The return of a successful original series in December provided a glimmer of hope at the end of a challenging year for Disney+.

That would be YA adaptation Percy Jackson and the Olympians, a show that, at the time of its debut, seemed to point the way forward for a platform laboring to move past its Star Wars and Marvel-related struggles.

Despite premiering in December 2023, Percy Jackson’s freshman season was the most-streamed Disney+ original by viewing time for 2024 and currently ranks as the service’s most-watched non-Star Wars or Marvel original TV season measured by Luminate Streaming Viewership (M).

But unfortunately for Disney, the show now appears to be suffering from the most dreaded of TV ailments: the sophomore slump.

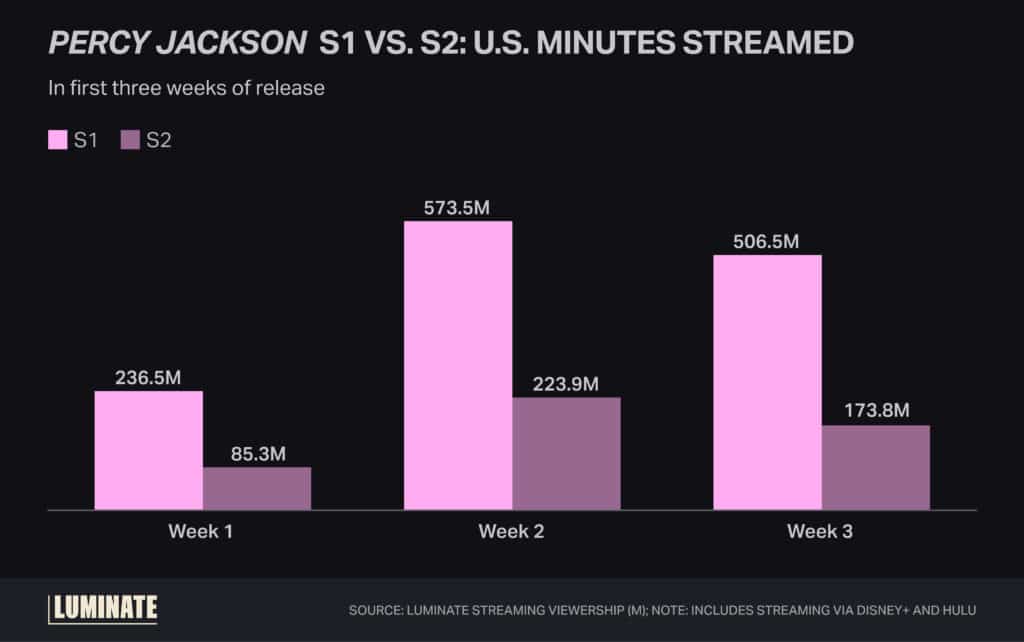

After three weeks of release, Percy Jackson Season 2 is significantly underperforming compared with its predecessor, receiving just 483 million U.S. minutes streamed in that time versus S1’s 1.3 billion. (This equates to 11.2 million total estimated views for S2 versus 31.5 million for S1.)

While the debut season had the advantage of premiering in a prime window for teen fans’ holiday-break viewing — the first two episodes dropped Dec. 19, 2023, whereas S2 premiered on Dec. 10 — this remains a major comedown for one of the biggest Disney+ hits of all time.

It’s possible the two-year gap between seasons was not advantageous in this case (relatively short though it was, two years is plenty of time for some young fans to age out of the series) or that the show ultimately failed to widen its audience beyond hardcore fans of the source novels.

But when viewed in the larger context of the U.S. streaming landscape, Percy Jackson appears simply symptomatic of Disney+’s overall struggles. In 2023, the SVOD’s share of original content engagement among the major services was just over 6%; in 2025, it was less than 3%.

As previously discussed in this space, Disney+ original series output dropped precipitously in that time, and while the service remains an essential subscription for families with young children, its appeal to the teen and adult market is less certain.

This is one reason Disney has been moving so aggressively to fold Hulu into the platform — to infuse Disney+ with “general entertainment” content that can power greater engagement.

As for Percy Jackson, fans can take some comfort in the fact that Disney renewed the show for a third season even before S2 debuted, to be based on the book series’ third entry, The Titan’s Curse. To continue beyond that, though, the adaptation may well have to break the curse of that sophomore slump.