By signing its landmark $1 billion deal with OpenAI earlier this month, Disney is looking to protect and extract value from its IP rather than risk floods of unmonetized, unrestricted, unauthorized derivatives at the leading AI platforms.

While “edge cases” that violate restrictions will undoubtedly occur, a license allows Disney to define those restrictions and makes them contractually enforceable. “Part of [the reasoning behind the deal] is exercising some licensing control, because once you’re in a license, you can dictate some license restrictions,” said Meeka Bondy, founder and principal of Meeka J. Bondy PLLC, a boutique law firm specializing in media, entertainment and technology. “People are going to do this no matter what, so create a place where it’s being done responsibly.”

Generative image and video services, including OpenAI’s Sora, have been widely used to create and share huge volumes of user-prompted content featuring character IPs. In a post-Sora blog post, OpenAI CEO Sam Altman described this opportunity for rights holders as “interactive fan fiction.”

Early data already suggests that a streaming video service that offers generative content capability would be more compelling to consumers if it enables them to interact with existing franchise IP or characters.

Nearly half (48%) of U.S. adults aware of generative AI would be likely or very likely to try a new AI-enabled platform that allowed them to generate and share content associated with franchise IP and its characters, per a May 2025 survey by FTI Consulting.

Interest was almost unanimous at 90% among a niche cohort of AI video tool users. That cohort has likely grown since OpenAI released the Sora app in September, up from about 9% of U.S. consumers in May.

Meanwhile, over half (58%) of AI-aware SVOD subscribers would be likely or very likely to keep their subscription if it offered AI features that allowed them to interact with characters.

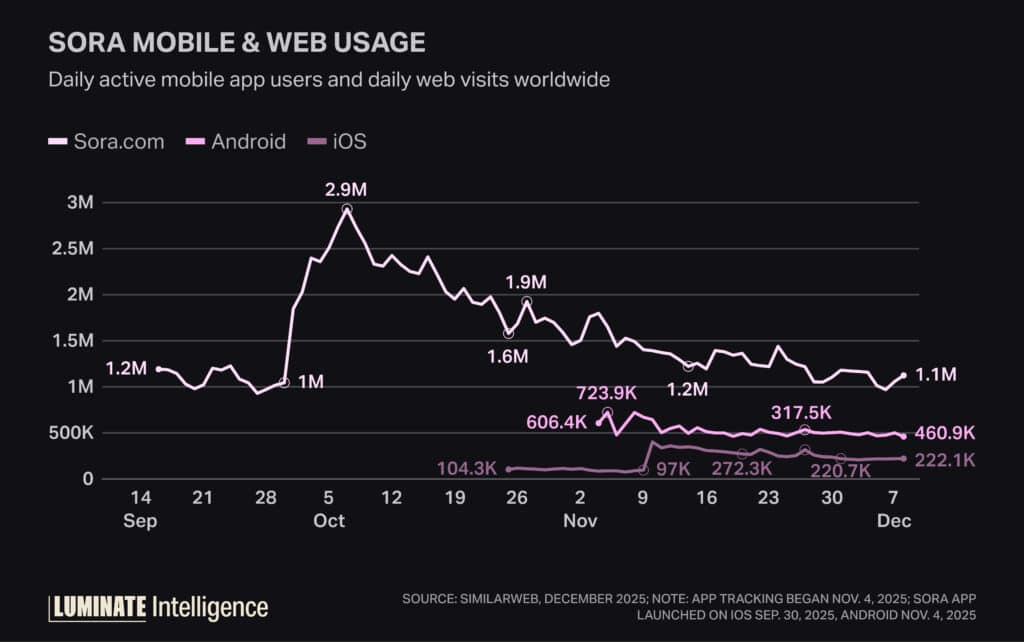

But overall, this amounts to a grand experiment. It’s still unproven if AI user-generated content will become a massive new user behavior, one with actual staying power capable of delivering a major new revenue stream for rights holders. In the weeks since Sora the social video app launched, mobile users and web activity have dropped, according to digital market intelligence company Similarweb.

The further-off but not unimaginable potential for AI UGC — and any IP licensing that might compel users to interact in those spaces — goes beyond discrete images or short-form social video to generated episodes.

“The Disney deal with OpenAI is more focused on memes and short-form video,” said Edward Saatchi, CEO of Amazon-backed Fable Studios, the startup developer behind the interactive streaming platform Showrunner AI, which lets users make their own derivative videos off of show IPs on the platform. “But if you project out a year, this will shift to become about generative episodes and stories.”

He noted that studios have been reluctant because they preferred a “bespoke” studio-branded AI platform offering only their IPs for UGC creation.

Going forward, industry debate will likely examine whether AI UGC is value destructive or dilutive (harmful user behavior, consumer backlash) or accretive (fan engagement, revenue growth) for IP.