Perhaps one of the unlikeliest success stories to come out of Hollywood in recent years was the surprise hit Terrifier 3, a horror film that cost just $2 million to make yet topped the box office in October 2024 with $19 million in its opening weekend.

But now Cineverse, the company behind Terrifier 3, is attempting something even scarier than that movie’s killer-clown protagonist: outrunning the ghost of Quibi. Jeffrey Katzenberg’s ill-fated short-form video venture apparently wasn’t enough to dissuade its producers from teaming up with Banyan Ventures to launch MicroCo, the first U.S.-based entry in the microdrama market that has been booming worldwide in recent years.

Somewhat similar to Quibi’s stock in trade, microdramas are a form of cheaply produced scripted narratives contained to episodes as short as a minute yet so addictive when done right that viewers not only binge them but pay for the right to access rapidly growing apps such as DramaBox and ReelShort to get more.

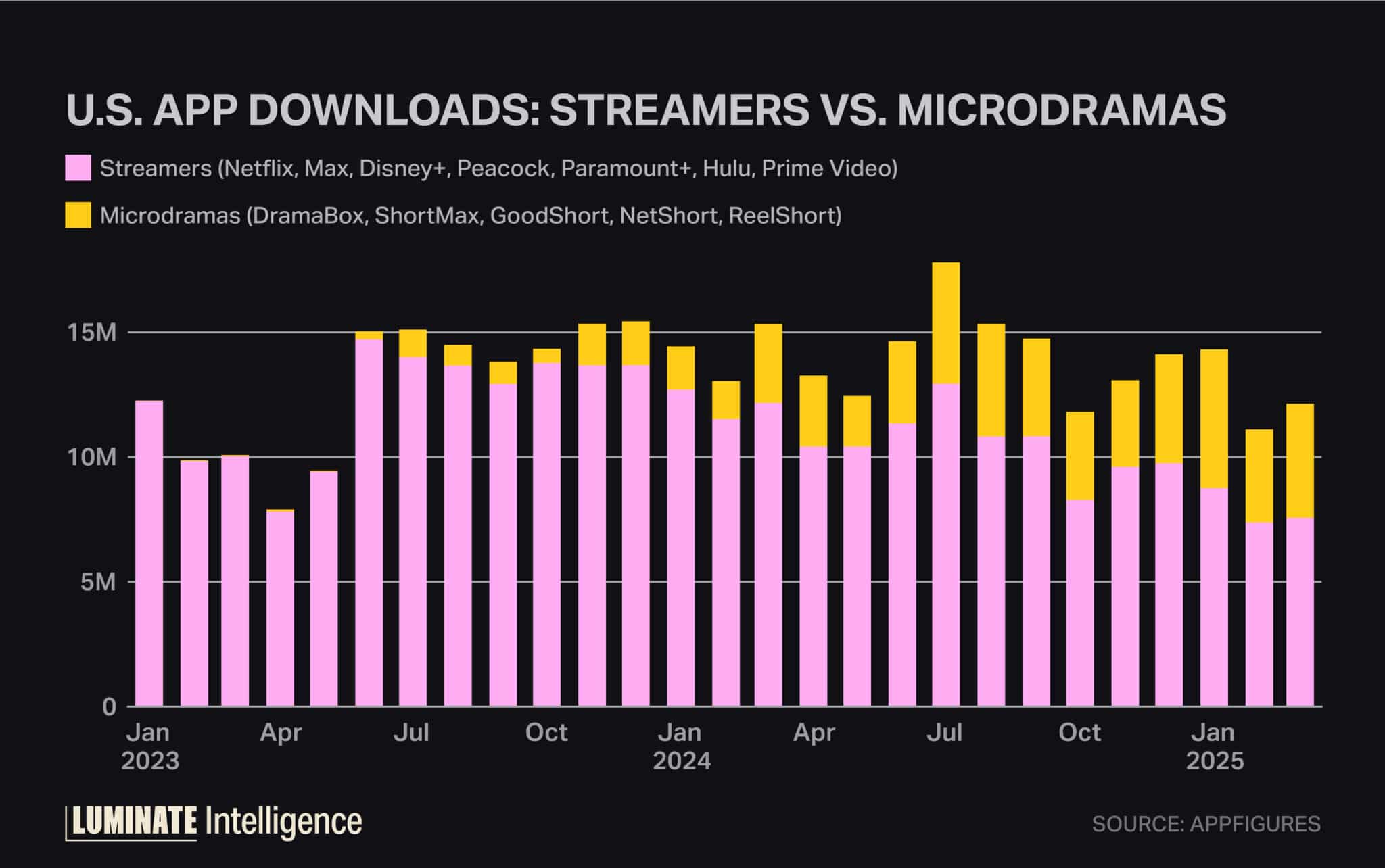

China is where the microdrama format first flourished, but it’s taking root many other places on the planet, including the U.S., where app downloads in the first quarter of 2025 were in striking distance to those of long-form SVOD market entrants, according to Appfigures.

MicroCo will bring together a quartet of experienced Hollywood hands in Lloyd Braun, Jana Winograde, Susan Rovner and Cineverse CEO Chris McGurk to see if they can import the magic of this format stateside.

To their credit, they seem to be saying just about all the right things to dissuade skeptics that they are on the fast train to Quibi 2.0: no drunken-sailor spending on programming, Katzenberg’s cardinal sin; and access to the same promotional network Cineverse used to vault Terrifier 3 out of obscurity. And of course AI is cited as a key ingredient in MicroCo’s go-to-market formula, so, you know, it’s a can’t-miss.

But there’s still one easy-to-overlook potential problem that factored into Quibi’s demise that MicroCo will have to address. Advertising isn’t the only revenue stream that will power this foray because users will presumably pay to use the app. That’s how existing microdrama players work: They sprinkle some samples of their content on leading social video platforms, including TikTok, then try to lure viewers back to a separate branded app to fork over a small fee that allows them to see how the story they got hooked on pans out.

What Quibi didn’t seem to understand was it couldn’t just build up an audience on a freestanding app, let alone one that demanded subscriber dollars, without making its presence felt on social video apps — to fish where the fish are, so to speak.

While MicroCo won’t make that mistake, its business model still seems predicated on users downloading a separate app to get full access to the content. Even if that content is brilliant, demanding such an extra step is a tall order for consumers already juggling the likes of TikTok, Instagram, YouTube and Netflix, to name just a few.

And should MicroCo somehow find success, surely those aforementioned sites could branch out into the microdrama business themselves and ramp up an audience frighteningly fast.

Which is why I don’t believe MicroCo actually has delusions of breaking into this market the way the first wave of Chinese apps have.

Not that there isn’t room for a better, smarter player. But if MicroCo is playing its cards right, the best move would be to sell to one of the social giants that could kill it quickly if it wanted to, offering itself up as something for them to buy rather than have to build.

Otherwise, the existence of MicroCo may not last longer than a microdrama itself.