% discount on the cost of both subscriptions ($40 for the bundle vs. $50 separately). But reports indicate this is just the beginning for Fox’s streaming bundle ambitions.

The company’s DTC chief, Pete Distad, recently told the Los Angeles Times that Fox “will look at more opportunities to bundle Fox One with other streaming services”; meanwhile, The Desk cited “a high-level source at Fox” expressing the company’s interest in bundling with essentially every legacy media streamer on the market.

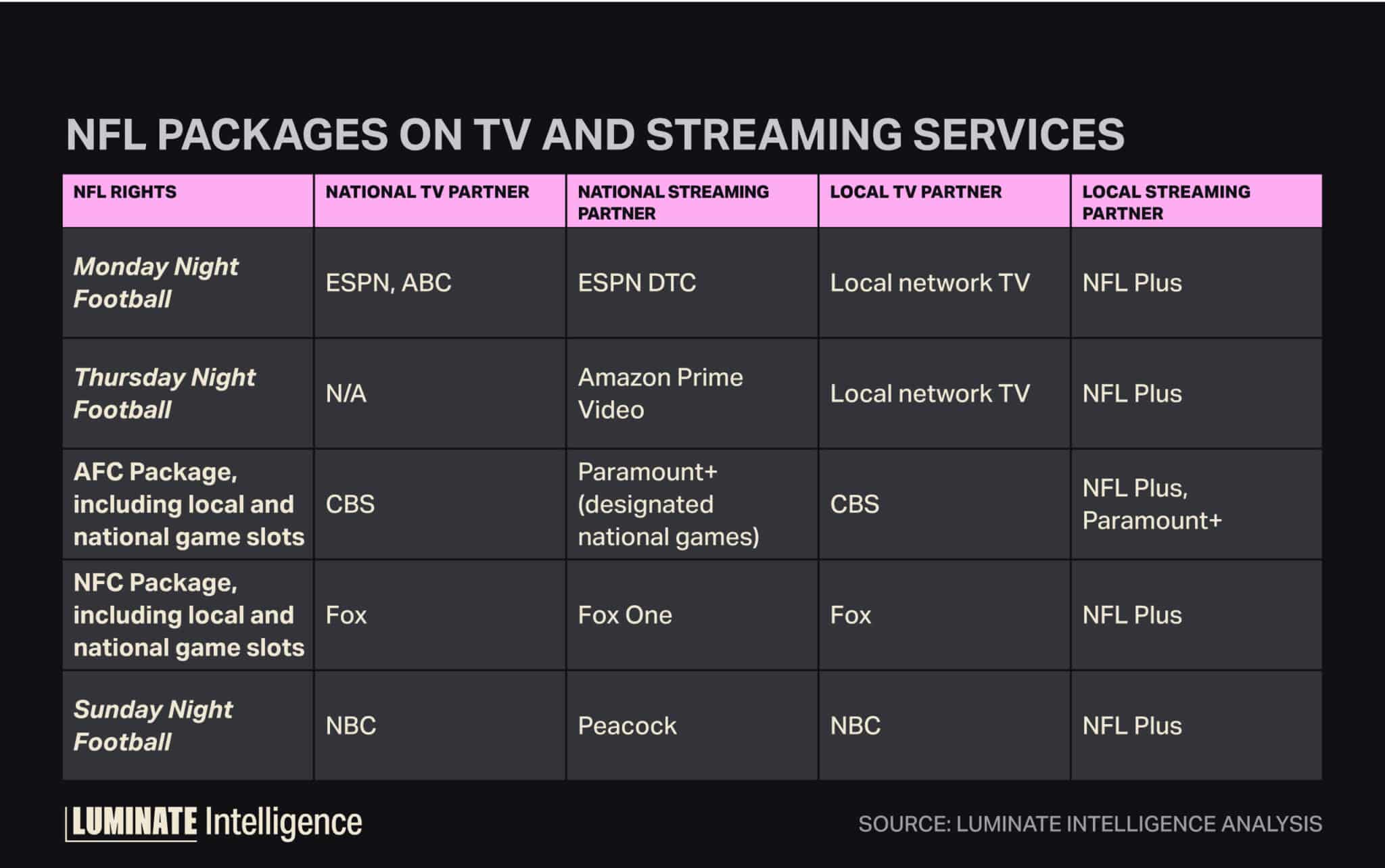

It makes sense: Fox One is most logical as a product when it is seen as a complement to platforms such as Peacock, Paramount+ and ESPN — or, to put it more bluntly, as the service that finally makes all NFL coverage available without a traditional pay-TV subscription.

It’s no secret that sports content is the driving force behind Fox One; the ESPN bundle indicates that much (though it will be interesting to see how many subscribers are lured by the presence of Fox News). It’s also fair to say that Fox, while possessing a respectable lineup of sports rights — expect the SVOD to see a surge of sign-ups around the FIFA World Cup next year — is not the most formidable player on its own.

It would therefore be a natural step for the company to explore packages with, say, its fellow Sunday afternoon NFL game broadcaster (CBS/Paramount+) or the home of Sunday Night Football (NBC/Peacock). Joining forces with as many sports rights holders — and especially as many NFL broadcasters — as possible is Fox One’s best bet for capturing consumer attention.

This would seem to indicate the media landscape is moving one step closer to the long-predicted “rebundling,” or the full re-creation of the cable bundle through OTT streaming. But it’s actually something a bit more nuanced: the ongoing shift of the linear TV model into the streaming space.

There is, after all, still no cable-esque way for consumers to pay one price for a package of all major streaming video content. But Fox One and ESPN (the SVOD) represent a new mode of subscription streamer, a higher-tier service aimed at selling linear content to cord-cutters. Both of these services are attempting to justify premium price points ($20 and $30 per month, respectively) by offering live content previously confined to cable outside of a cumbersome pay-TV package.

These price points are, for now, carefully calibrated so as not to cannibalize cable subscribers. But ESPN and Fox will make more money per SVOD subscriber than they do per cable customer; ESPN’s $30 price point is reportedly exactly double the $15-per-subscriber carriage fee it receives for all of its channels.

Meanwhile, the linear audience is continuing to erode, and pay-TV providers are beginning to offer “skinny bundles” that allow subscribers to ditch sports channels such as ESPN for a lower price — yet another blow to the network’s longstanding business model.

As such, the ESPN SVOD is explicitly designed to move the network toward a post-cable future. While revenues from the streamer may never match the monies generated by the cable business model at its peak, the DTC service is a necessary move to maximize profits in a shrinking media landscape.

As for Fox, its place in that post-cable future is far more uncertain — hence the bundling strategy. The beauty of the pay-TV bundle, of course, was in forcing consumers to pay for everything whether they wanted it or not, a model the à la carte streaming era has upended. But if Fox One can’t be effective as a main course on its own, its leadership is betting that it might be enticing on a plate with something else.