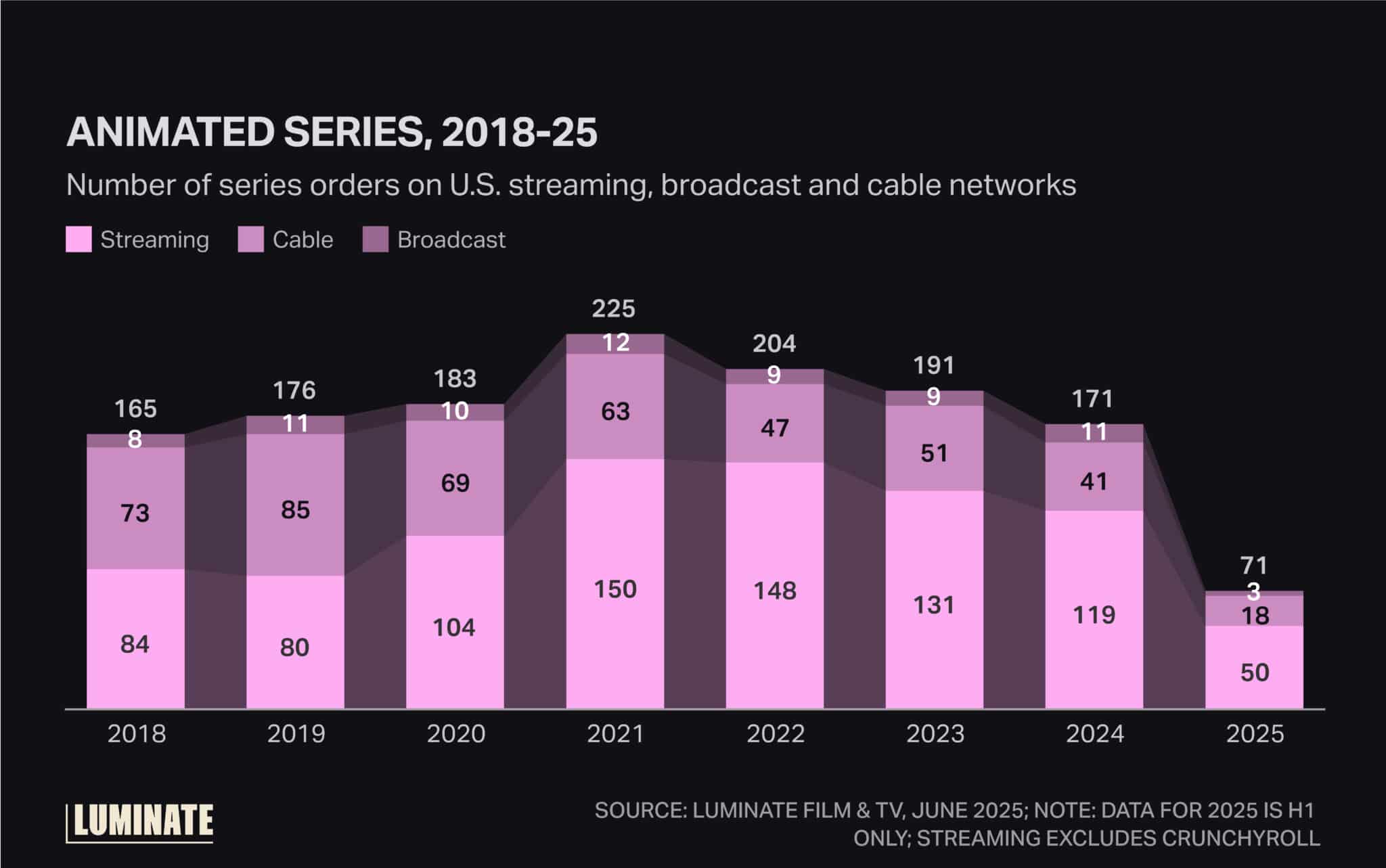

Animated series have endured a boom-and-bust cycle in recent years. Commissions volume for animated shows continued to rise during the pandemic, driven by increases in series orders on streaming, as U.S. media companies rushed to fill streaming services with exclusive content and COVID halted live-action shoots.

But the post-peak TV marketplace hasn’t spared animation from the contraction in U.S. production, as content spending normalizes while streamers pursue profitability. Animated series projects were also delayed by the 2023 writer and actor strikes and January’s L.A. fires.

Total animated series orders have dropped since 2022, affecting streaming as well as broadcast and cable networks. Series orders on cable have been in longer decline, falling progressively year over year since 2019.

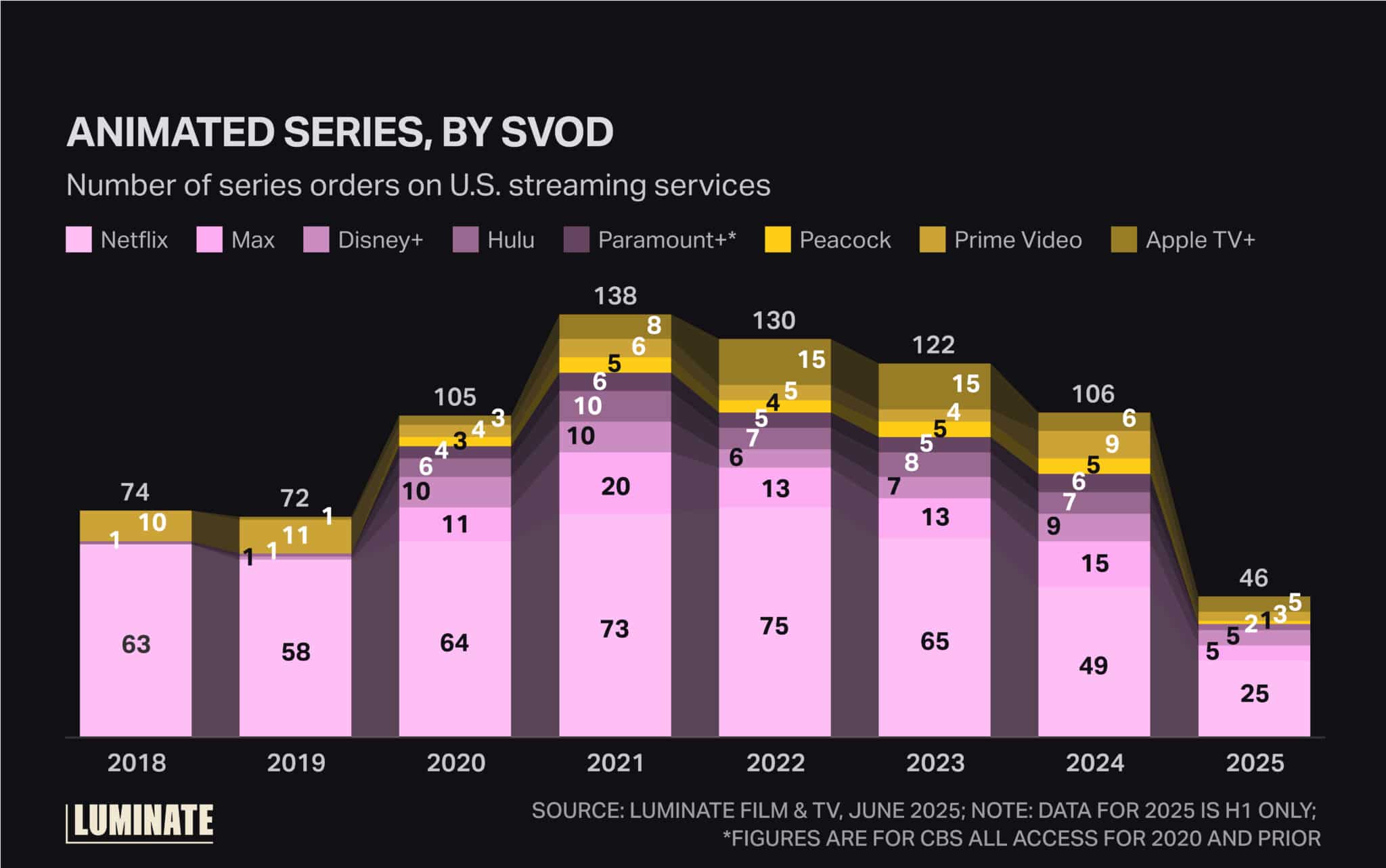

Broken out by SVOD service, the drop in animated series on streaming services is particularly acute for Netflix and Apple TV+. Animated series on the latter have emphasized children’s animation, many adapted from kids’ book IP, though the slate has reduced from 15 in 2022 to five in 2025.

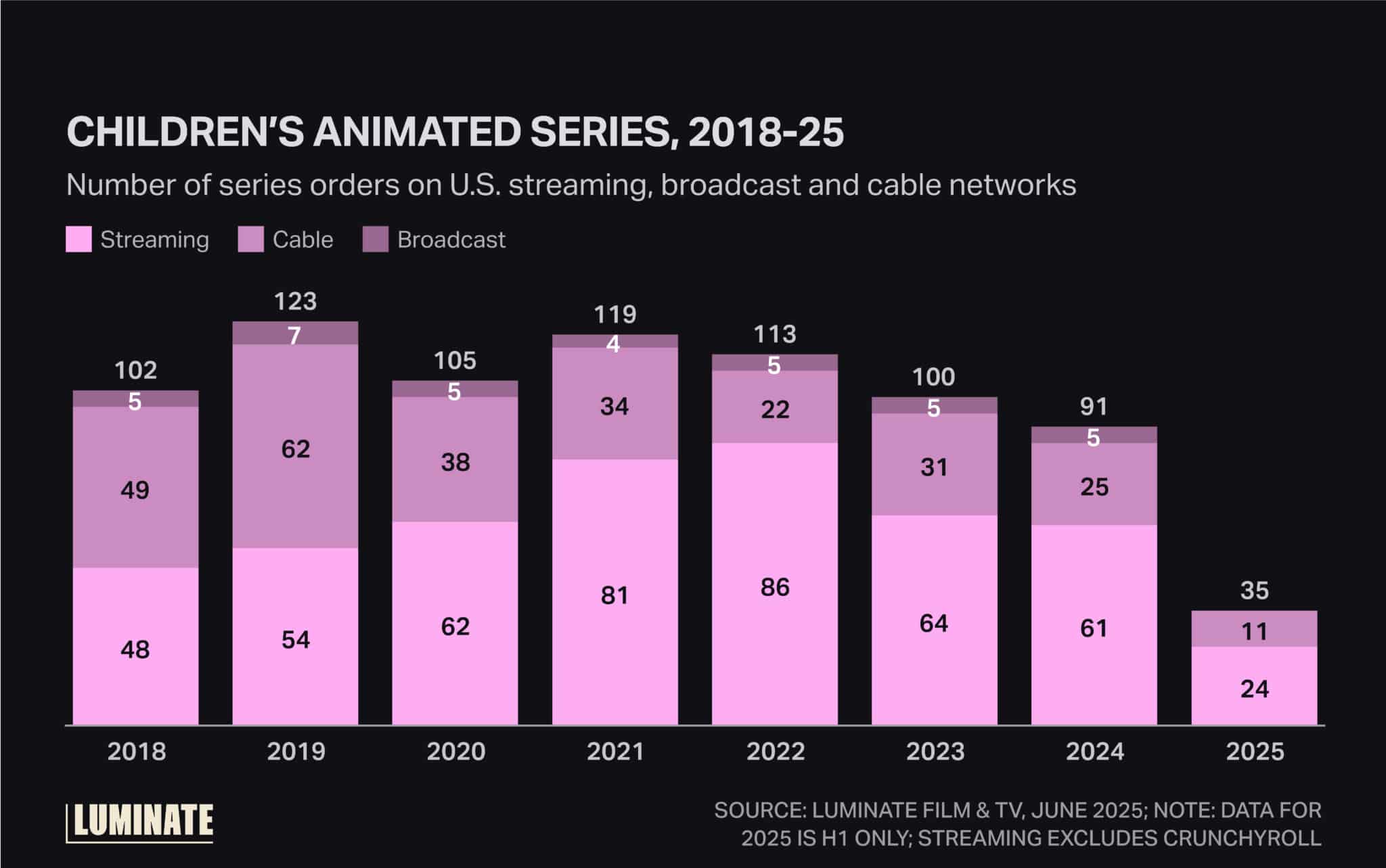

Animated kids series have been especially challenged by shifting viewership and audience behavior as the kids segment of the audience abandons linear TV and children’s attention fragments across a range of digital platforms, from YouTube to Netflix and Disney+ to Roblox and Fortnite. Kids animated series orders have declined year over year on cable networks since 2020 and on streaming since 2023.

While YouTube franchises such as Cocomelon have successfully migrated to SVOD, some animation producers now have a greater intention to reach kids where they are, such as by distributing content on YouTube to audience test and grow new IP before investing more substantially to produce a series or content for other digital platforms.

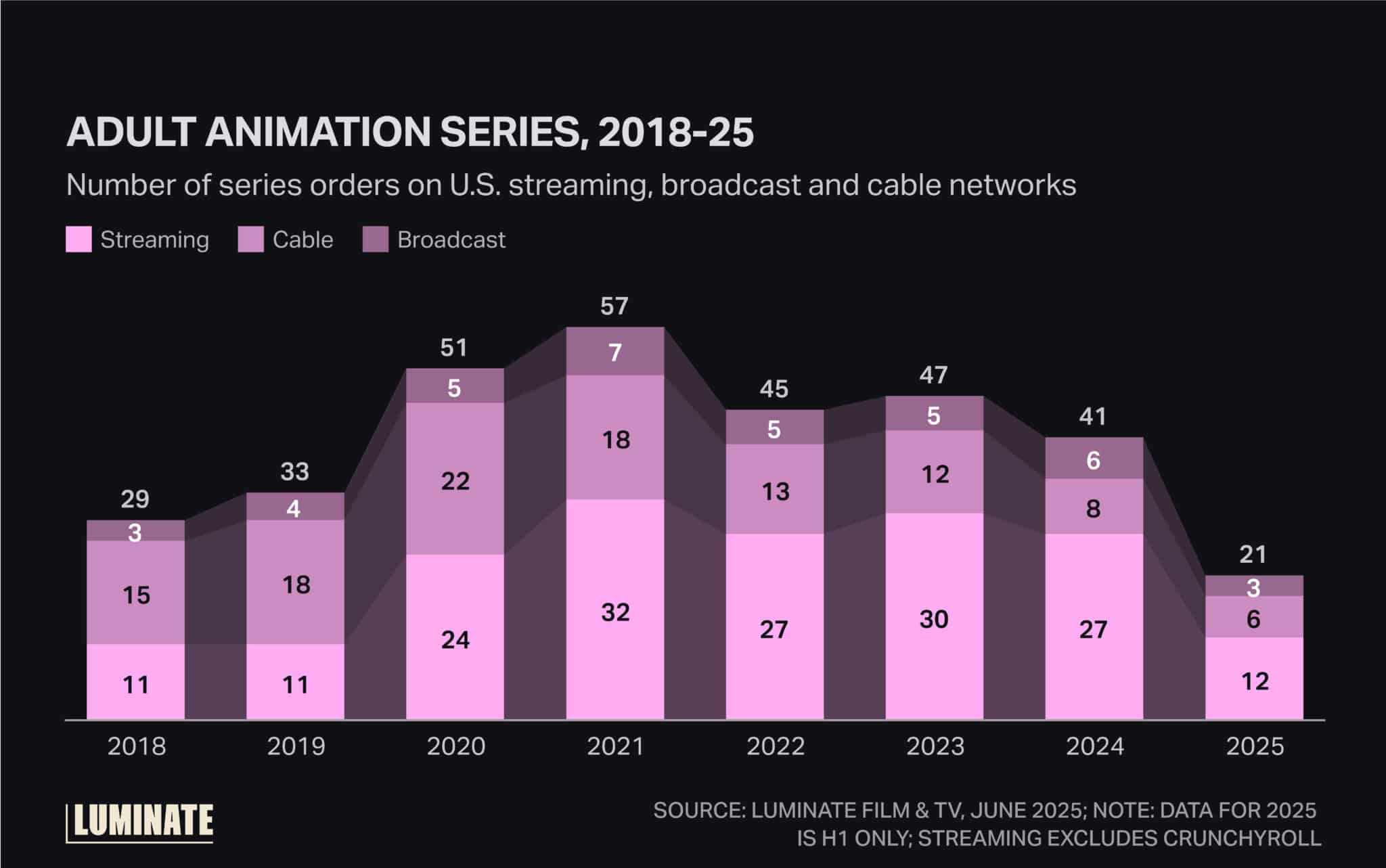

Adult animation has fared better amid the broader production slowdown, though it still declined on cable. Netflix, Amazon and Warner Bros. Discovery have all been increasing their focus on adult animation.

Studios have thrown their weight behind long-running adult animated comedy mainstays, including Fox’s lineup of The Simpsons, Family Guy, Bob’s Burgers and American Dad, while Paramount struck a five-year overall deal for South Park reportedly valued at $1.5 billion to stream the show exclusively on Paramount+.

Amid the genre’s growing global popularity, U.S.-produced adult animated series are increasingly taking inspiration from anime. Anime aesthetics and themes have influenced several recent series, including cultural hits Blue Eye Samurai and Arcane on Netflix and Scavengers Reign on HBO Max.

Beyond challenges tied to distribution and fragmenting audiences, the animation industry is confronting the prospect of further change from generative AI. Major studios, VFX, animation studios and prominent AI studios are evaluating the potential for generative AI in workflows, and some are actively integrating the tech to produce imagery. Yet for many, practical shortcomings in production remain, as do legal, ethical and artistic questions.

In addition to examining studio output trends in U.S. animated film and TV since the pandemic, the new Luminate Intelligence special report Animation + AI reviews the state of industry attitudes and exploration of generative AI imagery in animation content production.

The report is grounded by insights gathered from over 30 one-on-one background conversations with leaders and experienced practitioners situated across the animation industry and around the world.