Disney announced last week that Hulu will be “fully integrated” into the Disney+ app in 2026, folding the storied streamer into the Disney Bundle. But does the demise of the Hulu app mean the beginning of the end for Hulu as a brand? Luminate Intelligence chief media analyst Andrew Wallenstein thinks so; media analyst Tyler Aquilina isn’t so sure. Here, the two debate what comes next for Hulu as it reaches the end of an era.

TYLER AQUILINA: Streaming consolidation has officially claimed its first major victim. The Hulu app will shut down next year, marking an ignoble conclusion for one of the first over-the-top video services to come to market.

It’s crucial to note, however, that this is not (yet) the end of the Hulu brand; in fact, it’s a new beginning of sorts. Not only will a standalone subscription remain available for those who want it, but the Hulu label — which has only ever existed in the U.S. market — will “become a global general entertainment brand,” per a Disney press release, replacing the “Star” branding used to categorize adult-oriented content on Disney+ abroad. So my question is this: Why would Disney be taking Hulu worldwide if the intention is to deprecate the brand in a year or two?

ANDREW WALLENSTEIN: I don’t think replacing Star with Hulu tells us anything about any future confidence in Hulu as a brand — maybe more a lack of confidence in Star. In any case, I firmly believe the shifts involving Hulu that were just announced are savvy stopgap measures, easing away from Hulu rather than marking the more dramatic cessation of the brand. That’s got to be Disney’s real endgame, but it can’t pull the plug on Hulu outright because that would trigger bad headlines the market would misunderstand as a sign of failure and probably confuse consumers, resulting in the kind of publicity nightmare created by HBO Max’s brand nonsense.

T.A.: I don’t necessarily disagree that Hulu may not be around in, say, a decade, but there’s plenty of reason for Disney to have confidence in the brand. Hulu had 55.5 million subscribers at the end of Q2, only 10% less than the UCAN Disney+ subscriber base (57.8 million). Some of those are duplicative, but that’s another key point: Hulu is a crucial component of the Disney Bundle, one from which Disney can milk additional dollars.

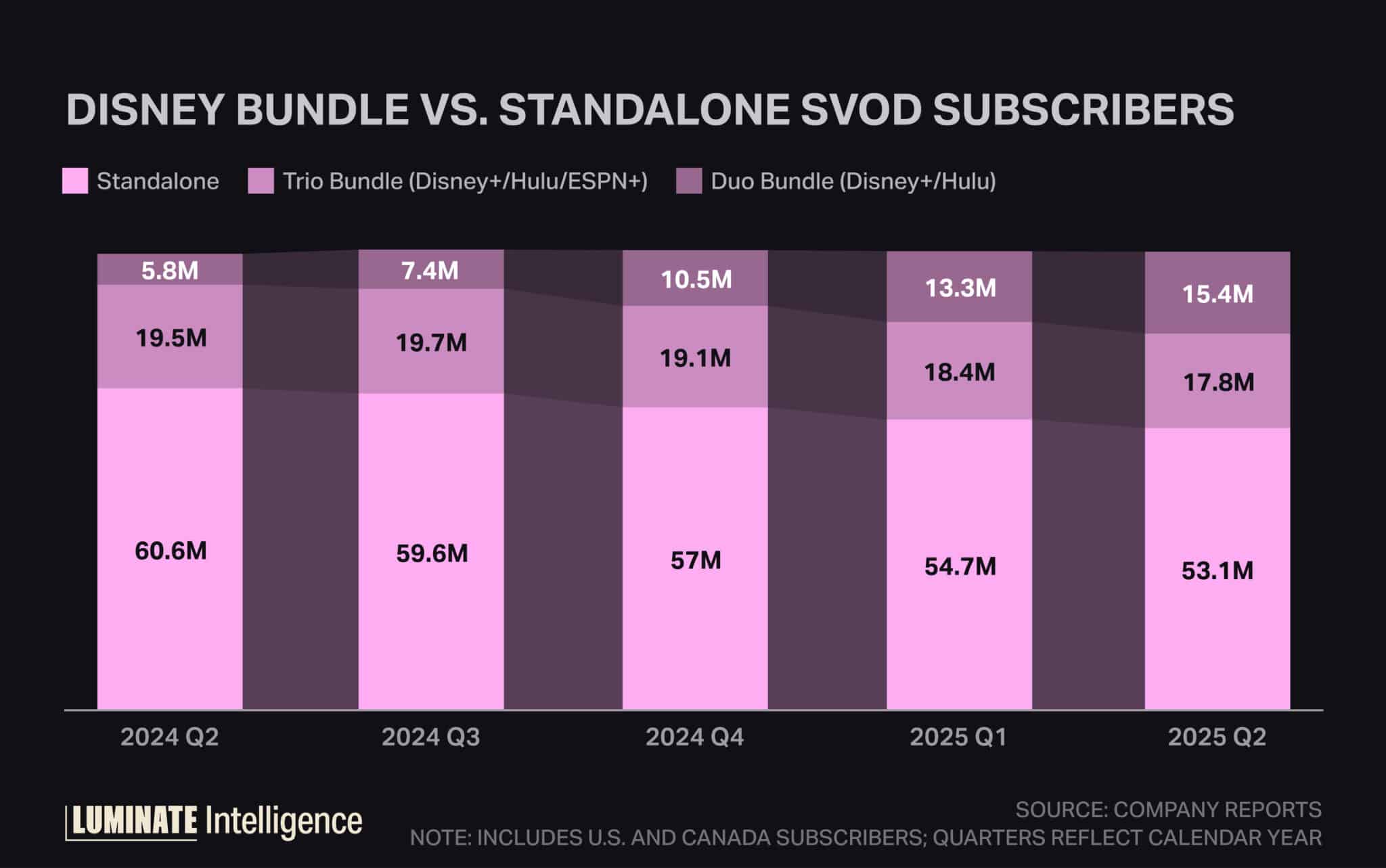

Out of Disney’s more than 86 million total streaming subs in UCAN, 33 million — nearly 40% — are bundle customers. And nearly half of those (15.4 million) subscribe to the “Duo Bundle” of just Disney+ and Hulu. That’s up more than 150% from a year ago, a sign that Hulu-branded content made for a valuable addition to Disney+.

A.W.: I’d be surprised if Hulu is around by 2027. Which isn’t to say it hasn’t done well enough, as the data you cite indicates, both on its own and as part of the bundle. But that demonstrates short-term value. Hulu is a booster rocket that will fall away much sooner than you think now that it’s completing the job of thrusting Disney+ into an orbit where it can better compete with Netflix. That means consolidating efforts, taking advantage of cost-saving synergies and, most important, not bifurcating the marketing. Consider that we already have the conjoined brand known as FX on Hulu. What are we going to call it now, “FX on Hulu on Disney+”?

T.A.: Far from bifurcating the marketing, I think this consolidation will actually center Disney’s streaming strategy around one core product: Disney+ as the streaming “super app.” Note that when the new ESPN direct-to-consumer product launches later this month, Trio Bundle subscribers “will be able to watch ESPN content within Disney+ seamlessly alongside Disney and Hulu entertainment and family programming,” according to another press release. Mouse House CEO Bob Iger clearly wants Disney+ to become the streaming destination for the company’s content.

You could take this as another omen of doom for Hulu, but I think it will be key to the super-app strategy to ensure subscribers of the bundle — which will cost, at a bare minimum, $17 per month, $36 if you want to stream all ESPN content — feel they’re getting as much value as possible.

In addition to a helpful label for adult content on family-friendly Disney+, the Hulu brand is an essential component of the Disney Bundle’s value proposition, and that’s more than a short-term benefit. It would be tough to convince consumers that they wouldn’t be losing something if Hulu went away and they found themselves paying the same “bundle” price for just one service, even if that service had vastly more content.

A.W.: I agree the super app is the goal, but to accomplish that most effectively means minimizing the brand-juggling act. The distinction between family-friendly Disney and the more adult Hulu has been blurry to begin with and fairly meaningless to most consumers. That said, let me be clear that I’m not suggesting Disney will eventually retire the ESPN brand, too; that’s an example of exactly the kind of truly differentiated offering Hulu never was — one too resonant with sports fans to ever retire.

I just can’t accept the notion that Hulu would stand shoulder to shoulder with real brands such as ESPN, Marvel and Star Wars under the Disney+ umbrella, which is why its time is almost up. Sad, really, when you consider the rather tortured history Hulu has had going back to its pre-Disney days. I can only wonder what its founding CEO, Jason Kilar, must be thinking seeing yet another disruption to a brand that was meant to be so much more.