US chart reporting Week 39 closed on Thursday, September 29, 2023, and with it, three quarters of the year are now in the books. As we hit the home stretch of 2023 (with the busy holiday season remaining) let’s take a look at where we stand in terms of music streaming through three-quarters of the year.

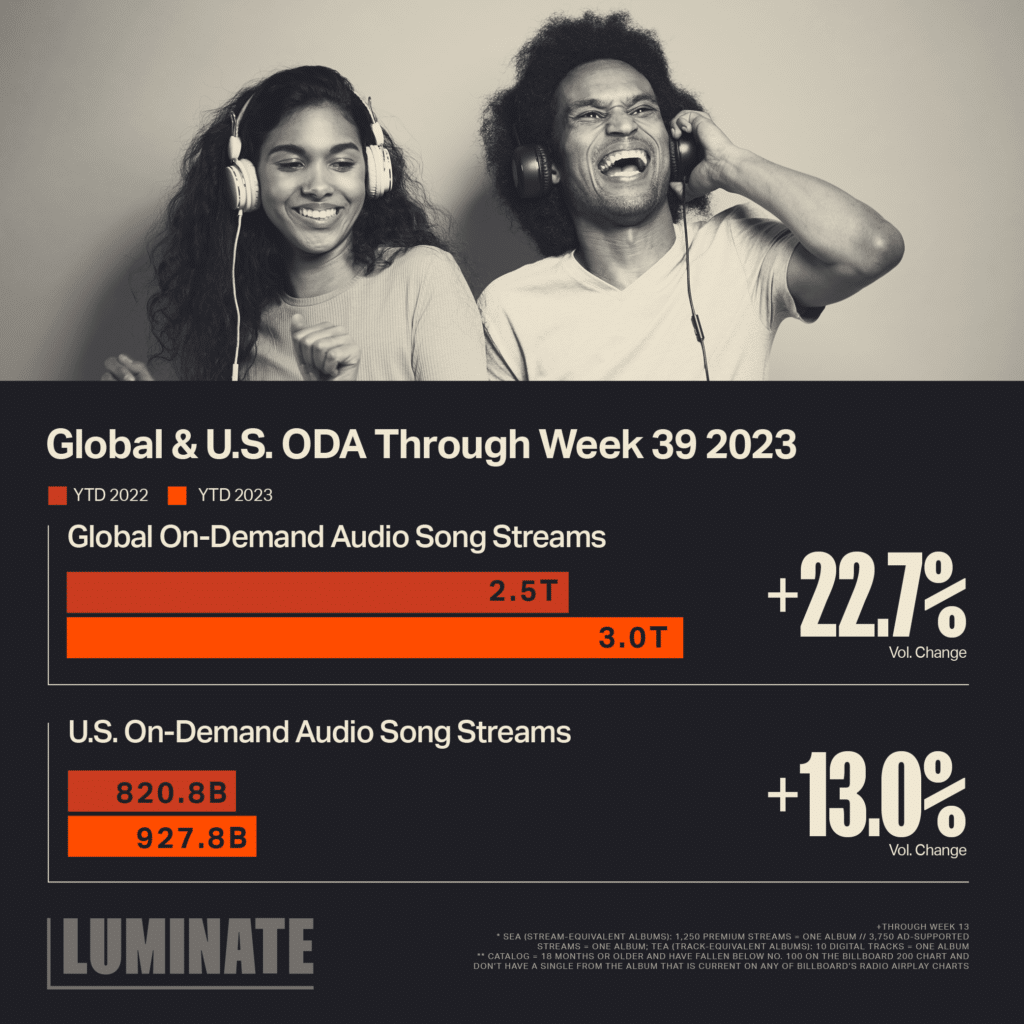

Global and US On-Demand Audio Streaming

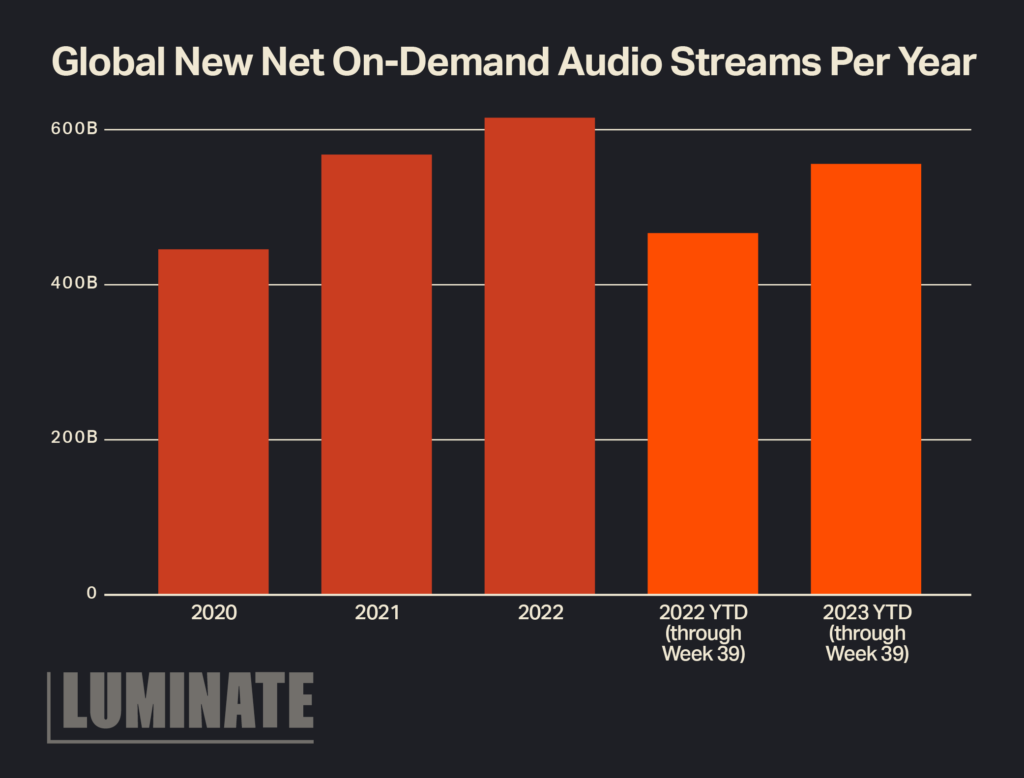

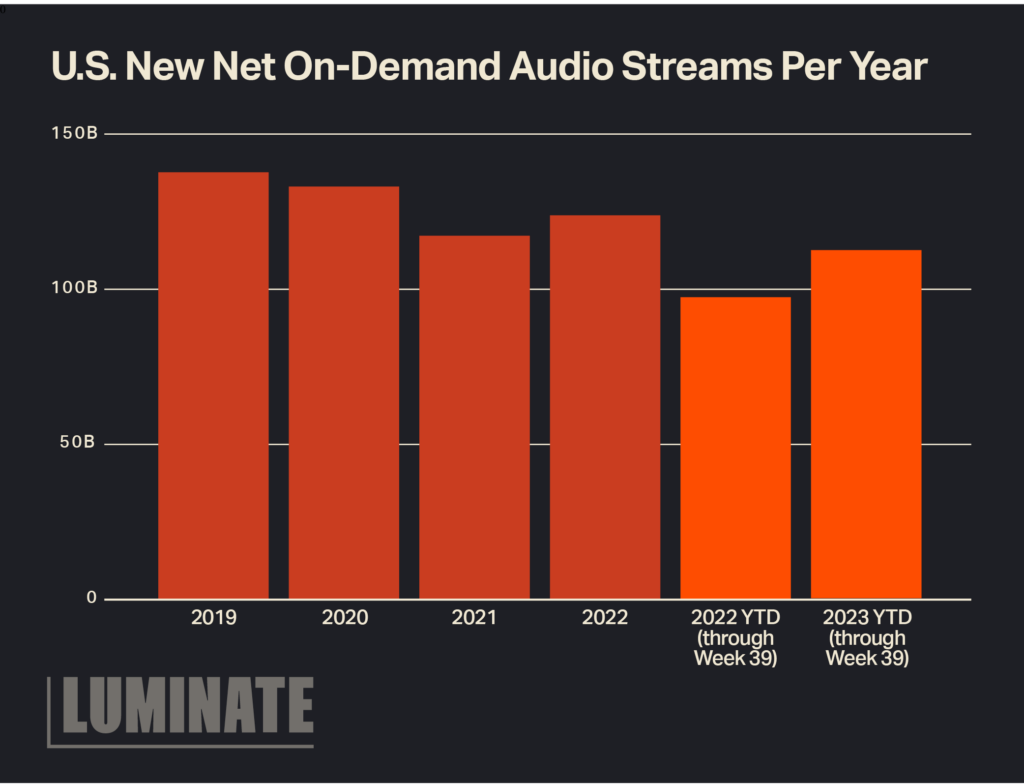

- Global On-Demand Audio (ODA) Streams are +559.4B over where they sat YTD through Q3 2022 as worldwide ODA streaming continues to accelerate. Note that we use the term “acceleration” here as the year-over-year volume growth is larger than it was at the end of third quarter 2023 compared to this time last year. The chart below shows the new net streams gained per year and acceleration occurs when there are more new streams than the year prior.

- Factors to Consider: It has been widely reported that technology adoption such as smartphone usage serves as a catalyst for music streaming and these evolving consumer behaviors – as well as the rise of emerging markets – are pushing the growth.

- US ODA continues overall acceleration as well as the market is currently +107.1B ahead of where it sat through the end of Q3 2022. This represents 13% growth and acceleration is again seen in the chart below where net new streams first accelerated in 2022 and 2023 is ahead of last year at this time as well.

- Something to keep an eye on: Both Global and US YOY ODA growth is down slightly from the pace seen through the first half of 2023. In our Midyear Music Report we reported Global 1H 2023 YOY growth at 22.9% and the US growth at 1H 2023 +13.5%. This is now 22.7% and 13%, respectively. Keep in mind that growth is still accelerating after last year, it’s just that we’ve seen a slight slowing from the pace through the first half of the year.

Consumer Research and Behavior

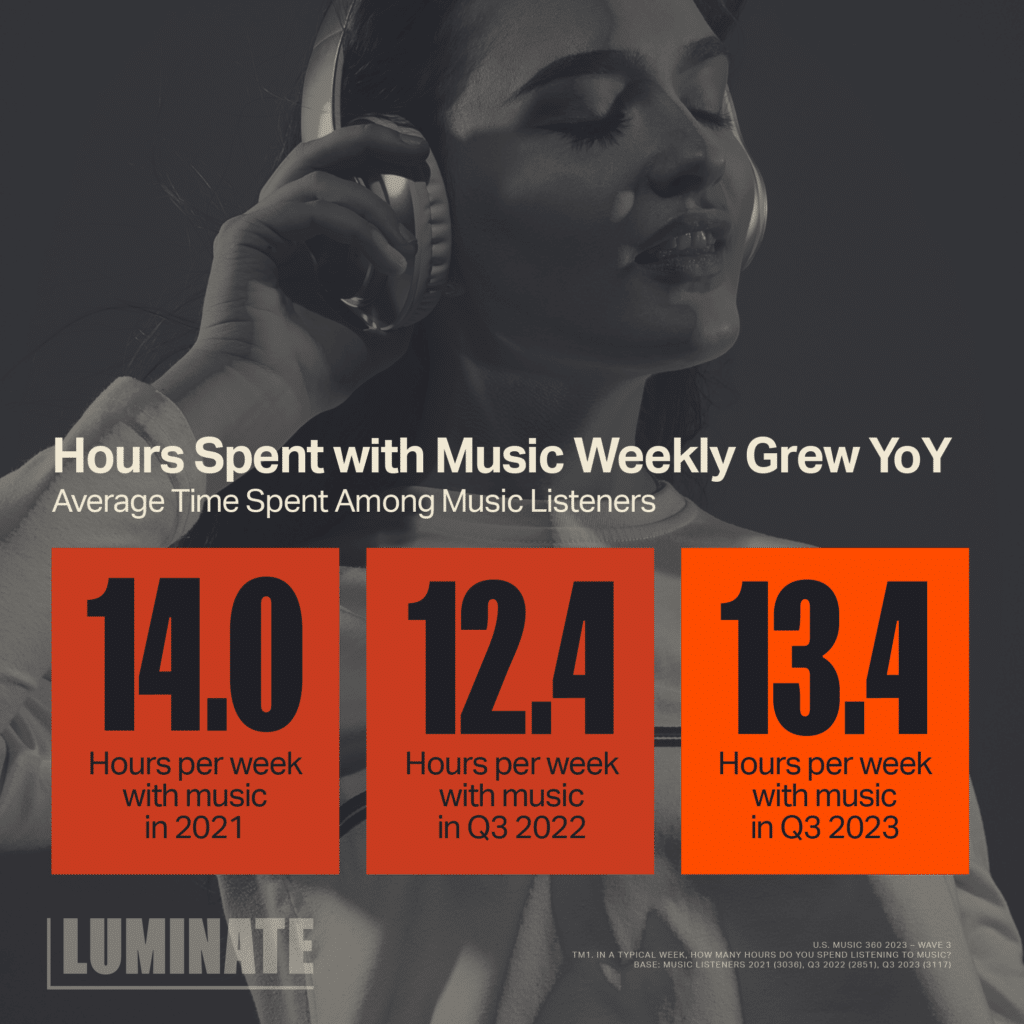

Along with the streaming acceleration we are seeing consumers report spending more time listening to music per week in Q3 2023 than they did in Q3 2022. In Luminate Insights’ most recent US Music 360 report published earlier this month, US Music Listeners report spending 13.4 hours per week with music in Q3 2023. This is up a full hour from the 12.4 hours per week they reported in Q3 2022 (but still down slightly from what was reported mid-pandemic). Overall, Gen Z leads all generations with 16.8 hours weekly, which is 25% more time with music than the average US listener.

Note: Melon added to Global-level reporting Week 23 2023. Melon does not report in US.

Please note, there was an error in our reporting of 2022 On-Demand Audio streams through week 39 in this week’s Tuesday Takeaway, published 10/17/23. The correct number is 820.8B ODA streams for 2022 through Week 39. With that correction in mind, the +13% increase we reported is still correct. We apologize for any confusion, as the Luminate team is dedicated to reporting accurate data.