Less than four years after the NBC Sports Network disappeared from the cable TV lineup, its corporate parent could be getting back in the game.

The Wall Street Journal reported late last month that NBCUniversal is considering launching a new sports cable network, with a debut potentially coming as early as this fall (no doubt just in time for the NBA’s return to NBC). The network would reportedly carry sports broadcasts that also stream on the NBCU SVOD Peacock.

Obviously, it’s a counterintuitive move for a company that’s just months away from spinning off the bulk of its cable TV assets, and rampant cord-cutting has made launching any linear assets an increasing rarity in recent years. But a closer look at the economics at play quickly reveals clear logic underlying the decision, reflecting a more nuanced reality than the hype around streaming often suggests.

In fact, to grasp one key motivator behind the decision, one need only break down the viewership for NBCU’s two flagship sports packages: the Olympics and the NFL.

Last summer, out of the average 30.6 million viewers that tuned in to NBCU’s daytime or primetime coverage of the Paris Olympics across the length of the Games, only 4.1 million were watching on streaming — just over 13% of the total audience, in other words.

As for the NFL, analysis of viewership data for NBC’s most-watched games of the 2024 season shows a similarly unbalanced split between linear and streaming.

In fact, when the games are arranged chronologically, streaming viewership appears to steadily decline over time, excluding the Minnesota Vikings-Detroit Lions matchup on Jan. 5, 2025 (when playoff seeding and a division title were on the line).

It would seem that, despite the epidemic of cord-cutting and Peacock’s much-hyped status as a live sports destination, the streamer remains a considerably smaller engagement driver for the biggest sports programming than traditional linear coverage.

Of course, both the Olympics and NFL games are available for free on NBC’s broadcast network, while Peacock cost, at a minimum, $8 per month last year (now $11 after yet another price hike).

Any potential audience on cable would be much smaller, particularly given what WSJ described as the new network’s planned distribution model: It would be offered only through select cable packages, presumably sports-centric premium add-ons and/or DirecTV’s “MySports” skinny bundle.

But the fact is this strategy is all about incremental reach: capturing holdout sports fans who refuse to cut the cord — nScreenMedia estimated 70.3 million U.S. households still had some form of pay TV as of Q1 2025; Peacock had 41 million subscribers at the end of that quarter — and, of course, the incremental revenue that comes from reaching those viewers.

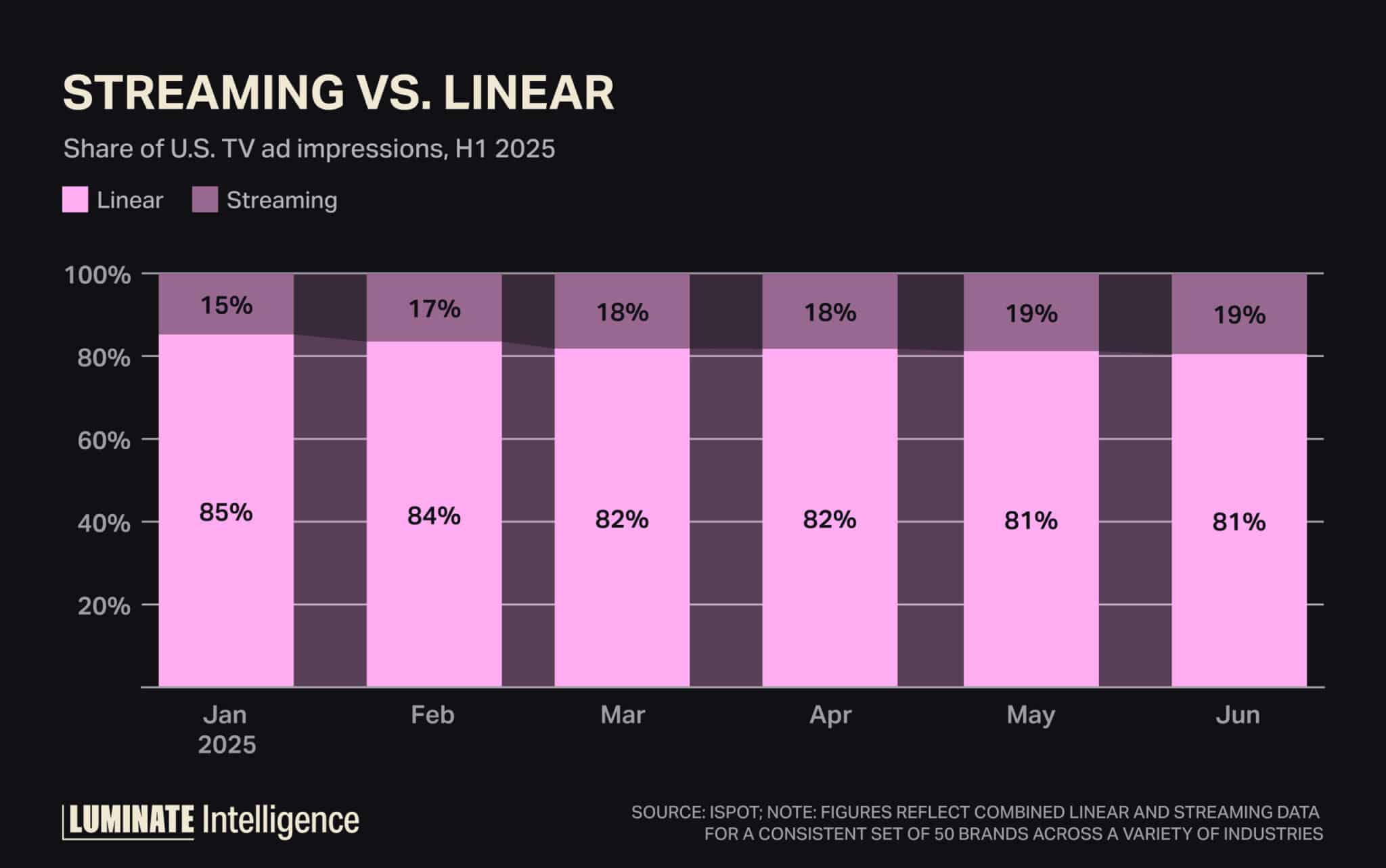

It’s worth remembering that, despite the growing presence of advertising on streaming, the bulk of U.S. TV ad revenue still sits with linear. Streaming’s share of all U.S. TV ad viewing was just 10.4% as of April, according to a Madison and Wall analysis, and a new report from ad-measurement firm iSpot found linear TV accounted for more than 80% of U.S. TV ad impressions in H1 2025.

There is, in short, still money to be made from the cable business, at least for the time being. It’s likely that another function of the new NBCU network would be to funnel its viewers to Peacock in due course, serving as, well, an advertisement for the SVOD.

But for now, while the legacy TV ecosystem is in unmistakable secular decline, the promised all-streaming-all-the-time world is simply not materializing as fast as the hype would have you believe. In other words, the TV game hasn’t entered garbage time just yet.